Humana health insurance Medicare supplement plans offer a crucial safety net for seniors navigating the complexities of healthcare costs. But with various plans and options, choosing the right one can feel overwhelming. This guide cuts through the jargon, comparing Humana’s offerings to other providers, detailing costs, enrollment, and the claims process. We’ll even spill the tea on customer experiences, helping you make an informed decision.

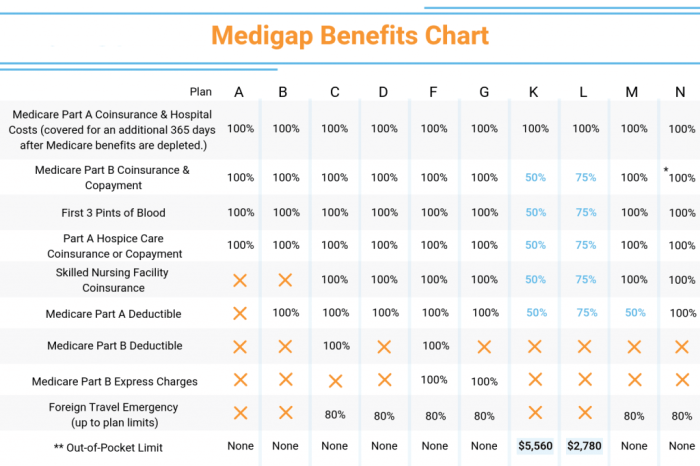

From understanding the differences between Original Medicare and supplemental coverage to navigating Humana’s network of doctors and hospitals, we’ll equip you with the knowledge to confidently choose a plan that fits your needs and budget. We’ll explore the various plan types (A, B, C, etc.), highlighting their benefits and limitations, and provide a clear comparison of key features like premiums, deductibles, and co-pays. Get ready to decode the world of Medicare supplements with Humana.

Humana Medicare Supplement Plan Overview

Source: ilhealthagents.com

Navigating the world of Medicare can feel like traversing a dense jungle, especially when it comes to supplemental insurance. Humana offers a range of Medicare Supplement plans, also known as Medigap plans, designed to fill the gaps in Original Medicare coverage. Understanding the nuances of these plans is crucial for making an informed decision about your healthcare future. This overview will help decipher the complexities of Humana’s Medigap offerings.

Humana Medicare Supplement Plan Types and Coverage, Humana health insurance medicare supplement

Humana, like other major insurance providers, offers various Medicare Supplement plans, typically labeled with letters (A, B, C, etc.). Each plan offers a different combination of coverage for Medicare Part A (hospital insurance) and Part B (medical insurance) deductibles, copayments, and coinsurance. For instance, Plan A is generally the most basic, covering a significant portion of Medicare’s cost-sharing but not all. Higher-lettered plans offer more comprehensive coverage, typically at a higher premium. It’s important to note that the specific benefits and costs can vary by state and even by county, so always check your local options. Humana’s website and local agents are excellent resources for obtaining the most up-to-date information.

Benefits and Limitations of Humana Medicare Supplement Plans

The primary benefit of Humana’s (and any provider’s) Medicare Supplement plans is the reduced out-of-pocket costs. These plans help cover expenses that Original Medicare doesn’t fully pay for, such as deductibles, copayments, and coinsurance. This can provide significant peace of mind, knowing that unexpected medical bills won’t cripple your finances. However, a key limitation is the cost of the premiums themselves. Medicare Supplement plans are not cheap; the premiums can be substantial, especially for plans with more extensive coverage. Furthermore, these plans don’t cover everything. They typically don’t cover vision, hearing, or dental care, and may have limitations on foreign travel coverage. Therefore, careful consideration of your individual needs and budget is essential.

Comparison of Humana Medicare Supplement Plans to Other Providers

Humana competes with other major insurance providers like AARP, UnitedHealthcare, and Mutual of Omaha in the Medicare Supplement market. While the specific plans and their coverage may vary slightly, the core benefits remain largely consistent across providers. The key differentiators often come down to premium costs, customer service, and the availability of specific plans in a given geographic area. It’s recommended to compare quotes from several providers to find the best fit for your circumstances. Remember, the “best” plan is subjective and depends on your individual health needs and financial situation.

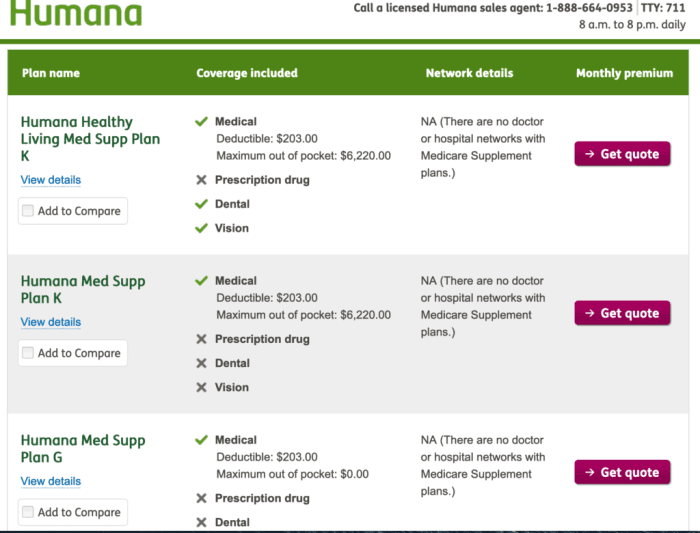

Comparison of Three Humana Medicare Supplement Plans

The following table compares three hypothetical Humana Medicare Supplement plans (the actual plans and their features vary by location and year). Remember to contact Humana directly for current and accurate plan details in your area.

| Plan | Monthly Premium (Example) | Part A Coverage | Part B Coverage |

|---|---|---|---|

| Plan A | $150 | Covers most hospital costs | Covers 80% of Medicare-approved costs after deductible |

| Plan G | $250 | Covers most hospital costs | Covers 100% of Medicare-approved costs after deductible |

| Plan N | $200 | Covers most hospital costs | Covers 100% of Medicare-approved costs after deductible, except for a $20 copay for doctor visits and a $50 copay for emergency room visits |

Humana’s Medicare Supplement Plan Costs and Premiums: Humana Health Insurance Medicare Supplement

Navigating the world of Medicare Supplement plans can feel like wading through a swamp of jargon and fine print. Understanding the costs involved is crucial before committing to a plan, and Humana, a major player in the Medicare Supplement market, offers a range of plans with varying premium structures. Let’s break down the key factors influencing your Humana Medicare Supplement plan premiums and how to find the best fit for your budget.

Several factors contribute to the final cost of your Humana Medicare Supplement plan. Age is a significant one; generally, older individuals pay higher premiums. Your location also plays a role, as healthcare costs vary across different states and regions. The specific plan you choose is another critical factor; plans offering broader coverage naturally command higher premiums than those with more limited benefits. Your health status, while not directly used in determining your premium for Medicare Supplement plans, might indirectly affect the cost through your utilization of healthcare services after enrollment. Finally, the insurer’s administrative costs and profit margins also factor into the overall premium calculation.

Obtaining a Personalized Premium Quote from Humana

Getting a personalized premium quote from Humana is straightforward. You can visit their website, humna.com, and use their online quoting tool. This tool typically requires you to input information such as your age, zip code, and the specific plan you’re interested in. Alternatively, you can contact Humana directly via phone or through a licensed insurance agent. These agents can guide you through the process, answer your questions, and help you compare different plans based on your individual needs and budget. Remember to compare quotes from multiple insurers to ensure you’re getting the best value for your money.

Humana Medicare Supplement Plan Payment Options

Humana offers a variety of payment options to make paying your premiums convenient. These typically include automatic bank drafts, allowing for seamless monthly payments. You can also opt for manual payments via mail, using checks or money orders. Some plans might accept credit card payments, though this may incur additional fees. It’s crucial to confirm the available payment methods directly with Humana or your insurance agent to ensure a smooth payment process.

Sample Premium Variations Based on Age and Plan Type

The following table illustrates potential premium variations, keeping in mind that these are illustrative examples and actual premiums will vary based on location, specific plan details, and other factors. Always check with Humana for the most up-to-date pricing.

| Age | Plan G | Plan N | Plan F (High Deductible) |

|---|---|---|---|

| 65 | $150 | $120 | $80 |

| 70 | $200 | $150 | $100 |

| 75 | $250 | $180 | $120 |

Enrollment Process and Eligibility Criteria

Navigating the world of Medicare Supplement plans can feel like wading through a swamp, but understanding the enrollment process and eligibility requirements can make the journey significantly smoother. This section breaks down the steps involved in signing up for a Humana Medicare Supplement plan, clarifies who’s eligible, and explains the different enrollment periods.

Eligibility for Humana Medicare Supplement plans hinges primarily on your Medicare status. You must already be enrolled in Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) to be eligible for a Medigap plan. Specific plan availability may also vary depending on your location and other factors. It’s always best to check directly with Humana for the most up-to-date information.

Eligibility Requirements

To enroll in a Humana Medicare Supplement plan, you must meet several key requirements. These requirements ensure that the plan is accessible to those who need it most and that the program remains financially sustainable. Failing to meet these requirements will prevent enrollment.

- You must be enrolled in Medicare Part A and Part B.

- You must be a legal resident of the United States.

- You may have additional requirements based on your state of residence.

Enrollment Periods

Understanding the different enrollment periods is crucial for securing the best possible coverage and avoiding potential penalties. Missing a key enrollment window could lead to higher premiums or limited plan options.

- Initial Enrollment Period (IEP): This period begins the month you turn 65 and are enrolled in Medicare Part B, and lasts for seven months. This is the best time to enroll without facing a penalty.

- Open Enrollment Period (OEP): This is a yearly window (typically from January 1st to March 31st) during which you can switch between different Medigap plans without medical underwriting. This allows for flexibility in choosing the best plan for your needs.

- Special Enrollment Periods (SEP): Certain life events, such as losing your current Medigap coverage due to a change in residency, can qualify you for a SEP. This allows enrollment outside of the standard IEP and OEP.

Step-by-Step Enrollment Guide

The enrollment process is straightforward, but careful attention to each step is essential to avoid delays or complications. Following these steps will help ensure a smooth and efficient enrollment experience.

- Check your eligibility: Verify that you meet all the eligibility requirements Artikeld above.

- Compare plans: Review the various Humana Medicare Supplement plans available in your area, comparing their benefits and premiums.

- Contact Humana: Reach out to Humana directly via phone, online, or through a licensed agent to discuss your options and enroll in your chosen plan.

- Provide necessary information: Be prepared to provide personal information, including your Medicare number and other relevant details.

- Review your policy: Carefully review your policy documents once you receive them to ensure everything is accurate and meets your expectations.

Customer Reviews and Testimonials

Understanding customer experiences is crucial when evaluating any Medicare Supplement plan. Analyzing reviews and testimonials provides valuable insight into Humana’s strengths and weaknesses, helping potential enrollees make informed decisions. This section summarizes common themes found in customer feedback, categorized for clarity.

Claims Processing Experiences

Customer reviews regarding Humana’s claims processing vary significantly. While many praise the efficiency and straightforwardness of the process, others report delays and difficulties. Positive experiences often highlight quick reimbursements and helpful customer service representatives guiding them through the process. Conversely, negative reviews frequently mention lengthy processing times, unclear communication, and frustrating interactions with customer service.

“Submitting my claim was easy, and I received my reimbursement within a week! The online portal was user-friendly.”

“I waited over a month for my claim to be processed, and I had to call multiple times to get updates. The representatives were unhelpful and dismissive.”

Customer Service Interactions

The quality of customer service is a recurring theme in Humana Medicare Supplement reviews. Positive feedback consistently mentions responsive, knowledgeable, and helpful representatives who readily addressed concerns and provided clear explanations. Negative reviews, however, describe unhelpful, unresponsive, or even rude representatives who were difficult to reach or provided inadequate assistance. Accessibility of customer service representatives, including phone wait times and online support options, also influences overall customer satisfaction.

“I was so impressed with the customer service representative I spoke with. She answered all my questions patiently and thoroughly.”

“Trying to reach someone by phone was a nightmare. I spent hours on hold, only to be disconnected.”

Plan Benefits and Coverage

Reviews regarding the specific benefits and coverage provided by Humana’s Medicare Supplement plans are generally positive, with many praising the comprehensive coverage and peace of mind it offers. However, some customers express concerns about specific exclusions or limitations within the plans. Understanding the nuances of the plan’s coverage and comparing it to other options is vital before enrollment.

“The plan covers almost everything, giving me the confidence to seek necessary medical care without worrying about the costs.”

“I was surprised to find that my specific medication wasn’t fully covered under the plan. The fine print needs to be reviewed carefully.”

Humana’s Network of Doctors and Hospitals

Choosing a Medicare Supplement plan often hinges on the breadth and accessibility of the provider network. Humana, a major player in the Medicare Supplement market, boasts a substantial network, but understanding its intricacies is crucial for making an informed decision. This section will clarify how Humana’s network functions and what to expect when seeking care.

Humana’s network of healthcare providers for Medicare Supplement plan holders is extensive, varying in size and composition depending on your geographic location. Generally, it includes a wide range of doctors, specialists, hospitals, and other healthcare facilities. The size and specific providers within the network are constantly evolving, with Humana adding and removing providers based on various factors like contract negotiations and provider performance. Access to a comprehensive directory is key to navigating this network effectively.

Finding In-Network Providers

Locating in-network doctors and hospitals is straightforward using Humana’s online resources. Their website features a provider search tool that allows you to search by specialty, location, name, or even zip code. This tool typically displays provider profiles, including their contact information, address, and accepted insurance plans (specifically highlighting Humana Medicare Supplement plans). The website also usually offers a downloadable directory, allowing for offline access to provider information. Humana’s mobile app also frequently mirrors these functionalities, offering convenient access to network information on the go.

Implications of Using Out-of-Network Providers

Using out-of-network providers with a Humana Medicare Supplement plan will generally result in higher out-of-pocket costs. While your plan may still offer some coverage, it will likely be significantly less than for in-network care. The specifics of out-of-network coverage vary depending on the specific Humana Medicare Supplement plan you choose. Your plan documents will detail the extent of coverage for out-of-network services, including any cost-sharing responsibilities you’ll bear. It’s crucial to carefully review these details before seeking care from an out-of-network provider to avoid unexpected financial burdens.

Cost Comparison: In-Network vs. Out-of-Network

Let’s consider a hypothetical scenario: Sarah, a Humana Medicare Supplement plan holder, needs a knee replacement. If she chooses an in-network surgeon and hospital, her out-of-pocket costs might be limited to a copay or coinsurance, perhaps totaling $2,000. However, if she chooses an out-of-network provider, her out-of-pocket costs could skyrocket to $10,000 or more, depending on the specific services rendered and the terms of her plan. This substantial difference highlights the financial prudence of utilizing in-network providers whenever possible. This example emphasizes the potential for significant cost savings by staying within the Humana network.

Claims Process and Reimbursement

Navigating the claims process for your Humana Medicare Supplement plan might seem daunting, but it’s actually pretty straightforward. Understanding the steps involved will ensure a smoother experience when you need to file a claim. This section details the process, common reasons for delays, and how to address them.

Submitting a Humana Medicare Supplement Claim

Submitting a claim typically involves gathering your medical documentation and submitting it to Humana via mail, fax, or their online portal. The specific method depends on your plan and the type of claim. Generally, you’ll need to provide information like your policy number, the dates of service, and the details of the medical services received. Humana will then process your claim, verifying the information with your healthcare provider.

Humana’s Claim Processing and Reimbursement

Once Humana receives your claim, they review it for accuracy and completeness. This involves verifying the medical necessity of the services, confirming the provider’s participation in their network (if applicable), and ensuring the charges align with their fee schedule. After verification, Humana will process the reimbursement, typically sending payment directly to the provider or to you, depending on your plan’s arrangement with the provider. Processing times vary but are generally within a reasonable timeframe.

Common Reasons for Claim Denials and Resolutions

While Humana strives for smooth claim processing, denials can occur. Common reasons include missing information, services not covered under your plan, or exceeding the plan’s benefit limits. Other reasons might involve improper billing codes or claims submitted outside the specified timeframe. If your claim is denied, you’ll receive a notification explaining the reason. Reviewing this notification carefully and contacting Humana’s customer service to appeal the decision is crucial. Providing additional documentation or clarifying the situation often resolves the issue.

Sample Claim Form

The information required for a claim varies slightly depending on the specifics of your plan and the type of service. However, a typical claim form would include the following:

| Information Category | Specific Information Needed | Example | Notes |

|---|---|---|---|

| Member Information | Name, Policy Number, Date of Birth | Jane Doe, 1234567, 01/01/1960 | Ensure accuracy; mismatches can cause delays. |

| Provider Information | Provider’s Name, Address, Phone Number, NPI Number | Dr. Smith, 123 Main St, 555-1212, 1234567890 | Accurate provider details are essential for verification. |

| Service Information | Dates of Service, Description of Services, Procedure Codes (CPT/HCPCS), Charges | 03/15/2024, Office Visit, 99213, $150 | Detailed and accurate descriptions are critical. |

| Claim Submission Information | Date of Submission, Method of Submission (Mail, Fax, Online), Signature | 04/15/2024, Online, Jane Doe Signature | Retain a copy of your submitted claim for your records. |

Understanding Medicare and Supplement Coverage

Source: ispot.tv

Navigating the world of Medicare can feel like deciphering a complex code. Understanding the difference between Original Medicare and Medicare Supplement plans is crucial to choosing the right coverage for your needs. This section breaks down the key distinctions and shows how a Humana Medicare Supplement plan can enhance your Original Medicare benefits.

Original Medicare, comprised of Part A (hospital insurance) and Part B (medical insurance), provides foundational coverage. However, it often leaves gaps in coverage, resulting in significant out-of-pocket expenses. This is where a Medicare Supplement plan, like those offered by Humana, steps in to fill those gaps and provide more comprehensive protection.

Original Medicare versus Medicare Supplement Plans

Original Medicare (Parts A and B) covers a significant portion of healthcare costs, but it doesn’t cover everything. Part A helps pay for hospital stays, skilled nursing facility care, hospice, and some home healthcare. Part B covers doctor visits, outpatient care, some preventive services, and durable medical equipment. However, both parts have deductibles, copayments, and coinsurance that can quickly add up. A Medicare Supplement plan, on the other hand, is designed to help pay for those out-of-pocket costs. It acts as a secondary insurer, picking up where Original Medicare leaves off. Think of it as an extra layer of protection.

How a Medicare Supplement Plan Complements Original Medicare

A Humana Medicare Supplement plan works alongside Original Medicare to create a more comprehensive coverage package. Imagine Original Medicare as the foundation of your healthcare coverage. It covers a significant portion of your medical bills, but it leaves some costs uncovered. The Humana Supplement plan then acts as a secondary layer, paying for many of those remaining expenses – like deductibles, copayments, and coinsurance – that Original Medicare doesn’t fully cover. This reduces your out-of-pocket expenses and provides greater financial security.

Types of Medical Expenses Covered by Humana’s Medicare Supplement Plans

Humana offers various Medicare Supplement plans (Plan G, Plan N, etc.), each with its own specific coverage details. However, generally, these plans help cover expenses such as:

* Hospital costs (Part A): This includes inpatient hospital stays, skilled nursing facility care, and hospice care. The supplement plan would help cover any remaining costs after Medicare Part A has paid its share.

* Doctor visits and outpatient care (Part B): This includes costs associated with seeing your doctor, getting tests, and receiving other outpatient services. The supplement plan would help cover deductibles, copayments, and coinsurance.

* Blood transfusions: Many plans help cover the costs associated with blood transfusions.

* Foreign travel emergency care: Some plans offer coverage for emergency medical care while traveling outside the United States.

The specific coverage details will vary depending on the chosen Humana Medicare Supplement plan. It’s essential to carefully review the plan’s brochure for complete information.

Visual Representation of Original Medicare and Humana Supplement Plan Coverage

Imagine two circles, one slightly larger than the other. The smaller circle represents Original Medicare’s coverage. It covers a substantial portion of healthcare costs, but there’s a gap – an area not covered. The larger circle, encompassing the smaller one, represents the combined coverage of Original Medicare and a Humana Medicare Supplement plan. The area where the larger circle extends beyond the smaller one shows the additional coverage provided by the Humana plan, filling in the gaps and significantly reducing your out-of-pocket costs. The more comprehensive coverage offers peace of mind, knowing that a larger portion of your healthcare expenses will be covered.

Final Wrap-Up

Source: seniorliving.org

Navigating the world of Medicare supplements can be a maze, but understanding Humana’s offerings is key to securing your healthcare future. By weighing the costs, coverage details, and customer feedback, you can confidently choose a plan that provides the protection you need. Remember to compare plans, explore your options, and don’t hesitate to reach out to Humana directly for personalized guidance. Your health deserves the best coverage, and this guide is here to help you find it.