Best insurance rates in NC? Finding the cheapest car, home, or health insurance in the Tar Heel State can feel like navigating a maze. But don’t worry, this isn’t some insurance-industry conspiracy; understanding the factors that influence your premiums is the key to unlocking serious savings. We’ll break down the North Carolina insurance market, reveal the secrets to scoring the best rates, and equip you with the knowledge to negotiate like a pro. Get ready to ditch those overpriced premiums!

From comparing auto insurance rates across major cities to understanding how your credit score impacts your premiums, we’ll cover everything you need to know. We’ll even show you how to leverage bundling, negotiate effectively, and choose the right insurance provider – all while keeping your wallet happy. Ready to become an insurance savvy Tar Heel? Let’s dive in!

Understanding North Carolina’s Insurance Market

Navigating the insurance landscape in North Carolina requires understanding the factors that influence premiums and the state’s regulatory environment. This knowledge empowers consumers to make informed decisions and secure the best possible coverage at competitive rates. The state’s unique characteristics significantly impact insurance costs, creating a dynamic market worth exploring.

Factors Influencing Insurance Costs in North Carolina

Several interconnected factors contribute to the variability of insurance costs across North Carolina. These include geographic location, demographic data, the claims history of individual drivers and homeowners, and the specific coverage chosen. For instance, coastal areas are typically more expensive to insure due to a higher risk of hurricane damage, while densely populated urban centers might see higher auto insurance premiums because of increased accident rates. Individual risk profiles play a crucial role; a driver with multiple accidents or traffic violations will pay significantly more than a driver with a clean record. Similarly, a homeowner in a high-crime area may face higher premiums than one in a safer neighborhood. Finally, the type and level of coverage selected directly impact the cost. Comprehensive coverage, while offering greater protection, naturally costs more than a basic policy.

North Carolina’s Insurance Regulatory Environment

North Carolina’s insurance regulatory environment is overseen by the North Carolina Department of Insurance (NCDI). This agency plays a critical role in ensuring fair pricing and protecting consumer interests. Compared to some other states, North Carolina’s regulatory approach can be characterized as moderately interventionist, balancing the needs of insurers with the needs of consumers. Some states have more stringent regulations regarding pricing and coverage options, leading to potentially higher premiums but more consumer protections. Other states might have a more laissez-faire approach, allowing for greater competition but potentially exposing consumers to higher risks. The NCDI’s role involves setting minimum coverage requirements, approving rate increases, and investigating complaints against insurance companies. This regulatory framework aims to create a balanced market where competition exists alongside consumer protection.

Types of Insurance Commonly Sought in North Carolina

North Carolinians, like residents of any state, seek a range of insurance products to mitigate various risks. Auto insurance is mandatory in North Carolina, covering liability for damages and injuries caused in accidents. Homeowners insurance protects property from damage caused by events like fire, theft, and weather-related incidents. Renters insurance offers similar protection for renters, covering their belongings and providing liability coverage. Health insurance, while not mandated at the state level, is crucial for covering medical expenses. Many North Carolinians obtain health insurance through their employers, the Affordable Care Act marketplace, or other avenues. Other common types of insurance include life insurance, which provides financial protection for beneficiaries upon the death of the insured, and umbrella insurance, which provides additional liability coverage beyond the limits of other policies. The specific needs for each type of insurance vary greatly based on individual circumstances, financial stability, and risk tolerance.

Finding the Best Rates

Navigating the North Carolina insurance market to find the best rates requires understanding the key factors influencing premiums. While individual circumstances vary, several elements consistently play a significant role in determining the cost of your insurance. Let’s delve into the most impactful ones.

Credit Scores and Insurance Premiums

Your credit score is a surprisingly influential factor in determining your insurance premiums in North Carolina. Insurers often use credit-based insurance scores, which are different from your traditional FICO score, to assess risk. The reasoning behind this is that individuals with poor credit history often demonstrate less responsible behavior, which can translate to a higher likelihood of filing insurance claims. A higher credit score generally correlates with lower premiums, while a lower score can lead to significantly higher costs. For example, a driver with an excellent credit score might pay hundreds of dollars less annually than a driver with a poor credit score, even if their driving records are identical. Improving your credit score can be a strategic move towards securing more affordable insurance.

Driving History’s Impact on Auto Insurance Costs

Your driving history is another cornerstone in determining your auto insurance premiums. A clean driving record, free from accidents and traffic violations, will almost always result in lower premiums. Conversely, accidents, especially those resulting in significant damage or injuries, can drastically increase your rates. Similarly, traffic violations like speeding tickets, DUIs, or reckless driving convictions will negatively impact your insurance costs. The severity and frequency of these incidents directly influence the premium increase. For instance, a single speeding ticket might result in a modest increase, while a DUI could lead to a substantial premium hike, potentially lasting for several years. Maintaining a safe driving record is paramount to keeping your auto insurance costs manageable.

Age and Location: Their Influence on Premiums

Age and location are two demographic factors that heavily influence insurance premiums. Younger drivers, statistically, are involved in more accidents than older, more experienced drivers. This higher risk translates to higher premiums for younger drivers. As drivers age and gain experience, their premiums typically decrease. Location also plays a crucial role. Areas with higher crime rates, more frequent accidents, or higher property values tend to have higher insurance premiums. For example, a driver living in a densely populated urban area with a high crime rate will likely pay more for car insurance than a driver residing in a rural, low-crime area, even if all other factors remain constant. Understanding these geographical variations is key to finding the best rates.

Types of Insurance and Rate Comparisons

Understanding the cost of insurance in North Carolina requires looking beyond simple averages. Rates vary significantly depending on location, coverage level, and individual circumstances. This section breaks down average rates for key insurance types across the state, highlighting factors influencing those costs.

Auto Insurance Rates Across Major NC Cities

Average auto insurance premiums fluctuate considerably depending on the city. Several factors contribute to these variations, including accident rates, crime statistics, and the density of the population. The following table provides a snapshot of estimated average annual premiums for minimum liability coverage in some major North Carolina cities. Remember that these are averages and your individual rate will depend on your driving history, vehicle type, and other personal factors.

| City | Average Annual Premium (Minimum Liability) | Factors Influencing Rates | Notes |

|---|---|---|---|

| Charlotte | $750 | High population density, higher accident rates | Data based on industry averages. |

| Raleigh | $700 | Growing population, moderate accident rates | Data based on industry averages. |

| Greensboro | $650 | Moderate population density, lower accident rates compared to Charlotte | Data based on industry averages. |

| Asheville | $600 | Lower population density, mountainous terrain impacting driving conditions | Data based on industry averages. |

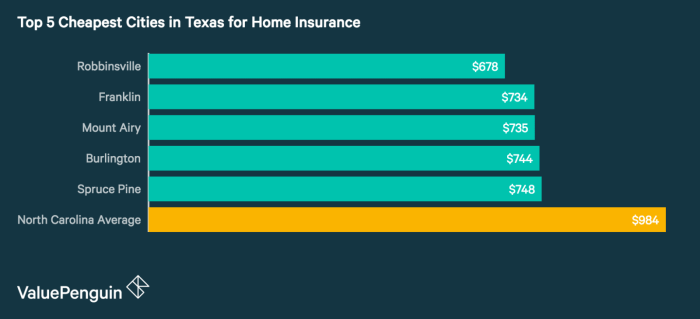

Factors Influencing Home Insurance Costs: Coastal vs. Inland NC, Best insurance rates in nc

The North Carolina coastline is beautiful, but it also presents unique risks to homeowners. Home insurance rates reflect these risks, with coastal properties generally commanding significantly higher premiums than those inland.

| Factor | Coastal NC | Inland NC | Explanation |

|---|---|---|---|

| Hurricane Risk | High | Low | Proximity to the Atlantic Ocean significantly increases the risk of hurricane damage. |

| Flood Risk | High | Low to Moderate (depending on location) | Coastal areas are more vulnerable to flooding from storm surges and rising sea levels. |

| Wind Damage Risk | High | Low | Strong coastal winds can cause significant damage to homes. |

| Construction Costs | Potentially Higher | Generally Lower | Repair and rebuilding costs can be higher in coastal areas due to demand and specialized materials. |

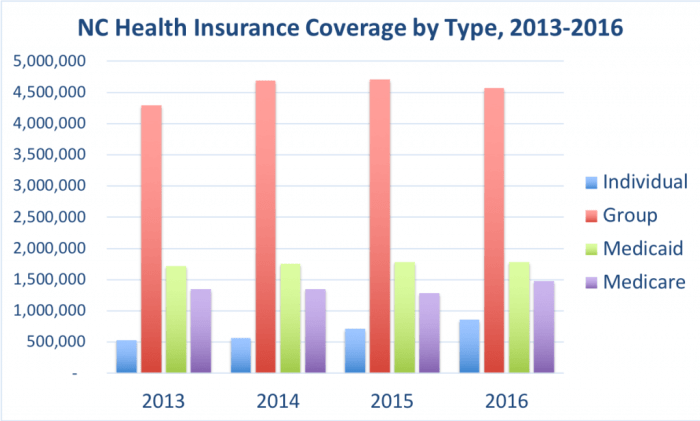

Health Insurance Coverage Levels and Rates in NC

North Carolina’s health insurance market offers various coverage levels, each with associated costs. Understanding these differences is crucial for choosing a plan that meets your needs and budget. The following table illustrates estimated average monthly premiums for different coverage levels. These are estimates, and actual costs will depend on factors such as age, health status, and the specific insurer.

| Coverage Level | Average Monthly Premium (Estimate) | Deductible (Estimate) | Out-of-Pocket Maximum (Estimate) |

|---|---|---|---|

| Bronze | $250 | $7,000 | $7,900 |

| Silver | $400 | $4,000 | $7,900 |

| Gold | $550 | $2,000 | $7,900 |

| Platinum | $700 | $1,000 | $7,900 |

Strategies for Lowering Insurance Costs

Navigating the world of insurance in North Carolina can feel like a maze, but lowering your premiums doesn’t have to be a mystery. By employing smart strategies and understanding your options, you can significantly reduce your annual insurance costs without sacrificing necessary coverage. This section Artikels effective methods to achieve this, empowering you to take control of your insurance spending.

Lowering your insurance costs involves a proactive approach that combines negotiation, careful planning, and a thorough understanding of your policy options. It’s not just about finding the cheapest initial quote; it’s about building a long-term relationship with your insurer that benefits both parties. Remember, the best strategy is a tailored one, considering your specific circumstances and risk profile.

Negotiating Lower Insurance Premiums

Negotiating your insurance premiums can feel daunting, but it’s often more effective than you might think. Insurance companies understand that retaining customers is often cheaper than acquiring new ones. Therefore, they are often willing to work with you to find a price point that suits both your needs and their bottom line. This involves presenting yourself as a low-risk customer, highlighting your good driving record (for auto insurance), or your history of responsible homeownership (for homeowners insurance). Don’t be afraid to shop around and use competing quotes as leverage during negotiations. A friendly, yet firm, approach often yields positive results.

A Checklist for Reducing Insurance Costs

Taking proactive steps to reduce your risk profile can significantly impact your insurance premiums. This checklist summarizes essential actions you can take:

The following actions demonstrate your commitment to risk mitigation, which insurance companies reward with lower premiums. This isn’t about cutting corners; it’s about being responsible and demonstrating your commitment to safety and financial prudence.

Hunting for the best insurance rates in NC? Finding affordable coverage can feel like navigating a maze, but understanding your options is key. A solid grasp of the fundamentals of insurance is your first step. Once you’ve got that down, you’ll be well-equipped to snag those killer rates and secure the best policy for your needs in North Carolina.

- Maintain a good driving record: Avoid accidents and traffic violations. A clean driving history is a significant factor in determining auto insurance rates.

- Improve your credit score: A higher credit score often translates to lower insurance premiums. This is because a good credit score is often correlated with responsible financial behavior.

- Install security systems: Home security systems, such as alarms and surveillance cameras, can reduce the risk of theft and damage, leading to lower homeowners insurance premiums.

- Bundle your insurance policies: Combining multiple insurance policies (auto, home, renters) with the same provider often results in significant discounts.

- Take defensive driving courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount on your auto insurance.

- Consider increasing your deductible: A higher deductible means lower premiums, but it also means you’ll pay more out-of-pocket in the event of a claim. Carefully weigh the pros and cons.

Bundling Insurance Policies

Bundling your auto, home, renters, or other insurance policies with a single provider is a common and effective way to save money. Insurance companies often offer significant discounts for bundling, as it simplifies their administrative processes and reduces the risk of losing a customer to a competitor. For example, bundling your car insurance with your homeowners insurance might lead to a 10-15% discount, or even more, depending on the insurer and your specific policies. This discount can amount to substantial savings over the course of a year.

Increasing Deductibles: Benefits and Drawbacks

Increasing your deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – is another strategy to lower your premiums. A higher deductible means lower monthly payments, but it also increases your financial responsibility in the event of a claim. For example, increasing your auto insurance deductible from $500 to $1000 might result in a 15-20% reduction in your premium. However, if you were to file a claim, you would have to pay $500 more out-of-pocket. Carefully assess your financial situation and risk tolerance before making this decision. Consider the likelihood of filing a claim and whether you can comfortably afford a higher deductible.

Choosing the Right Insurance Provider

Source: valchoice.com

Navigating the world of insurance in North Carolina can feel overwhelming, but selecting the right provider is crucial for securing your financial future. The best provider for you will depend on your specific needs and risk profile. Let’s break down how to make an informed decision.

Choosing an insurance provider involves more than just comparing prices. While cost is a significant factor, the level of customer service, policy coverage details, and the company’s financial stability all play vital roles in ensuring you receive the protection you need when you need it.

Comparison of Three Major NC Insurance Providers

While specific offerings change frequently, a general comparison can illustrate the importance of researching individual provider details. Let’s hypothetically compare three large North Carolina insurers—we’ll call them Provider A, Provider B, and Provider C— focusing on their general approaches to customer service, policy options, and digital accessibility. Provider A is known for its extensive network of local agents, offering personalized service but potentially higher premiums. Provider B emphasizes digital convenience with a robust online platform and self-service options, potentially sacrificing some personalized support. Provider C strives for a balance, offering both online tools and a network of agents, aiming to cater to a wider range of customer preferences. Remember, these are hypothetical examples and actual provider offerings should be independently verified.

Factors to Consider When Selecting an Insurance Company

Selecting the right insurance company requires careful consideration of several key factors. Ignoring these aspects can lead to unexpected costs or inadequate coverage in the event of a claim.

- Financial Stability: Look for companies with strong financial ratings from organizations like A.M. Best. A financially sound company is more likely to be able to pay out claims when needed.

- Customer Service: Read reviews and check customer satisfaction ratings to gauge the responsiveness and helpfulness of the company’s customer service team. Consider ease of contacting representatives and the speed of claim processing.

- Policy Coverage: Carefully compare the specific coverages offered by different providers. Ensure the policy adequately protects your assets and meets your individual needs. Don’t just focus on the price; understand what’s included and what’s excluded.

- Discounts and Bundling Options: Many insurers offer discounts for bundling multiple insurance types (home and auto, for example), safe driving records, or security systems. Explore these options to potentially lower your premiums.

- Claims Process: Research the company’s claims process. Look for information on how easy it is to file a claim, the speed of processing, and the overall customer experience during the claims process.

Importance of Reading Policy Details Carefully

Before committing to any insurance policy, thoroughly review the policy documents. Understanding the terms, conditions, exclusions, and limitations is crucial to avoid surprises later. Pay close attention to the definitions of covered events, deductibles, and premium amounts. Don’t hesitate to contact the insurer or an independent insurance agent to clarify any unclear points.

“Failing to understand your policy’s fine print can lead to significant financial losses in the event of a claim.”

Assessing Customer Reviews and Ratings

Online reviews and ratings provide valuable insights into a company’s reputation and customer satisfaction. However, approach them critically. Consider the volume of reviews, the range of experiences expressed, and whether the reviews seem genuine. Websites like the Better Business Bureau and independent review platforms can offer helpful information, but always cross-reference information from multiple sources.

Resources for Finding Insurance Information

Source: cloudinary.com

Navigating the world of North Carolina insurance can feel like a maze, but thankfully, there are numerous resources available to help you find the best rates and coverage. This section will equip you with the tools and knowledge to effectively research and compare insurance options, ultimately saving you time and money. We’ll cover reliable online comparison sites, a step-by-step guide to using these tools, and information on state-sponsored assistance programs.

Finding the right insurance policy requires careful research and comparison. Don’t rely solely on a single source; leverage multiple resources to ensure you’re getting the best possible deal. Remember, the goal is to find a policy that offers adequate coverage at a price that fits your budget.

Reliable Online Resources for Comparing Insurance Rates in NC

Several reputable websites specialize in comparing insurance rates from multiple providers. These sites allow you to input your information once and receive quotes from various companies, streamlining the comparison process. Using these tools saves you the time and effort of contacting each insurer individually. Some popular options include, but aren’t limited to, NerdWallet, The Zebra, and Policygenius. Each site’s interface may differ slightly, but the core functionality remains the same: providing multiple quotes based on your specified criteria.

Using Online Insurance Comparison Tools Effectively

Effectively using online comparison tools requires a systematic approach. First, gather all necessary information, including your driver’s license number, vehicle information (for auto insurance), and details about your home (for homeowners insurance). Second, be precise when inputting your information, as inaccuracies can lead to inaccurate quotes. Third, compare not only price but also coverage details. A slightly higher premium might offer significantly better protection. Finally, always read the fine print of any quote before committing.

State-Sponsored Programs and Initiatives for Insurance Affordability

North Carolina offers several programs designed to make insurance more affordable for its residents. These programs often target specific demographics or situations, such as low-income families or those recovering from natural disasters. Researching these programs can significantly reduce your insurance costs. The North Carolina Department of Insurance website is an excellent resource for information on available programs and eligibility criteria. Examples might include subsidies for low-income individuals or assistance programs following declared emergencies. Checking the NCDOI website for current programs is crucial, as availability and eligibility requirements may change.

Illustrative Examples of Rate Variations

Understanding how various factors influence your insurance premiums in North Carolina is key to securing the best rates. Let’s look at some real-world examples to illustrate the impact of driving history, location, and bundling.

Driving Record Impact on Auto Insurance Costs

A clean driving record significantly impacts your auto insurance premium. Consider two hypothetical drivers in Charlotte, NC, both driving similar vehicles. Driver A has a spotless record for five years, while Driver B has been involved in two at-fault accidents and received a speeding ticket within the same period. Driver A might qualify for a significant discount, potentially paying $800 annually for comprehensive coverage. Driver B, on the other hand, could expect to pay considerably more, perhaps around $1,500 or even higher due to the increased risk associated with their driving history. This difference highlights the importance of safe driving practices in keeping your insurance costs low.

Location’s Influence on Home Insurance Premiums

Location plays a crucial role in determining home insurance premiums. Let’s compare two homes with similar features and values: one in a quiet, established neighborhood in Raleigh, NC, and another in a coastal area prone to hurricanes near Wilmington, NC. The Raleigh home, situated in a low-risk area, might command an annual premium of $1,200. The Wilmington home, however, faces higher risks of hurricane damage and flooding, leading to a significantly higher premium, potentially reaching $2,000 or more per year. This demonstrates how geographical location and associated risks directly impact the cost of home insurance.

Cost Savings from Bundling Insurance Policies

Bundling your auto and home insurance policies with the same provider often leads to significant cost savings. Imagine a homeowner in Asheville, NC, who currently pays $1,000 annually for auto insurance and $1,300 for home insurance with separate companies. By bundling these policies with a single insurer, they might receive a discount of 15-20%, potentially reducing their total annual premium to approximately $2,000 instead of $2,300. This illustrates the financial benefits of combining insurance needs under one provider.

Last Recap: Best Insurance Rates In Nc

Source: amistadinsuranceservices.com

Securing the best insurance rates in NC isn’t about luck; it’s about strategy. By understanding the factors that influence premiums, actively comparing quotes, and negotiating effectively, you can significantly lower your costs. Remember, being informed is your biggest weapon. Armed with the knowledge in this guide, you’re ready to conquer the North Carolina insurance market and keep more money in your pocket. So go forth, compare, and conquer those premiums!