Car insurance without inspection? Sounds too good to be true, right? But it’s a real thing, offering a faster, potentially cheaper way to get insured. This isn’t a magic trick; there are specific eligibility requirements and types of coverage involved. We’ll break down everything you need to know, from understanding the fine print to finding the best deals, so you can decide if skipping the inspection is the right move for you.

This guide dives deep into the world of no-inspection car insurance, exploring the eligibility criteria, available policy types, cost factors, and potential risks. We’ll compare it to traditional car insurance and help you navigate the process of finding a provider that fits your needs. Prepare to get clued up on all things car insurance – the inspection-free way.

Eligibility Criteria for No-Inspection Car Insurance

Snagging car insurance without an inspection sounds like a dream, right? Skip the hassle, get the coverage. But before you celebrate, let’s dive into the nitty-gritty of eligibility. It’s not a free-for-all; certain conditions must be met to qualify for this convenient option.

Getting car insurance without an inspection typically hinges on a few key factors. Insurance companies assess risk differently, and your eligibility depends heavily on your history and the specifics of your vehicle. While some providers might be more lenient, others stick to stricter guidelines. Understanding these nuances is crucial to successfully securing a policy.

Factors Affecting Eligibility for No-Inspection Policies

Insurance companies use a variety of factors to determine eligibility for no-inspection policies. These factors are often weighted differently depending on the specific insurer. Generally, a clean driving record and a vehicle history free of accidents or major damage significantly increase your chances of approval. Your credit score can also play a role, as it reflects your overall financial responsibility. The age and make/model of your vehicle are also considered; newer cars with a good safety record might be more easily insured without an inspection.

Variations in Eligibility Criteria Across Providers

The requirements for no-inspection car insurance vary significantly among different insurance providers. Some companies might be more willing to waive inspections for low-risk drivers with good credit and newer vehicles, while others might require a more extensive review process, even for seemingly low-risk individuals. For example, a company specializing in insuring classic cars might be more lenient with inspections than a company focused on high-risk drivers. Always compare policies and eligibility requirements across multiple insurers to find the best fit.

Situations Where Inspections Might Be Waived

Several situations might allow for an inspection waiver. For instance, if you’re already an existing customer with a spotless record and are simply adding a new vehicle to your policy, the insurer might forgo an inspection. Similarly, if you’re purchasing a car directly from a dealership and they provide all necessary documentation verifying the vehicle’s condition, an inspection could be unnecessary. In some cases, if the vehicle is very new, or you are insuring a car that has already been thoroughly inspected by another party (e.g., a mechanic’s report), the insurer might waive the inspection.

Application Processes: With and Without Inspections

The application process for car insurance with an inspection usually involves scheduling an appointment with an approved inspector, undergoing the inspection, and then submitting the report along with your application. The process without an inspection typically involves providing more detailed information about your vehicle and driving history. This might include submitting documentation like the vehicle’s title, registration, and photos. The insurer may also request additional information, like a vehicle history report from a reputable service. The application process for no-inspection policies is often faster and more convenient, but requires more upfront documentation.

Types of Car Insurance Offered Without Inspection

Source: aaspma.org

Navigating the world of car insurance can be tricky, especially when you encounter options like policies without vehicle inspections. These policies often come with higher premiums, reflecting the increased risk for the insurer. Understanding the full scope of your insurance options is key before committing, as the lack of inspection might mean stricter terms and conditions for your car insurance without inspection policy.

So, do your homework before signing on the dotted line!

Securing car insurance without an inspection can be a lifesaver, especially if you’re short on time or your vehicle isn’t readily accessible. However, understanding the types of coverage available is crucial before you sign on the dotted line. Not all policies offer the same level of protection, and limitations often exist. Let’s break down the common types.

Policy Types Offered Without Inspection

The availability of no-inspection car insurance policies varies by insurer and state. Generally, you’ll find that some level of liability coverage is more readily available without inspection than comprehensive or collision coverage. The reason for this lies in the risk assessment process – liability insurance focuses on the financial responsibility to others in the event of an accident, while comprehensive and collision cover your vehicle directly, necessitating a more detailed assessment of its condition.

| Policy Type | Key Features | Benefits | Limitations |

|---|---|---|---|

| Liability Insurance | Covers bodily injury and property damage to others caused by an accident you’re at fault for. Minimum coverage requirements vary by state. | Provides essential financial protection in case you injure someone or damage their property. It’s often the most accessible type of no-inspection insurance. | Does not cover damage to your own vehicle, even if you are at fault. Coverage limits are determined by the policy and may not be sufficient to cover significant damages. |

| Comprehensive Insurance | Covers damage to your vehicle from non-collision events such as theft, vandalism, fire, or natural disasters. | Provides peace of mind knowing your vehicle is protected against a wide range of unexpected events. Can be valuable if your car is relatively new or has high replacement cost. | Often requires a higher premium and may not be available without inspection, especially if the vehicle is older or has a known history of problems. Deductibles apply. |

| Collision Insurance | Covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. | Protects your investment by covering repairs or replacement costs in the event of an accident, even if you are at fault. | Similar to comprehensive, this may be harder to obtain without inspection, particularly for older or higher-risk vehicles. Deductibles apply. Often comes with higher premiums. |

Factors Affecting Premiums for No-Inspection Policies

Source: banburyfm.com

Securing car insurance without an inspection might seem like a convenient shortcut, but the price you pay can vary significantly. Several factors influence the premium you’ll see, and understanding these can help you navigate the market and potentially save money. This isn’t a simple “one size fits all” situation; your individual circumstances heavily dictate the final cost.

While skipping the inspection offers speed and ease, insurers compensate for the lack of a physical assessment by relying more heavily on other data points to assess risk. This means that certain factors become even more important in determining your premium. Essentially, the insurer is making a calculated guess about your vehicle’s condition, and that guess impacts your cost.

Premium Differences Between No-Inspection and Inspection Policies

No-inspection policies generally come with higher premiums compared to those requiring inspections. This is because the insurer accepts a higher level of uncertainty about the vehicle’s condition and potential repair costs. An inspection allows for a more accurate risk assessment, potentially leading to lower premiums for drivers with well-maintained vehicles. The difference can be substantial, ranging from a few percentage points to a much higher increase, depending on the factors mentioned below. For example, a driver with a spotless driving record might see only a slight increase, while someone with a history of accidents might face a much larger premium jump when opting for a no-inspection policy.

Factors Impacting Premium Costs

Understanding the factors that influence your premium is key to making an informed decision. Insurers use a complex algorithm, but some key elements consistently emerge as significant contributors to the final cost.

- Driving History: Accidents, speeding tickets, and claims filed in the past significantly impact your premium, regardless of whether an inspection is involved. A clean driving record will generally result in lower premiums, while a history of incidents will inevitably increase your cost, especially with a no-inspection policy as the insurer has less concrete data to mitigate the risk.

- Age and Location: Younger drivers generally pay more due to higher statistical risk. Similarly, your location plays a role; areas with higher crime rates or more frequent accidents tend to have higher insurance premiums. These factors are considered regardless of inspection requirements.

- Vehicle Year, Make, and Model: Even without an inspection, the insurer uses the vehicle’s details to assess its risk profile. Newer cars generally cost less to insure than older models due to safety features and lower likelihood of mechanical failure. Certain makes and models might also have a history of higher repair costs, impacting your premium.

- Coverage Level: The type and amount of coverage you choose directly influence your premium. Comprehensive coverage, which protects against a broader range of incidents, will be more expensive than liability-only coverage. This applies consistently across both inspection and no-inspection policies.

- Credit Score: In many regions, your credit score is a factor in determining your insurance premium. A higher credit score often correlates with lower premiums, reflecting a perceived lower risk. This is an element independent of any vehicle inspection.

Scenario Demonstrating Premium Impact

Let’s consider two drivers, both applying for no-inspection car insurance on a 2018 Honda Civic.

Driver A: 35 years old, clean driving record, excellent credit score, lives in a low-risk area, chooses liability-only coverage.

Driver B: 22 years old, two accidents in the past three years, average credit score, lives in a high-risk urban area, chooses comprehensive coverage.

Driver A will likely receive a significantly lower premium than Driver B. While both are using no-inspection policies, the cumulative effect of their individual circumstances creates a considerable difference in their final insurance cost. The insurer is compensating for the lack of inspection by relying more heavily on the known risk factors associated with each driver. Driver B’s higher risk profile necessitates a higher premium to cover the potential for claims.

Potential Risks and Benefits of No-Inspection Car Insurance: Car Insurance Without Inspection

Choosing car insurance without an inspection can seem like a quick win, saving you time and potentially money. However, it’s a decision that requires careful consideration, as it involves a trade-off between convenience and potential risks. Understanding both sides of the coin is crucial before making a choice.

No-inspection car insurance offers a streamlined application process, eliminating the need for a physical vehicle assessment. This can be particularly appealing to those with busy schedules or those whose vehicles are located remotely. However, this convenience comes at a price – the insurer has less information about the vehicle’s condition, which can lead to complications.

Risks Associated with No-Inspection Car Insurance

The primary risk is that the insurer might not have a complete picture of your vehicle’s condition. If your car has hidden damage or mechanical issues that aren’t disclosed, you might face difficulties in getting a fair claim settlement in case of an accident or damage. For example, if your car has pre-existing rust damage that isn’t visible during the application process and later leads to a significant repair, the insurer might deny or partially cover the claim, citing undisclosed pre-existing damage. Additionally, if your vehicle is significantly older or has a modified engine, you might find that the coverage is inadequate for the actual risk involved. Essentially, you are relying on your own accurate assessment of your car’s condition, which can be subjective.

Advantages of No-Inspection Car Insurance

There are situations where no-inspection insurance can be advantageous. For instance, if you’re insuring a relatively new car in excellent condition, and you have a strong driving record, the insurer may be comfortable offering coverage without a physical inspection. This can save you both time and the cost associated with an inspection. Another scenario is when you’re insuring a classic car that’s rarely driven and is meticulously maintained; the owner may feel an inspection is unnecessary given the car’s condition and limited usage. The speed and simplicity of the process are also significant advantages for those who need insurance quickly.

Downsides of Not Having a Vehicle Inspection

The absence of a vehicle inspection means the insurer relies heavily on the information you provide. Inaccurate or incomplete information could lead to complications down the line. This could range from an inadequate policy to claim denials. A proper inspection allows the insurer to assess factors like the vehicle’s age, mileage, and overall condition, leading to a more accurate risk assessment and a fairer premium. Without this, the insurer might underestimate the risk, potentially leading to higher premiums for everyone or inadequate coverage for you.

Case Study: The Garcia Family

The Garcia family recently purchased a used minivan. Due to time constraints, they opted for no-inspection car insurance. The minivan was relatively new and appeared to be in good condition. However, a few months later, a hidden mechanical issue surfaced, requiring expensive repairs. Their insurance company partially covered the repairs, citing the lack of a pre-existing condition disclosure. While the no-inspection policy saved them time initially, the resulting claim experience highlighted the potential downsides of not having a vehicle inspection. The initial savings were offset by the additional costs and hassle of dealing with a partially covered claim. This illustrates the importance of weighing the convenience against the potential risks before choosing this type of insurance.

Comparison with Traditional Car Insurance

Choosing between traditional car insurance and no-inspection policies involves understanding the differences in the application process, time commitment, and overall cost. While both offer crucial financial protection, the methods of obtaining coverage differ significantly. Let’s break down the key contrasts.

Process Differences in Obtaining Car Insurance, Car insurance without inspection

The acquisition of car insurance with and without an inspection follows distinct pathways. Traditional car insurance necessitates a physical inspection of your vehicle to assess its condition, influencing the premium calculation. This inspection usually involves a third-party assessor who examines the vehicle’s mechanical and cosmetic aspects. In contrast, no-inspection car insurance skips this step, relying instead on the information you provide in your application. This streamlined approach reduces the time and effort required from the policyholder.

Paperwork, Time Commitment, and Cost Comparison

The paperwork involved in obtaining traditional car insurance is generally more extensive than that required for no-inspection policies. Traditional policies often involve multiple forms, including vehicle details, driving history, and potentially additional documentation related to the vehicle’s condition post-inspection. The time commitment also differs, with traditional policies often requiring scheduling an inspection appointment, potentially causing delays. No-inspection policies typically involve a shorter application process, completed entirely online or through a quick phone call. The overall cost can also vary. While no-inspection policies might seem cheaper initially, the lack of a vehicle assessment could lead to higher premiums in the long run if an accident reveals undisclosed damage.

Detailed Comparison Table

| Feature | With Inspection | Without Inspection | Differences |

|---|---|---|---|

| Application Process | Requires vehicle inspection by a third-party assessor; involves more extensive paperwork. | Typically online or phone application; minimal paperwork. | Traditional policies involve a more involved process, including a physical inspection and more extensive documentation. No-inspection policies are significantly faster and simpler. |

| Time Commitment | Longer due to scheduling and attending the vehicle inspection. | Shorter, often completed within minutes or hours. | Significant time savings with no-inspection policies, as the inspection step is eliminated. |

| Paperwork | More extensive; includes vehicle details, driving history, and potentially inspection reports. | Minimal; primarily application forms with basic vehicle and driver information. | The amount of paperwork is considerably less with no-inspection policies. |

| Cost | Initial cost might be higher due to inspection fees, but premiums may be more accurately reflect risk. | Initial cost might be lower, but premiums may be higher in the long run if undisclosed damage is later revealed. | The initial cost difference can vary, but long-term costs are affected by the level of risk assessment. Traditional policies offer a more comprehensive risk assessment, potentially leading to more accurate premium pricing over time. |

Finding No-Inspection Car Insurance Providers

Securing car insurance without an inspection can seem daunting, but with the right approach, it’s entirely achievable. This section Artikels the various avenues you can explore to find insurers offering these convenient policies, the questions to ask, and the crucial step of comparing quotes before making a decision.

Finding the right provider requires a multi-pronged approach. Don’t rely on just one method; casting a wide net increases your chances of finding the best deal.

Avenues for Finding No-Inspection Car Insurance Providers

Several avenues exist for discovering insurers offering no-inspection car insurance. These range from online comparison tools to directly contacting insurance companies. Actively exploring these options is crucial to finding a suitable policy.

- Online Comparison Websites: Many websites specialize in comparing car insurance quotes from multiple providers. These sites often filter results based on specific criteria, including the availability of no-inspection policies. Using these tools saves time and effort by presenting various options in one place.

- Directly Contacting Insurance Companies: Contacting insurance companies directly allows for personalized service and the opportunity to ask specific questions about their no-inspection policies. This approach can be particularly helpful for obtaining detailed information not readily available online.

- Insurance Brokers: Independent insurance brokers can access a wider range of insurance providers than you could on your own. Their expertise can be invaluable in navigating the complexities of car insurance options and identifying policies tailored to your needs.

Questions to Ask Insurance Providers

Before committing to a policy, asking the right questions ensures you understand the terms and conditions completely. This proactive approach prevents surprises and helps you make an informed decision.

- Specific eligibility requirements: Inquire about the precise criteria for no-inspection policies, such as vehicle age, make, and model limitations. Understanding these limitations upfront prevents disappointment later.

- Premium calculation methods: Ask how premiums are determined for no-inspection policies. Understanding the factors influencing your premium allows you to compare quotes more effectively.

- Policy coverage details: Clarify the specific coverages included in the no-inspection policy. Ensure it aligns with your needs and expectations. Confirm whether there are any exclusions or limitations compared to traditional policies.

- Claim process specifics: Inquire about the claim process for no-inspection policies. Understanding this aspect before a claim is necessary provides peace of mind.

Importance of Comparing Quotes

Comparing quotes from multiple providers is essential for securing the best possible deal. Different insurers offer varying premiums and coverage options, making comparison crucial for finding the most suitable and affordable policy.

Comparing quotes from at least three different providers is recommended to ensure you are getting the most competitive price and coverage.

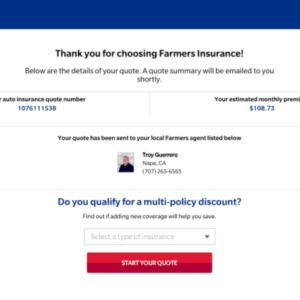

Obtaining a Quote and Purchasing a Policy

The process of obtaining a quote and purchasing a no-inspection car insurance policy is generally straightforward. However, understanding the steps involved ensures a smooth and efficient experience.

- Gather necessary information: Before contacting insurers, collect all the necessary information, including your driver’s license, vehicle information, and driving history.

- Request quotes: Contact insurers through their websites, phone, or email to request quotes. Be prepared to answer questions about your vehicle and driving history.

- Compare quotes: Carefully review the quotes received, comparing premiums, coverages, and policy terms.

- Choose a policy: Select the policy that best meets your needs and budget.

- Complete the application: Fill out the application form accurately and completely.

- Pay the premium: Pay the initial premium to activate your policy.

Illustrative Scenarios for No-Inspection Car Insurance

Source: co.uk

No-inspection car insurance offers a streamlined approach to securing coverage, but its suitability depends heavily on the specific circumstances. Let’s explore a few scenarios to illustrate when this type of insurance might be beneficial, and when it might fall short.

New Car Purchase Scenario

Imagine Sarah, a recent college graduate, just bought a brand-new electric vehicle. She’s excited but budget-conscious. The dealership offers her a no-inspection insurance policy as part of a financing package. Since the car is practically pristine, Sarah sees no need for a lengthy inspection and appreciates the quick and easy process. The lower upfront cost compared to traditional insurance also helps her manage her finances effectively. This scenario highlights how no-inspection insurance can be attractive for buyers of new vehicles, where the vehicle’s condition is unlikely to be a significant concern.

Used Car Purchase Scenario

Consider Mark, who purchased a used car privately. He’s already had a mechanic inspect the car and is confident in its condition. Obtaining a traditional policy would mean scheduling an inspection, adding extra time and hassle to the process. No-inspection insurance allows Mark to get his coverage quickly and easily, without the added expense and inconvenience of a separate inspection. The pre-existing mechanical knowledge and confidence in the car’s condition make no-inspection insurance a practical choice.

Scenario Where No-Inspection Insurance Might Not Be Suitable

Let’s say David bought a very old, high-mileage car with a known history of mechanical issues. While he secured a good price, he’s aware that significant repairs might be needed soon. In this case, a no-inspection policy might not be the wisest choice. A traditional policy, with a thorough inspection, could reveal hidden problems that might impact the insurer’s assessment of risk and potentially lead to a higher premium but also more accurate coverage. The potential for significant future repair costs outweighs the convenience of a quicker process.

No-Inspection Insurance Claim Process Scenario

Suppose Lisa, insured with a no-inspection policy, was involved in a minor fender bender. The damage is limited to her bumper. She reports the accident to her insurer, provides photos of the damage, and completes a simple accident report form. The insurer processes the claim efficiently, as there’s no need for a separate vehicle inspection to assess the damage. The claim is approved, and the repairs are covered according to her policy terms. This scenario demonstrates the streamlined claim process associated with no-inspection insurance, emphasizing its efficiency in handling straightforward claims.

Closing Notes

So, is car insurance without inspection the right choice for you? The answer, like most things in life, depends. Weigh the pros and cons carefully – the potential for faster coverage versus potential limitations and higher premiums. By understanding the eligibility criteria, available policies, and cost factors, you can make an informed decision that protects your wallet and your vehicle. Remember to compare quotes from multiple providers to find the best deal that suits your unique circumstances. Happy driving!