California Real Estate Errors and Omissions Insurance: Navigating the complex world of real estate in California requires a safety net, and that’s where E&O insurance steps in. Think of it as your professional bodyguard against the unexpected – those costly mistakes that can derail your career. This isn’t just about avoiding lawsuits; it’s about peace of mind, allowing you to focus on what you do best: closing deals and building your business.

This comprehensive guide unpacks everything you need to know about California real estate E&O insurance, from understanding its purpose and the various coverage options available to choosing the right policy for your specific needs. We’ll explore the common risks faced by real estate professionals, the claims process, and how to calculate the cost of premiums. Get ready to arm yourself with the knowledge to protect your future.

Understanding California Real Estate E&O Insurance

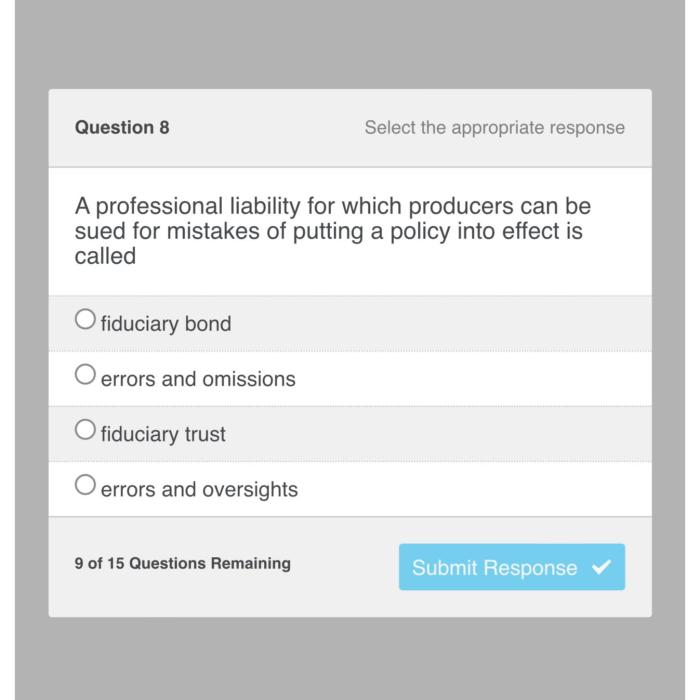

Source: cheggcdn.com

Navigating the complex world of California real estate requires a robust understanding of risk management. Errors and omissions (E&O) insurance plays a crucial role in protecting real estate professionals from financial losses stemming from unintentional mistakes or negligence in their professional duties. This insurance is not a luxury, but rather a vital tool for mitigating potential liabilities and ensuring long-term career stability.

Purpose and Function of E&O Insurance in California Real Estate

California real estate professionals, including brokers, agents, and property managers, face numerous potential liabilities in their daily operations. A single oversight, such as a missed disclosure or inaccurate representation, could result in costly lawsuits and significant financial repercussions. E&O insurance acts as a safety net, covering the costs associated with defending against such claims and paying resulting judgments or settlements. It provides peace of mind, allowing professionals to focus on their clients and their business without the constant worry of unforeseen legal battles. The policy’s function is to protect against financial losses arising from claims alleging professional negligence or errors in the performance of real estate services.

Types of Coverage Offered Under a Typical E&O Policy

A typical California real estate E&O policy offers several key coverage areas. These typically include coverage for legal defense costs, settlements, and judgments resulting from claims of negligence, errors, or omissions in professional services. Some policies may also include coverage for regulatory investigations or administrative fines related to professional conduct. The specific coverage details, however, vary significantly depending on the insurer and the policy purchased. Additional coverage options might include coverage for advertising injury or personal injury.

Examples of Covered and Excluded Activities

Standard E&O policies typically cover a wide range of real estate activities, including property listings, contract negotiations, disclosures, and property management. For example, a claim arising from a missed disclosure in a property listing, leading to a lawsuit from a buyer, would likely be covered. Similarly, errors in preparing a purchase agreement that result in financial losses for a client could also be covered. However, exclusions are common. Intentional acts, criminal acts, and violations of fair housing laws are usually excluded. Furthermore, coverage often does not extend to claims arising from bodily injury or property damage, which would typically fall under a general liability policy. Specific policy language dictates the precise boundaries of coverage.

Comparison of Coverage Provided by Different Insurers

The real estate E&O insurance market in California is competitive, with numerous insurers offering various policy options. Coverage limits, premiums, and specific exclusions can vary significantly between insurers. Some insurers might offer broader coverage for specific types of claims, while others may have more restrictive exclusions. It’s crucial to compare quotes from multiple insurers and carefully review policy language to find the coverage that best suits individual needs and risk profiles. Factors such as the agent’s experience level, transaction volume, and the types of properties handled often influence premium pricing and policy terms. A broker specializing in insurance for real estate professionals can assist in navigating this complex landscape.

Who Needs California Real Estate E&O Insurance?

In the dynamic world of California real estate, errors and omissions (E&O) insurance isn’t just a good idea—it’s often a necessity. The potential for costly mistakes is ever-present, and the financial consequences of a lawsuit can be devastating for professionals without adequate protection. Understanding who needs this insurance and why is crucial for navigating the legal and financial landscape of the industry.

California real estate professionals face a multitude of potential risks daily. From inaccurate property disclosures to missed deadlines and contract breaches, the potential for errors is significant. This risk extends to all levels of the industry, highlighting the broad need for E&O insurance. The absence of this crucial coverage can lead to severe financial burdens and even career-ending consequences.

Types of Real Estate Professionals Benefiting from E&O Insurance

Real estate agents, brokers, and property managers all stand to gain significantly from securing E&O insurance. Agents, often the frontline representatives, are particularly vulnerable to claims stemming from misrepresentations, negligent advice, or missed deadlines. Brokers, overseeing teams of agents, face a wider scope of potential liability. Property managers, responsible for the day-to-day operations of properties, also encounter numerous opportunities for errors or omissions, leading to potential legal action from owners or tenants. Essentially, anyone involved in the transaction, management, or legal aspects of real estate in California benefits from the protection offered by E&O insurance.

Potential Risks Faced Without E&O Coverage

Operating without E&O insurance exposes real estate professionals to considerable financial risks. A single lawsuit, regardless of merit, can drain personal savings and assets. Even if the professional is ultimately found not liable, the costs of legal defense can be staggering. Beyond financial ruin, a lawsuit can severely damage reputation and credibility, making it difficult to continue operating in the industry. The stress and distraction of legal proceedings also significantly impact productivity and overall well-being.

Legal Implications of Inadequate Insurance Protection

While not always a direct legal requirement, the lack of adequate E&O insurance can have significant legal implications. In some cases, it could affect a professional’s ability to secure a license or maintain professional affiliations. Furthermore, a court might consider the absence of insurance when determining liability and awarding damages. This means that without coverage, a professional might be held personally liable for substantial financial penalties, even if the error was unintentional. Having sufficient E&O insurance demonstrates due diligence and can strengthen a professional’s legal defense.

Comparison of Insurance Needs Across Real Estate Professionals

The specific insurance needs vary depending on the professional’s role and level of responsibility. Consider the following:

| Professional Type | Common Risks | Recommended Coverage Level | Cost Factors |

|---|---|---|---|

| Real Estate Agent | Misrepresentation of property facts, contract errors, missed deadlines | $100,000 – $500,000 | Transaction volume, years of experience, claims history |

| Real Estate Broker | Agent errors, supervisory liability, contract disputes, regulatory violations | $500,000 – $2,000,000 | Number of agents supervised, transaction volume, company size |

| Property Manager | Tenant disputes, property damage, negligence in maintenance, lease violations | $250,000 – $1,000,000 | Number of properties managed, rental income, claims history |

Claims and Coverage Under California E&O Insurance

Source: cranefloresllp.com

Navigating the complexities of California real estate often involves unforeseen risks. Errors and omissions (E&O) insurance provides a crucial safety net for professionals facing claims related to their professional services. Understanding the types of claims covered, the claims process, and the factors influencing claim evaluations is vital for both agents and brokers.

Common Claims Against California Real Estate Professionals

Real estate professionals in California face a range of potential claims. These often stem from missed deadlines, inaccurate property disclosures, negligent misrepresentation, and breaches of fiduciary duty. For example, failing to disclose material defects in a property could lead to a significant claim if a buyer discovers the issue after purchase. Similarly, mishandling escrow funds or providing inaccurate advice on zoning regulations can result in costly legal battles. These claims can significantly impact a professional’s reputation and financial stability.

The E&O Insurance Claims Process

Filing a claim typically involves notifying the insurer promptly after a potential claim arises. This notification should include a detailed description of the incident, including dates, parties involved, and any documentation related to the alleged error or omission. The insurer will then investigate the claim, gathering evidence and interviewing witnesses. This process can take time, depending on the complexity of the claim. Following the investigation, the insurer will determine coverage and may offer a settlement or defend the insured in court.

Factors Insurers Consider When Evaluating Claims

Several factors influence an insurer’s decision on a claim. These include the policy’s terms and conditions, the nature and severity of the alleged error or omission, the insured’s adherence to professional standards, and the availability of evidence supporting the claim. For instance, if an agent failed to disclose a known material defect due to negligence, the insurer is more likely to cover the claim than if the agent acted in good faith and made a reasonable mistake. Similarly, maintaining thorough documentation can significantly strengthen an insured’s position during the claims process.

Scenarios Leading to E&O Claims

Understanding potential scenarios that could trigger an E&O claim is crucial for proactive risk management.

- Failure to Disclose Material Defects: An agent fails to disclose known water damage in a basement, leading to a costly repair for the buyer after the sale. This omission directly violates California’s disclosure laws.

- Misrepresentation of Property Facts: An agent inaccurately describes a property’s square footage or features, leading to a buyer’s dissatisfaction and potential legal action. This could be due to reliance on inaccurate information from the seller or insufficient due diligence.

- Breach of Fiduciary Duty: An agent prioritizes their own interests over the client’s, such as recommending a particular lender due to personal gain rather than the client’s best financial interest.

- Missed Deadlines: An agent misses crucial deadlines for paperwork or disclosures, resulting in penalties or legal complications for the client. This underscores the importance of careful time management and record-keeping.

- Negligent Advice: An agent provides inaccurate advice on zoning regulations or property taxes, causing financial losses for the client. This highlights the importance of relying on expert advice when necessary and clearly stating limitations in one’s expertise.

Cost and Factors Affecting Premiums: California Real Estate Errors And Omissions Insurance

Source: shutterstock.com

Navigating California real estate’s complex regulations necessitates robust Errors and Omissions insurance. Finding the right coverage is crucial, much like securing the proper insurance in other states; for example, consider the specific needs when researching insurance manhattan ks , which highlights the importance of tailored protection. Ultimately, California real estate E&O insurance safeguards against potential liabilities, offering peace of mind for professionals in a high-stakes market.

Securing Errors and Omissions (E&O) insurance for your California real estate business is a crucial step in protecting your financial well-being. However, the cost of this coverage can vary significantly, influenced by a range of factors. Understanding these factors is key to securing the right policy at a competitive price.

Several key elements determine the premium you’ll pay for California real estate E&O insurance. These factors interact to create a unique price for each policyholder, making direct comparisons challenging without detailed individual assessments.

Factors Influencing Premium Costs

The cost of your E&O insurance premium is a complex calculation. It’s not simply a matter of the coverage amount; numerous aspects of your business and operations play a significant role. These factors are often weighted differently by different insurers, leading to variations in pricing.

Insurers meticulously analyze your risk profile. This involves a detailed review of your business history, the types of transactions you handle, your claims history (if any), the size of your operation, and the types of properties you work with. A history of claims, for example, will generally result in higher premiums. Similarly, high-value transactions or working with complex properties increase your perceived risk.

Impact of Business Size and Type

The scale and nature of your real estate operation significantly influence premium costs. A large brokerage firm managing hundreds of transactions annually will naturally face higher premiums than a solo agent handling a smaller volume of deals. Specialization also plays a role; agents specializing in high-value properties or complex transactions like commercial real estate will typically pay more.

The type of real estate activities you undertake is another crucial factor. For example, agents specializing in commercial real estate often face higher premiums due to the higher potential for liability associated with larger, more complex transactions. Similarly, property managers often face different premium structures than sales agents due to the ongoing nature of their responsibilities.

Pricing Structures Among Insurance Providers

Different insurance providers utilize varied pricing models. Some may emphasize a flat-rate structure based on your coverage level, while others might adopt a tiered system with premiums increasing based on factors like transaction volume or property value. Additionally, some insurers might offer discounts for certain professional certifications or affiliations, or for bundling E&O coverage with other insurance products.

It’s vital to compare quotes from multiple insurers before selecting a policy. This ensures you’re getting the most competitive price for the level of coverage you need. Don’t solely focus on the premium; carefully examine the policy details, coverage limits, and exclusions to ensure the policy adequately protects your business.

Typical Cost Ranges for Different Coverage Levels

The following table provides a general overview of typical cost ranges. Remember, these are estimates and actual costs can vary widely based on the factors discussed previously. Always obtain personalized quotes from several insurers for an accurate assessment.

| Coverage Level | Premium Range | Deductible Options | Policy Limits |

|---|---|---|---|

| $1 Million | $500 – $2,000 | $1,000 – $5,000 | $1,000,000 |

| $2 Million | $800 – $3,500 | $2,500 – $10,000 | $2,000,000 |

| $3 Million | $1,200 – $5,000+ | $5,000 – $15,000+ | $3,000,000 |

| $5 Million | $2,000 – $8,000+ | $10,000 – $25,000+ | $5,000,000 |

Choosing the Right California Real Estate E&O Insurance Policy

Navigating the world of Errors and Omissions (E&O) insurance for California real estate professionals can feel overwhelming. Finding the right policy isn’t just about ticking boxes; it’s about securing your financial future and protecting your professional reputation. A well-chosen policy offers peace of mind, knowing you’re covered against potential claims arising from professional negligence or errors.

Choosing the right California Real Estate E&O insurance policy requires careful consideration of several key factors. Ignoring these factors could leave you vulnerable to significant financial losses. This section will Artikel the crucial elements to evaluate when selecting your coverage.

Policy Terms and Conditions

Reading the fine print is crucial. Don’t just skim the highlights; thoroughly review the policy’s terms and conditions. Pay close attention to the definition of “covered claims,” exclusions, and limitations. Understanding what is and isn’t covered is paramount. For instance, some policies may exclude coverage for intentional acts or specific types of claims. A clear understanding of these limitations is vital in making an informed decision. Compare the definitions of “errors” and “omissions” across different policies – these can vary significantly. Look for policies with clear, concise language, avoiding overly technical jargon. If anything is unclear, contact the insurer directly for clarification before signing.

Comparing Policy Options

Once you’ve identified several potential insurers, comparing their policy options is essential. Create a comparison chart to easily evaluate key features. Consider factors such as coverage limits, premiums, deductibles, and the types of claims covered. For example, compare policies offering $1 million versus $2 million in coverage – the higher limit provides greater protection, but naturally, at a higher cost. Analyze the deductibles carefully; a higher deductible will lower your premium, but you’ll pay more out-of-pocket in the event of a claim. Don’t solely focus on price; prioritize the breadth and depth of coverage that best suits your specific needs and risk profile.

Evaluating Insurer Financial Strength and Reputation

Before committing to a policy, research the financial stability and reputation of the insurance provider. Check their rating with independent rating agencies like A.M. Best, Moody’s, or Standard & Poor’s. A high rating indicates financial strength and a greater likelihood of the insurer being able to pay out claims. Furthermore, look for reviews and testimonials from other real estate professionals. Online resources and professional organizations often provide valuable insights into the experiences of other agents with different insurance providers. Consider contacting several insurers directly to discuss your specific needs and ask questions about their claims process. A responsive and helpful insurer can make a significant difference during a stressful claims process.

Illustrating Common E&O Insurance Scenarios

Real estate professionals, from agents to brokers and property managers, face numerous risks daily. Errors and omissions (E&O) insurance is crucial for mitigating the financial fallout from these risks. Let’s examine some common scenarios where E&O coverage proves invaluable.

Failure to Disclose a Material Defect

Imagine Sarah, a real estate agent, sells a house with a known history of foundation problems. She fails to disclose this material defect to the buyer, either due to oversight or intentional omission. The buyer, discovering the foundation issues after purchase, incurs significant repair costs—potentially exceeding $50,000. The buyer could sue Sarah for misrepresentation or negligence. This lawsuit could result in substantial legal fees and a judgment against Sarah for the repair costs, potentially impacting her personal assets. E&O insurance would cover Sarah’s legal defense costs and the judgment awarded to the buyer, protecting her from financial ruin.

Property Manager’s Negligence Leading to Property Damage

Consider Mark, a property manager responsible for a large apartment complex. Due to negligence, he fails to address a recurring plumbing issue, leading to a significant water leak that damages multiple units. The resulting water damage requires extensive repairs and displaces tenants. The property owner sues Mark for negligence, claiming his failure to maintain the property resulted in substantial financial losses due to repair costs and loss of rental income. The claim could easily reach hundreds of thousands of dollars. E&O insurance would cover Mark’s legal defense and the financial losses incurred by the property owner.

Broker’s Misrepresentation of a Property’s Value, California real estate errors and omissions insurance

John, a real estate broker, overestimates the value of a commercial property to entice a buyer. He knowingly inflates the property’s worth in his marketing materials and during negotiations. The buyer, relying on John’s inflated valuation, purchases the property at an excessively high price. Upon discovering the true market value, the buyer realizes significant overpayment and sues John for misrepresentation. This lawsuit could result in a substantial financial judgment against John, potentially leading to significant personal liability. E&O insurance would help cover the legal costs and the financial judgment awarded to the buyer, safeguarding John’s financial well-being.

Outcome Summary

Protecting your real estate career in California isn’t just about having a license; it’s about having the right insurance. Understanding California Real Estate Errors and Omissions insurance is crucial for mitigating risk and ensuring your long-term success. By carefully considering your specific needs, comparing policy options, and choosing a reputable insurer, you can safeguard your business and maintain professional peace of mind. Don’t leave your future to chance; invest in the protection you deserve.