Does homeowners insurance cover tenants? It’s a question that sparks more confusion than a dropped soufflé. While your homeowner’s policy protects your property, the extent of that protection when a tenant’s involved is a surprisingly nuanced area. We’re diving deep into the specifics, exploring scenarios where coverage applies, and those where it decidedly doesn’t. Get ready to unravel the mysteries of shared liability and insurance policies.

Understanding the interplay between homeowner’s insurance, tenant liability, and renter’s insurance is crucial for both landlords and renters. This isn’t just about avoiding hefty repair bills; it’s about protecting everyone involved from financial ruin. We’ll break down the key aspects of each type of insurance, examine real-life scenarios, and help you navigate the often-confusing world of policy language. By the end, you’ll be equipped to understand your rights and responsibilities, and you’ll be able to confidently discuss insurance coverage with your agent.

Homeowner’s Insurance Basics

Source: nunezagency.com

So, your homeowner’s insurance probably won’t cover your renters, right? That’s where things get tricky. If you’re running a small business from home, you’ll definitely need a different kind of protection, like the comprehensive general liability insurance for small business detailed here: comprehensive general liability insurance for small business. This ensures you’re covered for incidents related to your business, leaving your homeowner’s policy to focus on the residential aspects.

Remember, separate coverage for separate risks!

So, you’ve got the keys to your dream home – congrats! But before you start unpacking, there’s one crucial step you shouldn’t skip: securing homeowner’s insurance. This isn’t just a formality; it’s a financial safety net that protects your biggest investment. Understanding the basics of this policy is key to ensuring you’re adequately covered.

Homeowner’s insurance is a contract between you and an insurance company. In exchange for your regular premium payments, the insurer agrees to cover certain losses or damages to your property and liability for accidents that occur on your property. Think of it as a comprehensive shield against unforeseen events, providing peace of mind in the face of the unexpected.

Standard Coverage Components

A standard homeowner’s insurance policy typically includes several key coverage sections. These sections work together to provide comprehensive protection, ensuring that you’re covered for a wide range of potential issues. Understanding these components allows you to choose a policy that best suits your individual needs and the specific risks associated with your property.

Coverage Sections

The core components of most homeowner’s insurance policies are:

* Dwelling Coverage: This covers damage to the physical structure of your home, including the walls, roof, and foundation. It typically covers damage from events like fire, windstorms, hail, and vandalism. For example, if a tree falls on your house during a storm, dwelling coverage would help pay for repairs.

* Other Structures Coverage: This covers damage to structures on your property that are separate from your main dwelling, such as a detached garage, shed, or fence. Similar perils covered under dwelling coverage usually apply here. Imagine a fire damaging your detached workshop; this coverage would help rebuild it.

* Personal Property Coverage: This protects your belongings inside your home from damage or theft. This includes furniture, electronics, clothing, and other personal items. If a fire destroys your belongings, this coverage would help replace them.

* Loss of Use Coverage: This covers additional living expenses if your home becomes uninhabitable due to a covered event. This could include hotel costs, temporary housing, or the cost of eating out while your home is being repaired. For instance, if a burst pipe floods your house, this coverage will assist with temporary accommodation.

* Liability Coverage: This protects you financially if someone is injured on your property or if you are held liable for damage to someone else’s property. This is crucial for protecting yourself from potentially significant legal costs. Think of a guest slipping and falling on your icy walkway, leading to medical expenses.

Examples of Covered Damages

Homeowner’s insurance typically covers damages resulting from a wide range of events. Understanding these scenarios can help you appreciate the value of having comprehensive coverage. For example, damage caused by:

* Fire: A house fire, regardless of the cause, is usually covered.

* Windstorms and Hail: Damage from high winds, tornadoes, or hailstorms is often covered.

* Vandalism: Damage caused by vandalism or malicious mischief is typically included.

* Theft: Losses due to burglary or theft are generally covered.

* Some Water Damage: Damage from burst pipes or sudden and accidental water damage is usually covered; however, flood damage often requires separate flood insurance.

Homeowner’s vs. Renter’s Insurance

It’s important to understand the key differences between homeowner’s and renter’s insurance. While both offer crucial protection, the coverage provided differs significantly.

| Coverage Type | Homeowner’s Coverage | Renter’s Coverage | Key Differences |

|---|---|---|---|

| Dwelling | Covers damage to the structure of the home | Does not cover the building itself | Homeowners insure the building; renters insure their belongings. |

| Personal Property | Covers belongings inside the home | Covers belongings inside the rental unit | Both cover personal property, but the value and extent of coverage can vary. |

| Liability | Covers injuries or damages caused to others | Covers injuries or damages caused to others | Both offer liability coverage, but policy limits may differ. |

| Loss of Use | Covers additional living expenses if the home is uninhabitable | Covers additional living expenses if the rental unit is uninhabitable | Both offer this coverage, but the specifics may vary depending on the policy. |

Tenant’s Liability and Coverage

Source: amazonaws.com

Renting out a property comes with its own set of risks, and understanding your homeowner’s insurance coverage regarding tenant liability is crucial. While your policy protects your property, it’s not a blanket guarantee against all tenant-related issues. Let’s break down the complexities of who’s responsible when things go wrong.

Homeowner liability for tenant-related incidents hinges on several factors, primarily the lease agreement and the nature of the incident. Your policy might cover damages caused by tenants, but only under specific circumstances. This means carefully examining your policy is essential to understand exactly what is and isn’t covered. It’s a bit like a legal puzzle where understanding the pieces is key to avoiding a costly surprise.

Homeowner’s Insurance Coverage for Tenant-Caused Damage

Generally, a homeowner’s insurance policy covers damage to the property itself caused by a tenant, provided it’s accidental and not due to intentional acts or negligence. For example, if a tenant accidentally starts a fire while cooking, the resulting damage to the structure of the house might be covered. Similarly, if a pipe bursts due to a faulty fixture that the tenant didn’t deliberately damage, repairs might be covered. The key here is accidental damage. The insurance company will likely investigate to determine if the damage was accidental or intentional.

Scenarios Where Homeowner’s Insurance Would Not Cover Tenant-Caused Damage

There are several situations where your homeowner’s insurance policy will likely not cover damage caused by your tenant. If the damage results from the tenant’s willful negligence or intentional actions, your claim will likely be denied. For instance, if a tenant deliberately damages the property out of spite or if they consistently fail to maintain the property leading to significant damage, the insurance company is unlikely to cover the cost of repairs. Similarly, damage resulting from illegal activities on the property is typically excluded. Think of it as a line between accidents and deliberate actions; the insurance is there to cover accidents, not intentional destruction.

Common Exclusions Related to Tenant Liability

Many homeowner’s insurance policies include specific exclusions related to tenant liability. These exclusions often cover damage caused by specific activities, such as those involving illegal substances or repeated violations of the lease agreement. For example, damage resulting from a tenant’s illegal drug manufacturing operation would not be covered. Similarly, damage caused by a tenant’s failure to maintain the property, such as water damage due to repeated neglect of a leaky faucet, might also be excluded. It’s vital to thoroughly review your policy’s specific exclusions to avoid unpleasant surprises. Remember, your policy is a contract, and understanding its terms is crucial.

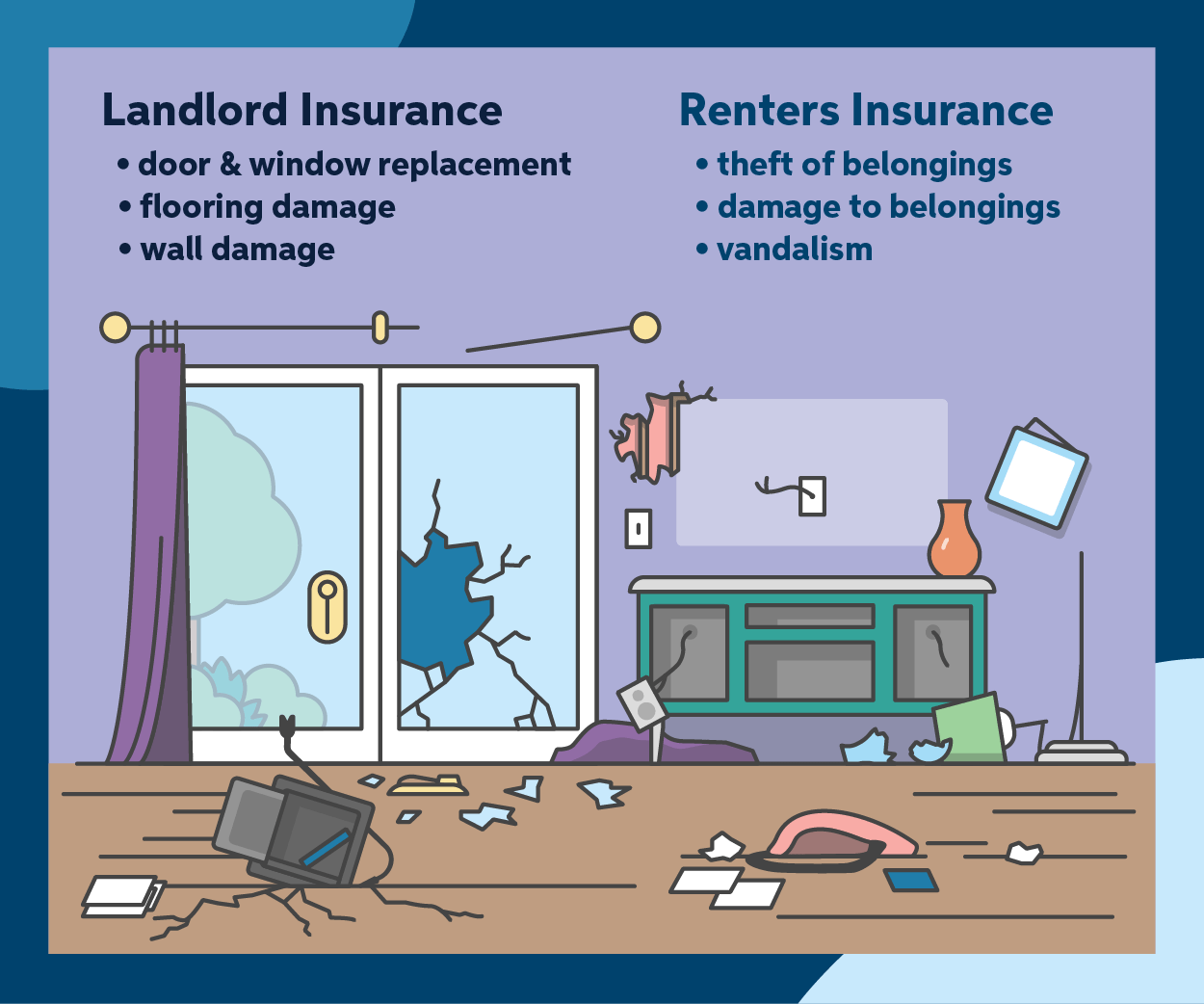

Renter’s Insurance and its Role

Renter’s insurance, often overlooked, is a crucial safety net for tenants. Unlike homeowner’s insurance, which protects the building itself, renter’s insurance safeguards your personal belongings and provides liability coverage. It’s a surprisingly affordable investment that can prevent significant financial hardship in the face of unexpected events. Think of it as a financial shield protecting your hard-earned possessions and peace of mind.

Renter’s insurance offers a vital layer of protection against various risks faced by tenants. It compensates for losses caused by theft, fire, water damage, and other covered perils, protecting your valuable possessions from financial ruin. Furthermore, it provides liability coverage, shielding you from legal and financial responsibility if someone is injured on your property. This coverage extends beyond just your apartment; it can cover you if you accidentally damage someone else’s property. The peace of mind that comes with knowing your belongings and yourself are protected is invaluable.

Typical Coverage Provided by Renter’s Insurance

A standard renter’s insurance policy typically includes coverage for personal property, additional living expenses, and personal liability. Personal property coverage reimburses you for the cost of replacing or repairing your belongings that are damaged or stolen. Additional living expenses cover temporary housing, food, and other necessities if your apartment becomes uninhabitable due to a covered event. Liability protection covers medical bills and legal costs if someone is injured on your property or if you accidentally damage someone else’s property. The specific amounts covered vary depending on the policy and chosen coverage levels. For instance, a policy might cover up to $30,000 for personal belongings and $100,000 for liability.

Comparison of Renter’s and Homeowner’s Insurance Coverage for Personal Belongings

The key difference between renter’s and homeowner’s insurance lies in what they cover. Homeowner’s insurance primarily protects the structure of the house and the land, while also offering some personal property coverage. Renter’s insurance, conversely, focuses solely on the tenant’s personal belongings and liability. Both offer personal property coverage, but the extent and specifics can vary. A homeowner’s policy might offer less comprehensive coverage for personal belongings compared to a dedicated renter’s policy, especially considering the value of possessions relative to the overall home value. For example, if a fire damages a homeowner’s $500,000 house, the personal property coverage might be capped at a smaller percentage, say $100,000. A renter, however, could have a renter’s policy with a much higher percentage of coverage dedicated to their personal possessions, ensuring they are fully protected.

Essential Features of a Comprehensive Renter’s Insurance Policy

A comprehensive renter’s insurance policy should include several key features to ensure adequate protection. Choosing a policy requires careful consideration of your individual needs and the value of your possessions. It’s crucial to understand the terms and conditions to avoid any unpleasant surprises in the event of a claim.

- High Personal Property Coverage: Ensure the policy covers the full replacement cost of your belongings, not just their depreciated value. Consider regularly updating the coverage amount as your possessions increase in value.

- Liability Coverage: Choose a policy with sufficient liability coverage to protect you against lawsuits resulting from accidents or injuries on your property. A higher limit is generally recommended.

- Additional Living Expenses Coverage: This coverage should be sufficient to cover your temporary housing and living costs if your apartment becomes uninhabitable due to a covered incident.

- Medical Payments Coverage: This covers medical expenses for guests injured on your property, regardless of fault.

- Coverage for Specific Items: Consider adding coverage for high-value items like jewelry, electronics, or musical instruments, which might require separate endorsements.

Specific Scenarios and Coverage

Understanding how homeowner’s insurance interacts with tenant liability is crucial for both landlords and renters. Let’s explore some common scenarios to illustrate the complexities of coverage in these situations. Remember, specific policy details vary, so always refer to your individual policy documents.

Tenant Negligence Causing Property Damage

Imagine Sarah, a tenant, accidentally leaves a faucet running, causing extensive water damage to the apartment below hers and the shared hallway. The resulting damage includes ruined flooring, damaged drywall, and mold remediation. In this scenario, Sarah’s negligence directly caused the damage. The homeowner’s insurance policy will likely cover the repairs to the building’s structure and common areas, but Sarah could be held responsible for the deductible and any damages exceeding the policy limits. Her renter’s insurance, if she has it, might cover her liability for the damages. The extent of coverage depends on the specific terms of both the homeowner’s and renter’s insurance policies.

Fire Started by a Tenant, Does homeowners insurance cover tenants

Let’s say Mark, a tenant, accidentally starts a fire in his kitchen while cooking. The fire spreads, causing significant damage to his apartment and affecting neighboring units. Homeowner’s insurance would likely cover the structural damage to the building, including repairs to the affected units and common areas. However, if the fire was deemed to be caused by Mark’s negligence (e.g., leaving a stove unattended), the homeowner’s insurance company might pursue reimbursement from Mark for the damages. Again, renter’s insurance would be crucial for Mark to cover his own belongings and potential liability for the damages. The investigation into the cause of the fire will be critical in determining the responsibility and subsequent coverage.

Damage Caused by a Tenant’s Guest

Consider this: Maria, a tenant, hosts a party. One of her guests accidentally breaks a valuable antique mirror belonging to the homeowner. The homeowner’s insurance might cover the damage to the mirror, but the homeowner’s insurance company could then pursue reimbursement from Maria, or potentially even her guest, depending on the circumstances and the policy terms. Maria’s renter’s insurance, if she has it, might also provide coverage for the liability resulting from her guest’s actions. This highlights the importance of having adequate liability coverage for both homeowners and renters.

Scenario Summary Table

| Scenario | Damage Type | Homeowner’s Coverage Applicability | Renter’s Insurance Applicability |

|---|---|---|---|

| Tenant leaves faucet running, causing water damage | Water damage to apartment and common areas | Likely covers structural damage to building; may pursue reimbursement from tenant for deductible and damages exceeding policy limits. | May cover tenant’s liability for damages. |

| Tenant starts kitchen fire | Fire damage to apartment and neighboring units | Likely covers structural damage; may pursue reimbursement from tenant if negligence is determined. | Crucial for covering tenant’s belongings and potential liability. |

| Tenant’s guest breaks homeowner’s antique mirror | Damage to homeowner’s property | Likely covers damage; may pursue reimbursement from tenant or guest. | May cover tenant’s liability for guest’s actions. |

Policy Language and Interpretation: Does Homeowners Insurance Cover Tenants

Understanding your homeowner’s insurance policy is crucial, especially when it comes to tenant liability. While your policy protects your property, the specifics of how it covers damage caused by tenants can be surprisingly nuanced. Failing to carefully review the policy language can lead to unexpected costs and disputes if a tenant causes damage.

Policy language regarding tenant liability often contains clauses and exclusions that limit coverage. These limitations are designed to protect the insurance company from excessive claims. It’s not about being unfair; it’s about defining the boundaries of what’s covered under the contract. Knowing these limitations is key to protecting yourself.

Common Policy Exclusions Related to Tenant Liability

Insurance companies carefully craft their policies to avoid ambiguity. However, the language can be dense and complex. Several common exclusions might impact your coverage regarding tenant-related incidents. These commonly involve intentional acts of vandalism or negligence that fall outside the bounds of typical wear and tear. Understanding these exclusions is vital to avoiding unpleasant surprises.

Examples of Policy Wording Indicating Coverage or Lack of Coverage

Let’s look at some examples. A policy might state, “Coverage is provided for accidental damage to the property caused by tenants during their occupancy, excluding damage resulting from intentional acts or gross negligence.” This clearly defines what is and isn’t covered. Conversely, a policy might exclude coverage for “any damage caused by a tenant’s illegal activities or violations of lease agreements.” This highlights the importance of thorough tenant screening. Another example could be, “Damage caused by a tenant’s pet is covered, up to a specified limit, provided the tenant has obtained prior written consent for pet ownership.” This demonstrates how specific conditions can impact coverage.

Sample Policy Clause Regarding Tenant Liability

This policy provides coverage for accidental damage to the insured property caused by tenants residing on the premises, provided such damage is not the result of intentional acts, gross negligence, or violation of applicable laws or lease agreements. The insurer’s liability is limited to the policy’s stated coverage limits and is subject to the policy’s deductible.

This sample clause highlights the key elements often found in tenant liability sections of homeowner’s insurance policies. Note the emphasis on accidental damage, exclusion of intentional acts, and the limitations on the insurer’s liability. Understanding such clauses is essential for managing risk and ensuring appropriate coverage.

Legal and Contractual Aspects

Navigating the legal landscape surrounding homeowner’s insurance and tenant responsibilities can be tricky. Understanding the interplay between homeowner’s insurance policies, lease agreements, and the legal obligations of both homeowners and renters is crucial for avoiding costly disputes and ensuring adequate protection. This section clarifies the legal responsibilities and how lease agreements shape insurance coverage in tenant-related incidents.

The legal responsibilities of homeowners and tenants regarding property damage are primarily defined by state law and the terms of their lease agreement. Homeowners generally have a legal duty to maintain their property in a reasonably safe condition, preventing foreseeable hazards that could cause injury or damage. Tenants, in turn, typically have a responsibility to avoid causing damage to the property and to report any existing damage to the landlord promptly. The specifics, however, are highly dependent on the individual lease agreement and applicable local ordinances.

Homeowner’s Legal Duties and Property Maintenance

Homeowners are legally obligated to maintain their property in a safe and habitable condition. This includes addressing known hazards, performing necessary repairs, and ensuring compliance with building codes and safety regulations. Failure to do so can result in legal liability if a tenant or visitor is injured due to negligence. For instance, a homeowner who fails to repair a known faulty staircase, resulting in a tenant’s injury, could face legal action and potentially significant financial consequences, regardless of insurance coverage. The extent of the homeowner’s liability depends on the specifics of the incident and the applicable laws, but it underscores the importance of proactive property maintenance.

Lease Agreements and Allocation of Responsibilities

The lease agreement acts as a legally binding contract outlining the responsibilities and liabilities of both the homeowner (landlord) and the tenant. A well-drafted lease agreement explicitly details who is responsible for repairing or replacing damaged property, and under what circumstances. For example, a lease might stipulate that the tenant is responsible for damage caused by their negligence, such as a broken window due to carelessness, while the homeowner is responsible for damage caused by normal wear and tear or unforeseen events like a burst pipe. Lease agreements often clarify who bears the cost of repairs and whether insurance coverage will be applied. Discrepancies or ambiguities in the lease agreement can lead to disputes, emphasizing the need for clear and comprehensive language.

Lease Agreements and Homeowner’s Insurance Coverage

The terms of a lease agreement can significantly impact the application of homeowner’s insurance coverage in tenant-related incidents. For example, if a lease specifies that the tenant is responsible for damage to the property, the homeowner’s insurance company may deny a claim if the damage falls under the tenant’s responsibility. Conversely, if the lease holds the homeowner responsible for a specific type of damage, and that damage occurs, the homeowner’s insurance is more likely to cover the costs. Therefore, carefully reviewing the lease agreement in conjunction with the homeowner’s insurance policy is essential to understanding the extent of coverage in case of an incident involving a tenant. It’s crucial to note that even with a clear allocation of responsibility in the lease, insurance companies may still conduct their own investigations to determine the cause of the damage and whether coverage applies under the policy’s terms.

End of Discussion

Source: auto-owners.com

So, does homeowners insurance cover tenants? The short answer is: sometimes. The long answer involves a careful examination of your specific policy, the lease agreement, and the nature of the damage. Understanding the nuances of liability, and having the right insurance coverage—whether it’s homeowner’s or renter’s—is key to protecting your assets and avoiding costly legal battles. Remember, proactive planning and a clear understanding of your insurance policy are your best defense against unexpected events. Don’t leave your financial future to chance; get informed!