Can you cancel claim car insurance – Can you cancel a car insurance claim? That’s a question many drivers grapple with after a fender bender or more serious accident. Sometimes, the paperwork, the hassle, or even a change of heart makes you wonder if backing out is an option. But before you tear up that claim form, let’s dive into the realities of canceling a car insurance claim – the ifs, ands, and buts of navigating this tricky situation. It’s not always a simple yes or no, and understanding the implications is key.

This guide breaks down the process, from understanding your policy’s cancellation clauses to exploring alternative solutions and potential consequences. We’ll cover everything from the steps involved in initiating a cancellation to the potential long-term effects on your premiums and driving record. Get ready to become a car insurance cancellation ninja!

Understanding Cancellation Policies

Source: ahainsurance.ca

So, you’ve filed a car insurance claim, but things have changed. Maybe you’ve found a solution to the damage without needing the insurance payout, or perhaps you’ve realized you’re better off covering the costs yourself. Whatever the reason, understanding if and how you can cancel your claim is crucial. Navigating the world of insurance cancellations can feel like a maze, but let’s unravel it together.

Cancelling a car insurance claim isn’t always a straightforward process. The timeframe and possibility of cancellation depend heavily on several key factors, making it essential to understand your policy and the stage of your claim. Insurance companies have varying policies, so knowing what to expect beforehand can save you time and frustration.

Claim Cancellation Timeframes

The time you have to cancel a car insurance claim varies greatly depending on your insurance provider and the specifics of your policy. Some companies might allow cancellation within a few days of filing, while others might have stricter deadlines, potentially tied to the completion of specific stages in the claims process, such as the initial investigation or the assessment of damages. It’s crucial to check your policy documents for the exact timeframe and any associated penalties. For example, a company like “InsureAll” might allow cancellation within 72 hours of filing, while “SafeDrive” might only permit it before the adjuster’s initial inspection.

Factors Influencing Cancellation

Several factors significantly influence whether you can cancel a claim and the process involved. The most important is the stage of the claim. If the claim is still in its early stages, with minimal investigation completed, cancellation is generally easier. However, if significant resources have already been invested in the claim – for example, if an adjuster has already visited the scene of the accident, or if repairs have begun – cancellation becomes much more complex, and may not be possible. Your policy’s specific terms and conditions also play a vital role. Some policies might explicitly Artikel the circumstances under which claim cancellation is permitted, while others may be more vague. Additionally, the reason for cancellation might also influence the process. For instance, if you’ve found an alternative solution to cover the damage, you’ll have a stronger case for cancellation than if you’re simply having second thoughts.

Examples of Possible Claim Cancellations

Consider these scenarios where claim cancellation might be feasible:

You discovered a minor scratch on your car that you initially thought was damage from an accident. After further inspection, you realized it was pre-existing.

You mistakenly filed a claim for damages that you later found were covered under a different insurance policy.

You settled the matter directly with the other party involved in the accident, and the costs are covered.

You found a cheaper way to repair your vehicle, eliminating the need for insurance coverage.

Comparison of Cancellation Policies Across Providers

Direct comparison of cancellation policies across different insurance providers requires extensive research into individual policy documents. This is because these policies are rarely standardized. For example, one company might offer a grace period of 48 hours, while another might allow cancellation only before the claim is assigned to an adjuster. Additionally, penalties for cancellation may differ significantly. Some insurers might charge administrative fees, while others might impact future premiums. To find the specific details, you must always refer to your insurance policy’s terms and conditions. Consulting a policy comparison website or contacting multiple insurers directly can be helpful in gathering this information.

Initiating the Cancellation Process

So, you’ve decided to cancel your car insurance claim. While it might seem straightforward, navigating the process requires understanding the steps involved and the necessary documentation. This section will guide you through the procedure, ensuring a smooth and efficient claim cancellation. Remember, policies vary, so always refer to your specific insurance provider’s guidelines.

Cancelling a claim isn’t about simply changing your mind; it usually involves specific reasons and procedures. Depending on your circumstances, you might need to provide a detailed explanation for withdrawing your claim. This could range from finding alternative solutions to resolving the damage to realizing the claim wasn’t necessary in the first place.

Claim Cancellation Steps and Required Documentation

Before you begin, gather all relevant documents. This will expedite the process and prevent unnecessary delays. A well-organized approach ensures a quicker resolution.

| Step | Action | Required Documentation | Important Notes |

|---|---|---|---|

| 1 | Contact your insurance provider. | Policy number, claim number. | Inform them of your intention to cancel the claim, clearly stating your reasons. Note the date and time of the call and the name of the representative. |

| 2 | Provide a written cancellation request. | Completed claim cancellation form (if provided), reason for cancellation, copies of all relevant documents related to the claim (e.g., repair estimates, police reports). | Keep a copy of the cancellation request for your records. A clear and concise explanation of your reasons will help expedite the process. |

| 3 | Confirm cancellation in writing. | Confirmation letter or email from your insurance provider. | Ensure you receive written confirmation that your claim has been officially cancelled. This protects you from any future disputes. |

| 4 | Return any related documents. | Any documents previously submitted to support your claim that are no longer needed (e.g., original repair estimates). | Follow the instructions provided by your insurer regarding the return of documents. This might involve sending them via mail or dropping them off in person. |

Claim Cancellation Flowchart

Imagine a flowchart. It would start with a box labeled “Decision to Cancel Claim.” This would lead to a diamond-shaped decision point: “Contact Insurer?” A “Yes” branch would go to a rectangle labeled “Contact Insurer (Phone or Email).” From there, another decision point: “Written Request Needed?” “Yes” leads to “Submit Written Request and Documentation.” “No” might lead directly to “Await Confirmation.” After “Submit Written Request and Documentation,” a path leads to “Await Confirmation.” Finally, a rectangle labeled “Claim Cancelled” signifies the end of the process. If at any point the insurer requests additional information, a loop back to “Submit Additional Documentation” would be included before continuing to “Await Confirmation.” The flowchart visually represents the sequential steps involved in cancelling a claim.

Consequences of Claim Cancellation: Can You Cancel Claim Car Insurance

Source: saymedia-content.com

Canceling a car insurance claim might seem like a simple solution, especially if the damage seems minor or the process feels overwhelming. However, this decision carries significant weight, impacting your premiums, claim history, and even your legal standing. Understanding these potential consequences is crucial before making such a choice.

Cancelling a car insurance claim can have far-reaching effects that extend beyond the immediate situation. The repercussions are multifaceted, affecting your financial standing, your insurance history, and even your legal position. Weighing these consequences carefully is essential to making an informed decision.

Impact on Future Premiums

Insurance companies meticulously track claims. Canceling a claim, even a seemingly insignificant one, can be interpreted as an attempt to avoid paying higher premiums in the future. Your insurer might view this as a higher risk, leading to increased premiums for your next policy renewal. This increase can be substantial, potentially outweighing the immediate savings from not pursuing the claim. For example, someone who cancels a small claim for a minor fender bender might see their premiums increase by 15-20% the following year, negating any short-term financial gain. This increase is often justified by the insurer’s assessment of increased risk.

Implications for Claim History

While not always explicitly stated on your insurance record, canceling a claim leaves a mark. Insurers use sophisticated algorithms to assess risk, and canceling a claim can trigger flags within these systems. Even if the claim doesn’t appear as a formal record, the internal notes and data collected by the insurer will reflect the cancellation. This could influence future claims processing and premium calculations, making it more challenging to secure favorable rates or have future claims processed smoothly. The lack of transparency in this process makes it critical to understand the potential long-term consequences.

Potential Legal Ramifications

In some cases, canceling a claim could have unintended legal ramifications. If the other party involved in the accident pursues legal action, your lack of a documented claim could weaken your defense. Furthermore, if the damage was more extensive than initially assessed, canceling the claim might leave you responsible for unforeseen repair costs or medical bills. Essentially, by canceling the claim, you relinquish the protection and support offered by your insurance policy, potentially exposing yourself to significant financial liability. This is especially true in cases involving significant property damage or personal injury.

Financial Implications of Cancellation Versus Proceeding

The financial implications of canceling versus proceeding with a claim need careful consideration. While canceling might seem to save money upfront, the potential increase in future premiums, along with the risk of unforeseen legal and financial liabilities, often outweighs this perceived benefit. A thorough cost-benefit analysis, considering all potential outcomes, is essential. For instance, pursuing a claim might result in higher premiums for a year or two, but this could be less than the cost of repairing your vehicle or covering medical expenses out of pocket. A clear understanding of the potential financial burden of each scenario is crucial for informed decision-making.

Alternative Solutions to Cancellation

So, you’re facing a car insurance claim and considering cancellation? Hold on a second! Before you pull the plug, let’s explore some alternative paths that might save you time, money, and a whole lot of headache. Sometimes, a little negotiation can go a long way.

Cancelling a claim often means losing out on potential compensation for your damages or injuries. Exploring other options first can be a much smarter move. This section will Artikel some viable alternatives and help you navigate the process of resolving your claim dispute effectively.

Negotiating a Settlement

Negotiating a settlement with your insurance company is often the most straightforward alternative to cancelling a claim. This involves discussing the details of your claim and attempting to reach a mutually agreeable compensation amount. Successful negotiation requires clear communication and a well-documented understanding of your losses. For example, if your car sustained $3,000 in damages but the insurer initially offers $2,000, you could present repair estimates and photos to justify your higher claim. A successful negotiation might result in a compromise, such as $2,500, which is better than potentially receiving nothing if you cancel the claim.

Effective Communication with the Insurance Provider, Can you cancel claim car insurance

Open and clear communication is key to exploring alternative solutions. Maintain a professional and respectful tone throughout your interactions. Keep detailed records of all communication, including dates, times, and the names of individuals you speak with. Clearly articulate your concerns, provide supporting documentation (repair estimates, medical bills, police reports), and actively listen to the insurance adjuster’s perspective. For instance, instead of saying “Your offer is insulting!”, try “I understand your offer, but based on these repair estimates, I believe a higher amount is warranted.” This approach fosters a more collaborative environment, increasing the chances of a positive outcome.

Comparison of Claim Resolution Approaches

| Approach | Pros | Cons |

|---|---|---|

| Negotiating a Settlement | Potentially faster resolution, avoids legal costs, maintains a working relationship with your insurer. | May not achieve full compensation, requires strong communication skills and documentation. |

| Filing a Formal Complaint | Escalates the issue, may lead to a more favorable outcome, potentially involves a neutral third party review. | Can be time-consuming, may require legal representation, may damage your relationship with the insurer. |

| Seeking Legal Counsel | Strongest potential for full compensation, access to legal expertise, insurer is more likely to settle to avoid litigation. | Most expensive option, time-consuming, can be adversarial. |

Seeking Legal Counsel

If negotiation and informal complaints fail, seeking legal counsel might be necessary. A lawyer specializing in insurance claims can assess the merits of your case, advise you on your legal options, and represent you in negotiations or litigation. They can help you gather and present evidence, navigate complex insurance policies, and advocate for your rights. The initial consultation often involves reviewing your claim documentation, discussing your goals, and determining the best course of action. Legal representation can significantly improve your chances of obtaining a fair settlement, especially in complex or high-value claims. For example, a lawyer might be able to demonstrate that the insurance company’s initial assessment of damages is flawed, leading to a revised and higher offer.

Specific Scenarios and Their Implications

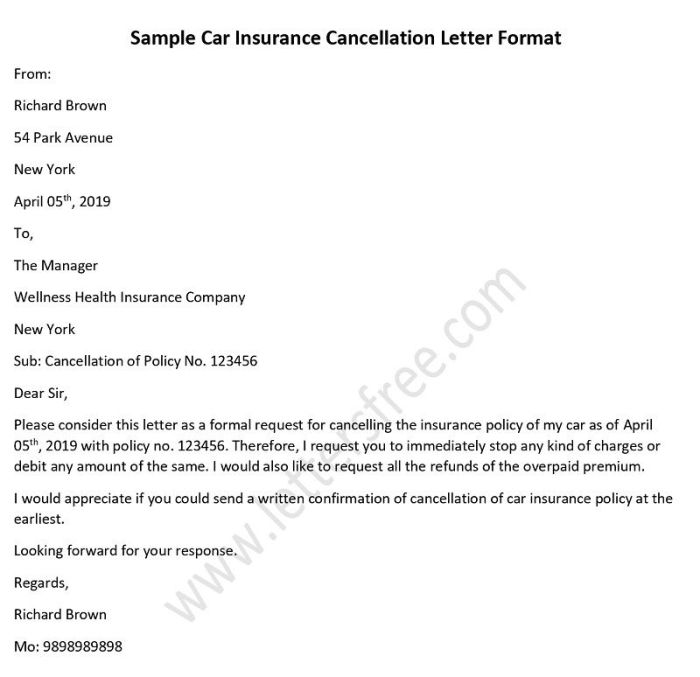

Source: lettersfree.com

Navigating the world of car insurance claim cancellations can feel like driving through a fog – unclear and potentially risky. Understanding specific scenarios and their outcomes is key to making informed decisions. Let’s explore some real-world examples to shed light on the complexities.

Successful Claim Cancellation

Imagine Sarah, who accidentally backed into a parked car, causing minor damage. She filed a claim, but after reviewing her policy and the relatively low cost of repair (under her deductible), she decided to withdraw the claim. Her insurance company readily agreed, as the claim hadn’t progressed beyond the initial reporting stage and involved minimal administrative work. This case illustrates that early intervention and straightforward situations often lead to successful cancellations, saving Sarah on potential premium increases and maintaining a clean claims history.

Impossible Claim Cancellation

Consider a different scenario: Mark caused a significant accident, resulting in substantial property damage and injuries to another driver. His insurance company investigated, interviewed witnesses, and determined Mark was at fault. In this case, cancelling the claim is highly unlikely. The insurance company has a legal and financial obligation to cover the damages and injuries resulting from the accident. Furthermore, the claim has likely progressed too far, with investigations completed and potentially legal proceedings underway. Attempting to cancel would be highly problematic and could have severe consequences, including potential legal action.

Partial Claim Cancellation

Let’s say John was involved in a multi-vehicle accident. His car sustained significant damage, and he filed a claim. The assessment revealed that while his car needed extensive repairs, some damage was due to pre-existing wear and tear, unrelated to the accident. In this situation, the insurance company might agree to a partial claim cancellation, covering only the damages directly attributable to the accident. This leaves John responsible for repairing the pre-existing damage. This demonstrates that careful documentation and clear communication with the insurer can sometimes lead to a partial resolution.

Multiple-Party Claims and Cancellation

A complex scenario involves a multi-vehicle accident with multiple parties involved and differing levels of fault. Imagine an accident involving three cars – Anna, Ben, and Cathy. Anna’s insurance company determines she’s partially at fault. If Anna tries to cancel her claim, it will complicate the overall settlement process, potentially impacting the claims of Ben and Cathy. The insurance companies will need to coordinate to determine liability and apportion responsibility amongst all parties. Attempting to cancel a claim in this complex scenario is highly unlikely to be successful and could significantly delay the resolution of all claims. It highlights the interconnectedness of claims in multi-party accidents and the importance of cooperation among all involved parties.

Illustrative Examples

Let’s visualize the process of canceling a car insurance claim and the associated paperwork to make it all clearer. These examples will paint a picture of what you might encounter in real-life scenarios.

Online Claim Cancellation Screenshot

Imagine a computer screen displaying a step-by-step online claim cancellation process. The top of the screen shows the insurance company’s logo and a clear heading: “Cancel Your Claim.” Below this, a progress bar indicates the user’s current stage in the process (perhaps showing three steps: “Reason for Cancellation,” “Confirmation,” “Completion”). The current step, “Reason for Cancellation,” is highlighted. A dropdown menu offers various options (e.g., “Duplicate Claim,” “Resolved Issue,” “Vehicle Repaired,” “Other”). Next to the dropdown is a text box for users to provide further details. Below the dropdown menu is a button labeled “Continue.” Further down the screen, a section labeled “Claim Details” displays the claim number, policy number, and the date the claim was filed. Finally, at the very bottom, there are links to the company’s FAQ page and customer service contact information. The overall design is clean and intuitive, using a calming color scheme (e.g., blues and greens) to reduce stress.

Car Insurance Claim Cancellation Form

Picture a physical form, printed on crisp white paper with the insurance company’s logo prominently displayed at the top. The form is titled “Car Insurance Claim Cancellation Request.” At the top, there are fields for the policyholder’s name, address, phone number, and email address. Below this, a section requires the claim number and the date of the claim. A significant section is dedicated to explaining the reason for cancellation. This section might include a space for a brief written explanation and a separate checkbox section for pre-defined reasons, such as “Claim was a mistake,” “Vehicle was repaired independently,” or “Dispute resolved.” There’s a section for the policyholder’s signature and the date of the signature. At the very bottom, there is a space for the insurance company’s stamp and a confirmation number. The form is well-organized, using clear headings and bold font to highlight key information. The overall appearance is professional and reassuring. A small print section at the bottom may include information about processing times and contact details.

Wrap-Up

So, can you cancel a car insurance claim? The short answer is: maybe. The long answer is significantly more nuanced, depending on your specific circumstances, your insurer’s policies, and the stage of the claim process. While canceling might seem like a quick fix, it’s crucial to weigh the potential repercussions carefully. Understanding your options, from negotiating a settlement to seeking legal advice, is paramount. Don’t rush into a decision; arm yourself with knowledge and make the choice that best protects your financial future and driving record.