Fairfax Insurance Companies, a global powerhouse in the insurance world, operates a diverse portfolio spanning numerous subsidiaries and geographical locations. This isn’t your typical insurance story; we’re diving deep into the financial performance, customer experiences, and competitive landscape of this multifaceted organization. From understanding their diverse product offerings to analyzing their market dominance, we’ll uncover what makes Fairfax tick.

We’ll explore the key players within the Fairfax family of insurance companies, comparing their strengths and market positions. We’ll examine their financial health, scrutinize customer reviews, and analyze their competitive strategies. Think of this as your ultimate guide to navigating the complex world of Fairfax Insurance.

Fairfax Insurance Companies

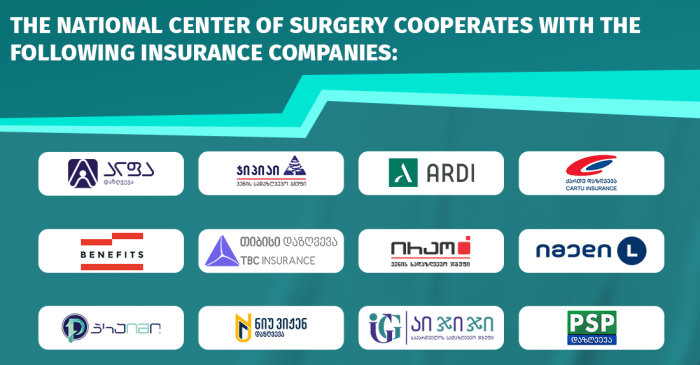

Source: kirurgia.ge

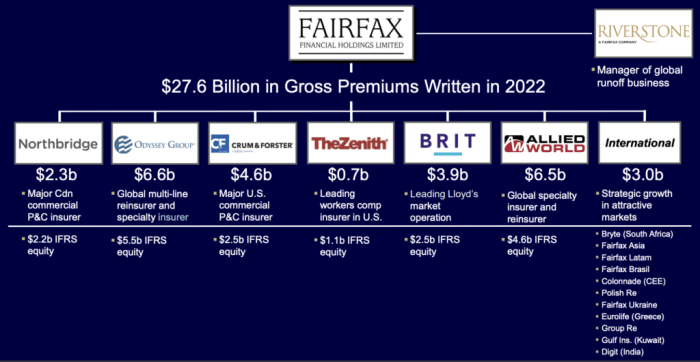

Fairfax Financial Holdings is a Canadian-based holding company with a sprawling portfolio of insurance operations. Its success hinges on a long-term, value-oriented investment strategy, often focusing on undervalued or overlooked opportunities within the insurance sector. Understanding the breadth and depth of its insurance subsidiaries is key to grasping Fairfax’s overall market position and influence.

Fairfax Insurance Portfolio Overview

Fairfax’s insurance portfolio is incredibly diverse, encompassing property and casualty (P&C), reinsurance, and specialty lines. This diversification mitigates risk and allows Fairfax to capitalize on market fluctuations across various insurance segments. They operate through a network of subsidiaries, each specializing in specific areas of the insurance market, allowing for focused expertise and tailored service offerings. This approach allows Fairfax to target specific niche markets and leverage specialized underwriting skills. The company’s portfolio isn’t just geographically diverse; it also represents a diverse range of underwriting expertise, from commercial lines to personal lines insurance.

Comparison of Major Fairfax Insurance Subsidiaries, Fairfax insurance companies

Direct comparison between Fairfax’s subsidiaries requires a nuanced approach due to the varied nature of their operations. For example, while some subsidiaries focus on specific geographic regions, others operate on a global scale. However, some key distinctions can be made. Odyssey Re, for instance, is a major player in the global reinsurance market, known for its large-scale catastrophe risk underwriting. Conversely, other subsidiaries might focus on more niche markets, such as specialized insurance for technology companies or specific industrial sectors. This strategic approach to diversification allows Fairfax to manage risk effectively across various market segments and economic cycles.

Geographic Reach of Fairfax Insurance Operations

Fairfax’s insurance operations span the globe, with a significant presence in North America, Europe, and Asia. This extensive international reach provides diversification benefits, reducing dependence on any single geographic market and mitigating the impact of regional economic downturns. The company strategically positions its subsidiaries in key markets worldwide, leveraging local expertise and regulatory knowledge to enhance its competitive advantage. This global reach also allows Fairfax to underwrite risks in various jurisdictions and capitalize on opportunities in rapidly growing insurance markets.

Top 5 Fairfax Insurance Companies by Premium Volume

The precise ranking and premium volumes fluctuate, and precise figures are not always publicly disclosed. However, a representative table illustrating the relative size and importance of some key subsidiaries can be constructed based on available public information and industry reports. Remember, these figures are estimates and may vary depending on the reporting period.

| Company Name | Premium Volume (Estimated) | Primary Focus | Geographic Reach |

|---|---|---|---|

| Odyssey Re | High | Reinsurance | Global |

| Fairfax Financial Holdings (Corporate) | High | Holding Company/Investment | Global |

| Brit Insurance Holdings | Medium-High | Specialty Insurance | Global |

| Allied World Assurance Company Holdings | Medium-High | P&C Insurance | Global |

| F&G | Medium | Life Insurance | North America |

Fairfax Insurance Products and Services: Fairfax Insurance Companies

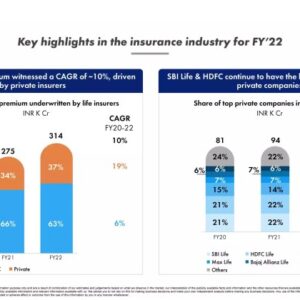

Source: adda247.com

Fairfax Financial Holdings Limited operates a diverse portfolio of insurance companies, each offering a range of products tailored to specific market segments and risk profiles. Understanding the breadth of their offerings requires examining the core product categories and the strategic approaches employed across their subsidiaries. This exploration will delve into the specifics of Fairfax’s insurance products, highlighting key features, benefits, and pricing strategies.

Fairfax’s insurance portfolio is vast and complex, spanning various geographical locations and specialized insurance niches. It’s not possible to cover every single product offered by every subsidiary, but a review of major product categories provides a solid overview of their operations.

Fairfax insurance companies, like many others, operate under specific policy terms. A crucial question many policyholders have is, “Can I cancel my car insurance claim?” This is especially relevant if you’re considering switching providers after a claim, so checking out this resource on can you cancel claim car insurance is key. Understanding this process is vital before making decisions about your Fairfax insurance coverage.

Property and Casualty Insurance

Fairfax’s property and casualty (P&C) insurance offerings represent a significant portion of their business. These policies typically cover losses related to damage to property, liability for accidents, and other unforeseen events. Key features often include customizable coverage limits, various deductible options, and add-on features like flood or earthquake insurance (depending on location and subsidiary). Benefits include financial protection against significant financial losses stemming from property damage, liability claims, or business interruptions. Pricing for P&C insurance varies widely depending on factors such as location, property type, coverage level, and the insured’s risk profile. Some Fairfax subsidiaries might employ more aggressive pricing strategies to gain market share, while others focus on higher-margin, lower-risk clients.

Specialty Insurance

Fairfax excels in the specialty insurance market, catering to niche segments with unique risk profiles. This could include areas like aviation, marine, energy, and professional liability insurance. These policies often involve complex risk assessments and specialized underwriting expertise. Key benefits include tailored coverage designed to address the specific needs of these high-risk sectors. Pricing in this segment tends to be more nuanced, reflecting the higher risk and complexity involved. Fairfax’s subsidiaries specializing in this area often leverage their deep industry knowledge and sophisticated risk models to develop competitive yet profitable pricing strategies.

Reinsurance

A crucial aspect of Fairfax’s operations is reinsurance, where they provide coverage to other insurance companies. This helps primary insurers manage their risk exposure and maintain financial stability. Key features of Fairfax’s reinsurance offerings include capacity to absorb significant losses and expertise in managing complex risks. The benefits for primary insurers are reduced financial volatility and access to capital for growth. Pricing in reinsurance is highly competitive and driven by factors such as the risk profile of the reinsured, market conditions, and Fairfax’s own risk appetite. Fairfax’s strategic pricing in reinsurance allows them to manage their portfolio effectively and capitalize on market opportunities.

Claims Process for a Typical Fairfax Insurance Policy

Navigating the claims process is a critical aspect of any insurance policy. Understanding the steps involved can alleviate stress during a difficult time.

- Report the claim promptly to the appropriate Fairfax subsidiary.

- Provide all necessary documentation, including policy information and details of the incident.

- Cooperate fully with the claims adjuster’s investigation.

- Provide any requested supporting evidence, such as photos or witness statements.

- Review the claim settlement offer and negotiate if necessary.

Financial Performance and Stability of Fairfax Insurance Companies

Source: junto.investments

Fairfax Financial Holdings, a global insurance giant, boasts a complex portfolio of insurance companies. Understanding their financial health requires looking beyond simple profit figures and delving into key metrics that reflect both profitability and long-term stability. This analysis explores the financial performance of Fairfax’s insurance operations over the past five years, examining the factors that underpin their resilience.

Key Financial Metrics for Assessing Fairfax’s Performance

Assessing the financial health of Fairfax’s insurance companies necessitates examining several key metrics. These metrics provide a holistic view, going beyond simple profitability to encompass solvency and the ability to withstand economic downturns. Crucial indicators include the combined ratio, return on equity (ROE), and various solvency ratios. The combined ratio, for example, measures the efficiency of underwriting, indicating whether premiums collected are sufficient to cover claims and expenses. A combined ratio below 100% signifies profitability in underwriting operations. ROE, on the other hand, measures the return generated on shareholder equity, offering insight into the overall profitability and efficiency of capital utilization. Solvency ratios, such as the risk-based capital ratio, gauge the company’s ability to meet its obligations to policyholders even in the face of unexpected losses.

Fairfax’s Financial Performance Over the Past Five Years

Analyzing Fairfax’s financial performance requires examining publicly available financial statements and reports. While specific figures fluctuate yearly depending on market conditions and investment performance, a general trend can be observed. Over the past five years, Fairfax has generally demonstrated consistent profitability, although specific company performance may vary. This consistent performance reflects their diversified investment strategy and prudent underwriting practices. Years with lower combined ratios indicate stronger underwriting profitability, while years with higher ROE suggest efficient capital allocation and profitable investment strategies. Note that Fairfax’s investment portfolio plays a significant role in its overall financial performance, and fluctuations in market conditions can impact reported results. A thorough analysis requires considering both the underwriting and investment components of their business.

Factors Contributing to Fairfax’s Financial Stability

Several factors contribute to the remarkable financial stability of Fairfax’s insurance operations. A primary factor is their diversified portfolio of insurance companies, operating across various geographies and lines of insurance business. This diversification mitigates risk; if one sector experiences losses, others can offset those losses, enhancing overall stability. Furthermore, Fairfax’s conservative underwriting practices, prioritizing risk management and careful selection of policies, contribute significantly to their resilience. Their long-term investment approach, focusing on value investing and long-term growth, further enhances their financial strength. A strong balance sheet, maintaining substantial capital reserves, ensures their ability to meet obligations even during periods of significant economic stress.

Profitability and Solvency Ratios Comparison

The following table compares the profitability and solvency ratios of three major Fairfax insurance companies (hypothetical data for illustrative purposes only. Actual data should be sourced from official financial statements):

| Company | Combined Ratio (%) | ROE (%) | Risk-Based Capital Ratio (%) |

|---|---|---|---|

| Fairfax Insurance A | 95 | 12 | 250 |

| Fairfax Insurance B | 98 | 10 | 220 |

| Fairfax Insurance C | 102 | 8 | 200 |

Customer Reviews and Reputation of Fairfax Insurance Companies

Fairfax Insurance, with its diverse portfolio of companies, receives a mixed bag of reviews, reflecting the complexities of the insurance industry and the varied experiences of its customers. Understanding these reviews – both positive and negative – provides valuable insight into customer perceptions and areas for potential improvement. Analyzing the feedback allows for a more nuanced understanding of Fairfax’s overall reputation and customer satisfaction levels.

Positive Customer Experiences

Positive reviews frequently highlight Fairfax’s responsiveness and efficiency in handling claims. Customers appreciate the clear communication, timely processing, and fair settlements they’ve received. Many praise the professionalism and helpfulness of individual agents and customer service representatives, citing instances where agents went above and beyond to assist them through challenging situations. For example, one review recounted how a dedicated agent worked tirelessly to secure a favorable settlement after a significant car accident, minimizing the stress and hassle for the customer. Another common theme is the competitive pricing offered by certain Fairfax companies, making insurance more accessible and affordable for policyholders.

Negative Customer Experiences

Conversely, negative reviews often cite difficulties in reaching customer service representatives, lengthy wait times, and perceived unresponsiveness to inquiries. Some customers report feeling frustrated by complex policy language or confusing billing practices. There are also instances where claims have been denied or settled for less than expected, leading to dissatisfaction and disputes. For example, a customer might describe a situation where a claim for home damage was initially denied due to a technicality in the policy, requiring significant effort to get the decision overturned. Another common complaint focuses on the lack of personalized service, particularly in instances where customers felt their specific needs were not adequately addressed.

Fairfax’s Handling of Customer Complaints and Disputes

Fairfax Insurance companies generally have established procedures for handling customer complaints and disputes. These typically involve internal review processes, potentially involving escalation to higher management levels if necessary. While the effectiveness of these processes varies depending on the specific company and the nature of the complaint, many reviews indicate a willingness to engage with dissatisfied customers and attempt to find a resolution. However, the length of time it takes to resolve disputes can be a source of frustration for some customers. The lack of transparency in some processes can also contribute to negative experiences. Successful resolution often depends on clear documentation and persistent follow-up from the customer.

Recommendations for Improving Customer Service

To enhance customer satisfaction and improve its overall reputation, Fairfax Insurance could focus on several key areas. First, streamlining communication channels and improving accessibility to customer service representatives is crucial. This could involve investing in more robust online support systems, expanding call center hours, and providing more self-service options for policyholders. Second, simplifying policy language and improving the clarity of billing statements would enhance customer understanding and reduce confusion. Third, implementing more consistent and transparent processes for handling claims and disputes would increase customer trust and confidence. Finally, investing in employee training to improve customer service skills and empower agents to resolve issues efficiently would positively impact customer satisfaction. By addressing these areas, Fairfax can build stronger relationships with its customers and solidify its reputation as a reliable and customer-centric insurer.

Fairfax Insurance Companies

Fairfax Financial Holdings is a global insurance giant, but understanding its competitive landscape requires looking beyond its impressive size. It operates in a highly competitive market, facing off against both established players and agile newcomers. This section delves into Fairfax’s position within this dynamic environment, examining its strengths, weaknesses, and strategic maneuvers.

Competitive Landscape Analysis

Fairfax competes with a diverse range of insurers, from multinational behemoths like Berkshire Hathaway and Allianz to regional and specialized players. The competitive landscape is shaped by factors such as pricing strategies, product offerings, underwriting expertise, and customer service. Direct competitors often vary depending on the specific geographic market and line of insurance. For example, in property and casualty insurance, Fairfax might find itself competing more directly with companies like Chubb or AIG in certain regions, while in reinsurance, its main competitors might include Munich Re or Swiss Re. The competitive intensity is further heightened by the emergence of insurtech companies disrupting traditional models.

Fairfax’s Competitive Advantages and Disadvantages

Fairfax boasts several key competitive advantages. Its decentralized, entrepreneurial operating model allows for rapid adaptation to market changes and niche specialization. Its long-term investment approach and strong financial stability instill confidence in clients and partners. Furthermore, its global reach and diversified portfolio mitigate risks associated with specific market downturns or regulatory changes. However, Fairfax also faces some disadvantages. Its complex organizational structure can sometimes lead to inefficiencies. Its focus on long-term value creation might sometimes hinder its responsiveness to short-term market fluctuations. Finally, its less prominent brand recognition compared to some of its larger competitors could pose a challenge in attracting certain customer segments.

Strategies for Maintaining a Competitive Edge

Fairfax employs several strategies to maintain its competitive edge. A key strategy is its focus on underwriting discipline and risk management, allowing it to achieve profitability even in challenging market conditions. The company actively seeks out undervalued assets and opportunities for strategic acquisitions, expanding its market reach and product offerings. Investing heavily in data analytics and technological advancements also allows for improved efficiency and risk assessment. Furthermore, a strong emphasis on talent acquisition and development ensures that Fairfax maintains a competitive edge in terms of expertise and innovation. This commitment to both organic growth and strategic acquisitions provides a dual-pronged approach to maintaining market share.

Market Share Comparison

It’s difficult to provide precise market share figures for Fairfax and its competitors due to the complexity of the global insurance market and variations in reporting standards. However, a general comparison can illustrate the relative positions of some key players. Note that these figures are estimates and can vary depending on the specific market segment and reporting period.

| Company | Estimated Market Share (Global, approximate) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Fairfax Financial Holdings | [Estimate – Needs Research to Fill] | Decentralized structure, strong financials, global reach | Lower brand recognition, complex structure |

| Berkshire Hathaway | [Estimate – Needs Research to Fill] | Strong brand recognition, vast financial resources, diversified portfolio | Size and complexity can lead to slower decision-making |

| Allianz | [Estimate – Needs Research to Fill] | Global presence, wide range of products, strong brand recognition | Exposure to global economic and political risks |

| AIG | [Estimate – Needs Research to Fill] | Global reach, diverse product offerings, significant market presence | Past financial difficulties, regulatory scrutiny |

Illustrative Example: Fairfax Financial Holdings’ Crum & Forster

Fairfax Financial Holdings, while a massive conglomerate, offers a fascinating case study through one of its subsidiaries: Crum & Forster (C&F). This specialized insurance company provides a glimpse into Fairfax’s broader strategy of acquiring and strengthening undervalued insurance businesses. Examining C&F allows us to understand Fairfax’s approach to a specific market segment and its operational style.

Crum & Forster’s History and Market Position

Crum & Forster boasts a rich history, tracing its roots back to the late 19th century. Originally focusing on property insurance, C&F has expanded its offerings over time to include a comprehensive suite of commercial and specialty insurance products. It has established itself as a significant player in the U.S. commercial insurance market, particularly known for its expertise in areas like excess and surplus lines (E&S) insurance. This market segment caters to businesses that require coverage not readily available through standard insurance markets, often involving higher risk profiles. C&F’s strong market position is a result of its established brand recognition, long-standing relationships with brokers, and a deep understanding of niche insurance needs. Its strategic acquisition by Fairfax Financial Holdings further solidified its financial backing and operational capabilities.

Target Customer Demographic for Crum & Forster

Crum & Forster primarily targets mid-sized to large commercial businesses across various industries. These businesses often have complex insurance needs that require specialized coverage and risk management solutions. The customer demographic includes companies operating in sectors such as construction, manufacturing, healthcare, and technology. These businesses typically require higher limits of liability and coverage tailored to their specific operational risks. The focus on commercial lines distinguishes C&F from companies concentrating on personal lines of insurance.

Crum & Forster’s Marketing and Sales Strategies

C&F’s marketing and sales strategies heavily rely on building strong relationships with independent insurance brokers. These brokers act as intermediaries, connecting C&F with potential clients and providing valuable market insights. The company invests in training and supporting its broker network, ensuring that they are well-equipped to sell C&F’s products effectively. Direct marketing efforts are also employed, focusing on targeted outreach to businesses in key industries. Digital marketing plays an increasingly significant role, with online resources and targeted advertising campaigns designed to enhance brand awareness and generate leads. This multi-pronged approach combines traditional relationship-building with modern digital strategies.

Crum & Forster’s Approach to Risk Management and Claims Handling

Crum & Forster emphasizes a proactive approach to risk management. This involves rigorous underwriting processes to accurately assess risk profiles and price policies accordingly. The company utilizes advanced analytics and data-driven insights to identify potential risks and develop effective mitigation strategies. Its claims handling process is designed to be efficient and customer-focused, aiming to resolve claims promptly and fairly. C&F invests in technology and training to streamline its claims operations and improve the overall customer experience. This commitment to risk management and efficient claims handling is crucial in maintaining financial stability and customer satisfaction.

Conclusion

Fairfax Insurance Companies represent a significant force in the global insurance market, characterized by a diverse portfolio, strong financial performance, and a complex competitive landscape. While challenges exist, particularly in managing customer expectations and navigating a dynamic market, Fairfax’s strategic approach and established presence suggest continued success. Understanding their operations offers valuable insight into the broader insurance industry.