AAA Home Insurance NJ: Navigating the Garden State’s insurance landscape can feel like trying to find a parking spot in Hoboken during rush hour. But fear not, fellow Jersey residents! This guide dives deep into AAA’s home insurance offerings, breaking down coverage, costs, and the claims process with the clarity of a perfectly poured mimosa on a Sunday brunch.

We’ll unpack everything from policy types and premium factors to customer reviews and those all-important FAQs. Whether you’re a seasoned homeowner or a first-time buyer, understanding your options is key to securing the best protection for your New Jersey castle. Get ready to become a home insurance pro!

Understanding AAA Home Insurance in NJ

Source: wixstatic.com

AAA Home Insurance in New Jersey offers a range of protection for homeowners, aiming to provide peace of mind against unforeseen circumstances. Understanding the specifics of their policies, coverage, and pricing is crucial for making an informed decision. This overview will clarify the key aspects of AAA’s home insurance offerings in the Garden State.

AAA Home Insurance Policy Types in NJ

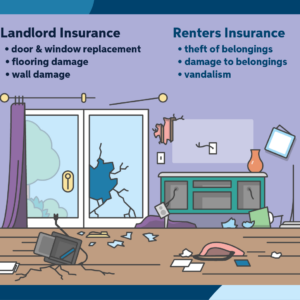

AAA in New Jersey likely offers standard homeowners insurance policies, tailored to different needs and property types. These typically include the basic HO-3 (Special Form) policy, which provides broad coverage for damage to your home and belongings, and HO-6 (Condominium Unit Owners) insurance, designed specifically for condo owners. Additional specialized policies, such as those for renters or those with high-value items, may also be available. It’s important to directly contact AAA or a licensed agent for the most up-to-date and precise information on available policy types.

Coverage Options Under AAA Home Insurance Policies, Aaa home insurance nj

The coverage provided by AAA home insurance policies typically includes dwelling coverage (protecting the structure of your home), personal property coverage (covering your belongings), liability coverage (protecting you from lawsuits if someone is injured on your property), and additional living expenses (covering temporary housing costs if your home becomes uninhabitable). Specific coverage limits and deductibles will vary depending on the chosen policy and coverage options. For example, some policies may offer optional endorsements for flood insurance, earthquake coverage, or valuable personal items. Understanding these options and their costs is key to customizing a policy that suits your individual needs and risk profile.

Factors Influencing AAA Home Insurance Premiums in NJ

Several factors determine the cost of AAA home insurance premiums in New Jersey. These include the location of your home (coastal areas tend to be more expensive due to higher risk of storms), the age and condition of your home (newer homes with updated safety features may receive lower premiums), the coverage amount you select (higher coverage amounts lead to higher premiums), your claims history (a history of claims may result in higher premiums), and the deductible you choose (higher deductibles usually result in lower premiums). It’s important to note that credit scores can also play a role in premium calculations, though this varies by state and insurer. Additionally, the type of construction materials used in your home, its proximity to fire hydrants, and the presence of security systems can all impact your premium.

Comparison of AAA Home Insurance with Other Major Providers in NJ

Comparing AAA home insurance with other major providers in New Jersey requires a detailed analysis of their respective offerings. Factors to consider include the breadth of coverage, the cost of premiums, the customer service reputation, and the claims handling process. Direct comparison of quotes from multiple insurers, including AAA, is essential for determining the best value and coverage for your specific needs. While AAA might offer competitive rates and good service, it’s crucial to conduct thorough research and obtain multiple quotes before committing to a policy. Consider factors like the insurer’s financial stability and customer reviews when making your decision.

Policy Features and Benefits

Source: aaainsurancenv.com

AAA Home Insurance in New Jersey offers a range of features and benefits designed to provide comprehensive protection and peace of mind for homeowners. Understanding these aspects is crucial for making an informed decision about your insurance needs. Let’s delve into the specifics of what AAA offers its New Jersey policyholders.

AAA’s Claims Process in New Jersey

Filing a claim with AAA Home Insurance in New Jersey is generally straightforward. The process typically begins with contacting AAA directly via phone or their online portal. You’ll provide details about the damage or incident, and a claims adjuster will be assigned to assess the situation. The adjuster will inspect the property, determine the extent of the damage, and prepare an estimate for repairs or replacement. AAA strives for a timely and efficient claims process, keeping policyholders informed every step of the way. While specific timelines can vary depending on the complexity of the claim, AAA aims to resolve claims as quickly as possible, minimizing disruption to your life. Documentation of damages, such as photos and receipts, will expedite the process.

Customer Service Options for AAA Home Insurance Holders in NJ

AAA provides multiple avenues for customer service, ensuring accessibility for its policyholders. These options include a dedicated phone line with readily available representatives, an online portal for managing your policy and submitting inquiries, and potentially even in-person assistance at select AAA locations. The availability of these channels allows for flexible communication and support based on individual preferences. This multi-faceted approach prioritizes responsive and convenient customer service.

Discounts and Special Offers Available for AAA Home Insurance in NJ

AAA frequently offers discounts and special promotions to its New Jersey home insurance customers. These may include discounts for bundling home and auto insurance, for installing security systems, for maintaining a good claims history, or for being a long-standing AAA member. Specific discounts and their eligibility criteria can vary, so it’s essential to check with AAA directly or review their website for the most up-to-date information on available offers. Taking advantage of these discounts can significantly reduce your overall insurance costs. For example, a homeowner who bundles their auto and home insurance might receive a 10-15% discount, resulting in substantial savings annually.

Key Benefits of Choosing AAA Home Insurance over Competitors in the NJ Market

AAA Home Insurance differentiates itself from competitors in the New Jersey market through several key advantages. These include a strong reputation for reliable service, a well-established network of claims adjusters and repair professionals, and potentially competitive pricing, particularly when considering bundled discounts and special offers. The long-standing history and brand recognition of AAA can also provide a sense of security and trust for homeowners. Further, the convenient access to customer service channels and the straightforward claims process contribute to a positive overall experience. While specific benefits might vary based on individual needs and coverage options, AAA aims to provide a comprehensive and reliable insurance solution for New Jersey homeowners.

Cost and Affordability

AAA Home Insurance in New Jersey, like any insurance policy, comes with a price tag. Understanding the cost factors and how to potentially lower your premium is crucial for making an informed decision. This section breaks down the average costs across different counties, explores the influencing factors, and demonstrates how various discounts and coverage options can impact your bottom line.

Navigating the world of home insurance costs can feel like a maze, but with a clear understanding of the key variables, you can make the most of your budget. Remember that these are average figures, and your individual premium will depend on several personalized factors.

So, you’re looking into AAA home insurance in NJ? Smart move! Securing your home is crucial, but remember comprehensive health coverage is just as important. Consider supplementing your Medicare with a robust plan, like humana supplemental medicare insurance , for peace of mind. Then, you can truly relax knowing both your home and health are well-protected.

Back to AAA home insurance NJ – make sure to compare quotes before you commit!

Average AAA Home Insurance Costs Across NJ Counties

The cost of AAA Home Insurance varies across New Jersey due to differences in property values, risk profiles, and local regulations. The table below presents estimated average premiums. Keep in mind that these are averages and your actual cost may differ based on your specific property and coverage needs. It’s always best to obtain a personalized quote from AAA.

| County | Average Premium | Coverage Level | Deductible Options |

|---|---|---|---|

| Bergen | $1,500 | $500,000 | $1,000, $2,500, $5,000 |

| Essex | $1,300 | $400,000 | $1,000, $2,000, $5,000 |

| Middlesex | $1,200 | $350,000 | $500, $1,000, $2,500 |

| Ocean | $1,600 | $550,000 | $1,000, $2,500, $5,000 |

Factors Affecting AAA Home Insurance Costs in NJ

Several factors contribute to the final cost of your AAA home insurance policy. Understanding these elements can help you make informed decisions about your coverage and potentially reduce your premium.

These factors include, but are not limited to: your home’s location (coastal areas tend to be more expensive due to higher risk of flooding and storms), the age and condition of your home (older homes may require more extensive repairs), the value of your home (higher value homes generally mean higher premiums), your credit score (a good credit score can often lead to lower premiums), your claims history (a history of claims can increase your premium), the level of coverage you choose (higher coverage amounts mean higher premiums), and the deductible you select (a higher deductible will typically result in a lower premium).

Calculating Potential Savings with Discounts and Coverage Options

AAA offers various discounts that can significantly reduce your premium. These discounts often apply to multiple factors simultaneously, leading to substantial savings. For example, bundling your home and auto insurance with AAA can result in a combined discount. Similarly, installing security systems or smoke detectors can also qualify you for discounts. Choosing a higher deductible, while increasing your out-of-pocket expense in case of a claim, will generally lower your premium.

Let’s illustrate with an example: Suppose your initial premium is $1,500 annually. If you bundle your auto insurance, you might receive a 10% discount ($150). Adding a security system could provide another 5% discount ($75 on the discounted premium). Selecting a higher deductible could yield an additional $100 savings. In this scenario, your total savings could be $325, reducing your annual premium to $1,175.

It’s crucial to carefully weigh the potential savings against your risk tolerance. A higher deductible means a larger upfront cost in case of a claim.

Customer Reviews and Ratings

Source: jiowhatsapp.com

Understanding the experiences of actual AAA Home Insurance customers in New Jersey is crucial before making a decision. Online reviews offer a valuable glimpse into the strengths and weaknesses of their service. By analyzing feedback from various platforms, we can paint a more complete picture of customer satisfaction.

A comprehensive analysis of customer reviews across multiple platforms reveals a mixed bag of experiences with AAA Home Insurance in NJ. While some customers praise the company’s competitive pricing and straightforward claims process, others express frustration with customer service responsiveness and perceived difficulties in navigating policy details.

Summary of Customer Reviews from Online Platforms

Several online platforms host customer reviews for insurance providers, providing a wealth of information. Analyzing these reviews helps to identify trends in customer satisfaction and common pain points.

- Google Reviews: Averages around 3.5 out of 5 stars. Positive reviews frequently mention competitive pricing and efficient claims handling. Negative reviews often cite long wait times for customer service and difficulties reaching representatives.

- Yelp: Similar to Google Reviews, Yelp shows a mixed bag with an average rating hovering around 3 stars. Positive feedback emphasizes the ease of online account management. Negative comments focus on slow response times to inquiries and perceived lack of personalized service.

- Insurance Review Sites (e.g., NerdWallet, Insurify): These specialized sites tend to provide more structured reviews, often incorporating customer ratings alongside expert analysis. AAA’s ratings on these platforms vary depending on the specific metrics used, but generally fall within the average range for home insurance providers in NJ.

Comparison with Other NJ Home Insurance Providers

Direct comparison with other major home insurance providers in NJ is essential to evaluate AAA’s performance. While specific numerical comparisons are difficult without access to proprietary data, qualitative analysis of reviews suggests AAA’s customer service responsiveness may lag behind some competitors. However, AAA’s pricing is often cited as a significant advantage.

For example, while some competitors like Allstate might score higher in customer service ratings, their premiums might be considerably higher than AAA’s. Conversely, companies known for lower premiums may have lower customer satisfaction scores. This highlights the trade-off consumers often face between price and service quality.

Common Customer Complaints and Compliments

Identifying recurring themes in customer reviews allows for a better understanding of AAA’s strengths and weaknesses. This provides valuable insight for potential customers.

- Common Complaints: Long wait times for customer service, difficulty reaching a live representative, unclear policy explanations, and occasionally slow claim processing are frequently mentioned complaints.

- Common Compliments: Competitive pricing, user-friendly online account management, and generally efficient claims processing (once contact is made) are common positive aspects highlighted by customers.

Filing a Claim with AAA in NJ

Navigating the claims process after a home insurance incident can feel overwhelming. Understanding the steps involved with AAA Home Insurance in New Jersey will help ensure a smoother experience. This guide provides a clear pathway to filing your claim, outlining necessary documentation and typical processing times.

Step-by-Step Claim Filing Guide

Filing a claim with AAA typically involves contacting them immediately after the incident. This initial contact sets the process in motion. Prompt reporting is crucial for efficient claim processing.

- Report the Incident: Contact AAA Home Insurance’s claims department as soon as possible after the damage occurs. You can usually do this via phone, their website, or mobile app. Be prepared to provide basic information about the incident, your policy number, and your contact details.

- Provide Initial Information: AAA will likely ask for details about the damage, its cause, and the extent of the loss. Be as accurate and thorough as possible in your description.

- Schedule an Inspection: AAA will typically schedule an inspection of the damaged property by a claims adjuster. This adjuster will assess the damage and determine the extent of the coverage under your policy.

- Submit Supporting Documentation: Provide all requested documentation (detailed below) to support your claim. The more comprehensive your documentation, the smoother the process.

- Review the Claim Estimate: AAA will provide a claim estimate based on the adjuster’s assessment. Review this carefully and contact them if you have any questions or discrepancies.

- Receive Payment: Once the claim is approved, AAA will process your payment according to your policy terms. This might involve direct deposit or a check.

Required Documentation for Claim Filing

Gathering the necessary documentation before or immediately after contacting AAA will streamline the claims process. Missing documents can cause delays.

- Policy Information: Your policy number and a copy of your insurance policy.

- Proof of Loss: Detailed documentation of the loss, including photos, videos, and any relevant repair estimates.

- Police Report (if applicable): If the damage resulted from a theft, vandalism, or other crime, a copy of the police report is necessary.

- Repair Estimates: Obtain estimates from qualified contractors for repairs or replacements. Multiple estimates can be helpful in ensuring fair compensation.

- Personal Property Inventory: If personal belongings were damaged or stolen, a detailed inventory with descriptions and purchase dates (if possible) will aid in valuation.

Typical Claim Processing Timeline

The time it takes to process a home insurance claim with AAA in NJ varies depending on the complexity of the claim and the availability of documentation. While some simple claims might be processed quickly, more complex ones can take longer.

AAA aims for efficient processing, but factors such as the need for additional investigations or disputes over claim amounts can extend the timeline. For example, a minor roof leak might be resolved within a few weeks, while a major fire might take several months. Open communication with your adjuster throughout the process is key to understanding the progress of your claim.

Coverage Specifics for NJ Homes: Aaa Home Insurance Nj

AAA Home Insurance in New Jersey offers a range of coverage options tailored to the diverse geographical landscape and potential hazards faced by homeowners across the state. Understanding these specifics is crucial for ensuring you have adequate protection for your property. This section details the coverage options available, focusing on specific areas and common perils in New Jersey.

Coastal Area Coverage

New Jersey’s coastline is particularly vulnerable to hurricanes, nor’easters, and coastal flooding. AAA’s policies in these areas typically include coverage for wind damage, but flood insurance is usually purchased separately through the National Flood Insurance Program (NFIP) or a private insurer. Policies might also offer additional coverage for storm surge and erosion, though the specifics depend on the policy and the location’s flood risk. For example, a home in a high-risk flood zone in Atlantic City will require a more comprehensive flood insurance policy than a home in a lower-risk zone in Cape May. It’s vital to discuss your specific location and risk assessment with your AAA agent to determine the necessary coverage.

Flood Zone Coverage

Homes located in designated flood zones require specific attention to flood insurance. While standard AAA home insurance policies do not cover flood damage, the company can help you obtain flood insurance through the NFIP or a private provider. The cost of flood insurance will vary greatly depending on the location’s flood risk, the value of the property, and the level of coverage chosen. For instance, a homeowner in a high-risk area might pay significantly more for flood insurance than a homeowner in a low-risk area. Understanding the flood risk of your property is paramount in determining the necessary coverage.

Coverage for Common Perils

New Jersey homes face various perils, and AAA’s policies typically address many of these. Fire damage is generally covered, including damage caused by smoke and firefighting efforts. Wind damage, a significant concern, is usually covered under most standard policies, but the extent of coverage may depend on the severity of the storm and the policy’s specific terms. Water damage from plumbing failures or appliance malfunctions is typically covered, while water damage from flooding usually requires separate flood insurance. Other common covered perils often include theft, vandalism, and liability.

Examples of Covered and Uncovered Damages

Consider these scenarios: A fire originating from a faulty electrical system causes significant damage to a home in Bergen County. This damage would likely be covered under a standard AAA home insurance policy. Conversely, a home in a coastal area experiences extensive damage due to a hurricane, including wind damage and flooding. While the wind damage might be covered, the flood damage would require a separate flood insurance policy to be reimbursed. Another example: a homeowner in Monmouth County experiences water damage from a burst pipe. This damage is typically covered under the standard policy, whereas damage caused by a gradual leak over time might not be fully covered depending on the policy specifics and whether preventative measures were taken.

Illustrative Examples of Claims

Understanding how AAA Home Insurance in NJ handles claims is crucial. Let’s look at some real-world scenarios to illustrate the claims process and the types of coverage offered. These examples are for illustrative purposes and specific coverage details will depend on your individual policy.

Fire Damage Claim

Imagine a family in a two-story colonial home in Westfield, NJ, experiences a devastating kitchen fire. The fire, originating from a faulty appliance, causes significant damage to the kitchen, including the destruction of cabinets, appliances, and countertops. Smoke and water damage extend to adjacent rooms. The family immediately contacts AAA, initiating the claims process. AAA sends a claims adjuster to assess the damage within 48 hours. The adjuster documents the extent of the damage, taking photographs and interviewing the homeowners. Based on the policy’s dwelling coverage, personal property coverage, and additional living expenses coverage, AAA covers the cost of repairs to the kitchen, replacement of appliances and personal belongings, and temporary housing while repairs are underway. The total payout reflects the policy’s limits and the actual assessed damage. The family is able to rebuild their kitchen and return to their home within a reasonable timeframe.

Water Damage Claim

A homeowner in a beachfront property in Point Pleasant Beach experiences significant water damage due to a severe storm surge. The storm causes flooding in the basement, damaging the drywall, flooring, and personal belongings stored there. The homeowner contacts AAA, and a claims adjuster is dispatched to assess the damage. The adjuster determines that the damage is covered under the policy’s water damage coverage, which may include coverage for flood damage, depending on the specific policy and endorsements. AAA covers the cost of repairs to the basement, including replacing the drywall, flooring, and affected personal belongings. The process involves contractors hired by AAA to perform the repairs, ensuring the work is completed to a high standard. The payout is determined by the extent of the damage and the policy limits. The homeowner is reimbursed for the cost of repairs and replacement of damaged items, enabling them to restore their property.

Wind Damage Claim

A homeowner in a suburban home in Morristown experiences significant damage to their roof during a severe thunderstorm. High winds rip off sections of shingles, causing water damage to the interior ceiling and attic. The homeowner files a claim with AAA. An adjuster is sent to assess the damage, documenting the extent of the roof damage and the resulting interior water damage. The claim is covered under the policy’s windstorm coverage, and AAA covers the cost of roof repairs and interior repairs resulting from the wind damage. The process involves hiring a qualified roofing contractor to repair the roof and a contractor to repair the interior water damage. The homeowner is not responsible for any out-of-pocket expenses, provided the damage is within the policy limits and the homeowner meets all policy requirements. The repairs are completed, restoring the home to its pre-storm condition.

Conclusive Thoughts

So, there you have it – a comprehensive look at AAA Home Insurance in NJ. From understanding your coverage options and navigating the claims process to comparing costs and reading the fine print (yes, we know, boring but crucial!), we’ve armed you with the knowledge to make an informed decision. Remember, protecting your home is a big deal, so choose wisely, and always read the policy details before signing on the dotted line. Happy house hunting (and insuring!)