Car Insurance Leominster: Navigating the world of car insurance in Leominster, MA can feel like driving through a maze blindfolded. But fear not, fellow drivers! This guide breaks down everything you need to know, from understanding coverage options and comparing premiums to finding the best deal and navigating tricky situations. We’ll unravel the mysteries of liability, collision, and comprehensive coverage, helping you choose the right protection for your ride.

We’ll explore the factors that impact your premiums – your driving record, age, the type of car you drive, and even your location within Leominster. We’ll also equip you with the knowledge to compare quotes effectively, negotiate better rates, and ultimately, find affordable car insurance that fits your budget and needs. Buckle up, it’s going to be a smooth ride!

Understanding Car Insurance in Leominster, MA

Source: lokapost.com

Finding the right car insurance in Leominster can be a real headache, navigating rates and coverage options. But comparing your options is key; for example, you might find similar challenges when researching rates in other areas, like checking out options for car insurance Biddeford before making a decision. Ultimately, the best car insurance for you in Leominster will depend on your individual needs and driving history.

Navigating the world of car insurance can feel like driving through a fog, especially when you’re trying to figure out the best coverage for your needs in a specific location like Leominster, Massachusetts. This guide aims to shed some light on the typical costs, coverage options, and factors influencing your premiums in this area.

Typical Car Insurance Costs in Leominster

Car insurance premiums in Leominster, like anywhere else, vary significantly depending on a number of factors. While providing an exact average is difficult without access to real-time data from all insurance providers, it’s safe to say that costs generally align with the statewide averages in Massachusetts, with potential adjustments based on local factors like accident rates and crime statistics. Expect to pay somewhere in the range of several hundred dollars annually for basic liability coverage, potentially climbing into the thousands for more comprehensive policies. Getting multiple quotes from different insurers is crucial for finding the best rate.

Types of Car Insurance Coverage Available in Leominster

Leominster residents have access to the standard types of car insurance coverage found throughout Massachusetts. These include:

* Liability Coverage: This is the most basic type of coverage, legally required in most states. It protects you financially if you cause an accident that injures someone or damages their property. Liability coverage typically includes bodily injury liability and property damage liability.

* Collision Coverage: This covers damage to your own vehicle resulting from a collision, regardless of who is at fault. If you’re involved in an accident, collision coverage will pay for repairs or replacement of your car.

* Comprehensive Coverage: This goes beyond collision, covering damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or weather-related damage.

* Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident caused by a driver who is uninsured or underinsured. It can cover your medical bills and vehicle repairs.

* Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault.

Factors Influencing Car Insurance Premiums in Leominster

Several factors play a significant role in determining your car insurance premium in Leominster. Understanding these factors can help you make informed decisions and potentially lower your costs.

* Driving Record: A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents and tickets can significantly increase your rates.

* Age and Gender: Younger drivers, particularly males, typically pay higher premiums due to statistically higher accident rates. As you age and gain more driving experience, your premiums usually decrease.

* Vehicle Type: The type of car you drive significantly impacts your insurance cost. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and increased risk of theft.

* Location: Your address in Leominster can influence your premium. Areas with higher accident rates or crime statistics may result in higher premiums.

* Credit Score: In many states, including Massachusetts, your credit score can be a factor in determining your insurance rates. A higher credit score generally translates to lower premiums.

Average Premiums for Different Car Insurance Providers in Leominster, Car insurance leominster

The following table provides estimated average premiums. These are for illustrative purposes only and should not be considered definitive quotes. Actual premiums will vary based on individual circumstances.

| Provider | Average Premium | Coverage Options | Customer Ratings |

|---|---|---|---|

| Progressive | $1200 (estimated annual) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | 4.2 stars (example) |

| State Farm | $1100 (estimated annual) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Med-Pay | 4.5 stars (example) |

| Geico | $1000 (estimated annual) | Liability, Collision, Comprehensive | 4.0 stars (example) |

| Liberty Mutual | $1300 (estimated annual) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Med-Pay | 4.3 stars (example) |

Finding Car Insurance in Leominster

Securing affordable and reliable car insurance in Leominster, Massachusetts, requires understanding the available options and navigating the quoting process effectively. This section will guide you through finding the right car insurance for your needs and budget.

Leominster, like any other city, offers a range of car insurance providers, each with its own pricing structure and coverage options. Choosing the right insurer depends on individual circumstances, such as driving history, the type of vehicle, and desired coverage level.

Car Insurance Companies Operating in Leominster

Many major and regional insurance companies operate in Leominster. While a complete list is impractical here, some prominent examples include Geico, State Farm, Liberty Mutual, Progressive, and Allstate. It’s crucial to remember that this is not an exhaustive list, and numerous smaller, independent agencies also serve the Leominster area. Directly contacting the companies or using online comparison tools is the best way to discover all available options.

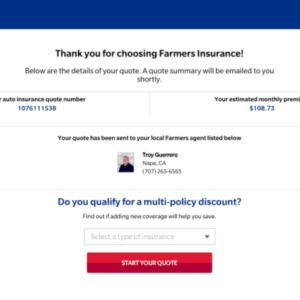

Obtaining a Car Insurance Quote in Leominster

Getting a car insurance quote is generally a straightforward process, whether done online, by phone, or in person. Most companies offer online quote tools where you input your information (driver’s license, vehicle details, desired coverage) to receive an instant estimate. Alternatively, you can contact companies directly by phone or visit their local offices. Be prepared to provide accurate and complete information to ensure an accurate quote.

Tips for Finding Affordable Car Insurance in Leominster

Finding affordable car insurance often involves strategic planning and comparison shopping. Several tactics can significantly impact your premium.

- Bundle your insurance: Combining car insurance with homeowners or renters insurance can often result in discounts.

- Maintain a good driving record: Accidents and traffic violations increase premiums. Safe driving habits are crucial.

- Consider higher deductibles: Opting for a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) typically lowers your premiums. Weigh this against your financial capacity to cover a higher deductible in case of an accident.

- Shop around: Compare quotes from multiple insurers to find the best rates. Don’t settle for the first quote you receive.

- Explore discounts: Many insurers offer discounts for various factors, including good student status, anti-theft devices, and safe driver courses. Inquire about available discounts.

Comparing Car Insurance Quotes

Effectively comparing quotes requires a systematic approach to ensure you’re making an informed decision.

- Gather quotes: Obtain quotes from at least three to five different insurance companies. Use a mix of online tools and direct contact.

- Standardize your coverage: Ensure that all quotes are for the same coverage levels to facilitate accurate comparison. Don’t compare apples and oranges.

- Analyze the details: Carefully review each quote, paying close attention to the premium, deductible, and coverage details. Look beyond the headline price.

- Check for hidden fees: Some insurers may have additional fees or surcharges. Be aware of these before making a decision.

- Read the fine print: Understand the terms and conditions of each policy before committing. Don’t hesitate to ask clarifying questions.

Specific Insurance Needs in Leominster: Car Insurance Leominster

Leominster, Massachusetts, like any other city, presents unique driving conditions and risks that directly influence car insurance rates and coverage needs. Understanding these local factors is crucial for securing the right policy at the right price. This section delves into the specific insurance considerations for drivers in Leominster.

Local Driving Conditions and Insurance Rates

Leominster’s road conditions, traffic patterns, and accident statistics all play a role in determining insurance premiums. For example, higher rates of accidents in certain areas of the city, perhaps due to congested roads or poorly maintained infrastructure, could lead to increased premiums for drivers residing in those zones. Similarly, the prevalence of deer-related accidents in more rural areas bordering Leominster could factor into the cost of comprehensive coverage. Insurance companies use actuarial data to assess risk, and these local factors are key components in that assessment.

Insurance Requirements for Different Vehicle Types

Massachusetts has specific minimum insurance requirements that apply to all vehicles, regardless of location. However, the type of vehicle significantly impacts the cost and type of coverage needed. For instance, insuring a motorcycle typically costs more than insuring a car due to the higher risk of injury associated with motorcycle accidents. Similarly, insuring a larger truck or commercial vehicle will likely require more comprehensive coverage and result in higher premiums than insuring a standard passenger car. Drivers should check with their insurance provider to ensure they meet all state requirements and have adequate coverage for their specific vehicle.

Potential Risks Specific to Driving in Leominster

Several factors specific to Leominster can influence insurance premiums. For instance, the presence of specific types of roadways, such as busy highways or winding residential streets, might contribute to a higher risk of accidents. Furthermore, the time of year can also be a factor; winter weather conditions can increase the likelihood of accidents, potentially leading to higher premiums for drivers who don’t have adequate winter coverage. Understanding these local risks allows drivers to better assess their insurance needs and choose appropriate coverage.

Frequently Asked Questions about Car Insurance in Leominster

Understanding common questions about car insurance in Leominster helps drivers make informed decisions. This section addresses several frequently asked questions.

Question 1: What is the minimum car insurance coverage required in Massachusetts?

Answer: Massachusetts requires minimum liability coverage of $20,000 for injuries to one person, $40,000 for injuries to two or more people, and $5,000 for property damage in a single accident.

Question 2: How can I lower my car insurance premiums in Leominster?

Answer: Several factors can influence your premiums. Maintaining a good driving record, opting for higher deductibles, bundling insurance policies (home and auto), and choosing a car with good safety ratings can all help lower your costs. Shopping around and comparing quotes from multiple insurers is also advisable.

Question 3: What type of coverage is best for drivers in Leominster?

Answer: The best coverage depends on individual needs and risk tolerance. Liability coverage is mandatory, but many drivers opt for comprehensive and collision coverage to protect against damage to their own vehicle. Uninsured/underinsured motorist coverage is also recommended, given the potential for accidents involving drivers without sufficient insurance.

Question 4: How do I file a car insurance claim in Leominster?

Answer: Contact your insurance provider immediately after an accident. They will guide you through the claims process, which typically involves providing information about the accident, police reports (if applicable), and vehicle damage.

Additional Considerations

Source: compareinsurance.ie

So, you’ve got a handle on finding and understanding car insurance in Leominster, but there are a few more crucial things to keep in mind. Navigating the world of claims, deductibles, and switching providers can feel overwhelming, but with a little knowledge, you can steer clear of any unexpected potholes. This section will equip you with the practical know-how to handle these common insurance situations.

Filing a Car Insurance Claim in Leominster

Filing a claim can feel stressful, but a methodical approach makes the process much smoother. First, ensure your safety and the safety of others involved. Then, contact the Leominster Police Department to report the accident and obtain a police report – this is crucial documentation for your claim. Next, contact your insurance provider as soon as possible. They will guide you through the necessary steps, which typically involve providing details of the accident, gathering information from witnesses, and potentially submitting photos of the damage. Remember to keep meticulous records of all communication and documentation related to your claim. Be prepared to provide details like the date, time, location, and description of the accident, as well as information about the other driver(s) involved. The quicker you act, the faster the process will generally be.

Comparison of Car Insurance Deductibles in Leominster

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing the right deductible involves a trade-off between cost and risk. A higher deductible means lower premiums (your monthly payment), but you’ll pay more if you have an accident. A lower deductible means higher premiums, but you’ll pay less out-of-pocket in the event of a claim. For example, a $500 deductible will result in lower monthly premiums than a $1000 deductible, but if you need to file a claim, you’ll pay $500 before your insurance coverage begins. Consider your financial situation and risk tolerance when selecting a deductible. If you have a limited budget and can handle a larger out-of-pocket expense in case of an accident, a higher deductible might be a good option. Conversely, if you prioritize minimizing out-of-pocket costs, a lower deductible, despite higher premiums, may be preferable.

Switching Car Insurance Providers in Leominster

Switching providers is surprisingly straightforward. First, obtain quotes from several companies to compare prices and coverage options. Once you’ve chosen a new provider, notify your current insurer of your intention to cancel your policy. Be sure to check your policy for cancellation deadlines and any associated fees. Your new provider will likely guide you through the necessary paperwork and transfer of information. Make sure to confirm your new policy’s effective date to avoid any gaps in coverage. It’s advisable to initiate the switch well in advance of your current policy’s expiration date to avoid any lapse in coverage. Remember to keep records of all communication and documentation throughout the process.

Resources for Car Insurance Information in Leominster

Finding reliable information is key to making informed decisions. Here are some helpful resources:

- The Massachusetts Division of Insurance: This state agency regulates the insurance industry and provides valuable information about consumer rights and insurance regulations.

- The National Association of Insurance Commissioners (NAIC): The NAIC offers resources and information on insurance topics across the United States.

- Consumer Reports: This organization provides independent reviews and ratings of insurance companies, helping consumers make informed choices.

- Your Local Leominster Library: Libraries often have access to consumer guides and resources on insurance and financial matters.

Illustrative Examples

Source: urbaninsuranceagency.com

Understanding the nuances of car insurance in Leominster, MA, often becomes clearer with concrete examples. Let’s explore a few scenarios to illustrate the impact of coverage choices and the role insurance plays in various situations.

Cost Difference Between Coverage Levels

Imagine two Leominster residents, Sarah and Mark, both driving similar vehicles. Sarah opts for a minimum liability policy, covering only the legally required amounts for bodily injury and property damage to others. Mark, however, chooses a comprehensive policy, including collision, comprehensive, and higher liability limits. Assuming Sarah’s minimum liability policy costs approximately $500 annually, Mark’s comprehensive policy might cost around $1200 annually, a difference of $700. This difference reflects the broader protection Mark secures, covering damage to his own vehicle and offering higher payouts in case of accidents involving significant injuries or property damage. The additional cost represents a trade-off between financial risk and peace of mind. The actual cost difference will vary based on individual factors like driving history, age, and the specific features of their chosen policies.

Typical Car Accident Scenario and Insurance Coverage

Consider a scenario where a Leominster resident, David, rear-ends another vehicle at a stoplight on Main Street. David’s car sustains moderate damage, requiring $3,000 in repairs. The other vehicle also requires repairs, estimated at $2,000. The other driver suffers minor whiplash, incurring $1,000 in medical expenses. If David has collision coverage on his policy, his insurance will cover the $3,000 in repairs to his vehicle, minus any deductible. His liability coverage will cover the $2,000 in repairs to the other vehicle and the $1,000 in medical expenses for the other driver. Without adequate insurance, David would be personally responsible for all these costs.

Benefits of Adequate Car Insurance Coverage

A Leominster resident, Anna, was involved in a serious accident that wasn’t her fault. Another driver ran a red light, causing a collision that totaled Anna’s car and resulted in significant injuries requiring extensive medical treatment. Anna’s comprehensive and high-liability policy covered the cost of her vehicle replacement, her medical bills, and the other driver’s medical expenses and vehicle repair. Without adequate insurance, Anna would have faced crippling debt from medical bills and vehicle replacement costs, potentially impacting her financial stability for years to come. Her insurance policy provided vital financial protection and peace of mind during a difficult time.

Another example highlights the importance of uninsured/underinsured motorist coverage. Imagine a Leominster resident, John, involved in an accident with an uninsured driver. The uninsured driver caused significant damage to John’s vehicle and resulted in substantial medical bills for John. Because John had uninsured/underinsured motorist coverage, his insurance company compensated him for the damages to his vehicle and his medical expenses, preventing a significant financial burden.

Closing Summary

Securing the right car insurance in Leominster doesn’t have to be a headache. By understanding the different coverage options, comparing quotes from various providers, and considering the factors that influence your premiums, you can confidently choose a policy that protects you and your vehicle. Remember, being informed is your best defense against unexpected costs and hassles on the road. Drive safe, and drive smart!