Car insurance Garner NC? Navigating the world of car insurance can feel like driving through a minefield, especially in a place like Garner, NC. But don’t worry, we’re here to help you decode the jargon, compare providers, and ultimately find the best coverage for your needs and budget. From understanding liability and collision coverage to scoring the best deals and knowing what to do after an accident, we’ll equip you with the knowledge to make informed decisions. This isn’t just about ticking a box; it’s about protecting yourself and your future.

This guide dives deep into the specifics of the Garner, NC car insurance market, exploring factors that influence premiums, highlighting top providers, and offering practical tips for securing the best possible deal. We’ll also cover essential coverage types, address common concerns, and provide real-world scenarios to illustrate the importance of adequate protection. Get ready to become a car insurance pro!

Understanding Car Insurance in Garner, NC

Source: garnercars.com

Navigating the world of car insurance can feel like driving through a fog, especially when you’re trying to figure out the best coverage for your needs in a specific location like Garner, North Carolina. This guide will shed some light on the car insurance market in Garner, helping you make informed decisions.

Factors Influencing Car Insurance Premiums in Garner, NC

Several factors contribute to the cost of car insurance in Garner. These aren’t just random numbers; they’re based on statistical analysis of risk. Insurers assess these factors to determine the likelihood of you filing a claim. Higher risk generally translates to higher premiums. Demographics play a significant role, with age and driving history being key components. Younger drivers, for example, statistically have more accidents, leading to higher premiums. Accident rates within Garner itself are another crucial factor. Areas with higher accident frequencies tend to have higher insurance rates. Similarly, crime statistics, particularly those related to car theft, influence premiums. Higher theft rates lead to increased comprehensive coverage costs. Finally, the type of vehicle you drive also impacts your premium. Sports cars, for instance, are often more expensive to insure due to their higher repair costs and increased risk of accidents.

Types of Car Insurance Coverage Available in Garner, NC

Understanding the different types of car insurance coverage is crucial for making an informed decision. Liability coverage is the most basic type, legally mandated in most states. It protects you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage goes beyond collisions, covering damage from events like theft, vandalism, or hail. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance. Medical payments coverage helps pay for medical bills for you and your passengers, regardless of fault. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, even if you’re at fault.

Average Car Insurance Premiums in Garner, NC

The following table provides estimated average annual premiums for different car insurance types in Garner, NC. These are averages and your actual premium will vary based on the factors discussed earlier. Remember to always shop around and compare quotes from multiple insurers.

| Coverage Type | Average Annual Premium | Factors Affecting Premium | Example Scenario |

|---|---|---|---|

| Liability | $500 – $800 | Driving record, age, location | A driver with a clean record in a low-risk area might pay closer to $500, while a driver with accidents might pay closer to $800. |

| Collision | $300 – $600 | Vehicle value, age, driving record | A newer, more expensive car will have a higher collision premium than an older, less expensive car. |

| Comprehensive | $200 – $400 | Vehicle value, location (theft rates), driving record | Someone living in a high-theft area might pay more for comprehensive coverage. |

| Uninsured/Underinsured Motorist | $100 – $200 | State requirements, driving record | This is often bundled with other coverages, but can be purchased separately. |

Finding the Best Car Insurance Deals in Garner, NC

Source: wcnc.com

Navigating the world of car insurance can feel like driving through a maze, especially in a city like Garner, NC. Finding the best deal requires a strategic approach, blending savvy research with a clear understanding of your needs. This guide will equip you with the tools to secure affordable and comprehensive car insurance coverage.

Finding affordable car insurance in Garner, NC, involves more than just clicking the first ad you see. It’s about being proactive and informed. Several strategies can significantly lower your premiums while ensuring you have the protection you need.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is paramount to securing the best car insurance deal. Different companies use varying algorithms and risk assessments, leading to significant price discrepancies for similar coverage. Failing to compare quotes could mean overpaying hundreds, even thousands, of dollars annually. For example, imagine two companies offering the same liability coverage; one might quote $1,000 annually, while another offers the same coverage for $800. That $200 difference adds up over the years.

Key Factors to Consider When Choosing a Car Insurance Provider

Choosing the right car insurance provider requires considering several key factors beyond just price. Coverage limits, deductibles, and customer service reputation all play a crucial role in your overall satisfaction and financial protection. For instance, a low premium might seem attractive initially, but inadequate coverage could leave you financially vulnerable in case of an accident. Similarly, a company with poor customer service ratings can turn a simple claim into a frustrating ordeal.

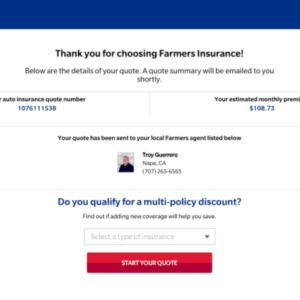

Obtaining Car Insurance Quotes in Garner, NC: A Step-by-Step Guide

Securing multiple car insurance quotes is a straightforward process, though it requires some dedicated effort. Follow these steps to efficiently compare options and make an informed decision.

- Gather Necessary Information: Before you start, collect your driver’s license information, vehicle information (year, make, model, VIN), and your driving history (including any accidents or tickets). Having this information readily available will streamline the quoting process.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple insurers simultaneously. These tools save you time and effort by providing a side-by-side comparison of various plans and prices.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide more personalized service and allow you to ask specific questions about policy details.

- Review Policy Details Carefully: Once you receive quotes, carefully review the policy details, including coverage limits, deductibles, and exclusions. Don’t just focus on the price; ensure the coverage meets your needs.

- Compare Apples to Apples: When comparing quotes, ensure you’re comparing similar coverage levels. Different insurers might use slightly different terminology, so pay close attention to the details to ensure a fair comparison.

Local Car Insurance Providers in Garner, NC: Car Insurance Garner Nc

Finding the right car insurance provider in Garner, NC can feel like navigating a maze. With so many options available, understanding the nuances of each company is crucial to securing the best coverage at the most competitive price. This section provides an overview of several prominent car insurance companies operating in Garner, offering insights into their strengths, weaknesses, and customer service experiences. Remember, rates and offerings can change, so it’s always best to get personalized quotes directly from the companies.

Choosing a car insurance provider involves more than just comparing prices. Factors like customer service responsiveness, claim processing efficiency, and the breadth of coverage options should all play a significant role in your decision. The following table summarizes key information for several popular providers in the Garner area.

Prominent Car Insurance Companies in Garner, NC

| Company Name | Contact Information | Special Offers/Features | Customer Reviews Summary |

|---|---|---|---|

| GEICO | 1-800-GEICO (434-26), geico.com | Competitive pricing, various discounts (good driver, bundling), online management tools. | Generally positive reviews regarding ease of online processes and competitive pricing; some negative comments regarding claim processing speed. |

| State Farm | Find a local agent via statefarm.com | Wide range of coverage options, strong local agent network, various discounts. | Mixed reviews, with praise for local agent accessibility and personalized service, but some complaints about higher premiums compared to competitors. |

| Progressive | 1-800-PROGRESSIVE (776-4737), progressive.com | Name Your Price® Tool for customized quotes, 24/7 claims service, various discounts. | Generally positive reviews for the Name Your Price® tool and ease of online quote generation; some complaints about customer service wait times. |

| Allstate | Find a local agent via allstate.com | Local agent support, various coverage options, accident forgiveness programs. | Reviews vary significantly depending on the local agent; some report excellent service while others cite difficulties reaching agents or resolving claims. |

| USAA | usaa.com (membership required) | Excellent customer service reputation, competitive rates for military members and their families, various discounts. | Consistently high ratings for customer service and claim handling, but membership is restricted to military personnel and their families. |

It’s important to note that the customer reviews summarized above are general observations based on publicly available information and should not be considered exhaustive or definitive. Individual experiences may vary.

Specific Coverage Needs in Garner, NC

Source: myallianceinsurance.com

Choosing the right car insurance in Garner, NC, goes beyond simply meeting minimum requirements. Understanding your specific needs based on local conditions and your personal circumstances is crucial for comprehensive protection. Factors like weather patterns, traffic density, and the prevalence of uninsured drivers all play a role in determining the optimal coverage for your situation.

Garner, like many areas of North Carolina, experiences its share of unpredictable weather, including occasional severe storms and even the occasional hail. Traffic congestion, particularly during peak hours, also increases the risk of accidents. These factors make a careful consideration of your insurance coverage essential to protect your financial well-being.

Finding the right car insurance in Garner, NC, can feel like navigating a maze. But comparing rates is key, and sometimes seeing what other states offer helps. For instance, checking out options like aaa insurance tulsa oklahoma gives you a broader perspective on pricing and coverage. Ultimately, understanding your needs in Garner, NC, will guide you to the best policy for your ride.

Uninsured/Underinsured Motorist Coverage in Garner, NC

Uninsured/underinsured motorist (UM/UIM) coverage is particularly important in Garner, NC, and across the state. A significant percentage of drivers operate without adequate insurance, leaving you vulnerable in the event of an accident caused by an uninsured or underinsured driver. UM/UIM coverage protects you and your passengers from medical bills, lost wages, and property damage even if the at-fault driver lacks sufficient insurance to cover your losses. Consider purchasing UM/UIM coverage limits that exceed the state minimum to ensure adequate protection in the event of a serious accident.

Comprehensive Coverage in Garner, NC

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as hailstorms, theft, vandalism, or damage from falling objects. Given Garner’s susceptibility to severe weather, comprehensive coverage is a wise investment. A hailstorm, for instance, could cause significant damage to your vehicle, and without comprehensive coverage, you would be responsible for the repair costs. The peace of mind provided by knowing your vehicle is protected against unforeseen events is invaluable.

Deductible Levels and Their Impact

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums. Choosing the right deductible involves balancing affordability with the financial burden of a potential out-of-pocket expense. For example, a $500 deductible might save you money on premiums, but you’ll have to pay $500 before your insurance covers the rest of the repair costs. A $1000 deductible will likely be cheaper, but you’ll pay more upfront if you need to file a claim.

Examples of Beneficial Coverage in Garner, NC

Imagine a scenario where a tree falls on your car during a storm. Comprehensive coverage would take care of the repairs. Or consider a situation where you’re involved in an accident with an uninsured driver who causes significant damage to your vehicle and injuries to you and your passengers. In this case, UM/UIM coverage would be essential to cover your medical expenses and vehicle repairs. Another example might be vandalism – someone keys your car. Comprehensive coverage will cover the repair or replacement costs. These examples highlight the importance of assessing your individual risk and selecting coverage that provides adequate protection against potential losses.

Factors Affecting Insurance Premiums

Getting the best car insurance rate in Garner, NC, isn’t just about luck; it’s about understanding the factors that influence your premium. Several key elements play a significant role in determining how much you’ll pay each month. Let’s break down some of the most important ones.

Driving History, Car insurance garner nc

Your driving record is a major factor in determining your car insurance premium. Insurance companies view a clean driving record as a sign of responsible behavior, rewarding you with lower rates. Conversely, accidents, speeding tickets, and DUI convictions significantly increase your premiums. For instance, a single at-fault accident could lead to a premium increase of 20-40%, depending on the severity of the accident and your insurance company. Multiple violations or accidents can result in even higher increases, or even cause your insurance to be canceled altogether. Maintaining a clean driving record is the most effective way to keep your premiums low.

Age and Gender

Statistically, younger drivers are involved in more accidents than older drivers, leading to higher insurance premiums for younger demographics. This is due to a combination of factors including less experience, higher risk-taking behaviors, and a lack of mature driving habits. Insurance companies often adjust rates based on age brackets, with premiums typically decreasing as drivers gain experience and age. Gender also plays a role, with some studies showing that male drivers tend to have slightly higher premiums than female drivers, reflecting historical trends in accident rates. These differences are constantly being reviewed and adjusted by insurance companies based on current data.

Vehicle Type and Value

The type and value of your vehicle significantly impact your insurance costs. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and the potential for greater damage in an accident. Conversely, insuring a smaller, less expensive car will typically result in lower premiums. The vehicle’s safety features also play a role; cars with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. The year, make, and model of your vehicle are all considered in the assessment of its value and associated risk.

Credit Score

In many states, including North Carolina, insurance companies use your credit score as a factor in determining your car insurance premium. A good credit score often translates to lower premiums, reflecting the perception that individuals with good credit are more financially responsible and less likely to file fraudulent claims. Conversely, a poor credit score can lead to significantly higher premiums. This practice is controversial, but it’s important to understand that it’s a legally permissible factor in many insurance calculations. Maintaining a good credit score can be a beneficial way to reduce your overall insurance costs.

Illustrative Scenarios

Understanding how car insurance works in real-life situations can be incredibly helpful. Let’s look at some common scenarios in Garner, NC, to illustrate the claims process and the types of coverage you might need.

Minor Accident Claim Process

Imagine you’re slowly pulling out of a parking lot in Garner and lightly tap the bumper of another car. Both vehicles have minor scratches. This is considered a minor accident. First, you’d want to exchange information with the other driver, including their name, contact details, insurance information, and license plate number. Then, you would take photos of the damage to both vehicles from multiple angles. Next, you’d report the accident to your insurance company, usually by phone or through their online portal. They’ll guide you through the next steps, which might involve providing the photos and the accident report. Depending on your policy and the extent of the damage, your insurance company might handle the claim directly with the other driver’s insurance company, or you might be directed to a repair shop approved by your insurer.

Major Accident Involving Multiple Vehicles

Picture a more serious scenario: a three-car pile-up on US-70 in Garner during rush hour. This is a major accident. The first priority is ensuring everyone’s safety and calling emergency services if needed. After ensuring everyone is safe, you’d again exchange information with all involved drivers. Thorough documentation is crucial here. This includes photos of the damage to all vehicles, the accident scene (showing the position of the vehicles), and any visible injuries. A police report is highly recommended in this type of situation. Contact your insurance company immediately to report the accident and provide all the collected information. Your liability coverage will help cover damages to other vehicles, while your collision coverage will handle repairs to your own vehicle, regardless of fault. If injuries are involved, your uninsured/underinsured motorist coverage might be relevant, and medical payments coverage will help with immediate medical expenses.

Weather-Related Damage Claim

A severe thunderstorm rolls through Garner, causing a large tree limb to fall on your car, damaging the windshield and roof. This is a claim for damage caused by a weather-related event. First, document the damage with photos and videos. If possible, get a statement from any witnesses. Contact your insurance company as soon as possible to report the damage. Comprehensive coverage is designed to handle this type of situation, covering damage caused by events outside your control, like hail, wind, or falling objects. You’ll likely need to provide the police report (if one was filed), photos of the damage, and possibly an estimate from a repair shop.

Documentation Needed for a Typical Insurance Claim

To successfully file a car insurance claim in Garner, NC, you’ll generally need several key documents. This typically includes your driver’s license, vehicle registration, insurance policy information, and contact information for all parties involved. Photos and videos of the damage to all vehicles and the accident scene are essential. A police report, if available, is highly valuable. Repair estimates from approved shops are necessary to determine the cost of repairs. Finally, any medical reports related to injuries sustained in the accident will be required if injuries occurred. The more thorough your documentation, the smoother and faster the claims process will be.

Final Thoughts

So, there you have it – your comprehensive guide to car insurance in Garner, NC. Remember, finding the right coverage isn’t a one-size-fits-all affair. By understanding the factors influencing premiums, comparing quotes, and choosing a provider that aligns with your needs, you can secure the peace of mind you deserve. Don’t leave your financial future to chance – arm yourself with knowledge and drive confidently, knowing you’re protected.