Cheap best auto insurance – sounds like a contradiction, right? We all want affordable car insurance, but “cheap” often means skimping on crucial coverage. This guide cuts through the marketing jargon and helps you find the sweet spot: reliable protection without breaking the bank. We’ll explore the factors influencing your premiums, smart ways to compare quotes, and strategies to snag the best deal without sacrificing safety.

Navigating the world of auto insurance can feel like decoding a secret language. From deductibles to liability limits, understanding the terminology is half the battle. This guide unpacks the complexities, empowering you to make informed decisions and find a policy that fits your needs and budget. Forget the confusing fine print; we’ll make it clear and simple.

Defining “Cheap Best Auto Insurance”

Finding the “cheap best” auto insurance is a classic case of wanting it all. The inherent tension lies in the often-inverse relationship between price and quality. Lower premiums usually come with compromises, while comprehensive coverage tends to be more expensive. Understanding this conflict is crucial for making informed decisions.

Consumers prioritize either “cheap” or “best” based on their individual financial situations and risk tolerance. Someone with a tight budget might prioritize the lowest premium, even if it means sacrificing some coverage. Conversely, a high-net-worth individual might prioritize comprehensive coverage, even if it means paying a higher premium. Factors like age, driving history, and the value of the vehicle also influence this prioritization.

Marketing Strategies of Insurance Companies

Insurance companies cleverly navigate this tension by marketing themselves as both affordable and high-quality. They achieve this through targeted advertising, highlighting specific features that appeal to different segments of the market. For example, some companies emphasize their low premiums in their advertising campaigns, attracting budget-conscious consumers. Others focus on the breadth and depth of their coverage, targeting those who prioritize protection above all else. They might use testimonials from satisfied customers or highlight specific features like roadside assistance or accident forgiveness to bolster their image of high quality. Companies may also use sophisticated algorithms to offer customized quotes that seem both cheap and tailored to the individual’s specific needs, thus masking the true trade-offs involved.

Pricing Models in Auto Insurance

The pricing of auto insurance is complex and varies significantly across providers. Different companies use different models, leading to a wide range of premiums for seemingly similar coverage.

| Pricing Model | Description | Advantages | Disadvantages |

|---|---|---|---|

| Usage-Based Insurance (UBI) | Premiums are based on driving habits tracked through telematics devices or smartphone apps. | Potentially lower premiums for safe drivers. | Privacy concerns; potential for inaccurate data impacting premiums. |

| Pay-As-You-Drive (PAYD) | Similar to UBI, but typically focuses on mileage driven. | Lower premiums for low-mileage drivers. | May not be suitable for all driving patterns. |

| Traditional Risk-Based Pricing | Premiums are based on factors like age, driving history, location, and vehicle type. | Widely available and relatively simple. | Can be less flexible and may not reflect individual driving behavior accurately. |

| Tiered Coverage | Offers different levels of coverage at different price points. | Allows for customization based on budget and needs. | Can be confusing and requires careful comparison of different tiers. |

Factors Influencing Auto Insurance Costs

Source: cloudinary.com

Finding the cheapest car insurance is a quest many of us undertake. But the price tag isn’t just plucked from thin air; several factors intricately weave together to determine your premium. Understanding these influences can help you navigate the insurance market more effectively and potentially save some serious dough. Let’s break down the key players.

Demographic Factors and Insurance Premiums

Your personal details play a surprisingly large role in how much you’ll pay for car insurance. Insurers use statistical models to assess risk, and your age, driving history, and location all contribute to this assessment. Younger drivers, statistically, are involved in more accidents, hence higher premiums. A clean driving record, conversely, signals lower risk and lower costs. Your location matters too; areas with high accident rates or theft rates naturally command higher premiums due to increased claims potential. For example, living in a bustling city center might cost you more than residing in a quiet suburban area.

Vehicle Type and Features Impact on Insurance Costs

The car you drive is another significant factor. Sports cars, luxury vehicles, and high-performance models are generally more expensive to insure because of their higher repair costs and the potential for more severe damage in accidents. Features like advanced safety technology, on the other hand, can work in your favor. Cars equipped with anti-theft systems, airbags, and automatic emergency braking often qualify for discounts, reflecting their contribution to accident prevention. Think of it this way: a beat-up Honda Civic will cost significantly less to insure than a brand-new Tesla Model S.

Coverage Levels and Their Influence on Price

The type and amount of coverage you choose directly impacts your premium. Liability coverage, which protects others in case you cause an accident, is usually mandatory. However, higher liability limits mean higher premiums. Collision coverage, which pays for repairs to your vehicle in an accident regardless of fault, adds to the cost, as does comprehensive coverage, which covers damage from non-collision events like theft or vandalism. Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) will lower your premium, but it means a larger upfront expense if you need to file a claim. Finding the right balance between coverage and affordability is key.

Discounts and Their Impact on the Final Price

Insurance companies offer a range of discounts to incentivize safe driving and loyalty. These can significantly reduce your final premium. Common discounts include: good student discounts (for students with good grades), safe driver discounts (for drivers with clean records), multi-car discounts (for insuring multiple vehicles with the same company), and bundling discounts (for combining auto insurance with other types of insurance, such as homeowners or renters insurance). For example, a good student discount might shave 10-20% off your premium, while a multi-car discount could save you even more. Always inquire about available discounts when getting quotes; you might be surprised at how much you can save.

Finding Affordable Auto Insurance Options

Finding the cheapest auto insurance shouldn’t feel like navigating a minefield. With a little savvy and the right approach, you can secure solid coverage without breaking the bank. This guide will equip you with the tools and knowledge to compare quotes effectively, understand policy types, and ultimately find the best deal for your needs.

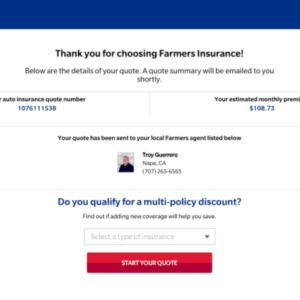

Comparing Auto Insurance Quotes Effectively

To find the best auto insurance deal, comparing quotes is essential. Don’t just settle for the first offer you see. A systematic approach will ensure you’re getting the most competitive price.

- Gather Your Information: Before you start, collect all the necessary information. This includes your driver’s license number, vehicle information (make, model, year), driving history (including accidents and violations), and your address. The more accurate your information, the more accurate the quotes you receive.

- Use Multiple Comparison Websites: Leverage online comparison tools. These websites allow you to input your information once and receive quotes from multiple insurers simultaneously. This saves you considerable time and effort. Popular examples include sites like NerdWallet, The Zebra, and Policygenius.

- Contact Independent Agents: Independent insurance agents work with multiple insurance companies, allowing them to shop around for you and potentially find better deals than you could on your own. They can also provide personalized advice.

- Get Quotes Directly from Insurers: While comparison websites are useful, it’s also beneficial to get quotes directly from individual insurance companies. This ensures you’re not missing out on any exclusive offers or discounts.

- Compare Apples to Apples: Don’t just focus on the price. Carefully review the coverage details of each quote. Make sure you’re comparing similar coverage levels to ensure a fair comparison. A lower premium with significantly less coverage might not be the best deal in the long run.

Resources for Finding Affordable Auto Insurance, Cheap best auto insurance

Several resources can help you find affordable auto insurance. Using a combination of these methods increases your chances of securing the best possible price.

- Online Comparison Websites: As mentioned earlier, sites like NerdWallet, The Zebra, and Policygenius provide a convenient way to compare quotes from multiple insurers.

- Independent Insurance Agents: These agents act as brokers, working with multiple insurance companies to find the best fit for your needs and budget.

- Directly from Insurance Companies: Contacting insurance companies directly allows you to access their specific offers and promotions, potentially uncovering discounts not available through comparison sites or agents.

- Your Existing Insurance Provider: Don’t overlook your current insurer. They may offer discounts or adjust your policy to lower your premium without sacrificing essential coverage.

Comparison of Different Insurance Policy Types

Understanding different policy types is crucial for choosing the right coverage at the right price. The cost varies significantly depending on the level of protection offered.

| Policy Type | Coverage | Typical Cost | Who it’s best for |

|---|---|---|---|

| Liability-Only | Covers damages to others’ property or injuries caused by you. | Lowest | Drivers with older cars or limited assets. |

| Collision | Covers damage to your car in an accident, regardless of fault. | Moderate | Drivers with newer cars or significant loan balances. |

| Comprehensive | Covers damage to your car from non-accident events (theft, vandalism, weather). | Moderate | Drivers with newer cars or significant loan balances. |

| Full Coverage | Combines liability, collision, and comprehensive coverage. | Highest | Drivers with newer cars, significant loan balances, or those wanting maximum protection. |

Interpreting Insurance Policy Documents

Understanding your policy document is vital. It Artikels your coverage details, limits, and exclusions. Don’t hesitate to ask your insurer for clarification on anything you don’t understand.

Carefully review the declarations page, which summarizes your coverage, premiums, and policy period. Pay close attention to the section outlining your coverage limits and deductibles.

Understanding Policy Details and Avoiding Pitfalls

Snagging a cheap auto insurance policy is great for your wallet, but don’t let the low price blind you to the fine print. Understanding the details of your policy is crucial to ensuring you’re actually protected when you need it most. Ignoring the specifics can lead to unexpected costs and insufficient coverage, leaving you financially vulnerable in the event of an accident.

Understanding your policy goes beyond just the price tag. It involves grasping the intricacies of deductibles, premiums, exclusions, and potential hidden fees. This knowledge empowers you to make informed decisions and avoid costly surprises down the line. Think of it as investing a little time upfront to save a lot of money and stress later.

Deductibles and Premiums: The Balancing Act

Your premium is the regular payment you make to maintain your insurance coverage, while your deductible is the amount you pay out-of-pocket before your insurance kicks in. Lower premiums usually mean higher deductibles, and vice versa. Finding the right balance depends on your risk tolerance and financial situation. Someone with a larger emergency fund might opt for a higher deductible and lower premium, while someone with limited savings might prefer a lower deductible and higher premium. Carefully consider your financial stability and potential exposure to risk when making this decision. For example, a young driver with a less-than-perfect driving record might choose a lower deductible to mitigate the risk of higher out-of-pocket expenses in case of an accident.

Common Exclusions and Limitations in Auto Insurance Policies

Most auto insurance policies have exclusions and limitations. These are specific situations or types of damage that aren’t covered. Common exclusions include damage caused by wear and tear, damage from intentional acts, and damage resulting from driving under the influence. Limitations might include caps on the amount of coverage for specific types of damage, like a limit on the payout for a rental car after an accident. Carefully review your policy document to understand exactly what is and isn’t covered. For instance, many policies exclude coverage for damage caused by floods or earthquakes, requiring separate coverage if you live in a high-risk area.

Hidden Fees and Additional Costs

Beware of hidden fees that can significantly increase your overall cost. These might include administrative fees, late payment penalties, or fees for adding or changing drivers on your policy. Some companies might also charge extra for certain coverage options, such as roadside assistance or rental car reimbursement. Always ask about all potential fees upfront to avoid any unexpected charges. For example, a seemingly inexpensive policy might come with a hefty fee for canceling it early, a detail easily overlooked if not explicitly asked about.

Potential Problems and Avoidance Strategies

Understanding the potential pitfalls of cheap auto insurance is crucial for making informed decisions. Here are some common problems and how to avoid them:

- Problem: Inadequate coverage leaving you financially responsible for significant repair costs or medical bills after an accident. Solution: Carefully compare coverage limits across different insurers and choose a policy that meets your needs, not just the lowest price.

- Problem: Unclear policy language or hidden fees leading to unexpected expenses. Solution: Thoroughly read your policy documents and ask questions to clarify anything you don’t understand. Don’t hesitate to contact the insurance company directly.

- Problem: Difficulty filing a claim or receiving timely payouts. Solution: Check the insurer’s customer service ratings and reviews before signing up. A reputable company will have a clear claims process and responsive customer support.

- Problem: Policy cancellation due to non-payment or failure to meet policy requirements. Solution: Set up automatic payments to avoid late fees and ensure you understand and meet all the policy’s conditions.

Illustrating Savings Strategies

Source: sme.asia

Saving money on auto insurance doesn’t have to feel like navigating a minefield. There are several smart strategies you can employ to significantly lower your premiums without compromising coverage. By understanding how insurers assess risk and what factors influence your rates, you can take control of your car insurance costs and keep more money in your pocket.

Lowering your auto insurance premiums is a game of smart choices and proactive measures. It’s about understanding your insurer’s pricing model and making adjustments to present yourself as a lower-risk driver. This involves both lifestyle changes and strategic decisions regarding your insurance policy.

Bundling Policies

Bundling your home and auto insurance with the same provider is a classic way to save. Insurance companies often offer discounts for bundling because it simplifies their administration and reduces the risk of losing a customer. For example, if you currently pay $100/month for auto insurance and $80/month for homeowners insurance, bundling might reduce your total monthly payment to $160, saving you $20 per month. This seemingly small saving adds up to $240 annually – money you can use for something more fun!

Improving Driving Record

Maintaining a clean driving record is paramount. Accidents and traffic violations significantly increase your insurance premiums. A single at-fault accident can lead to a substantial increase in your rates for several years. Conversely, a spotless record demonstrates to insurers that you’re a responsible driver, leading to lower premiums. For instance, someone with multiple speeding tickets might pay 20-30% more than a driver with a clean record.

Increasing Deductibles

Raising your deductible – the amount you pay out-of-pocket before your insurance kicks in – directly impacts your premium. A higher deductible means lower monthly payments, but it also means you’ll pay more if you have an accident. The trade-off involves carefully weighing the potential savings against the risk of a larger upfront expense in case of an accident. Consider your financial situation and emergency fund before making this decision. For example, increasing your deductible from $500 to $1000 might lower your monthly premium by $20-$30, saving $240-$360 annually. However, remember you’ll pay an extra $500 in the event of a claim.

Defensive Driving Courses and Safety Features

Completing a defensive driving course can demonstrably lower your insurance premiums. Many insurers offer discounts to drivers who complete these courses, recognizing that they’ve gained valuable skills to reduce accident risk. Similarly, cars equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, often qualify for discounts. These features statistically reduce the severity and likelihood of accidents, thus making you a less risky driver in the eyes of your insurer. A defensive driving course might get you a 5-10% discount, while safety features could save you another 5-15%.

Premium Cost, Deductible, and Out-of-Pocket Expenses

Consider this scenario illustrated by a simple table:

| Scenario | Monthly Premium | Deductible | Accident Cost (Example: $5,000 repair) | Out-of-Pocket Expense |

|---|---|---|---|---|

| Low Premium, Low Deductible | $150 | $250 | $5000 | $250 + (5000-250) = $5000 (Insurance pays $4750) |

| Medium Premium, Medium Deductible | $120 | $500 | $5000 | $500 + (5000-500) = $5000 (Insurance pays $4500) |

| High Premium, High Deductible | $90 | $1000 | $5000 | $1000 + (5000-1000) = $5000 (Insurance pays $4000) |

This table demonstrates that while a higher deductible lowers your monthly premium, your total out-of-pocket expense in case of an accident remains the same. The difference lies in how much you pay upfront versus how much the insurance company covers. Choosing the right balance depends on your risk tolerance and financial capabilities. Remember that the annual savings from a higher deductible could potentially offset the increased out-of-pocket expense if you avoid accidents.

Epilogue: Cheap Best Auto Insurance

Source: jakartastudio.com

Finding cheap best auto insurance isn’t about settling for the bare minimum; it’s about being a savvy consumer. By understanding the factors that influence your premiums, comparing quotes effectively, and utilizing available discounts, you can secure affordable coverage that provides the peace of mind you deserve. Remember, a little research goes a long way in protecting your wallet and your future.