Commute or pleasure car insurance Reddit? It’s a question burning in the minds of many drivers, juggling daily commutes with weekend adventures. Are you paying more than you need to? This deep dive into Reddit’s car insurance discussions reveals the common concerns, cost comparisons, and clever strategies for saving money, helping you navigate the often-confusing world of car insurance.

From uncovering the factors influencing your premiums – mileage, driving record, and even the type of car you drive – to exploring strategies to lower your costs, we’ll unpack the insights shared by Reddit users. We’ll also delve into the legal aspects, offering real-world scenarios to illustrate the importance of accurate information and proper coverage.

Reddit Discussions on Commute vs. Pleasure Car Insurance: Commute Or Pleasure Car Insurance Reddit

Navigating the world of car insurance can feel like driving through a minefield, especially when the difference between “commute” and “pleasure” use comes into play. Reddit, that sprawling digital town square, offers a wealth of user experiences and opinions on this very topic. Let’s dive into the common threads woven through these online discussions.

Common Themes in Reddit Discussions

Reddit threads about commute vs. pleasure car insurance often revolve around the perceived higher risk associated with daily commutes. Users frequently discuss the increased mileage, exposure to rush hour traffic, and the higher likelihood of accidents during longer drives. The impact of these factors on insurance premiums is a central concern. Another recurring theme is the difficulty in accurately representing one’s driving habits to insurance companies, leading to potential discrepancies in coverage or pricing. Finally, users frequently share their experiences with different insurers, comparing rates and customer service.

Frequent Concerns Expressed by Reddit Users

The most prevalent worry among Reddit users centers on the potential for significantly higher premiums when declaring daily commutes. Many feel that the current insurance models don’t adequately differentiate between a short, low-risk commute and a lengthy, high-risk one. Another significant concern is the lack of transparency in how insurance companies calculate rates based on commute information. Users often express frustration at the perceived arbitrariness of premium adjustments. The potential for increased premiums after even minor accidents, even if those accidents weren’t directly related to commuting, is also a frequent source of anxiety.

Insurance Companies Frequently Mentioned on Reddit

Several insurance companies consistently appear in Reddit discussions regarding commute vs. pleasure insurance. Progressive and State Farm are frequently cited, with mixed reviews. Some users praise their competitive rates and straightforward policies, while others complain about unexpected premium increases or difficulties in adjusting coverage. Geico is another commonly mentioned insurer, often lauded for its ease of use and online tools, but also criticized by some for potentially less personalized service. USAA, typically catering to military personnel and their families, receives consistently positive feedback for its customer service and competitive rates, though eligibility restrictions limit its accessibility. Finally, smaller regional insurers sometimes receive mention, with reviews varying widely depending on location and specific experiences.

Comparison of Average Insurance Costs

The following table summarizes average insurance costs based on user experiences shared on Reddit. Note that these are anecdotal and should not be considered definitive. Actual costs vary widely depending on location, driving history, vehicle type, and other factors.

| Company | Type of Use | Average Cost (USD/Year) | User Comments |

|---|---|---|---|

| Progressive | Commute | $1200 | “Rates went up significantly after I added my commute.” |

| State Farm | Pleasure | $850 | “Good rates, but customer service can be slow.” |

| Geico | Commute | $1100 | “Easy online process, but felt the rate was a bit high.” |

| USAA | Pleasure | $700 | “Excellent customer service, very competitive rates.” |

Factors Influencing Insurance Premiums

Getting the best car insurance rate, whether for your daily commute or weekend adventures, depends on a surprising number of factors. Insurance companies meticulously analyze your driving habits, vehicle details, and even your location to calculate your premium. Understanding these factors can help you navigate the insurance landscape and potentially save money.

Factors Considered in Commute Vehicle Insurance Premiums

Insurance companies assess several key factors when determining premiums for vehicles primarily used for commuting. These factors go beyond simply the make and model of your car; they delve into your daily routine and risk assessment. The higher the perceived risk, the higher the premium. This includes considerations like the distance of your commute, the type of roads you travel on (highway vs. city streets), and the time of day you typically commute. The more congested or dangerous your commute route, the greater the potential for accidents and therefore, a higher premium. Furthermore, the age and condition of your vehicle play a significant role, as older cars may be more prone to mechanical failures and less likely to withstand collisions.

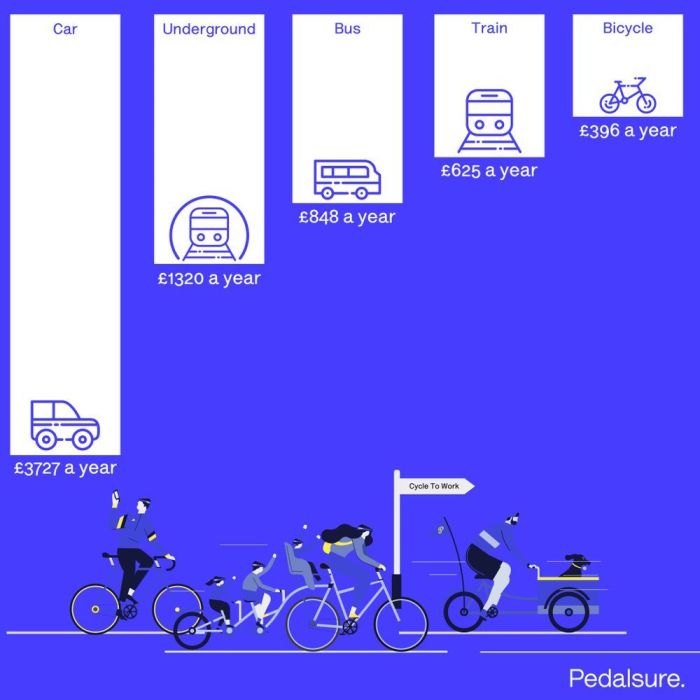

Mileage’s Impact on Insurance Costs

Mileage is a significant factor affecting car insurance premiums for both commute and pleasure vehicles. The more miles you drive, the greater the chance of being involved in an accident. This directly correlates to higher risk and higher premiums. For commute vehicles, the daily mileage is a key factor, with longer commutes typically resulting in higher premiums. For pleasure vehicles, annual mileage is often used as the metric. Someone who drives a weekend car only a few thousand miles a year will typically pay less than someone who uses their “pleasure” vehicle for long road trips frequently. For example, a driver commuting 50 miles round trip daily will likely pay considerably more than someone who only drives their car for errands a few times a week.

Coverage Comparison: Commute vs. Pleasure Cars, Commute or pleasure car insurance reddit

While the core coverages – liability, collision, and comprehensive – are generally available for both commute and pleasure vehicles, the specifics might differ. Commute vehicles might benefit from higher liability coverage limits, given the increased exposure to accidents due to frequent driving. Conversely, a pleasure vehicle might opt for additional coverage, such as roadside assistance or rental car reimbursement, which might be less crucial for a commute vehicle. For instance, a business professional driving a luxury car for both work and pleasure might choose comprehensive coverage with a high deductible for their personal use, while opting for a lower deductible for the commute aspect. The coverage choice should reflect the value and usage of the vehicle.

Impact of Driving Behaviors on Insurance Rates

Driving behaviors significantly impact insurance premiums for both commute and pleasure vehicles. Speeding tickets, accidents, and DUI convictions all result in increased premiums. The severity of the infraction directly impacts the premium increase. A single speeding ticket might result in a modest increase, while a DUI conviction could lead to significantly higher premiums or even policy cancellation. For example, a driver with multiple speeding tickets in a short period will face a steeper increase than someone with a single minor infraction. This is true regardless of whether the infractions occurred while driving a commute or pleasure vehicle. Insurance companies view consistent poor driving behavior as a higher risk and adjust premiums accordingly.

Strategies for Lowering Insurance Costs

Source: com.au

Navigating the Reddit threads on commute vs. pleasure car insurance can be a minefield, especially when comparing rates. But your home insurance might also impact your car premiums; check out the reviews on aaa home insurance reddit to see if bundling could save you some dough. Ultimately, finding the best car insurance deal depends on your specific needs and driving habits, so do your research!

Navigating the world of car insurance can feel like driving through a fog – premiums vary wildly, and finding the best deal feels like a treasure hunt. But fear not, fellow drivers! This section unveils effective strategies Reddit users swear by to slash their commute car insurance costs. We’ll explore coverage options, the impact of your ride itself, and provide a handy comparison to illuminate your choices.

Effective Strategies for Reducing Car Insurance Premiums

Reddit is a goldmine of insurance hacks, and many users consistently share their success stories. These strategies aren’t just internet whispers; they’re practical steps you can take to lower your monthly payments. Remember, your mileage may vary, but these tips offer a solid starting point.

- Shop Around and Compare Quotes: This seems obvious, but it’s the cornerstone of saving money. Don’t settle for the first quote you receive. Use comparison websites and contact multiple insurers directly to see who offers the best rates for your specific profile.

- Bundle Your Policies: Insurers often offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. This is a simple way to leverage savings.

- Maintain a Good Driving Record: This is a big one. Accidents and traffic violations significantly increase your premiums. Safe driving is not just responsible; it’s financially smart.

- Consider Telematics Programs: Some insurers use telematics devices or apps that track your driving habits. If you’re a safe driver, this can lead to lower premiums. However, be aware of privacy implications before signing up.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can significantly reduce your premium. Weigh the risk and reward carefully based on your financial situation.

- Pay in Full: Many insurers offer discounts for paying your premium annually instead of monthly. This eliminates the convenience fee often associated with installment payments.

Insurance Coverage Options for Commuters

Choosing the right coverage is crucial, especially for commuters who face higher risk due to increased mileage. Different coverage levels offer varying degrees of protection, and understanding the nuances can save you money without compromising safety.

- Liability Coverage: This covers damages to other people’s property or injuries sustained by others in an accident you cause. It’s usually legally required and a must-have.

- Collision Coverage: This covers damages to your vehicle in an accident, regardless of fault. Commuters might consider this essential due to the increased likelihood of incidents.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events like theft, vandalism, or weather-related damage. This is a valuable consideration, especially for newer vehicles.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s a wise investment, given the prevalence of uninsured drivers.

Impact of Vehicle Type and Features on Insurance Costs

Your car’s make, model, and features significantly impact your insurance premium. Certain vehicles are statistically more likely to be involved in accidents or are more expensive to repair, leading to higher insurance costs.

- Vehicle Safety Features: Cars with advanced safety features like anti-lock brakes, airbags, and electronic stability control often receive discounts because they reduce the risk of accidents and injuries.

- Vehicle Value and Repair Costs: Luxury cars and vehicles with expensive parts are more costly to insure due to higher repair bills.

- Vehicle History: A car’s history (accidents, repairs) can affect its insurance rate. A vehicle with a clean history generally commands lower premiums.

- Vehicle Type: Sports cars and high-performance vehicles typically have higher insurance premiums due to their higher risk profile.

Sample Insurance Cost Comparison

This chart illustrates how different coverage choices impact monthly payments. Remember, these are examples and actual costs will vary based on individual factors.

| Coverage | Monthly Payment (Example) |

|---|---|

| Liability Only | $50 |

| Liability + Collision | $100 |

| Liability + Collision + Comprehensive | $150 |

| Liability + Collision + Comprehensive + Uninsured/Underinsured | $175 |

Legal and Regulatory Aspects

Navigating the legal landscape of car insurance can be tricky, especially when the purpose of your driving shifts from leisurely weekend trips to the daily grind of commuting. Understanding the legal requirements and how they impact your coverage is crucial for protecting yourself and your finances. Failure to comply with these regulations can lead to hefty fines, legal battles, and even the suspension of your driving privileges.

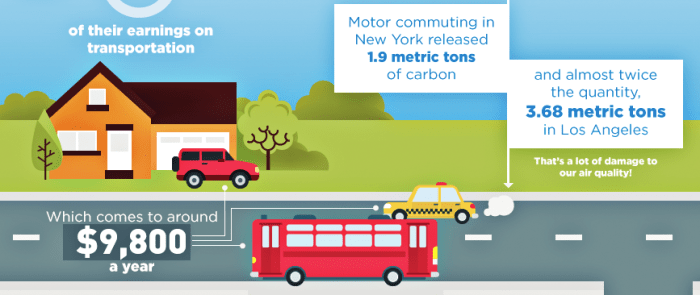

The use of a personal vehicle for commuting significantly alters the risk profile assessed by insurance companies. This increased risk is often reflected in higher premiums. The legal implications extend beyond simply paying more; they encompass the type and extent of coverage you’re entitled to in case of an accident.

Legal Requirements for Commute Vehicle Insurance

State laws mandate minimum levels of liability insurance for all drivers. These minimums typically cover bodily injury and property damage caused to others in an accident. However, the specific requirements vary significantly by state. Some states might have higher minimums or specific requirements for commercial use vehicles, even if used for commuting. For instance, a state might require higher liability limits if you regularly transport passengers for compensation, even if it’s just carpooling with coworkers. Always check your state’s Department of Motor Vehicles (DMV) website for precise details on minimum coverage requirements. Failure to maintain the minimum required insurance coverage can result in hefty fines, license suspension, and even vehicle impoundment.

Implications of Using a Personal Vehicle for Commuting on Insurance Coverage

Using your personal vehicle for commuting can affect your insurance coverage in several ways. Firstly, it increases the likelihood of accidents, as you’re driving more frequently and potentially during peak traffic hours. This increased risk translates to potentially higher premiums. Secondly, some insurance policies might have specific exclusions or limitations regarding commercial use. If you’re using your car for anything beyond personal use – even a short commute – you should explicitly inform your insurer. Failing to do so could invalidate your coverage in case of an accident. This is particularly important if your commute involves driving on toll roads or highways frequently, as these environments often present higher risk scenarios.

Comparison of Legal Responsibilities

The legal responsibilities of drivers remain largely the same regardless of whether they are using their vehicle for commuting or personal use. The fundamental duty of care – to drive safely and responsibly – applies in all situations. However, the context might influence the interpretation of negligence in an accident. For example, if an accident occurs during a commute, the court might consider factors like traffic conditions and the driver’s adherence to commute-specific driving practices (e.g., using designated carpool lanes). In essence, while the core legal responsibilities are consistent, the specific circumstances of the accident can impact the legal proceedings.

Key Legal Points

- State laws mandate minimum liability insurance coverage for all drivers, with variations in requirements across states.

- Using a personal vehicle for commuting increases the risk profile and may lead to higher insurance premiums.

- It’s crucial to inform your insurer about the use of your vehicle for commuting to avoid coverage issues.

- Failure to maintain minimum insurance coverage can result in significant penalties.

- The core legal responsibility of safe driving remains consistent regardless of the purpose of the trip, though the context might affect accident liability assessments.

Illustrative Scenarios

Source: ghost.io

Understanding the nuances of car insurance, especially when it comes to commuting versus pleasure use, requires looking at real-world examples. These scenarios highlight the potential impact of your vehicle usage declaration on your insurance coverage and claims process.

Significant Insurance Claim Due to Commuting

Imagine Sarah, a diligent worker who commutes 50 miles each way to her job daily. One foggy morning, she loses control of her car on a slick highway, causing a multi-vehicle accident. The damage to her car is extensive, requiring a complete rebuild, and several other vehicles are also significantly damaged. The resulting insurance claim is substantial, potentially exceeding her policy’s coverage limits if she only declared pleasure use. The added frequency of driving inherent in her commute significantly increased the risk and, consequently, the claim amount. Had she accurately declared her commute, her premiums might have been higher, but her coverage would have been adequate.

Difference in Insurance Payouts for Commute vs. Pleasure Accidents

Let’s compare two scenarios involving identical accidents. In the first, Mark, using his car for a weekend getaway (pleasure use), rear-ends another vehicle at low speed. The damage is minimal, limited to a dented bumper. His insurance covers the repairs, and the payout is relatively small. In the second scenario, John, using the same car model for his daily commute, is involved in the same type of low-speed accident. Because his insurance policy reflects his commute, the claim processing might be slightly more complex, and the payout could potentially be influenced by factors like time of day and location (congestion, accident hotspots). However, the payout will still likely cover the repairs. The key difference is the potential for higher premiums for John due to the increased risk associated with daily commuting.

Filing a Claim for a Commute-Related Accident

David, a software engineer, is involved in an accident during his morning commute. He immediately calls the police to report the accident and obtain a police report. He then contacts his insurance company, providing them with the police report number, details of the accident, and contact information for the other driver involved. His insurance company assigns a claims adjuster who investigates the accident, reviews the police report, and assesses the damage to both vehicles. David provides photos and repair estimates. After verifying the details, the insurance company processes the claim, covering the repair costs and any medical expenses, according to the terms of his policy which accurately reflects his commute.

Incorrect Information Affecting Insurance Coverage

Maria, to save money on insurance premiums, falsely declares her car is used solely for pleasure. She actually uses it for a demanding 60-mile round-trip commute every day. When she is involved in an accident during her commute, her insurance company discovers the discrepancy through their investigation. They might deny coverage or significantly reduce the payout, citing misrepresentation of facts on her application. This could leave Maria with substantial out-of-pocket expenses for repairs and medical bills. This scenario underscores the importance of accurate information when obtaining car insurance.

Final Review

Source: industrytap.com

So, are you commuting in style or just paying extra? The Reddit car insurance conversation reveals a world of nuances. Understanding the factors that impact your premiums, leveraging smart strategies to lower costs, and being aware of the legal landscape are crucial. By arming yourself with this knowledge, you can navigate the insurance world with confidence and potentially save a significant chunk of change. Happy driving (and saving!).