Humana Supplemental Medicare Insurance: Navigating the world of Medicare can feel like decoding a secret language, right? But what if we told you there’s a way to add extra layers of protection and peace of mind? That’s where Humana’s supplemental plans step in, offering a safety net beyond basic Medicare coverage. This isn’t just about numbers and policies; it’s about ensuring you get the healthcare you deserve without breaking the bank. We’ll break down the essentials, from understanding the different plan types to mastering the enrollment process, so you can choose the best fit for your needs.

Whether you’re already enrolled in Medicare or just starting to explore your options, understanding the nuances of supplemental insurance is key. This guide will delve into Humana’s offerings, comparing them to other major providers, and helping you make an informed decision. We’ll cover everything from eligibility and enrollment to claims and customer service, providing real-world scenarios to illustrate how these plans work in action. Get ready to become a Medicare pro!

Humana Supplemental Medicare Insurance Plans

Navigating the world of Medicare can feel like deciphering a complex code, but understanding supplemental insurance is key to ensuring comprehensive coverage. Humana offers a range of plans designed to fill the gaps left by Original Medicare, providing extra financial protection and peace of mind. This overview will explore Humana’s offerings, highlighting their key features and comparing them to other major providers.

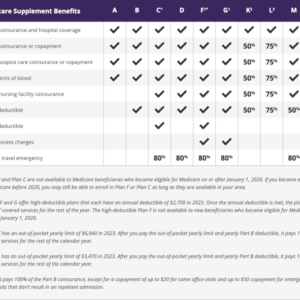

Humana’s Medigap Plans

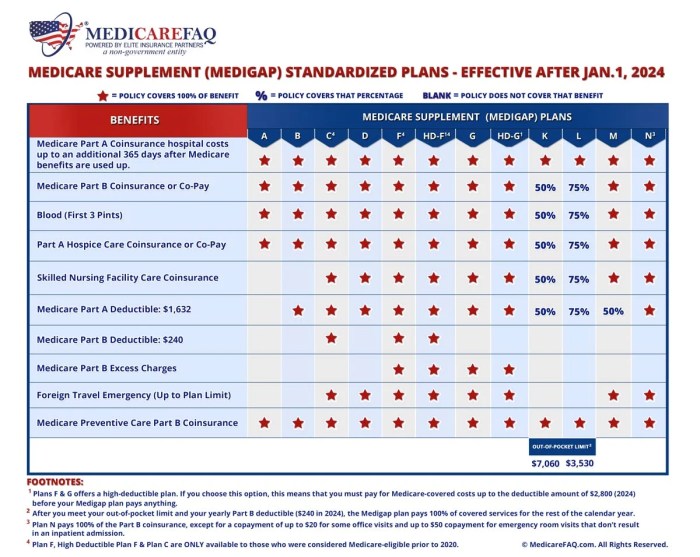

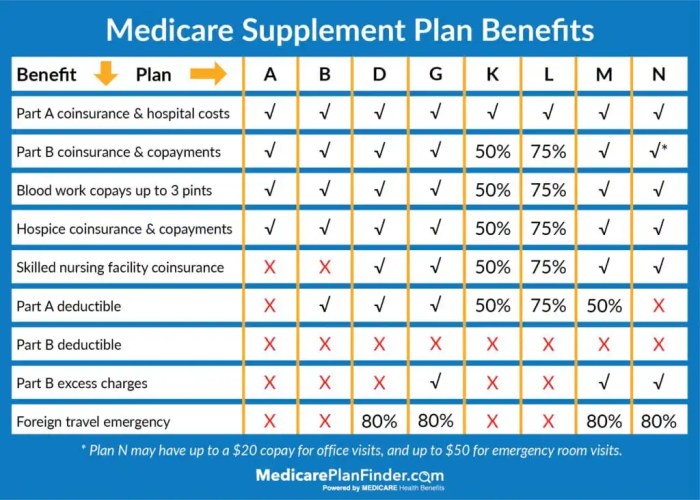

Humana offers Medigap plans, also known as Medicare Supplement Insurance. These plans are standardized by the federal government, meaning a Plan G from Humana will offer the same coverage as a Plan G from another provider. However, premiums and customer service can vary. Medigap plans help cover out-of-pocket costs like deductibles, copayments, and coinsurance that Original Medicare doesn’t cover. Different plans offer different levels of coverage; for example, Plan G covers most out-of-pocket costs, while Plan F (no longer available to those newly enrolled in Medicare) covered nearly all. Choosing the right plan depends on your individual needs and budget.

Humana’s Medicare Advantage Plans

Unlike Medigap, Humana’s Medicare Advantage plans (Part C) are managed care plans that replace Original Medicare. They offer comprehensive coverage, often including prescription drug coverage (Part D), vision, hearing, and dental benefits. However, these plans typically require you to see doctors within their network. Humana offers various Medicare Advantage plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and Special Needs Plans (SNPs) designed for specific populations, such as those with chronic conditions. The coverage and cost will vary significantly depending on the specific plan chosen.

Comparison of Humana Supplemental Plans with Other Providers

While Medigap plans offer standardized coverage, the premiums and customer service experience can differ significantly between providers. AARP, UnitedHealthcare, and Mutual of Omaha are some of the major competitors offering similar Medigap plans. The best provider for you will depend on factors like your location, the specific plan you need, and your personal preferences. For Medicare Advantage, the comparison becomes more complex as plans vary widely in their coverage and cost structure. Comparing plans from Humana, UnitedHealthcare, and Aetna, for instance, requires a careful review of the specific benefits and limitations of each. Factors like network size, doctor availability, and included services need careful consideration.

Comparison of Three Humana Supplemental Plans

The following table compares three different Humana supplemental plans (hypothetical examples for illustrative purposes, actual plans and costs vary by location and individual circumstances. Always consult Humana directly for current information).

| Plan Type | Premium (Monthly) | Deductible (Annual) | Copay (Doctor Visit) |

|---|---|---|---|

| Humana Medigap Plan G | $150 | $0 (Part A) / $203 (Part B) | Varies by provider |

| Humana Medicare Advantage Plan (HMO) | $0 | $0 | $30 |

| Humana Medicare Advantage Plan (PPO) | $50 | $0 | $40 |

Eligibility and Enrollment Process: Humana Supplemental Medicare Insurance

Navigating the world of Medicare supplements can feel like wading through a swamp of jargon. But understanding Humana’s eligibility requirements and enrollment process is key to securing the coverage you need. This section breaks down the process into manageable steps, making it easier to find the right plan for your needs.

Eligibility for Humana’s Medicare supplemental plans hinges primarily on your Medicare status. You must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance) to be eligible for a Humana Medigap plan. There are no income or asset limits to qualify. However, Humana, like other providers, may offer different plans in different geographic areas, so availability depends on your location. Pre-existing conditions are generally covered, but there may be waiting periods for specific conditions, depending on the plan and when you enroll.

Eligibility Requirements

To be eligible for a Humana Medicare supplemental insurance plan, you must meet the following criteria:

- Be enrolled in both Medicare Part A and Part B.

- Be a legal resident of the United States.

- Reside in a service area where Humana offers the plan you are interested in.

It’s crucial to check Humana’s website or contact them directly to confirm plan availability in your specific area. Remember that specific plan details, including coverage and cost, can vary based on your location and the plan selected.

Enrollment Process

The enrollment process for a Humana Medicare supplemental plan is relatively straightforward. However, understanding the timing is critical to avoid gaps in coverage. The process generally involves completing an application, providing necessary documentation, and undergoing a brief review.

Application Procedures and Required Documentation

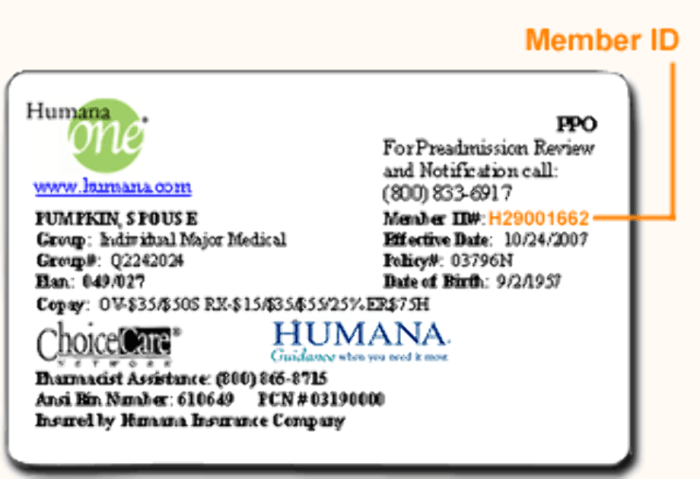

Applying for a Humana Medigap plan typically involves completing an online application through their website or contacting a Humana representative directly by phone. You’ll need to provide your Medicare information, including your Medicare Number and Part B enrollment date. You may also need to provide other personal information, such as your address and date of birth. In some cases, Humana may request medical information to assess your health status and determine the appropriate plan.

Open Enrollment Period and Special Enrollment Opportunities

There’s a specific window called the “Medicare Annual Enrollment Period” (AEP) during which you can switch between Medicare Advantage and Medigap plans without penalty. This usually occurs from October 15th to December 7th each year, with coverage beginning January 1st of the following year. However, there are also special enrollment periods that may apply to you if you experience certain life changes, such as turning age 65 or losing other health coverage. These exceptions allow you to enroll outside of the AEP.

Steps to Enroll in a Humana Supplemental Plan

Here’s a summary of the steps involved:

- Determine your eligibility by verifying your Medicare Part A and Part B enrollment.

- Research available Humana plans in your area and compare their benefits and costs.

- Complete the Humana application either online or via phone.

- Provide all requested documentation, including your Medicare card information.

- Review your application and policy details carefully before finalizing enrollment.

Remember, it’s always advisable to speak with a licensed insurance agent or Humana representative for personalized guidance. They can help you understand your options and select the best plan to fit your individual needs and budget.

Cost and Premium Factors

Understanding the cost of Humana supplemental Medicare insurance is crucial for making informed decisions about your healthcare coverage. Several factors interplay to determine your monthly premium, and it’s important to be aware of these influences before choosing a plan. This section will break down the key elements impacting your overall cost.

Factors Influencing Humana Supplemental Medicare Insurance Costs

Numerous factors contribute to the final cost of your Humana supplemental Medicare insurance plan. These factors are not mutually exclusive and often interact to shape your premium. For example, your age might influence your health status, which in turn, affects your risk profile and, consequently, your premium.

Age’s Impact on Premiums

Generally, older individuals tend to have higher premiums than younger ones. This is because the likelihood of needing more extensive medical care increases with age. Insurers account for this increased risk by adjusting premiums accordingly. This isn’t discriminatory; it reflects actuarial principles used to ensure the financial stability of the insurance pool. For instance, a 65-year-old might pay significantly less than a 75-year-old for the same plan.

Health Status and Premium Costs

Your health status significantly influences your premium. Individuals with pre-existing conditions or a history of significant medical issues often face higher premiums. This is because insurers assess the likelihood of needing expensive treatments and incorporate that risk into the premium calculation. Someone with a history of heart disease, for example, might pay more than someone with a clean bill of health.

Location and Premium Variation

Geographic location plays a significant role in determining your premium. The cost of healthcare varies considerably across different states and even within the same state. Areas with higher healthcare costs generally have higher insurance premiums. For example, premiums in a major metropolitan area with high-cost hospitals might be considerably higher than those in a rural area.

Premium Ranges Across Plan Types and Locations

Providing precise premium ranges requires specific plan details and location information, which varies significantly. However, to illustrate the general principle, consider these hypothetical examples: A basic supplemental plan in a rural area of the Midwest might range from $50-$150 per month, while a more comprehensive plan in a major coastal city could range from $200-$400 or more. These are illustrative examples only and should not be taken as definitive pricing. It is crucial to obtain personalized quotes based on your specific circumstances.

| Factor | Impact on Premium | Example | Additional Notes |

|---|---|---|---|

| Age | Generally increases with age | 65-year-old vs. 75-year-old: Significantly higher for the 75-year-old | Reflects increased healthcare utilization with age. |

| Health Status | Higher premiums for pre-existing conditions or significant health history | Individual with heart disease vs. healthy individual: Higher for the individual with heart disease. | Insurers assess the likelihood of costly treatments. |

| Location | Higher premiums in areas with higher healthcare costs | Major city vs. rural area: Higher premiums in the major city. | Reflects variations in healthcare provider costs and utilization. |

| Plan Type | More comprehensive plans generally cost more | Basic supplemental plan vs. comprehensive plan: Comprehensive plans have higher premiums. | Reflects the extent of coverage offered by the plan. |

Claims and Reimbursement Procedures

Source: clipartcraft.com

Navigating Humana supplemental Medicare insurance can be tricky, especially when considering additional coverage options. If you’re in Tulsa, Oklahoma, you might want to check out other insurers like aaa insurance tulsa oklahoma to compare plans and pricing. Ultimately, understanding your Humana plan’s gaps and finding the best supplemental coverage is key to ensuring comprehensive healthcare.

Navigating the claims process with Humana supplemental Medicare insurance can feel straightforward once you understand the steps involved. This section Artikels the process for submitting claims, receiving reimbursements, and appealing denials, ensuring you receive the coverage you’re entitled to. Remember, specific details may vary depending on your plan, so always refer to your policy documents for the most accurate information.

Filing a claim with Humana is generally a simple process, whether you’re dealing with doctor’s visits, hospital stays, or other covered services. Humana offers various methods for submitting your claim, making it convenient to manage your healthcare expenses. Understanding the reimbursement process and the typical timeframe for payment is crucial for effective financial planning.

Claim Submission Methods

Humana provides several ways to submit your claims. You can choose the method that best suits your needs and technological comfort level. Options typically include online submission through the Humana website, mailing a paper claim form, or using a mobile app (if available). Each method requires specific information, such as your member ID, provider information, and details of the services rendered. Submitting your claim accurately and completely helps expedite the processing time.

Reimbursement Processing and Timeframes

Once Humana receives your claim, it’s reviewed to ensure all necessary information is included and that the services are covered under your plan. The processing time varies, but generally, you can expect to receive reimbursement within a few weeks. However, complex claims or those requiring additional information may take longer. Humana will notify you of the status of your claim and provide an explanation if any part of it is denied. Factors such as the volume of claims and the complexity of your specific claim can influence the processing speed. For example, a simple claim for a doctor’s visit might be processed much faster than a claim involving a lengthy hospital stay requiring extensive documentation.

Appealing a Claim Denial

If Humana denies your claim, you have the right to appeal the decision. The appeal process typically involves submitting additional documentation or information to support your claim. Humana will provide instructions on how to file an appeal, usually including specific forms and deadlines. Understanding the grounds for appeal and gathering the necessary evidence is essential for a successful appeal. For instance, if a claim was denied due to a lack of pre-authorization, providing proof of the authorization request would strengthen your appeal.

Step-by-Step Claim Filing Guide

Submitting your claim accurately and efficiently is key to a smooth reimbursement process. Following these steps will help ensure your claim is processed promptly:

- Gather all necessary information: This includes your Humana member ID, the provider’s name and contact information, dates of service, a description of the services received, and any relevant documentation such as bills or receipts.

- Choose your submission method: Select the method that best suits your preference – online, mail, or mobile app.

- Complete the claim form accurately: Double-check all information for accuracy to avoid delays.

- Submit your claim: Send your claim using your chosen method, ensuring you keep a copy for your records.

- Track your claim: Monitor the status of your claim through the Humana website or by contacting customer service.

Customer Service and Support

Navigating the world of Medicare supplemental insurance can feel overwhelming, but Humana aims to simplify the process with comprehensive customer service options. Understanding how to access support and resolve any issues is crucial for a smooth and positive experience. This section details the various avenues available to Humana Medicare supplemental insurance members for assistance.

Humana provides a multi-faceted approach to customer support, ensuring accessibility for members regardless of their preferred communication method. Their commitment to responsiveness and resolution is a key component of their service philosophy. This ensures members feel confident in their choice of Humana supplemental insurance.

Customer Service Channels

Humana offers a variety of ways to contact customer service, prioritizing convenience and accessibility. Members can choose the method that best suits their needs and comfort level. These options include phone support, online resources, and mail correspondence.

Phone support is often the quickest and most direct method. Humana maintains a dedicated customer service line staffed with knowledgeable representatives who can answer questions, address concerns, and assist with various tasks. The phone number is readily available on their website and member materials. For individuals who prefer written communication, Humana offers a mailing address for inquiries and correspondence. This option allows members to document their requests and receive written responses. Finally, a robust online portal provides access to account information, claims status, and frequently asked questions (FAQs). This self-service option allows members to quickly find answers and manage their accounts independently.

Resolving Issues and Complaints, Humana supplemental medicare insurance

Humana has established processes for addressing member concerns and resolving complaints efficiently. If a member experiences an issue, they should first attempt to resolve it through the available customer service channels. If the issue remains unresolved, Humana provides escalation procedures, allowing members to reach a higher level of support within the organization.

The process typically involves contacting customer service initially, documenting the issue, and following up if necessary. Humana’s commitment to customer satisfaction is reflected in their dedication to resolving complaints promptly and fairly. They provide clear guidelines and procedures for handling disputes, ensuring a transparent and equitable process for all members. This process typically involves detailed documentation of the complaint, investigation by Humana, and a written response outlining the resolution or next steps.

Customer Support Experience and Contact Information

The typical Humana customer support experience involves a friendly and knowledgeable representative who actively listens to the member’s concerns and works diligently to find a solution. Representatives are trained to handle a wide range of inquiries, from simple questions about coverage to more complex issues related to claims or billing. The online portal offers a wealth of self-service resources, including FAQs, educational materials, and tools for managing accounts.

Humana’s commitment to customer satisfaction is reflected in their proactive approach to problem-solving and their willingness to assist members in navigating the complexities of Medicare supplemental insurance. While specific wait times may vary, Humana strives to provide timely and efficient service. To contact Humana customer service, members can typically find the phone number and mailing address on their insurance card or the company website. The website also provides access to the online portal and other helpful resources.

Comparing Humana to Competitors

Source: medicarefaq.com

Choosing a Medicare supplement plan can feel overwhelming, given the sheer number of providers and plan options available. Understanding the key differences between major players like Humana, AARP, and UnitedHealthcare is crucial for making an informed decision that best suits your individual needs and budget. This section compares Humana’s offerings to those of its leading competitors, highlighting key distinctions in coverage, cost, and customer service.

Coverage Differences Between Humana, AARP, and UnitedHealthcare

While all three companies offer Medicare Supplement plans (Medigap), the specific benefits and coverage details can vary significantly. For instance, Humana might offer plans with enhanced benefits in certain areas, such as vision or hearing, that AARP or UnitedHealthcare may not include in their standard plans. Conversely, a competitor might provide better coverage for specific medical procedures or treatments. A thorough review of each company’s plan brochures and benefit summaries is essential before making a choice. It’s vital to compare the specific plan details, not just the company names, as plan variations within each company also exist.

Cost and Premium Variations Among Providers

Premiums for Medigap plans vary widely based on factors like age, location, and the specific plan chosen. Humana’s premiums might be competitive in certain regions and for specific plan types, while AARP or UnitedHealthcare might offer lower premiums in other areas or for different plans. It’s crucial to obtain personalized quotes from each provider to accurately compare costs. Consider the long-term cost implications, not just the initial premium, as premiums can increase over time. Remember that even seemingly small premium differences can add up significantly over many years.

Customer Service and Support Comparisons

Customer service experiences can differ dramatically between providers. Humana, AARP, and UnitedHealthcare each have their own customer service infrastructure, including phone support, online resources, and potentially in-person assistance. Reading online reviews and checking independent ratings can provide insights into the responsiveness and helpfulness of each provider’s customer service teams. Factors such as wait times, ease of accessing information, and the resolution of customer issues should all be considered. A positive customer service experience can significantly impact the overall satisfaction with a Medicare supplement plan.

Key Features Comparison Table

| Feature | Humana | AARP (Through UnitedHealthcare) | UnitedHealthcare |

|---|---|---|---|

| Plan Options | Various Medigap plans (A, B, G, etc.) with potential added benefits | Selection of Medigap plans, often with a focus on simplicity | Wide range of Medigap plans, often with different benefit packages |

| Premium Costs | Varies by plan, location, and age; requires personalized quote | Varies by plan, location, and age; requires personalized quote | Varies by plan, location, and age; requires personalized quote |

| Customer Service | Multiple channels (phone, online, potentially in-person); customer service ratings vary | Multiple channels (phone, online); customer service ratings vary | Multiple channels (phone, online, potentially in-person); customer service ratings vary |

| Additional Benefits | May include enhanced benefits depending on the specific plan (e.g., vision, hearing) | May include specific added benefits depending on the plan | May include specific added benefits depending on the plan |

Illustrative Scenarios

Source: medicareplanfinder.com

Understanding how Humana’s supplemental Medicare plans work in real-world situations can be crucial. Let’s examine a few common medical scenarios to illustrate the coverage and out-of-pocket costs you might expect. Remember, specific costs will vary depending on your chosen plan, location, and the specifics of your healthcare needs. Always refer to your plan’s summary of benefits for precise details.

Hospitalization Due to a Heart Attack

Imagine a scenario where you experience a heart attack and require hospitalization. Let’s assume your Medicare Part A (hospital insurance) covers your hospital stay, but leaves a significant portion of the bill uncovered. A Humana supplemental plan, depending on the specific plan chosen, might cover your hospital copay, coinsurance, and potentially some of the expenses not covered by Medicare Part A, such as the cost of certain tests or therapies. For example, Medicare Part A might cover 80% of the $50,000 hospital bill, leaving a $10,000 gap. A Humana supplemental plan could potentially reduce your out-of-pocket expense to $2,000 by covering a significant portion of the remaining cost. This would greatly reduce your financial burden during a stressful time.

Doctor’s Visit for Routine Checkup

A routine checkup with your primary care physician is a common healthcare need. Medicare Part B (medical insurance) typically covers a portion of these visits, but often leaves a copay. A Humana supplemental plan could help cover this copay, potentially reducing your cost from $50 to $0. This seemingly small amount adds up over the course of a year and provides significant peace of mind. This helps prevent unexpected costs from derailing your budget.

Prescription Drug Costs for High Blood Pressure

Managing a chronic condition like high blood pressure often involves ongoing prescription drug costs. Medicare Part D (prescription drug insurance) helps, but it has its own deductible, co-pays, and coverage gaps (the “donut hole”). A Humana supplemental plan could help mitigate the cost of your prescription drugs by reducing your out-of-pocket expenses within the coverage gap or by lowering your co-pays for medications. For example, a monthly prescription costing $100 might have a $25 co-pay under Part D. A supplemental plan might lower this co-pay to $10 or even cover it entirely, saving you $15 per month or $180 annually.

Out-of-Pocket Maximums

It’s important to understand the concept of out-of-pocket maximums. Most Humana supplemental plans have an annual out-of-pocket maximum. Once you reach this limit, the plan covers 100% of eligible expenses for the rest of the year. This provides significant protection against catastrophic medical costs. For instance, if your out-of-pocket maximum is $5,000, and you incur $6,000 in eligible expenses, Humana would cover the additional $1,000.

Final Summary

Choosing the right Medicare supplemental plan is a big decision, but it doesn’t have to be overwhelming. By understanding Humana’s offerings, comparing them to competitors, and considering your individual needs, you can confidently navigate the complexities of Medicare and secure the best possible healthcare coverage. Remember, a little preparation can go a long way in ensuring a healthier and more financially secure future. So, take your time, do your research, and don’t hesitate to reach out to Humana or a qualified insurance advisor for personalized guidance. Your health and financial well-being are worth it!