Best workers comp insurance for construction isn’t just about ticking a box; it’s about safeguarding your crew and your business. Construction sites are inherently risky, with electricians battling high voltage, carpenters wielding power tools, and ironworkers dancing with gravity at dizzying heights. A single accident can cripple your bottom line, not to mention the devastating impact on your workers. Finding the right workers’ compensation insurance is crucial, not just for legal compliance, but for peace of mind. This guide navigates the complexities of finding the best coverage to protect your team and your business.

We’ll break down the different types of policies, explore key features to look for, and help you understand how to choose a provider that’s financially stable and offers excellent customer support. Beyond the insurance itself, we’ll delve into proactive risk management strategies – from robust safety training programs to cutting-edge safety technology – to minimize accidents and keep your premiums down. Think of it as building a solid foundation for your business, one safety measure and smart insurance choice at a time.

Understanding Construction Worker Risks

Construction work, while vital to our infrastructure, carries inherent dangers. The industry boasts a higher-than-average rate of workplace injuries compared to other sectors, impacting both workers and businesses significantly. Understanding these risks is crucial for implementing effective safety measures and securing appropriate workers’ compensation insurance.

Construction worker injuries are often severe and costly, leading to lost productivity, increased medical expenses, and potential legal liabilities for employers. A comprehensive understanding of these risks allows for proactive strategies to mitigate these challenges.

Common Construction Workplace Injuries

Falls, struck-by incidents, caught-in/between hazards, and electrocutions represent the “Fatal Four” – the leading causes of death in the construction industry. Beyond these, numerous other injuries occur regularly, including lacerations, fractures, sprains, strains, and repetitive stress injuries. These injuries can range from minor to catastrophic, resulting in temporary or permanent disabilities. The severity and frequency of these injuries vary considerably depending on the specific trade and the site conditions.

Risks Faced by Different Construction Trades

Different construction trades face unique risks based on their specific tasks and tools. Electricians, for example, risk electrocution, arc flash burns, and falls from heights while working on power lines or electrical systems. Carpenters frequently suffer from repetitive strain injuries due to prolonged use of hand tools and power saws, as well as injuries from cuts and lacerations. Ironworkers, who work at significant heights, are at high risk of falls, as well as injuries from dropped objects or falling materials. Heavy equipment operators face risks associated with operating machinery, including crushing injuries and rollovers. Each trade presents its own unique set of hazards requiring specialized safety protocols and training.

Impact of Injuries on Worker Productivity and Business Operations

The impact of construction worker injuries extends beyond the individual worker. Injuries lead to lost workdays, reduced productivity, and increased healthcare costs. Businesses face financial burdens associated with workers’ compensation claims, potential legal fees, and the costs of retraining replacement workers. Project delays due to worker absences can further impact profitability and potentially lead to contract penalties. The cumulative effect of these factors can significantly damage a construction company’s financial health and reputation. A proactive approach to safety, including comprehensive training, proper equipment, and a strong safety culture, is crucial to minimizing these negative impacts.

Injury Rates Across Construction Specialties

| Construction Specialty | Injury Rate (per 100 full-time workers) | Common Injuries | Contributing Factors |

|---|---|---|---|

| Ironworkers | 15 | Falls, crush injuries, lacerations | Working at heights, heavy equipment |

| Electricians | 12 | Electrocution, burns, falls | Electrical hazards, working at heights |

| Carpenters | 10 | Cuts, lacerations, repetitive strain injuries | Hand tools, power tools, repetitive movements |

| General Laborers | 8 | Strains, sprains, back injuries | Manual handling, lifting heavy objects |

*Note: These are illustrative examples and actual rates may vary depending on data sources and reporting methodologies. Accurate injury rates should be obtained from reliable industry sources such as the Bureau of Labor Statistics.*

Key Features of Workers’ Compensation Insurance Policies

Source: keymedia.com

Finding the best workers comp insurance for construction is crucial for protecting your business and your employees. If you’re based in Tennessee, securing the right coverage is paramount, and researching options like those available through insurance Kingsport TN can be a great starting point. Remember, the right workers’ comp policy means peace of mind knowing your crew is covered, no matter the job site.

Navigating the world of workers’ compensation insurance for your construction company can feel like scaling a skyscraper without safety gear. Understanding the different policy types and their nuances is crucial for protecting your business and your employees. This section breaks down the key features you need to know to make an informed decision.

Choosing the right workers’ compensation insurance policy is a critical step in managing risk and ensuring your construction business is legally compliant and financially protected. Different policies offer varying levels of coverage and cost, making careful consideration essential.

Types of Workers’ Compensation Insurance Policies

Construction companies typically have access to several types of workers’ compensation insurance policies. The most common include standard policies offered by private insurers, state-funded programs, and self-insurance options. Private insurers offer a range of coverage options tailored to specific business needs and risk profiles, often providing more flexibility. State-funded programs are usually more standardized, offering a baseline level of coverage, and are often the default option if a company cannot secure private insurance. Self-insurance involves a company setting aside funds to cover potential workers’ compensation claims, a strategy typically employed by larger companies with substantial financial resources and a demonstrated history of low claims. Each option presents a unique set of advantages and disadvantages in terms of cost, coverage, and administrative burden.

Coverage Provided by Workers’ Compensation Insurance Policies

Workers’ compensation insurance policies generally cover medical expenses related to work-related injuries or illnesses. This includes doctor visits, hospital stays, surgery, physical therapy, and prescription medications. Lost wages are also covered, compensating employees for time missed from work due to injury. Rehabilitation services, such as vocational training or physical therapy, are often included to help injured workers return to work or adapt to new roles. The specifics of coverage, however, vary depending on the policy and the state regulations. For example, some policies might have limitations on the duration of lost wage benefits or the types of medical treatments covered.

Policy Exclusions and Limitations

It’s important to understand that workers’ compensation policies are not all-encompassing. Common exclusions include injuries resulting from an employee’s willful misconduct or intentional self-harm. Injuries sustained outside of work hours or while engaging in activities unrelated to employment are usually not covered. Policies also frequently have limitations on the amount of compensation payable for specific types of injuries or illnesses. For instance, a policy might cap the total amount payable for lost wages or impose a limit on the number of weeks of benefits provided. Careful review of the policy’s fine print is essential to understand these exclusions and limitations.

Factors Influencing the Cost of Workers’ Compensation Insurance

Several factors significantly impact the cost of workers’ compensation insurance for construction firms.

- Industry Classification: Construction is inherently risky, leading to higher premiums than less hazardous industries.

- Payroll: Higher payroll generally translates to higher premiums, as the cost is often calculated as a percentage of payroll.

- Claims History: A history of frequent or high-cost workers’ compensation claims will significantly increase future premiums.

- Safety Program: Implementing a robust safety program and demonstrating a commitment to workplace safety can lead to lower premiums through experience modification ratings.

- Employee Demographics: The age and experience of employees can influence premiums, as older or less experienced workers may pose a higher risk.

- State Regulations: State laws and regulations governing workers’ compensation vary, affecting the cost of insurance.

Understanding these factors allows construction companies to proactively manage their risk profile and potentially lower their insurance costs. For example, investing in comprehensive safety training programs and implementing rigorous safety protocols can demonstrably reduce the frequency and severity of workplace accidents, leading to lower premiums over time. Similarly, maintaining accurate records of employee demographics and claims history can facilitate a more precise risk assessment and more competitive insurance pricing.

Choosing the Right Insurance Provider: Best Workers Comp Insurance For Construction

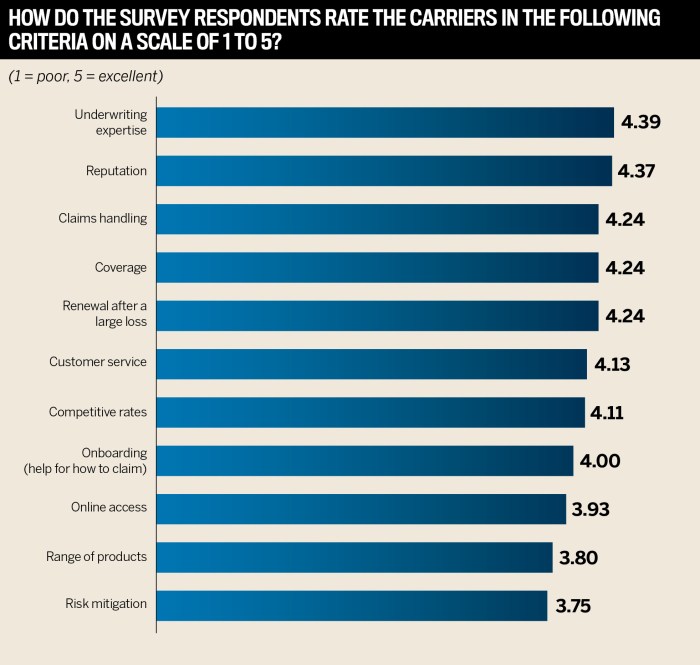

Picking the right workers’ compensation insurance provider for your construction business is crucial. It’s not just about the price; it’s about ensuring you have reliable coverage and a smooth claims process when things go wrong – and in construction, things *do* go wrong. The wrong provider can lead to headaches, delays, and even financial instability for your company. Choosing wisely can save you time, money, and a lot of stress.

Finding the right fit involves more than just comparing premiums. You need to carefully evaluate the insurer’s financial strength, reputation, and the quality of services they provide. This includes assessing their claims handling process, customer service responsiveness, and the overall ease of working with them.

Financial Stability and Reputation of Insurance Providers

A financially stable insurance provider is essential. You need confidence that they’ll be able to pay out claims when needed. Look for companies with high ratings from financial rating agencies like A.M. Best. A strong reputation, indicated by positive reviews and a history of fair claims handling, is equally vital. Investigate the provider’s history, checking for any significant legal issues or widespread customer complaints. Don’t hesitate to ask for references from other construction companies they insure. Word-of-mouth can be incredibly valuable. For example, a provider with consistent A ratings from A.M. Best and numerous positive testimonials on independent review sites demonstrates a strong track record.

Comparison of Services Offered by Different Insurers

Different insurers offer varying levels of service. Claims processing speed and efficiency can significantly impact your business. A quick and straightforward claims process minimizes disruption to your operations. Similarly, responsive and helpful customer support is crucial. You need to be able to easily contact your insurer with questions and receive timely assistance. Some insurers offer specialized services tailored to the construction industry, such as safety consultations or risk management programs. These can be invaluable in reducing accidents and lowering your premiums. For example, one insurer might offer a dedicated construction claims adjuster with years of industry experience, while another might rely on a more generalized approach.

Factors to Consider When Negotiating Rates with Insurance Providers

Negotiating your insurance rates effectively requires preparation. Start by understanding your company’s risk profile. Factors such as your safety record, the type of construction work you perform, and your employee demographics all influence your premiums. Gather quotes from multiple insurers and compare them side-by-side, paying attention to not just the premium but also the coverage provided. Consider bundling policies, such as general liability and commercial auto insurance, to potentially negotiate better rates. Don’t be afraid to leverage your company’s positive safety record or any loss control measures you’ve implemented to negotiate a lower premium. For instance, a company with a demonstrably strong safety program, resulting in a low number of worker’s compensation claims over the past few years, might be able to secure a significantly reduced premium.

Summary of Top-Rated Insurance Providers for Construction Businesses

| Provider | Strengths | Weaknesses | Special Features |

|---|---|---|---|

| XYZ Insurance | Strong financial rating, excellent customer service | Slightly higher premiums than some competitors | Dedicated construction risk management team |

| ABC Insurance Group | Competitive pricing, fast claims processing | Customer service can be inconsistent | Online claims portal |

| 123 Workers’ Comp | Wide range of coverage options, proactive safety programs | Relatively new company, smaller market share | Safety training resources for clients |

| DEF Insurance Solutions | Highly specialized in construction insurance, strong safety expertise | May not offer the broadest range of coverage | Customized risk assessment for each client |

Cost-Effective Risk Management Strategies

Source: infocoverage.com

Smart construction companies understand that proactive safety measures aren’t just ethical—they’re financially savvy. Investing in robust risk management translates to lower workers’ compensation premiums, reduced downtime, and a more productive, healthier workforce. By focusing on prevention, you’re not just protecting your employees; you’re safeguarding your bottom line.

Implementing comprehensive safety programs is the cornerstone of effective risk management. These programs actively reduce workplace accidents, a leading driver of increased workers’ compensation costs. A well-structured program demonstrates to insurers a commitment to safety, leading to favorable premium rates. Furthermore, a safer work environment boosts employee morale and productivity, creating a positive feedback loop of cost savings and improved performance.

Safety Training Program Examples

Effective safety training goes beyond simply ticking boxes. It involves engaging, practical instruction tailored to the specific hazards of the construction industry. Successful programs utilize a multi-faceted approach, incorporating classroom learning, hands-on demonstrations, and regular refresher courses. For example, a program might include detailed instruction on fall protection techniques, complete with demonstrations of proper harness use and anchor point selection. Similarly, training on operating heavy machinery could include simulations and practical exercises to reinforce safe operating procedures. Another critical component is training on hazard communication, ensuring workers understand and can identify potential dangers like asbestos or chemical exposure. Regular assessments and feedback mechanisms are crucial to ensure the training is effective and relevant. A well-documented training program also serves as evidence of due diligence should an incident occur.

Benefits of Safety Equipment and Technology

Investing in high-quality safety equipment is not an expense; it’s an investment in preventing costly injuries. Hard hats, safety glasses, and proper footwear are fundamental. Beyond the basics, technologies like fall arrest systems, automated safety monitoring systems, and body-worn cameras can significantly reduce risks. For example, a fall arrest system can prevent fatal falls from heights, while automated monitoring systems can alert supervisors to potential hazards in real-time. Body-worn cameras can provide valuable evidence in the event of an accident, helping to determine the cause and prevent future incidents. The initial cost of this equipment is often offset by the long-term savings achieved through injury prevention. Consider the cost of a single lost-time injury versus the cost of a comprehensive safety equipment program—the contrast is stark.

Regular Safety Inspections and Hazard Mitigation

Regular safety inspections are not merely a formality; they are a proactive measure to identify and address potential hazards before they cause accidents. These inspections should be conducted routinely by trained personnel, with a checklist covering all aspects of the worksite. The findings should be meticulously documented, with corrective actions implemented promptly. For instance, a regular inspection might reveal loose scaffolding, improperly stored materials, or exposed wiring—all potential sources of accidents. Addressing these issues promptly prevents injuries and demonstrates a commitment to safety, which is positively reflected in workers’ compensation insurance premiums. Furthermore, the documented inspection reports serve as valuable evidence of proactive risk management.

Claims Process and Dispute Resolution

Source: keymedia.com

Navigating the workers’ compensation claims process can feel like traversing a maze, especially within the high-risk environment of construction. Understanding the steps involved, potential disputes, and avenues for appeal is crucial for both employers and employees. This section breaks down the process, offering clarity and practical guidance.

Filing a Workers’ Compensation Claim

The process begins with immediate reporting of the injury. Prompt notification is key to a smoother claim. The injured worker should report the incident to their supervisor as soon as possible, typically within 24-72 hours, depending on state regulations. This initial report triggers the formal claims process. Next, the worker will usually need to complete a claim form provided by their employer’s insurance carrier, detailing the injury, circumstances, and medical treatment sought. Supporting documentation, such as medical records and witness statements, should be included. The insurance company then investigates the claim, which may involve interviews, site visits, and medical evaluations. The insurer will determine the eligibility of the claim and the extent of benefits payable, such as medical expenses and lost wages. Timely submission of all required documentation is crucial to avoid delays.

Appealing a Denied Claim

If a claim is denied, the worker has the right to appeal the decision. The appeal process varies by state, but generally involves filing a formal appeal with the relevant state workers’ compensation agency within a specified timeframe. This often involves submitting additional evidence or arguing for a different interpretation of the facts. A hearing may be scheduled before an administrative law judge, who will review the evidence and make a determination. Legal representation is often advisable during the appeal process, particularly if the denial involves significant financial implications. Workers should carefully review their state’s specific appeal procedures and deadlines.

Common Disputes in Workers’ Compensation Claims

Disputes frequently arise regarding the cause of the injury, the extent of the disability, and the appropriate level of benefits. For example, a dispute might occur if the insurer argues the injury wasn’t work-related, or if the worker disagrees with the physician’s assessment of their disability. Another common area of contention is the adequacy of medical care provided by the insurer. Disputes may also arise over the calculation of lost wages, especially if the injured worker is self-employed or has fluctuating income. In cases involving pre-existing conditions, determining the extent to which the work injury aggravated or contributed to the condition can be a significant point of contention. Finally, disagreements about the appropriate level of vocational rehabilitation services are also frequent.

Workers’ Compensation Claim Flowchart, Best workers comp insurance for construction

Imagine a flowchart with the following steps:

1. Injury Occurs: The worker sustains a work-related injury.

2. Report Injury: The worker reports the injury to their supervisor.

3. Claim Filed: The worker files a claim with the employer’s insurance carrier.

4. Investigation: The insurance company investigates the claim.

5. Claim Approved/Denied: The insurance company approves or denies the claim.

6. Benefits Paid (if approved): Medical expenses and lost wages are paid.

7. Claim Denied – Appeal: If denied, the worker can appeal the decision.

8. Hearing: A hearing may be held before an administrative law judge.

9. Final Decision: A final decision is rendered.

The Impact of State Regulations

Navigating the world of workers’ compensation insurance for construction companies requires a keen understanding of the significant variations in state regulations. These differences aren’t merely bureaucratic hurdles; they directly impact the cost, coverage, and overall compliance burden for businesses operating across multiple states or even within a single state with complex projects. Understanding these nuances is crucial for effective risk management and financial planning.

State regulations significantly influence the cost and coverage of workers’ compensation insurance. The level of benefits mandated by each state’s laws, including medical expenses, lost wages, and death benefits, directly affects the premiums insurers charge. States with more generous benefits packages naturally command higher premiums. Furthermore, the administrative processes and dispute resolution mechanisms vary widely, influencing both the cost of handling claims and the potential financial exposure for employers. These differences can be substantial, making it essential for contractors to tailor their insurance strategies to the specific requirements of each state where they operate.

State-Specific Workers’ Compensation Laws

Each state possesses its own unique workers’ compensation laws, creating a complex patchwork across the nation. These laws dictate eligibility criteria, benefit levels, and the procedures for filing and resolving claims. For instance, some states may have stricter definitions of what constitutes a work-related injury, leading to fewer accepted claims and potentially lower premiums. Conversely, states with broader definitions might see higher claim rates and, consequently, higher premiums. The availability of different types of coverage, such as temporary disability benefits or vocational rehabilitation, also varies considerably. Ignoring these differences can expose businesses to significant legal and financial risks.

Employer Compliance Requirements

Compliance with state workers’ compensation regulations is mandatory for most employers in the construction industry. Failure to comply can result in substantial penalties, including fines, back taxes, and even criminal charges. Key requirements typically include securing workers’ compensation insurance coverage, maintaining accurate records of employee injuries and illnesses, promptly reporting workplace accidents, and cooperating fully with investigations. The specific documentation and reporting requirements vary by state, often necessitating specialized software or the services of a compliance consultant. Employers must also stay updated on changes in state regulations, which can be frequent and complex.

Comparison of Workers’ Compensation Laws Across States

The following table highlights key differences in workers’ compensation laws across several states, illustrating the significant variations that exist. Note that this is a simplified representation, and consulting with legal and insurance professionals is crucial for accurate and up-to-date information.

| State | Average Premium Cost (Example – adjust for current data) | Maximum Weekly Benefit (Example – adjust for current data) | Claim Reporting Requirements |

|---|---|---|---|

| California | $X (replace with current data) | $Y (replace with current data) | Within 1 day of accident |

| Texas | $A (replace with current data) | $B (replace with current data) | Within 8 days of accident |

| New York | $C (replace with current data) | $D (replace with current data) | Within 10 days of accident |

| Florida | $E (replace with current data) | $F (replace with current data) | Within 7 days of accident |

Emerging Trends in Construction Workers’ Compensation

The construction industry, a cornerstone of economic growth, is undergoing a significant transformation, driven by technological advancements and a heightened focus on worker well-being. These changes are profoundly impacting workers’ compensation insurance, demanding innovative approaches to risk management and claims processing. This section explores the key emerging trends shaping the future of construction workers’ compensation.

Technological Advancements in Workplace Safety and Insurance

Technological advancements are revolutionizing workplace safety in construction. Wearable sensors embedded in safety gear can monitor workers’ movements and vital signs, providing real-time data on potential hazards and fatigue. Drones equipped with high-resolution cameras are used for site inspections, identifying potential risks before they lead to accidents. Virtual and augmented reality (VR/AR) technologies are employed for training simulations, allowing workers to practice safe procedures in a risk-free environment. This proactive approach, fueled by data-driven insights, is leading to a reduction in workplace injuries and a more efficient claims process. For example, a large construction firm in California implemented wearable sensor technology, resulting in a 25% reduction in fall-related injuries within a year. The data collected allowed for targeted safety interventions and improved training programs.

The Role of Data Analytics in Risk Management and Claims Processing

Data analytics is becoming increasingly crucial in managing risk and processing claims in the construction industry. By analyzing historical injury data, insurers can identify high-risk jobs, tasks, and locations. This allows for targeted risk mitigation strategies, such as improved safety training or the implementation of new safety protocols. Predictive modeling can help identify workers at higher risk of injury based on factors such as age, experience, and past injury history. This allows for proactive interventions, such as personalized safety training or ergonomic assessments. Furthermore, data analytics streamlines the claims process, enabling faster and more accurate processing of claims. For instance, an insurance company in Texas utilized data analytics to identify a correlation between specific types of scaffolding and increased fall-related injuries. This led to the development of new safety guidelines for scaffolding usage, resulting in a significant decrease in claims related to scaffolding accidents.

Emerging Trends in Workers’ Compensation Insurance for Construction

Several emerging trends are reshaping workers’ compensation insurance for the construction industry. One notable trend is the increasing adoption of telematics and connected devices to monitor vehicle safety and driving behaviors. This allows insurers to assess risk more accurately and offer tailored insurance premiums based on driving performance. Another trend is the rise of value-based insurance programs, which incentivize construction firms to invest in proactive safety measures by offering lower premiums for companies with strong safety records. Furthermore, the use of artificial intelligence (AI) in claims processing is becoming more prevalent, enabling faster and more efficient claims handling. The integration of blockchain technology offers the potential for secure and transparent claims processing, reducing fraud and improving efficiency. Finally, the increasing focus on mental health in the workplace is leading to expanded coverage for mental health-related injuries and illnesses.

Innovative Approaches to Reducing Workplace Injuries and Improving Worker Well-being

Innovative approaches are being implemented to reduce workplace injuries and improve worker well-being. These include implementing comprehensive safety programs that focus on proactive risk mitigation, ergonomic assessments to prevent musculoskeletal disorders, and the use of technology to improve worker safety and productivity. Construction companies are increasingly investing in employee wellness programs, such as on-site health clinics and fitness initiatives. These programs promote a healthier workforce, leading to reduced absenteeism and improved productivity. For example, a large construction firm in New York City implemented a comprehensive safety program, including regular safety training, improved safety equipment, and a robust reporting system. This resulted in a 30% reduction in workplace injuries within two years. Another company implemented an ergonomic assessment program, leading to a reduction in musculoskeletal disorders among workers.

Conclusion

Securing the best workers’ comp insurance for your construction business isn’t a one-size-fits-all solution. It’s a strategic investment that requires careful consideration of your specific risks, your workforce, and your budget. By understanding the nuances of different policies, prioritizing risk management, and choosing a reliable provider, you can build a safety net that protects your workers and safeguards your business from financial ruin. Remember, a well-informed decision today can prevent a costly headache tomorrow. So, get out there and build smart!