Errors and omissions insurance Washington state: Navigating the complex world of professional liability in the Evergreen State can feel like climbing Mount Rainier in flip-flops. But don’t worry, this isn’t your average insurance policy. We’re diving deep into the nitty-gritty of E&O insurance in Washington, covering everything from what it protects you from to how much it’ll cost you. Get ready to ditch the liability worries and embrace the peace of mind that comes with proper coverage.

This guide breaks down the essentials of Errors and Omissions insurance in Washington, offering practical advice and insights for professionals across various fields. We’ll explore the key coverages, common exclusions, factors affecting premiums, the claims process, and how to choose the right provider. We’ll also unravel the legal landscape and examine real-life scenarios to illustrate the importance of E&O insurance in protecting your professional reputation and financial well-being.

Defining Errors and Omissions Insurance in Washington State

Errors and omissions (E&O) insurance is a crucial safety net for professionals in Washington State, providing coverage against financial losses stemming from mistakes or negligence in their professional services. It’s a specialized type of liability insurance designed to protect against claims alleging professional errors or omissions that cause financial harm to clients. Understanding its nuances is key for professionals seeking to mitigate risk and protect their livelihoods.

Core Coverage Provided by Errors and Omissions Insurance in WA

E&O insurance in Washington, like in other states, primarily covers the costs associated with defending against and settling claims of professional negligence. This includes legal fees, court costs, and settlement amounts awarded to clients who suffered financial losses due to an error or omission in the professional’s services. The policy will typically cover claims arising from acts, errors, or omissions that occurred during the policy period, even if the claim isn’t filed until later. Importantly, it does *not* cover intentional acts or criminal activity.

Professionals Typically Needing Errors and Omissions Insurance in Washington State

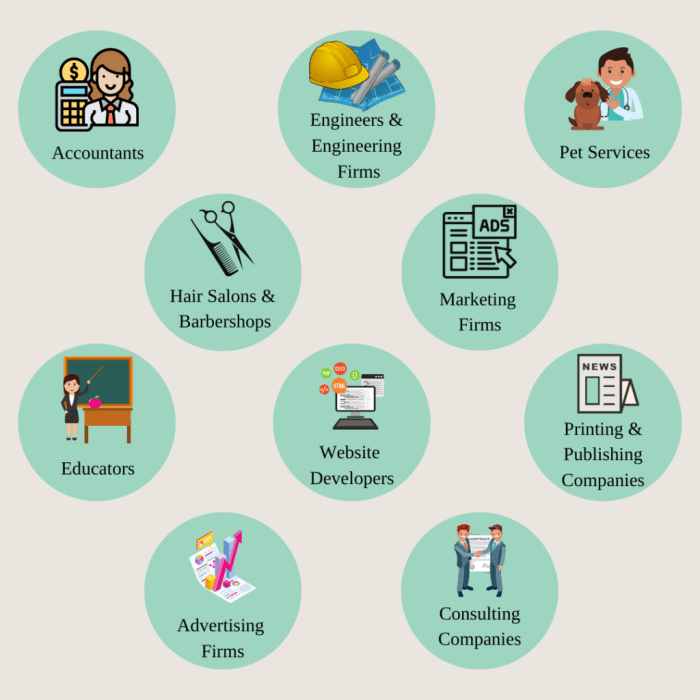

A wide range of professionals in Washington State benefit from E&O insurance. This includes, but is not limited to, architects, engineers, doctors, lawyers, insurance agents, real estate brokers, consultants, and financial advisors. Essentially, any professional who provides advice, services, or designs that could potentially lead to financial loss for a client should consider E&O coverage. The specific needs and coverage amounts will vary depending on the profession and the level of risk involved.

Examples of Claims Covered Under an Errors and Omissions Policy in WA

Consider these scenarios: An architect mistakenly omits a crucial structural element in building plans, leading to costly repairs for the client. A financial advisor provides faulty investment advice that results in significant financial losses for their client. A lawyer misses a crucial filing deadline, harming their client’s case. All of these situations could potentially be covered under a comprehensive E&O policy, provided the error or omission was unintentional and within the scope of the policy. The specifics of coverage will always depend on the individual policy terms.

Comparison of Errors and Omissions Insurance with Other Professional Liability Insurance Types

While E&O insurance is a type of professional liability insurance, it’s distinct from other forms. For instance, medical malpractice insurance covers claims specifically against healthcare providers for medical negligence. Similarly, directors and officers (D&O) insurance protects corporate executives from liability related to their decisions. E&O insurance focuses specifically on the professional services provided and the financial losses resulting from errors or omissions in those services, making it a vital tool for professionals seeking comprehensive risk management. The key difference lies in the *type* of professional and the *nature* of the potential liability.

Key Exclusions and Limitations of Washington State E&O Policies: Errors And Omissions Insurance Washington State

Source: premiermountaininsurance.com

Errors and omissions (E&O) insurance in Washington, while offering crucial protection for professionals, isn’t a blanket guarantee against all potential liabilities. Understanding the policy’s exclusions and limitations is vital for ensuring adequate coverage. This section will detail common exclusions, coverage limits, and situations leading to claim denials.

Common Exclusions in Washington State E&O Policies

Many E&O policies in Washington exclude specific types of claims. These exclusions are carefully worded and designed to prevent coverage for certain predictable risks. Ignoring these exclusions could lead to significant financial hardship in the event of a claim.

- Fraudulent Acts: Claims arising from intentional misrepresentation or fraudulent acts are typically excluded. This means if a professional knowingly provides false information leading to a client’s loss, the E&O policy likely won’t cover it.

- Criminal Acts: Coverage usually doesn’t extend to claims stemming from criminal activity, such as embezzlement or theft.

- Bodily Injury or Property Damage: E&O insurance primarily addresses financial losses due to professional negligence; it typically doesn’t cover physical harm or property damage. Separate liability insurance is needed for such situations.

- Contractual Liability: Certain contractual obligations might not be covered. For example, if a contract specifically assigns liability for a certain type of loss, the E&O policy may not cover that loss.

- Prior Acts: Policies usually exclude claims related to acts or omissions occurring before the policy’s inception date. This highlights the importance of continuous coverage.

Policy Limits and Deductibles

E&O policies in Washington, like most insurance policies, have limitations on the amount of coverage provided. Understanding these limits is crucial.

Policy limits represent the maximum amount the insurer will pay for covered claims during a policy period or per incident. Deductibles are the out-of-pocket expense the insured must pay before the insurer starts covering the claim. For example, a policy with a $100,000 limit and a $5,000 deductible means the insurer will pay up to $100,000 after the insured pays the initial $5,000. Higher limits generally mean higher premiums.

Claim Denial Scenarios under a Washington E&O Policy

Several scenarios can result in a claim denial under a Washington E&O policy.

- Claim Outside Policy Coverage: If the claim falls under an explicit exclusion, such as intentional misconduct or bodily injury, the claim will be denied.

- Failure to Meet Policy Conditions: Policies often require prompt notification of potential claims. Failure to do so can lead to claim denial.

- Lack of Professional Negligence: The claimant must prove professional negligence. If the alleged error or omission wasn’t a breach of the professional’s duty of care, the claim might be denied.

- Insufficient Evidence: The claimant needs to provide sufficient evidence to support their claim. Lack of documentation or witness testimony could lead to denial.

Examples of Limited or Excluded Coverage

Consider these examples:

A software developer mistakenly deletes a client’s crucial data due to a coding error. While this might seem like a clear E&O claim, if the developer intentionally deleted the data, the claim would likely be denied due to the exclusion of fraudulent acts. Alternatively, if the contract explicitly stated the developer wouldn’t be liable for data loss, coverage could be excluded due to contractual liability limitations.

A financial advisor gives incorrect tax advice, leading to a client’s significant tax penalty. If this advice was based on knowingly false information, the claim would likely be excluded. However, if the advice was based on an honest mistake or oversight, the claim might be covered, subject to the policy limits and deductible.

Factors Affecting Premiums in Washington State

Securing Errors and Omissions (E&O) insurance is crucial for professionals in Washington State, but the cost of this coverage can vary significantly. Understanding the factors that influence premium calculations is essential for budgeting and finding the right policy. Several key elements determine the final price you’ll pay.

Several interconnected factors influence the cost of Errors and Omissions insurance in Washington State. These factors are often assessed individually, but their combined effect determines the final premium. Understanding these elements allows professionals to better manage their insurance costs and make informed decisions.

Professional Experience

Professional experience significantly impacts E&O insurance premiums. Insurers view seasoned professionals with a proven track record of successful practice as lower risk. Years of experience demonstrate competence and a reduced likelihood of errors or omissions. Conversely, newer professionals or those with limited experience are considered higher risk, leading to higher premiums. This reflects the increased potential for mistakes as they gain experience and build their client base. For example, a lawyer with 20 years of experience will likely receive a lower premium than a recent law school graduate.

Claims History

A clean claims history is a significant factor in determining E&O insurance premiums. Insurers meticulously track claims filed against policyholders. A history of claims, especially those resulting in payouts, significantly increases premiums. Multiple claims suggest a higher risk profile, indicating a greater likelihood of future claims. Conversely, a policyholder with no claims history will typically enjoy lower premiums, reflecting their reduced risk. For instance, a physician with several malpractice claims will likely face higher premiums than a colleague with a spotless record.

Type of Profession

The specific profession plays a critical role in premium calculations. High-risk professions, such as medical professionals or financial advisors, typically face higher premiums due to the potential for significant financial losses associated with errors or omissions. These professions often involve complex procedures and substantial financial transactions, increasing the potential for costly mistakes. Conversely, professions with lower risk profiles, such as some types of consultants, may qualify for lower premiums. For instance, a neurosurgeon will likely pay significantly more for E&O insurance than a marketing consultant.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Professional Experience | Years of practice and demonstrated competence. | Lower premiums for experienced professionals; higher premiums for those with limited experience. | A seasoned architect vs. a recent graduate. |

| Claims History | Past claims filed against the professional. | Higher premiums with a history of claims; lower premiums with a clean record. | A doctor with multiple malpractice suits vs. one with no claims. |

| Type of Profession | The inherent risk associated with the professional’s field. | Higher premiums for high-risk professions; lower premiums for lower-risk professions. | A surgeon vs. a librarian. |

| Revenue/Policy Limits | The amount of revenue generated and the desired coverage limits. | Higher premiums for higher revenue and higher policy limits. | A large firm vs. a sole practitioner, or higher policy limits requested. |

The Claims Process in Washington State for E&O Insurance

Navigating the claims process for Errors and Omissions (E&O) insurance in Washington State can feel daunting, but understanding the steps involved can significantly ease the burden. This section Artikels the process, required documentation, and the insurer’s role, providing a clear path for handling a claim.

Filing an E&O Insurance Claim in Washington State

Submitting a claim involves promptly notifying your insurance provider of the potential claim. This should occur as soon as you become aware of a potential error or omission that could lead to a claim against you. Early notification allows the insurer to begin investigating and protecting your interests. Failure to promptly report a claim can jeopardize your coverage.

Documentation Required for an E&O Insurance Claim, Errors and omissions insurance washington state

Supporting your claim with comprehensive documentation is crucial for a smooth and successful process. This documentation helps the insurer assess the validity of the claim and determine the extent of coverage. Insufficient documentation can delay or even prevent the payment of your claim.

- Claim Form: A completed and accurate claim form provided by your insurer is the foundational document.

- Detailed Description of the Alleged Error or Omission: A clear and concise explanation of the mistake, including dates, individuals involved, and the nature of the alleged negligence.

- Supporting Documentation: This could include contracts, emails, letters, reports, and any other relevant documents that support your claim and demonstrate the error or omission.

- Copies of Relevant Communication: All correspondence related to the claim, including communications with the claimant, should be included.

- Financial Records: If the claim involves financial losses, provide detailed financial records to substantiate the damages.

The Role of the Insurance Company During the Claims Process

Your insurance company plays a vital role in managing your E&O claim. Their involvement extends beyond simply processing paperwork. They act as your advocate and provide crucial support throughout the process.

- Investigation: The insurer will conduct a thorough investigation to determine the validity of the claim and the extent of coverage.

- Legal Representation: In many cases, the insurer will provide legal representation to defend you against the claim.

- Negotiation and Settlement: The insurer will negotiate with the claimant to reach a fair and equitable settlement.

- Payment of Damages: If the claim is valid and within the policy limits, the insurer will pay the damages on your behalf.

Step-by-Step Guide to the E&O Claims Process

Following a structured approach to filing a claim ensures efficiency and minimizes potential complications.

- Report the Incident: Immediately notify your insurer of the potential claim. Provide a preliminary overview of the situation.

- Gather Documentation: Compile all relevant documents that support your claim. Thorough documentation is paramount.

- Complete the Claim Form: Carefully complete the claim form provided by your insurer, ensuring accuracy and completeness.

- Submit the Claim: Submit the completed claim form and all supporting documentation to your insurer.

- Cooperate with the Investigation: Fully cooperate with the insurer’s investigation, providing any additional information or documentation as requested.

- Review Settlement Offers: Carefully review any settlement offers provided by the insurer and discuss them with your legal counsel.

Finding and Choosing an E&O Insurance Provider in Washington

Source: slidesharecdn.com

Navigating the world of Errors and Omissions (E&O) insurance in Washington can feel overwhelming. With numerous providers offering varying levels of coverage and pricing, finding the right fit for your specific needs requires careful consideration and comparison. This section Artikels key factors to help you make an informed decision.

Choosing the right E&O insurance provider isn’t just about finding the cheapest policy; it’s about securing comprehensive protection tailored to your profession and risk profile. A thorough understanding of your needs and a careful evaluation of potential providers are crucial steps in this process.

Comparison of E&O Insurance Providers in Washington

Several insurance companies operate in Washington State, offering E&O insurance to various professionals. Direct comparison is difficult without specific professions and risk profiles in mind, as coverage and pricing vary widely. For instance, a software developer’s needs will differ significantly from those of a financial advisor. Instead of a direct comparison, it’s more effective to focus on the features and strengths of different provider types. Some providers specialize in specific industries, offering tailored policies and a deeper understanding of industry-specific risks. Others may offer broader coverage across various professions but may lack the specialized expertise of niche providers. Large national insurers often provide standardized policies, while smaller, regional companies might offer more personalized service and potentially more competitive pricing for certain risk profiles.

Factors to Consider When Selecting an E&O Insurance Provider

Selecting an E&O provider involves several critical factors beyond simply price. A comprehensive assessment ensures you receive adequate protection while managing costs effectively.

The following factors warrant careful consideration:

- Policy Coverage: Examine the policy’s scope, ensuring it adequately covers your professional activities and potential liabilities. Pay close attention to specific exclusions and limitations.

- Claims Process: Understand the provider’s claims handling procedures. A streamlined and responsive claims process can be invaluable during a crisis.

- Financial Stability: Research the insurer’s financial strength and stability. Check ratings from agencies like A.M. Best to ensure they can meet their obligations in the event of a claim.

- Customer Service: A responsive and helpful customer service team can make a significant difference in your overall experience.

- Premium Cost: While cost is a factor, it shouldn’t be the sole determining factor. Prioritize adequate coverage over the lowest premium.

- Policy Limits: Ensure the policy’s coverage limits are sufficient to cover potential damages or legal fees.

- Reputation and Reviews: Research the provider’s reputation and read online reviews from other clients to gain insights into their performance and customer satisfaction.

Importance of Reviewing Policy Details Before Purchasing E&O Insurance

Before committing to any E&O policy, thoroughly review all policy details. This includes the definitions of covered events, exclusions, limitations, and the claims process. Overlooking crucial details can lead to inadequate coverage and financial hardship in the event of a claim. Don’t hesitate to ask questions and seek clarification from the provider if anything is unclear. A clear understanding of the policy’s terms and conditions is paramount.

Checklist for Selecting an E&O Insurance Provider

Using a checklist can help ensure you don’t overlook critical aspects when comparing providers.

- Clearly define your professional activities and potential risks.

- Obtain quotes from multiple E&O insurance providers.

- Compare policy coverage, including limits and exclusions.

- Investigate the provider’s financial stability and claims process.

- Assess the provider’s reputation and customer service.

- Carefully review all policy documents before signing.

- Seek professional advice from an insurance broker if needed.

Legal and Regulatory Aspects of E&O Insurance in Washington

Navigating the world of Errors and Omissions (E&O) insurance in Washington State requires understanding the legal framework governing its use and the role of regulatory bodies. This section Artikels key legal and regulatory aspects, potential pitfalls of inadequate coverage, and dispute resolution processes.

Washington State Laws and Regulations Concerning E&O Insurance

Washington State, like other states, doesn’t have specific laws solely dedicated to E&O insurance. Instead, the regulation of E&O insurance falls under the broader umbrella of the state’s insurance laws and regulations, primarily overseen by the Washington State Insurance Commissioner. These overarching laws dictate licensing requirements for insurance providers, policy content standards, and consumer protection measures that indirectly impact E&O policies. For example, laws regarding unfair claims practices apply equally to E&O claims. The specific regulations relevant to E&O insurance are often found within the Washington Administrative Code (WAC), which contains detailed rules concerning insurance practices. It’s crucial for businesses to understand that while no single law defines E&O, compliance with general insurance regulations is paramount.

Role of the Washington State Insurance Commissioner

The Washington State Insurance Commissioner plays a vital role in overseeing the E&O insurance market. Their responsibilities include licensing and regulating insurance companies offering E&O coverage, ensuring compliance with state laws and regulations, investigating complaints against insurers, and enforcing penalties for violations. The Commissioner’s office also provides resources and information to consumers regarding insurance matters, including understanding E&O policies and filing complaints. Their authority extends to ensuring fair claims practices, preventing fraud, and maintaining the solvency of insurance companies. This oversight helps protect both businesses purchasing E&O insurance and the overall stability of the insurance market within the state.

Potential Legal Implications of Inadequate E&O Insurance in Washington

Operating a business in Washington without adequate E&O insurance can expose you to significant legal and financial risks. If a client successfully sues you for professional negligence or errors in your services, and you lack sufficient coverage, you could face substantial personal liability. This could include covering legal fees, court costs, and any awarded damages, potentially leading to bankruptcy. Furthermore, depending on the nature of your business and the severity of the claim, you could also face disciplinary actions from relevant professional licensing boards. The lack of insurance could significantly weaken your defense in legal proceedings and severely impact your professional reputation. For instance, a design firm without sufficient E&O insurance could face devastating financial consequences if a building design error leads to a lawsuit.

Resolving Disputes with an E&O Insurance Provider in Washington

Disputes with E&O insurance providers can arise over coverage denials, claim settlements, or other policy-related issues. Washington State offers several avenues for resolving these disputes. Initially, attempting to resolve the matter directly with the insurer through communication and negotiation is recommended. If this fails, consumers can file a complaint with the Washington State Insurance Commissioner’s office. The Commissioner’s office will investigate the complaint and attempt mediation between the parties. If mediation fails, the next step might involve arbitration or litigation in civil court. It is advisable to seek legal counsel to understand your rights and options when dealing with a dispute with your E&O insurer. The specific process will depend on the nature of the dispute and the terms of the insurance policy.

Illustrative Scenarios of E&O Claims in Washington

Source: ticnc.com

Errors and omissions (E&O) insurance protects professionals from claims arising from mistakes or negligence in their services. Understanding real-world scenarios helps illustrate the importance and scope of this coverage in Washington State. The following examples highlight the diverse range of professions and situations that can lead to E&O claims.

Medical Professional E&O Claim

A surgeon in Seattle, Dr. Anya Sharma, performed a routine laparoscopic cholecystectomy (gallbladder removal). Post-surgery, the patient, Mr. David Lee, experienced severe internal bleeding requiring emergency surgery. An investigation revealed Dr. Sharma inadvertently nicked a major blood vessel during the procedure, a mistake not immediately apparent during the initial surgery. Mr. Lee subsequently filed an E&O claim against Dr. Sharma, alleging medical malpractice and seeking compensation for his medical expenses, lost wages, and pain and suffering. The claim was settled out of court for a significant sum, with Dr. Sharma’s E&O insurance covering the majority of the settlement costs, legal fees, and related expenses. This scenario illustrates the high stakes involved in medical practice and the crucial role of E&O insurance in mitigating financial risk.

Financial Advisor E&O Claim

Ms. Sarah Chen, a financial advisor in Spokane, provided investment advice to her client, Mr. Robert Miller, recommending a high-risk investment strategy unsuitable for Mr. Miller’s risk tolerance and financial goals. Mr. Miller experienced significant losses due to this inappropriate investment advice. He subsequently filed an E&O claim against Ms. Chen, alleging negligence and breach of fiduciary duty. The claim went to arbitration, resulting in a ruling against Ms. Chen, requiring her to compensate Mr. Miller for his financial losses. Ms. Chen’s E&O insurance covered the awarded damages, preventing significant personal financial repercussions. This case highlights the importance of thorough due diligence and suitable client assessment in financial advising.

Lawyer E&O Claim

Attorney John Smith, practicing in Tacoma, represented a client in a real estate dispute. Due to an oversight, Mr. Smith missed a crucial filing deadline, resulting in the loss of his client’s claim. The client, Ms. Emily Davis, suffered substantial financial losses due to this missed deadline and filed an E&O claim against Mr. Smith for professional negligence. Mr. Smith’s E&O insurance company defended him and negotiated a settlement with Ms. Davis to compensate her for her losses. This case underscores the importance of meticulous record-keeping and attention to detail in legal practice.

Architect E&O Claim

Architect, Ms. Jessica Lee, designed a new residential building in Olympia. During construction, structural defects were discovered, requiring significant and costly repairs. The homeowner, Mr. Tom Brown, claimed that these defects were due to Ms. Lee’s negligent design, leading to an E&O claim against her. The claim went to court, and expert witnesses testified on both sides regarding the design specifications and building codes. Ultimately, the court found Ms. Lee partially liable, ordering her to contribute to the repair costs. Her E&O insurance policy covered a portion of the court judgment and associated legal fees. This scenario exemplifies how unforeseen issues during construction can lead to significant E&O claims for architects.

Final Conclusion

So, there you have it – a comprehensive look at Errors and Omissions insurance in Washington State. Protecting your professional livelihood shouldn’t be a guessing game. By understanding the intricacies of E&O insurance, you can confidently navigate potential risks and focus on what truly matters: excelling in your profession. Remember, a little proactive planning goes a long way in ensuring a secure and successful future. Now go forth and conquer, protected!