Car Insurance Milford MA: Navigating the world of car insurance can feel like driving through a maze blindfolded, especially in a place like Milford, MA. But fear not, fellow drivers! This guide cuts through the jargon and helps you find the best coverage at the best price. We’ll explore everything from understanding your needs and comparing providers to scoring sweet deals and knowing your rights.

From the impact of your driving history on premiums to the influence of your car’s make and model, we’ll unravel the factors that determine your insurance costs in Milford. We’ll also equip you with savvy tips to lower your premiums, like bundling insurance or maintaining a spotless driving record. Think of this as your ultimate survival kit for navigating the Milford, MA car insurance landscape.

Understanding Car Insurance in Milford, MA

Milford, Massachusetts, like any other town, presents a unique set of considerations when it comes to car insurance. Understanding these nuances can save you money and ensure you have the right coverage. This guide breaks down the essential aspects of car insurance in Milford, helping you navigate the process with confidence.

Typical Car Insurance Needs of Milford, MA Residents

Milford residents, like many suburban communities, likely need a balance of comprehensive and collision coverage. The prevalence of commuting to nearby cities like Boston might necessitate higher liability limits to protect against potential accidents involving higher-value vehicles. Additionally, coverage for uninsured/underinsured motorists is crucial given the unpredictable nature of driving. Homeowners in Milford may also benefit from adding coverage for personal property within their vehicles.

Factors Influencing Car Insurance Premiums in Milford, MA

Several factors contribute to the cost of car insurance in Milford. Demographics play a role; the age and driving history of residents significantly influence premiums. A younger population might see higher rates due to statistically higher accident involvement. Crime rates, while not directly impacting insurance premiums, can indirectly influence them by affecting the likelihood of vehicle theft or vandalism. Milford’s accident history, as recorded by the state’s Department of Transportation or similar agencies, directly impacts insurance company risk assessments, resulting in higher premiums in areas with a higher frequency of accidents. The type of vehicle driven also significantly impacts cost, with luxury or high-performance cars typically commanding higher premiums due to repair costs.

Types of Car Insurance Coverage Available in Milford, MA

Standard car insurance policies in Milford, MA, offer a range of coverages. Liability insurance covers damages caused to others in an accident. Collision coverage pays for repairs to your vehicle regardless of fault. Comprehensive coverage protects against non-collision events such as theft, vandalism, or weather damage. Uninsured/underinsured motorist coverage safeguards you in cases where the at-fault driver lacks sufficient insurance. Medical payments coverage helps pay for medical bills resulting from an accident, regardless of fault. Personal Injury Protection (PIP) provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault.

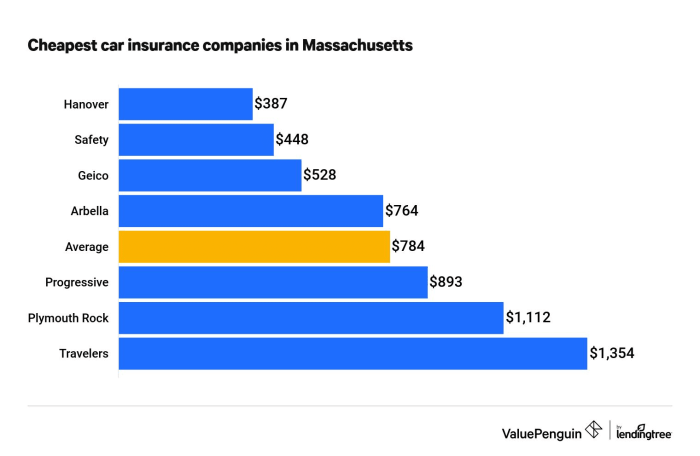

Comparison of Average Car Insurance Costs in Milford, MA Versus Other Massachusetts Towns

Precise comparisons of average car insurance costs between Milford and other Massachusetts towns require access to proprietary insurance data. However, general trends suggest that suburban areas like Milford may have slightly lower premiums than major cities like Boston due to lower traffic density and crime rates. Conversely, towns with a history of higher accident rates may have higher average premiums. Factors such as the age and driving history of the insured population within each town heavily influence these variations. It’s important to obtain quotes from multiple insurers to compare costs directly rather than relying solely on generalized averages.

Finding Car Insurance Providers in Milford, MA

Source: stantonins.com

Securing affordable and comprehensive car insurance in Milford, MA, requires understanding the available options. Navigating the insurance landscape can feel overwhelming, but with a little research, you can find the right coverage at the right price. This section will guide you through finding car insurance providers in Milford, focusing on major companies, local agencies, and a comparison of their services.

Major Car Insurance Companies in Milford, MA, Car insurance milford ma

Several major national and regional insurance companies operate in Milford, MA, offering a variety of coverage options. Choosing the right company depends on your individual needs and budget. It’s crucial to compare quotes and policies before making a decision.

Here are five major car insurance companies operating in Milford, MA (Note: Availability may vary. Contact companies directly for confirmation.):

- State Farm

- Geico

- Liberty Mutual

- Progressive

- Allstate

Local Insurance Agencies in Milford, MA

Local insurance agencies offer personalized service and can often provide competitive rates. They are a valuable resource for understanding your options and tailoring a policy to your specific requirements. Direct contact with these agencies allows for a more tailored approach to your insurance needs.

Here is contact information for three local insurance agencies in Milford, MA (Note: This information is for illustrative purposes and may not be entirely up-to-date. Always verify contact details before reaching out.):

- Agency Name: [Insert Local Agency Name 1]

Phone: (508) 555-1212

Website: [Insert Website Address 1] - Agency Name: [Insert Local Agency Name 2]

Phone: (508) 555-1213

Website: [Insert Website Address 2] - Agency Name: [Insert Local Agency Name 3]

Phone: (508) 555-1214

Website: [Insert Website Address 3]

Comparison of Milford, MA Insurers

Comparing insurers based on coverage options and pricing is essential for making an informed decision. The following table provides a general comparison; actual rates vary based on individual factors such as driving history, vehicle type, and coverage level.

| Company Name | Contact Information | Coverage Options | Average Premium Range |

|---|---|---|---|

| State Farm | 1-800-STATEFARM (Website: statefarm.com) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection | $[Lower Bound] – $[Upper Bound] |

| Geico | 1-800-GEICO (Website: geico.com) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection | $[Lower Bound] – $[Upper Bound] |

| Liberty Mutual | 1-800-LIBERTY (Website: libertymutual.com) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection | $[Lower Bound] – $[Upper Bound] |

Note: The average premium ranges are estimates and may vary significantly depending on individual circumstances.

Finding the right car insurance in Milford, MA can be a maze, but comparing rates is key. You might even consider broadening your search to see what options are available elsewhere, like checking out the rates for auto insurance Bradford PA , to get a better sense of the market. Ultimately, understanding your needs and comparing quotes in Milford, MA will help you find the perfect policy.

Obtaining a Car Insurance Quote

The process of obtaining a car insurance quote is straightforward. This flowchart illustrates the steps involved.

(Note: The following is a textual representation of a flowchart. Imagine a visual flowchart with boxes and arrows connecting them.)

Start –> Gather Information (Driving History, Vehicle Information, etc.) –> Contact Insurers (Phone, Online, or In-Person) –> Provide Information to Insurer –> Receive Quote –> Compare Quotes –> Choose Policy –> Purchase Policy –> End

Factors Affecting Car Insurance Rates in Milford, MA

Securing affordable car insurance in Milford, MA, involves understanding the various factors that influence your premiums. Insurance companies meticulously assess risk, and several key elements contribute to the final cost. Let’s delve into the specifics.

Driving History’s Impact on Premiums

Your driving record significantly impacts your car insurance rates. Accidents and traffic violations are red flags for insurers, indicating a higher likelihood of future claims. A clean driving history, on the other hand, suggests lower risk and often translates to lower premiums. For instance, a single at-fault accident could lead to a substantial premium increase, potentially lasting several years. Similarly, multiple speeding tickets or more serious offenses like DUI convictions will dramatically raise your rates. In Milford, MA, as in most areas, insurance companies utilize a points system to track driving infractions, with each point adding to the overall risk assessment. The more points you accumulate, the higher your premiums will be.

Age and Driving Experience

Age and driving experience are strongly correlated with insurance rates. Young drivers, typically under 25, are statistically more likely to be involved in accidents, leading to higher premiums. This is due to a combination of factors including less experience behind the wheel, higher risk-taking behavior, and potentially less developed driving skills. Conversely, senior drivers, particularly those over 65, may also see higher rates due to potential health concerns or age-related driving limitations. However, drivers in the prime age range (roughly 25-65) generally enjoy the lowest rates due to their established driving history and lower accident probability. This age-based pricing reflects the statistical risk assessment employed by insurance companies.

Vehicle Factors Influencing Insurance Costs

The type of vehicle you drive heavily influences your insurance costs. Factors such as the make, model, and year of your car all play a role. Luxury vehicles or high-performance sports cars often have higher insurance premiums due to their higher repair costs and greater potential for theft. Older vehicles may have lower premiums due to their lower value, but may also lack advanced safety features that impact rates. Conversely, newer vehicles with advanced safety features like automatic emergency braking or lane departure warnings may qualify for discounts. The vehicle’s safety rating, as determined by organizations like the IIHS (Insurance Institute for Highway Safety), also plays a significant part in determining premiums. A vehicle with a high safety rating will typically command lower insurance rates.

Insurance Rates for Different Driver Types

Insurance rates vary considerably based on driver type. As mentioned earlier, young drivers face significantly higher premiums compared to more experienced drivers. Senior drivers, while sometimes facing higher rates due to potential health concerns, may also qualify for senior discounts offered by some insurers. Other factors such as occupation and marital status can also influence rates. For example, some professions may be considered higher risk, leading to higher premiums. Similarly, married individuals often receive lower rates compared to single individuals, reflecting a statistically lower accident rate among married drivers. It’s important to shop around and compare quotes from multiple insurers to find the best rate for your specific circumstances.

Tips for Saving Money on Car Insurance in Milford, MA: Car Insurance Milford Ma

Source: cloudinary.com

Saving money on car insurance in Milford, MA, is achievable with a strategic approach. By understanding the factors that influence your premiums and taking proactive steps, you can significantly reduce your annual costs. This section explores practical strategies to help you keep more money in your wallet.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Insurance companies frequently offer discounts for customers who bundle their policies. This is because managing multiple policies for a single customer is more efficient for the insurer, allowing them to pass on the savings to you. For example, bundling your car insurance with a homeowners policy from the same provider could result in a discount of 10-15%, potentially saving you hundreds of dollars annually. The exact discount will vary depending on the insurer and the specific policies bundled.

Maintaining a Good Driving Record

A clean driving record is a cornerstone of securing lower car insurance premiums. Accidents and traffic violations significantly increase your risk profile in the eyes of insurance companies, leading to higher premiums. Maintaining a spotless record, free from accidents and speeding tickets, demonstrates responsible driving habits and reduces the likelihood of claims, thus lowering your risk and your premiums. Conversely, a history of accidents or traffic violations can lead to increases in your premiums for several years.

Shopping Around for Car Insurance

Comparing quotes from multiple insurance providers is crucial to finding the best rates. Don’t settle for the first quote you receive. Instead, obtain quotes from at least three to five different companies. This allows you to compare coverage options, deductibles, and premiums to find the most suitable and cost-effective plan. Websites and apps that compare car insurance quotes can simplify this process, allowing you to input your information once and receive multiple quotes simultaneously.

Increasing Your Deductible

Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lower your premiums. While a higher deductible means you’ll pay more in the event of an accident, it also reduces your overall insurance costs. Carefully weigh the potential cost of a higher deductible against the savings on your premiums. Consider your financial situation and risk tolerance when making this decision. For example, increasing your deductible from $500 to $1000 could lead to a noticeable reduction in your monthly premium.

Choosing the Right Coverage

Carefully evaluate your insurance needs and choose the appropriate coverage levels. Avoid unnecessary coverage that might inflate your premiums without providing significant added value. Understanding the different types of coverage, such as liability, collision, and comprehensive, and selecting the levels that best suit your individual circumstances can help you save money without compromising essential protection. For example, if you drive an older car, you might consider dropping collision and comprehensive coverage, as the repair costs might exceed the car’s value.

Understanding Milford, MA Specific Regulations

Milford, MA, like all municipalities, operates under the broader framework of Massachusetts state car insurance laws, but there aren’t unique local regulations that significantly alter the standard requirements. Understanding these state-level rules is crucial for Milford residents to ensure compliance and secure adequate coverage. This section clarifies the essential aspects of car insurance in Milford, focusing on minimum coverage, claims procedures, and available resources.

Minimum Car Insurance Coverage Requirements in Milford, MA

Massachusetts mandates minimum liability coverage for all drivers. This means you must carry insurance that covers bodily injury and property damage caused to others in an accident you’re at fault for. The specific minimums are defined by state law and are not specific to Milford. Failing to maintain this minimum coverage can result in significant penalties, including fines and suspension of your driver’s license. It’s essential to check the current Massachusetts state regulations for the precise monetary amounts for these minimum coverage limits, as they can be subject to change. A quick online search for “Massachusetts minimum car insurance requirements” will provide the most up-to-date information.

Filing a Car Insurance Claim in Milford, MA

The process of filing a car insurance claim in Milford follows the standard procedures Artikeld by your insurance provider. Regardless of your location within Massachusetts, the initial steps are generally consistent. This typically involves reporting the accident to your insurer as soon as possible, providing all necessary details, and cooperating with any investigations. Your insurer will guide you through the necessary paperwork and documentation. It’s advisable to keep detailed records of the accident, including police reports, witness statements, and photographs of the damage. If the accident involves injuries, immediate medical attention should be sought, and medical records should be meticulously documented and provided to your insurer. Remember, timely reporting and accurate documentation are key to a smooth claims process.

Resources for Milford, MA Drivers Needing Car Insurance Assistance

Several resources are available to Milford residents who need help with their car insurance. The Massachusetts Division of Insurance offers a wealth of information on car insurance regulations, consumer rights, and complaint procedures. Their website provides access to forms, FAQs, and contact information for assistance. Additionally, independent consumer advocacy groups can offer guidance and support in navigating insurance issues. These organizations often provide free or low-cost consultations to help drivers understand their options and protect their rights. Finally, local community organizations may offer resources and referrals for drivers facing financial challenges in obtaining or maintaining car insurance. A thorough online search for “car insurance assistance Massachusetts” will yield a comprehensive list of available resources.

End of Discussion

Source: cheapcarinsuranceco.com

So, there you have it – your comprehensive guide to car insurance in Milford, MA. Remember, finding the right coverage isn’t just about ticking boxes; it’s about securing your peace of mind on the road. By understanding the factors that influence your premiums, comparing providers, and employing smart strategies, you can confidently choose a policy that perfectly fits your needs and budget. Happy driving!