Idaho Small Business Health Insurance: Navigating the often-murky waters of employee healthcare can feel like a shipwreck waiting to happen for Idaho’s small business owners. But don’t worry, this isn’t another dry, boring policy manual. We’re diving into the nitty-gritty, exploring the options, costs, and legal hoops you need to jump through to keep your team healthy and happy – without sinking your business. We’ll uncover the secrets to finding affordable, effective coverage that actually works for your unique situation.

From understanding the specific challenges faced by Idaho’s small business landscape to comparing different health insurance plans (HMOs, PPOs, and more!), we’ll equip you with the knowledge to make informed decisions. We’ll also delve into the Affordable Care Act’s implications, cost-cutting strategies, and how to communicate effectively with your employees about their benefits. Think of this as your ultimate survival guide for small business healthcare in the Gem State.

Understanding the Idaho Small Business Landscape

Source: apollo-insurance.com

Idaho’s small business sector is a vital component of its economy, characterized by a diverse range of industries and a significant contribution to job creation. However, navigating the complexities of providing employee benefits, particularly health insurance, presents unique challenges for these businesses. Understanding the specific characteristics of Idaho’s small businesses is crucial to developing effective solutions.

Idaho’s small businesses are largely comprised of firms with fewer than 50 employees. While there’s a representation across various sectors, agriculture, tourism, and natural resource-based industries are particularly prominent. Many are family-owned and operated, contributing to a strong sense of community but also potentially limiting resources for benefit administration. The prevalence of smaller businesses impacts the overall economic health and resilience of the state.

Typical Characteristics of Idaho Small Businesses

Idaho’s small business landscape is diverse, but certain common threads emerge. The majority are concentrated in rural areas, often facing unique logistical and infrastructural challenges compared to their urban counterparts. Many operate with limited budgets, making strategic resource allocation, including employee benefits, a critical consideration. The predominance of family-owned businesses also influences decision-making processes regarding employee benefits, often reflecting a personal approach rather than a purely business-driven strategy. For example, a small family-owned restaurant might prioritize employee retention through flexible scheduling over a comprehensive benefits package, reflecting their unique operational realities.

Challenges Faced by Idaho Small Businesses Regarding Employee Benefits

The high cost of health insurance is a primary hurdle for Idaho small businesses. Finding affordable and comprehensive plans that meet the needs of their employees while remaining fiscally sustainable is a constant struggle. Administrative burdens associated with managing benefits, including compliance with regulations and paperwork, add to the strain on already limited resources. Competition for skilled labor also intensifies the pressure to offer competitive benefits packages, further increasing costs. The lack of access to affordable insurance options directly impacts employee retention and recruitment, potentially hindering growth and productivity.

Economic Impact of Healthcare Costs on Idaho Small Businesses

The financial burden of healthcare costs significantly impacts the profitability and sustainability of Idaho small businesses. Rising premiums and deductibles can force businesses to reduce employee compensation, limit hiring, or even postpone expansion plans. This can create a ripple effect, impacting the overall economic vitality of the state. For instance, a small construction firm struggling with high healthcare costs may delay taking on new projects, reducing economic activity and potentially delaying infrastructure development. The financial strain also necessitates a focus on cost-cutting measures, which may inadvertently impact employee morale and productivity. The long-term consequences of these financial pressures can be substantial, potentially leading to business closures or reduced growth.

Available Health Insurance Options for Idaho Small Businesses

Navigating the world of health insurance can feel like deciphering a complex code, especially for Idaho small business owners juggling multiple responsibilities. Understanding your options is crucial for attracting and retaining employees while managing your budget effectively. This section breaks down the key types of health insurance plans available, the role of brokers, and the associated costs.

Types of Health Insurance Plans

Idaho small businesses have access to several types of health insurance plans, each with its own structure and cost implications. Choosing the right plan depends on your budget, employee needs, and preferences for healthcare access. The three most common types are HMOs, PPOs, and POS plans.

HMO (Health Maintenance Organization): HMO plans typically involve choosing a primary care physician (PCP) within the network. Referrals from your PCP are usually required to see specialists. HMOs generally offer lower premiums but more limited choices in doctors and hospitals. Think of it as a more tightly controlled network focused on preventative care.

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see any doctor or specialist, in-network or out-of-network, without needing a referral. However, seeing out-of-network providers will result in higher out-of-pocket costs. PPOs typically have higher premiums than HMOs but offer greater choice.

POS (Point of Service): POS plans blend features of both HMOs and PPOs. You choose a PCP within the network, and referrals may be required for specialists. However, you can also see out-of-network providers, but at a higher cost. POS plans aim to strike a balance between cost and flexibility.

The Role of Insurance Brokers

Insurance brokers act as invaluable guides for Idaho small businesses navigating the complexities of health insurance. They work independently of insurance companies, allowing them to compare plans from multiple providers and find the best fit for your specific needs and budget. Brokers can handle all the paperwork, answer your questions, and advocate for you during negotiations with insurance companies. Their expertise can save you time, money, and headaches.

Cost Breakdown of Health Insurance Plans

The cost of health insurance for small businesses in Idaho varies widely depending on the plan type, number of employees, and employee demographics (age, health status, etc.). Key cost components include premiums, deductibles, co-pays, and out-of-pocket maximums.

Premiums: These are the monthly payments made to maintain the insurance coverage. Premiums vary significantly based on plan type and coverage level.

Deductibles: This is the amount you pay out-of-pocket before the insurance company starts covering expenses. Higher deductibles typically mean lower premiums.

Co-pays: These are fixed fees you pay for doctor visits or other services. Co-pays are usually lower for in-network providers in HMO and POS plans.

Out-of-Pocket Maximum: This is the most you will pay out-of-pocket in a year. Once this limit is reached, the insurance company covers 100% of eligible expenses.

Sample Health Insurance Plan Comparison

This table provides a simplified comparison of four hypothetical plans. Actual costs will vary based on the specifics of each plan and your employee demographics. Always consult with an insurance broker or directly with insurance providers for accurate, up-to-date pricing.

| Plan Type | Monthly Premium (per employee) | Deductible (per employee) | Co-pay (Doctor Visit) |

|---|---|---|---|

| HMO Plan A | $300 | $1,000 | $25 |

| PPO Plan B | $450 | $2,000 | $50 |

| POS Plan C | $375 | $1,500 | $40 |

| Catastrophic Plan D | $150 | $7,000 | $0 (except for preventative care) |

Navigating the Legal and Regulatory Landscape

Offering health insurance to your employees in Idaho involves understanding a complex web of legal requirements and regulations. Failure to comply can lead to significant penalties, so it’s crucial for Idaho small business owners to familiarize themselves with the key aspects of the legal landscape. This section will Artikel the essential legal considerations and available resources to ensure compliance.

The Affordable Care Act (ACA) significantly impacts how small businesses in Idaho provide health insurance. While the ACA’s employer mandate doesn’t apply to businesses with fewer than 50 full-time equivalent employees, understanding the ACA’s provisions is still vital for several reasons. Knowing the regulations surrounding minimum essential coverage, preventative care, and the individual mandate helps businesses make informed decisions about their employee benefits packages. Moreover, even if not subject to the employer mandate, understanding the ACA landscape allows businesses to better navigate the options available to them and their employees.

Key Legal Requirements and Compliance Considerations for Idaho Small Businesses

Idaho, like other states, adheres to federal regulations concerning health insurance, primarily governed by the Employee Retirement Income Security Act of 1974 (ERISA) and the ACA. ERISA dictates the standards for employee benefit plans, including health insurance. Compliance involves ensuring that the plan documents are properly drafted, maintained, and administered. This includes meeting requirements for plan disclosure, fiduciary responsibilities, and handling employee contributions and claims. For example, a business offering a self-funded health plan needs to ensure compliance with ERISA’s stringent reporting and disclosure requirements. Further, state regulations might add layers of complexity, such as specific requirements for reporting or plan design. Businesses should consult with legal and insurance professionals to ensure full compliance.

Implications of the Affordable Care Act (ACA) for Idaho Small Businesses

While Idaho small businesses with fewer than 50 full-time equivalent employees aren’t subject to the ACA’s employer mandate to provide health insurance, the ACA still has significant implications. The ACA’s expansion of Medicaid in some states (though not fully implemented in all) can impact employee eligibility for government subsidies, influencing the employer’s decision on whether to offer benefits. The ACA also impacts the individual market, potentially affecting employee decisions on obtaining coverage through the marketplace. For example, an employee might opt to use the marketplace if the employer’s plan is not as comprehensive as what’s available through the ACA exchanges, even if the employer does offer a plan. Understanding these market dynamics helps small businesses in Idaho make strategic decisions about their employee benefits.

Resources Available to Idaho Small Businesses for Navigating Health Insurance Regulations

Several resources are available to help Idaho small businesses navigate the complexities of health insurance regulations. The Idaho Department of Insurance offers guidance and information on state-specific regulations. The Small Business Administration (SBA) provides resources and support for small businesses, including information on health insurance options. Private consultants specializing in employee benefits and health insurance compliance can also offer valuable assistance in navigating the regulatory landscape and ensuring compliance. Additionally, online resources and professional organizations offer valuable insights and best practices for managing employee health insurance. Utilizing these resources is crucial for Idaho small businesses to ensure compliance and effectively manage their employee benefits.

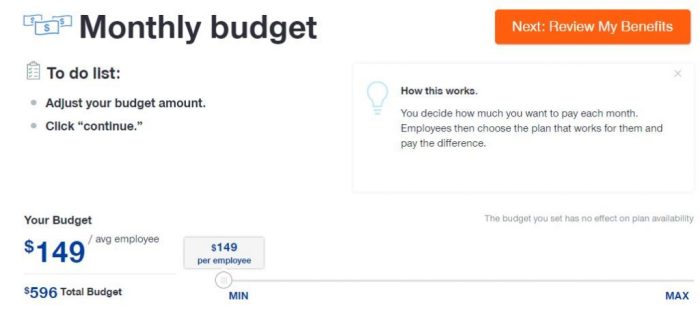

Strategies for Cost-Effective Health Insurance: Idaho Small Business Health Insurance

Navigating the world of small business health insurance in Idaho can feel like trekking through a dense forest. But fear not, intrepid entrepreneur! There are smart strategies you can employ to keep costs down without sacrificing the well-being of your valued employees. This section Artikels practical approaches to make health insurance a manageable expense, allowing you to focus on what truly matters: growing your business.

Reducing health insurance costs for your Idaho small business requires a multi-pronged approach. It’s not about cutting corners; it’s about strategic planning and leveraging available resources. By carefully considering employee contributions, implementing wellness programs, and understanding your options, you can create a sustainable and affordable health insurance plan.

Wellness Programs and Their Impact on Premiums

Investing in employee wellness programs isn’t just a feel-good initiative; it’s a smart business decision with a direct impact on your bottom line. Studies consistently show that healthier employees take fewer sick days, resulting in increased productivity and reduced healthcare costs. Wellness programs can include initiatives like on-site fitness facilities, subsidized gym memberships, health screenings, smoking cessation programs, and educational workshops on healthy eating and stress management. These programs demonstrate your commitment to employee well-being while simultaneously lowering your overall insurance premiums through reduced claims. For example, a company offering a comprehensive wellness program might see a 10-15% reduction in healthcare costs over time, according to data from the Society for Human Resource Management (SHRM). This translates to significant savings, especially for small businesses.

Employee Contribution Methods

The way you structure employee contributions significantly affects both your costs and employee morale. There are several methods to consider:

Several approaches exist for employee contributions, each with its own advantages and disadvantages. Careful consideration should be given to employee compensation and overall affordability.

| Contribution Method | Description | Pros | Cons |

|---|---|---|---|

| Percentage of Premium | Employees pay a fixed percentage of the total premium cost. | Simple to administer; allows for flexibility based on plan selection. | Can be challenging for employees with lower incomes; may lead to dissatisfaction if percentages are high. |

| Flat Dollar Amount | Employees contribute a fixed dollar amount each month, regardless of the plan’s cost. | Predictable for employees; easier budgeting for both employer and employee. | May not be equitable for employees selecting different plans with varying costs. |

| Tiered Contribution | Employees contribute different amounts depending on the plan chosen (e.g., higher contribution for a more comprehensive plan). | Offers employees choices; encourages cost-consciousness; aligns costs with plan benefits. | More complex to administer; requires careful consideration of plan tiers and contribution levels. |

Sample Employee Benefits Package for an Idaho Small Business

Let’s imagine a hypothetical small business in Idaho, “Boise Brew Co.,” with 15 employees. They’ve decided to offer a competitive benefits package to attract and retain talent. Their sample package could include:

A well-structured benefits package attracts and retains top talent. Boise Brew Co.’s example shows a balance between cost-effectiveness and employee satisfaction.

| Benefit | Description |

|---|---|

| Health Insurance | Offering a choice between two plans: a Bronze plan (higher employee contribution, lower employer cost) and a Silver plan (lower employee contribution, higher employer cost). Employees contribute a percentage of the premium, with a tiered system based on plan choice. |

| Dental Insurance | Basic dental coverage offered at a reasonable cost. Employee contributions are a fixed dollar amount per month. |

| Vision Insurance | Vision coverage included as part of the overall benefits package. No employee contribution required. |

| Paid Time Off (PTO) | Accrued PTO based on tenure, offering a competitive amount of paid time off. |

| Wellness Program | Gym memberships subsidized; on-site yoga classes offered once a week; annual health screenings provided. |

Finding and Selecting an Insurance Provider

Source: successharbor.com

Choosing the right health insurance provider is crucial for Idaho small businesses. The right fit can significantly impact employee morale, productivity, and the company’s bottom line. A thorough research process is essential to avoid costly mistakes and ensure your employees receive the best possible coverage.

Finding the perfect insurance provider for your Idaho small business requires careful consideration and a strategic approach. This involves more than just comparing prices; it’s about understanding the nuances of each provider’s offerings and how well they align with your specific needs. Don’t underestimate the time and effort required – the payoff in terms of employee well-being and cost savings will be substantial.

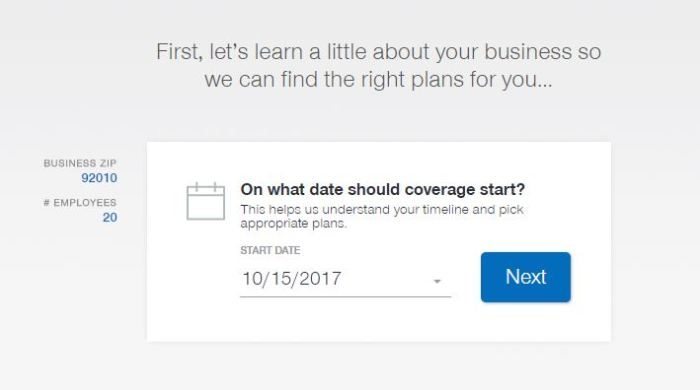

Researching and Comparing Insurance Providers

Effective research involves utilizing multiple resources. Start by leveraging online comparison tools that allow you to input your business specifics (number of employees, desired coverage levels, etc.) to receive customized quotes. Next, reach out directly to insurance brokers specializing in small business health insurance in Idaho. These brokers often have access to a wider range of plans and can provide personalized guidance. Don’t hesitate to check online reviews and ratings to gauge the experiences of other small business owners. Remember, the goal is to build a shortlist of providers that seem like a good fit based on initial research.

Key Factors to Consider When Choosing a Provider

Several key factors must be considered when selecting a health insurance provider. Network size is crucial; a larger network ensures your employees have access to a broader range of doctors and hospitals. Premium costs are obviously a major concern, but remember to consider the overall cost of care, including deductibles, co-pays, and out-of-pocket maximums. Administrative ease and the provider’s customer service responsiveness are also critical. A provider with a user-friendly online portal and responsive customer support can save you significant time and frustration. Finally, consider the provider’s financial stability and reputation for paying claims promptly and efficiently. Choosing a financially sound and reputable provider minimizes the risk of future complications.

Questions to Ask Potential Insurance Providers

Before committing to a provider, prepare a list of specific questions. These should cover aspects such as the provider’s network of physicians and hospitals within Idaho, details of the plan’s coverage (what’s included, what’s excluded), the process for filing claims, and the availability of various support resources. Inquire about the provider’s experience with small businesses and their ability to handle the unique needs of your company size. Don’t hesitate to ask about any hidden fees or potential increases in premiums. Finally, clarify the provider’s customer service policies and the methods for contacting them in case of questions or problems. Thorough questioning ensures you make an informed decision.

Employee Communication and Education

Open and effective communication is the cornerstone of a successful employee benefits program. Failing to clearly explain health insurance options can lead to confusion, dissatisfaction, and ultimately, higher administrative costs for your business. A proactive approach to educating your employees about their health insurance benefits fosters a more engaged and informed workforce.

Effective communication requires a multi-pronged strategy that utilizes various channels and formats to reach employees with different learning styles and preferences. This includes both initial onboarding and ongoing reinforcement of key information. Regular updates are crucial, especially given the ever-changing landscape of healthcare regulations and insurance plans.

Methods for Communicating Health Insurance Information

Clear, concise, and easily accessible information is key. This can be achieved through a combination of methods. For instance, a comprehensive employee handbook section dedicated to health insurance benefits provides a readily available reference point. Additionally, holding informational meetings or webinars allows for direct interaction and the opportunity to answer questions in real-time. Finally, utilizing internal communication channels like email newsletters or intranet postings ensures consistent reinforcement of key information. Consider creating short, easily digestible videos explaining complex concepts.

Examples of Educational Materials

A well-designed benefits guide is an essential tool. This guide should clearly Artikel plan options, including premiums, deductibles, co-pays, and out-of-pocket maximums. It should also explain the process of enrolling in a plan, filing claims, and accessing necessary healthcare services. Visual aids, such as charts and graphs, can make complex information more accessible. Supplement the guide with FAQs addressing common employee questions. For example, a question about using the company’s preferred provider network could be addressed with a clear explanation of the benefits and how to find in-network doctors. Consider creating a glossary of healthcare terms to demystify jargon.

Addressing Employee Concerns and Questions

Establish a clear process for addressing employee questions and concerns. This could involve designating a specific HR representative as the point of contact for health insurance inquiries. Regularly scheduled Q&A sessions, either in person or via online forums, provide a platform for open dialogue and address concerns proactively. Maintaining an updated FAQ document on the company intranet allows employees to find answers to common questions independently. For more complex issues, providing access to a dedicated benefits consultant can ensure employees receive timely and accurate guidance. Remember, addressing employee concerns promptly and thoroughly builds trust and fosters a positive work environment.

Illustrative Examples of Health Insurance Plans

Source: successharbor.com

Choosing the right health insurance plan for your Idaho small business can feel overwhelming. The market offers a variety of options, each with its own strengths and weaknesses regarding coverage, cost, and network access. Understanding the key differences between plans is crucial for making an informed decision that best suits your employees’ needs and your budget. Let’s examine three common types of plans.

Health Maintenance Organization (HMO) Plan

HMO plans typically offer lower premiums in exchange for a more restricted network of doctors and hospitals. You’ll generally need to choose a primary care physician (PCP) within the network who will then refer you to specialists. While this can sometimes add an extra step, the benefit is often lower out-of-pocket costs. For example, an HMO plan might have a $50 copay for a doctor’s visit and a low deductible, meaning you’ll pay less out-of-pocket before the insurance kicks in significantly. However, if you need to see a specialist outside the network, your costs could be significantly higher, potentially negating the initial premium savings. Network limitations can also be a drawback if your employees live in a more rural area of Idaho with fewer in-network providers.

Preferred Provider Organization (PPO) Plan, Idaho small business health insurance

PPO plans provide more flexibility than HMOs. They generally allow you to see any doctor or specialist, in-network or out-of-network, without needing a referral. However, this flexibility often comes at the cost of higher premiums. While you’ll pay more upfront, the out-of-pocket maximum might be comparable to an HMO, limiting your total annual spending. For instance, a PPO might have a higher copay for in-network visits (perhaps $100), but seeing an out-of-network provider would simply result in a higher cost share, rather than complete denial of coverage. The wider network choice is a significant advantage for businesses with employees spread across the state or those who value the freedom to choose their own healthcare providers.

Point of Service (POS) Plan

POS plans blend features of both HMOs and PPOs. They usually require you to select a PCP within the network, but offer the option to see out-of-network providers for a higher cost. This provides a middle ground between the cost-effectiveness of an HMO and the flexibility of a PPO. Think of it as an HMO with a safety net. A POS plan might have lower premiums than a PPO but higher than an HMO. Copays and deductibles would likely fall somewhere between the two, providing a balance between cost and choice. For example, a POS plan might have a $75 copay for in-network visits and a higher cost-sharing percentage for out-of-network care. This option can be suitable for businesses seeking a compromise between cost control and provider choice.

Final Thoughts

Securing affordable and comprehensive health insurance for your Idaho small business doesn’t have to be a headache-inducing ordeal. By understanding the landscape, comparing your options, and employing smart strategies, you can create a benefits package that attracts and retains top talent while keeping your business financially afloat. Remember, a healthy team is a productive team, and with the right approach, you can navigate the complexities of health insurance and emerge victorious. So, ditch the overwhelm and embrace the clarity – your employees (and your bottom line) will thank you.