AARP secondary insurance to Medicare: Navigating the complexities of Medicare can feel like wandering through a maze. You’ve got Part A, Part B, deductibles, co-pays – it’s enough to make your head spin! But what happens when Medicare doesn’t cover everything? That’s where supplemental insurance, like the plans offered through AARP, steps in. This guide breaks down everything you need to know about AARP’s Medicare supplement plans, helping you find the right coverage to protect your wallet and your health.

We’ll delve into the specifics of AARP’s offerings, comparing them to other providers and highlighting the key features, costs, and enrollment processes. We’ll also address common concerns and potential drawbacks, empowering you to make an informed decision that best suits your individual needs and budget. Get ready to ditch the Medicare confusion and embrace a clearer path to comprehensive healthcare coverage.

Understanding Medicare’s Coverage Gaps

Medicare, while a vital safety net for seniors and people with disabilities, doesn’t cover everything. Understanding its limitations is crucial for navigating healthcare costs and ensuring you receive the care you need without facing unexpected financial burdens. Many find that supplementing their Medicare coverage with a secondary plan provides essential protection against these gaps.

Medicare Part A (hospital insurance) and Part B (medical insurance) have significant limitations. Part A primarily covers inpatient hospital stays, skilled nursing facility care, hospice, and some home healthcare, but it has deductibles and copayments. Part B covers doctor visits, outpatient care, and some preventive services, but it also involves deductibles, co-insurance, and doesn’t cover all services.

Medicare’s Uncovered Expenses

Medicare typically doesn’t cover many important healthcare expenses. These include most vision, hearing, and dental care; many prescription drugs (unless you have Part D coverage, which has its own limitations); long-term care; most health screenings not specifically covered under preventive care guidelines; and private duty nursing. The cost of these services can quickly add up, leaving beneficiaries with substantial out-of-pocket expenses.

Situations Requiring Supplemental Insurance, Aarp secondary insurance to medicare

Supplemental insurance, such as Medigap or a Medicare Advantage plan with enhanced benefits, becomes essential in several situations. For example, a prolonged hospital stay exceeding Part A’s coverage, needing extensive physical therapy after a surgery, requiring frequent doctor visits for a chronic condition, or needing expensive prescription medications not fully covered by Part D. Without supplemental coverage, these scenarios could lead to significant financial strain.

Out-of-Pocket Cost Comparison

The following table illustrates the potential difference in out-of-pocket costs with and without supplemental insurance. These are examples and actual costs can vary based on individual plans and healthcare needs.

| Scenario | Medicare Only (Estimated) | Medicare + Supplemental Insurance (Estimated) | Savings with Supplemental Insurance (Estimated) |

|---|---|---|---|

| Hospital Stay (3 days) | $5,000 | $1,000 | $4,000 |

| Prescription Drugs (Annual) | $3,000 | $1,500 | $1,500 |

| Doctor Visits (Annual) | $1,000 | $200 | $800 |

| Physical Therapy (Post-Surgery) | $2,000 | $500 | $1,500 |

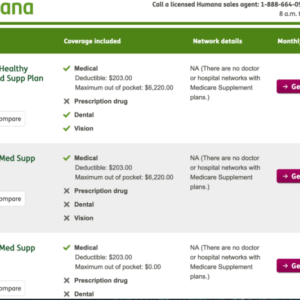

AARP’s Role in Medicare Supplement Plans

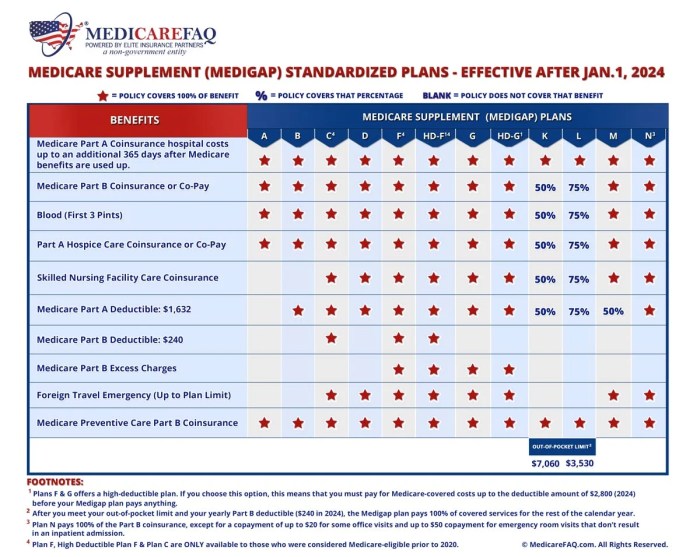

Source: medicarefaq.com

AARP, the American Association of Retired Persons, doesn’t actually *offer* Medicare Supplement plans themselves. Instead, they partner with UnitedHealthcare to provide a range of Medigap plans, leveraging their extensive network and brand recognition to offer competitive options to their members. This collaboration allows AARP to extend its services beyond advocacy, providing a valuable benefit to its vast membership base navigating the complexities of Medicare.

AARP’s involvement simplifies the process for seniors seeking Medigap coverage. By partnering with a reputable insurer like UnitedHealthcare, they provide a curated selection of plans, eliminating the need for extensive research across numerous providers. This streamlined approach aims to make the often-daunting task of choosing supplemental insurance more manageable for older adults.

AARP Medicare Supplement Plan Types and Features

AARP, through its partnership with UnitedHealthcare, offers a variety of Medigap plans, each corresponding to a specific Plan letter (A through N, and K). These plans adhere to standardized benefits defined by federal regulations, meaning a Plan G from AARP will offer the same basic coverage as a Plan G from another provider. The key differences often lie in pricing and customer service. However, the specific plans offered can vary by state, so it’s crucial to check availability in your area. For example, a Plan F might be highly competitive in one state but unavailable in another. Understanding your individual healthcare needs and comparing the costs within your region is vital before selecting a plan.

Comparing AARP Plans with Other Providers

While AARP plans offer the convenience of a well-known brand and often competitive pricing, they are not inherently superior to plans from other providers. The key differentiator isn’t the coverage itself (as that’s standardized by Medicare), but rather the insurer’s customer service, claims processing efficiency, and network of doctors. Some consumers may find AARP’s customer service to be particularly responsive, while others may prefer a different insurer based on their individual experiences or the provider network’s alignment with their healthcare needs. For example, a senior whose specialist is not in UnitedHealthcare’s network might find a plan from another provider more beneficial despite a slightly higher premium.

Key Advantages and Disadvantages of Choosing an AARP Plan

Choosing a Medicare Supplement plan involves careful consideration. The following points highlight the pros and cons of selecting an AARP plan through UnitedHealthcare.

- Advantages:

- Established Brand Recognition and Trust: AARP’s reputation adds a layer of confidence.

- Potentially Competitive Pricing: AARP plans often aim for competitive rates within the market.

- Streamlined Selection Process: The curated selection simplifies the decision-making process.

- Access to AARP Member Resources: AARP’s broader support network can be valuable.

- Disadvantages:

- Limited Plan Options: The selection might be narrower compared to choosing from a broader range of providers.

- Potential for Higher Premiums in Certain Areas: Pricing can vary geographically; a plan might not always be the cheapest in a specific location.

- Dependence on UnitedHealthcare’s Network: Coverage may be limited outside UnitedHealthcare’s network of doctors and hospitals.

- Customer Service Experiences Vary: While AARP aims for high quality, individual experiences can differ.

Cost and Premiums of AARP Medicare Supplement Plans

Understanding the cost of AARP Medicare Supplement plans is crucial before enrolling. Several factors influence the final premium, and it’s important to carefully consider these before making a decision. This section will detail those factors and provide examples to help you navigate the pricing structure.

Factors Influencing Premium Costs

Several key factors determine the cost of an AARP Medicare Supplement plan. Your age is a primary driver; generally, older individuals pay higher premiums. Your location also plays a significant role, as insurance companies adjust pricing based on regional healthcare costs and claim patterns. The specific plan you choose—plans with broader coverage typically have higher premiums—also affects the cost. Finally, your health status isn’t directly factored into the premium calculation for Medicare Supplement plans (unlike some other types of insurance), but pre-existing conditions will not be excluded from coverage.

Premium Payment Methods

AARP Medicare Supplement plans offer various payment options for your convenience. Most commonly, premiums are paid monthly through automatic bank drafts, offering a seamless and hassle-free payment experience. However, many insurers also allow for quarterly, semi-annual, or annual payments. Check directly with your chosen insurance provider to determine the specific payment options available and any associated fees or discounts.

Examples of Premium Amounts

The following table provides example premium amounts. Remember that these are illustrative examples only and actual premiums will vary based on the factors discussed above. Always contact the insurance provider for the most up-to-date and accurate pricing information specific to your situation.

| Plan Type | Age 65 | Age 75 | Age 85 |

|---|---|---|---|

| Plan A | $100 | $150 | $225 |

| Plan F | $175 | $250 | $375 |

| Plan G | $150 | $225 | $350 |

| Plan N | $125 | $180 | $275 |

*Note: These are hypothetical examples and do not reflect actual premiums offered by any specific insurer. Contact AARP or the insurer directly for current pricing.*

Enrollment Process and Eligibility Criteria

Source: poetry-lyrics.com

Navigating the enrollment process for an AARP Medicare Supplement plan can seem daunting, but understanding the steps and eligibility requirements simplifies the journey. This section breaks down the process, clarifying eligibility, enrollment periods, and the overall procedure.

AARP Medicare Supplement plans are offered by UnitedHealthcare, so the enrollment process mirrors their procedures. Eligibility hinges on your Medicare status and age, with specific enrollment windows determining when you can apply without facing penalties.

Eligibility Requirements for AARP Medicare Supplement Plans

To be eligible for an AARP Medicare Supplement plan, you must first be enrolled in Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You must also be a resident of the United States. There are no income or asset requirements for enrollment. Specific plan availability may vary by state.

Steps Involved in Enrolling in an AARP Medicare Supplement Plan

The enrollment process is straightforward, but careful attention to detail is key. It typically involves these steps:

- Review Plan Options: Compare available plans and their coverage details to find the best fit for your needs and budget. Consider factors such as premiums, deductibles, and co-insurance.

- Contact UnitedHealthcare: Reach out to UnitedHealthcare directly via phone, online, or through a licensed insurance agent to begin the application process. You will need your Medicare information readily available.

- Complete Application: Provide all required information accurately and completely on the application form. This includes personal details, Medicare information, and health history questions. Inaccurate information can delay or prevent approval.

- Medical Underwriting (May Apply): Depending on the plan and your health history, you may undergo medical underwriting. This involves providing additional medical information for review. This step is designed to assess your risk and determine your eligibility.

- Policy Issuance: Upon approval, you’ll receive your policy documentation outlining coverage details, premiums, and other important information. Ensure you understand all aspects of your policy before it takes effect.

Open Enrollment Period and Special Enrollment Periods

Understanding enrollment periods is crucial. Missing the initial enrollment window can lead to higher premiums or limited options.

Open Enrollment Period: This period occurs during your initial enrollment in Medicare Part B. It’s a six-month period beginning the month you turn 65 and are enrolled in Medicare Part B. This is the best time to enroll without facing medical underwriting or potential penalties.

Special Enrollment Periods (SEP): These periods allow enrollment outside of the open enrollment period under specific circumstances. Examples include loss of other health coverage, moving out of your current plan’s service area, or enrolling in Medicare Part B after the initial enrollment period.

Navigating Medicare’s complexities? AARP supplemental insurance can be a lifesaver, filling those pesky gaps in coverage. But finding the right agent is key, and that’s where local expertise comes in; check out kaplansky insurance needham for a potential resource. Ultimately, securing the best AARP secondary insurance plan requires careful research and professional guidance to maximize your Medicare benefits.

Flowchart Illustrating the Enrollment Process

Imagine a flowchart with these steps:

Start -> Review Plan Options -> Contact UnitedHealthcare -> Complete Application -> Medical Underwriting (if applicable) -> Policy Issuance -> End

Each step is represented by a box, with arrows connecting them to show the sequential flow of the process. The “Medical Underwriting” box would have a conditional arrow, branching off to a “Policy Approved” box and a “Policy Denied” box, depending on the outcome. The “Policy Approved” box would then connect to the “Policy Issuance” box, while the “Policy Denied” box would connect back to the “Complete Application” box to suggest the need for corrections or additional information. The “End” box signifies the completion of the enrollment process.

Claims and Reimbursement Procedures

Source: googleusercontent.com

Navigating the claims process with your AARP Medicare Supplement plan is generally straightforward. Understanding the steps involved and what to expect will ensure a smoother experience when seeking reimbursement for covered medical expenses. This section details the process, typical timelines, and examples to clarify any potential uncertainties.

Filing a claim with an AARP Medicare Supplement plan typically involves submitting necessary documentation to the insurance provider. The specific process might vary slightly depending on the plan and the type of claim, but the fundamental steps remain consistent. Response times also depend on factors such as the completeness of the submitted documentation and the insurer’s current workload.

Claim Submission Process

Submitting a claim involves gathering necessary documentation, completing the claim form (often available online), and sending it to the insurer via mail, fax, or online portal. The required documentation usually includes the original Explanation of Benefits (EOB) from Medicare, receipts for services rendered, and the completed claim form. The insurer will review the claim, verify coverage, and process the reimbursement accordingly.

Typical Reimbursement Times

While processing times can vary, most AARP Medicare Supplement plans aim to process claims within a few weeks of receiving all necessary documentation. However, complex claims or those requiring additional information may take longer. It’s always advisable to keep a copy of all submitted documentation for your records and to contact the insurer if you haven’t received a response within a reasonable timeframe. Delays may occur due to high claim volumes or if additional information is required.

Claim Scenarios and Handling

Let’s illustrate with a couple of examples. Scenario 1: A beneficiary receives a hospital bill of $5,000 after a heart procedure. Medicare pays $3,000, leaving a $2,000 balance. With a Medicare Supplement plan, the beneficiary submits the EOB and bill to the insurer. The insurer, after verifying coverage, reimburses the remaining $2,000, based on the plan’s coverage details. Scenario 2: A beneficiary has a $100 doctor’s visit. Medicare pays $80. The beneficiary submits the EOB and receipt. The insurer reviews and reimburses the remaining $20, based on the plan’s co-pay structure. These are simplified examples; actual reimbursements depend on specific plan benefits and policy details.

Step-by-Step Claim Submission Guide

- Gather all necessary documentation: This includes the original Medicare Explanation of Benefits (EOB), itemized bills or receipts from healthcare providers, and your AARP Medicare Supplement insurance card.

- Complete the claim form: This form is usually available online through your insurer’s website or can be requested via phone or mail. Ensure all information is accurate and complete.

- Submit the claim: Choose your preferred method of submission – mail, fax, or online portal. Keep a copy of all submitted documents for your records.

- Track your claim: You can usually track the status of your claim online through your insurer’s website or by contacting their customer service department.

- Receive your reimbursement: Once the claim is processed, the insurer will send you a payment for the covered expenses. This is usually via direct deposit or check.

Comparing AARP Plans with Other Medicare Supplement Options

Choosing a Medicare Supplement plan can feel overwhelming, with numerous providers offering various plans at different price points. AARP plans are a popular choice, but it’s crucial to compare them against other major providers to ensure you’re getting the best value for your needs. This section will analyze AARP plans alongside competitors, focusing on benefits, costs, customer service, and administrative aspects.

AARP Plan Benefits and Costs Compared to Competitors

AARP Medicare Supplement plans are underwritten by UnitedHealthcare, a large national insurer. This partnership provides AARP with significant buying power, potentially translating to competitive pricing. However, other major providers like Humana, Mutual of Omaha, and Blue Shield of California also offer comprehensive Medicare Supplement plans. Direct comparison of premiums and benefits requires checking current rates in your specific location, as these vary considerably based on age, location, and plan type (Plan A, Plan F, etc.). Generally, AARP plans often fall within the competitive range of pricing, sometimes slightly higher or lower than others depending on the specific plan and location. The key differentiator often comes down to the specifics of the plan’s coverage and the quality of customer service.

Customer Service and Plan Administration Differences

Customer service experiences can significantly influence satisfaction with a Medicare Supplement plan. While AARP leverages UnitedHealthcare’s extensive network, the actual customer service experience can vary. Similarly, other providers, such as Humana and Mutual of Omaha, have their own customer service departments with varying levels of responsiveness and helpfulness. Factors like wait times, ease of contacting representatives, and the resolution of claims are critical considerations. Reading online reviews and seeking recommendations from others in your area can provide valuable insights into the customer service provided by different companies. Plan administration, including the ease of submitting claims and the speed of reimbursement, also differs among providers. Some providers may have more user-friendly online portals or mobile apps than others.

Key Factors to Consider When Comparing Plans

When comparing Medicare Supplement plans, several key factors should be carefully evaluated. These include:

- Premium Costs: The monthly premium is a significant factor, but don’t solely focus on the lowest price. Consider the overall value for the coverage provided.

- Coverage Details: Carefully examine the specific benefits offered by each plan. Some plans offer more comprehensive coverage than others, potentially offsetting a higher premium.

- Customer Service Reputation: Research the customer service reputation of each provider. Read online reviews and seek personal recommendations.

- Claims Processing Efficiency: Consider how efficiently each provider processes claims and reimburses expenses.

- Financial Stability of the Insurer: Choose a plan offered by a financially stable and reputable insurance company.

Comparison Table: Three Major Medicare Supplement Providers

This table provides a simplified comparison. Actual premiums and benefits will vary by location and specific plan type. Always check current rates and plan details directly with the providers.

| Provider | Plan Type Example (Illustrative) | Approximate Monthly Premium Range (Illustrative) | Customer Service Reputation (Illustrative) |

|---|---|---|---|

| AARP (UnitedHealthcare) | Plan G | $150 – $250 | Generally positive, but experiences vary. |

| Humana | Plan F | $120 – $220 | Mixed reviews, some praise, some complaints about wait times. |

| Mutual of Omaha | Plan N | $80 – $180 | Known for strong customer service, but premiums may be higher for certain plans. |

Potential Drawbacks and Considerations

Choosing a Medicare Supplement plan, even one backed by a reputable organization like AARP, requires careful consideration. While AARP plans offer valuable coverage, they aren’t a one-size-fits-all solution. Understanding potential limitations and alternative options is crucial for making an informed decision that aligns with your individual needs and financial situation. This section will explore potential drawbacks and help you determine if an AARP Medicare Supplement plan is the right fit for you.

AARP Medicare Supplement plans, while offering comprehensive coverage, aren’t immune to certain limitations. These limitations aren’t necessarily flaws, but rather aspects to consider within the context of your specific health and financial circumstances. Factors such as your age, health status, and anticipated healthcare costs will play a significant role in determining whether an AARP plan offers the best value.

Limitations of AARP Medicare Supplement Plans

AARP plans, like all Medicare Supplement plans, don’t cover everything. They primarily fill the gaps left by Original Medicare, but some services, such as vision, hearing, and dental care, are typically not included. Furthermore, premiums can be substantial, especially for higher coverage levels, and they increase with age. The cost of the plan may not always be the lowest compared to other providers offering similar coverage. It’s vital to compare multiple plans to ensure you’re getting the best value for your money. Finally, the specific benefits and coverage details can vary between plan types (Plan A, Plan F, etc.), so careful review of the policy is essential.

Situations Where an AARP Plan Might Not Be Optimal

An AARP plan might not be the best choice for everyone. For instance, individuals with relatively low healthcare expenses might find that the premiums outweigh the benefits. Someone expecting minimal medical needs in the near future might be better served by a more affordable plan with lower premiums, even if it means less comprehensive coverage. Similarly, those with significant pre-existing conditions might find that a different plan, possibly one with more specialized coverage, better addresses their unique needs. A thorough review of your healthcare history and projected future needs is paramount before making a decision.

Factors to Consider Before Selecting an AARP Plan

Before enrolling in an AARP Medicare Supplement plan, several crucial factors deserve careful consideration. Firstly, assess your current and anticipated healthcare needs. Consider your age, health history, and any pre-existing conditions. Secondly, compare the costs of different AARP plans and those offered by other providers. Don’t just focus on the monthly premium; consider the overall out-of-pocket costs. Thirdly, understand the specific coverage details of each plan, paying close attention to what is and isn’t covered. Finally, seek professional advice from an independent insurance agent who can provide unbiased guidance and help you compare different options.

Warning Signs to Watch Out for

Choosing a Medicare Supplement plan requires vigilance. Here are some red flags to watch out for:

- High-pressure sales tactics: Legitimate insurers will provide information and answer your questions without pressuring you into an immediate decision.

- Promises that sound too good to be true: Be wary of guarantees of exceptionally low premiums or incredibly comprehensive coverage that seems unrealistic.

- Lack of transparency: If the insurer is unclear about the plan’s details or avoids answering your questions directly, proceed with caution.

- Unexpected fees or charges: Thoroughly review the policy documents to ensure there are no hidden fees or charges.

- Difficulty contacting the insurer or obtaining necessary information: A reputable insurer will be readily available to address your questions and concerns.

Last Word: Aarp Secondary Insurance To Medicare

Ultimately, choosing the right Medicare supplemental insurance is a deeply personal decision. While AARP offers competitive plans with various benefits, it’s crucial to weigh your specific healthcare needs, budget, and long-term financial goals against the options available from other providers. Don’t hesitate to compare apples to apples, scrutinize the fine print, and consider seeking advice from a qualified insurance professional. Remember, informed choices lead to peace of mind, especially when it comes to your health and financial well-being. So, take your time, do your research, and find the plan that gives you the best coverage for your buck.