Insurance. It’s a word that conjures up images of paperwork, fine print, and maybe a little boredom. But the truth is, insurance is your financial safety net, a crucial component of adulting that often gets overlooked until it’s too late. Understanding the different types of insurance – from life and health to property and liability – is key to protecting yourself and your loved ones from unforeseen circumstances. This isn’t just about avoiding financial ruin; it’s about securing peace of mind and building a solid foundation for your future.

We’ll dive deep into the world of insurance, breaking down the complexities into easily digestible chunks. We’ll explore the factors that affect premiums, navigate the claims process, and even peek into the future of this ever-evolving industry. Get ready to ditch the insurance anxiety and embrace the power of protection.

Types of Insurance

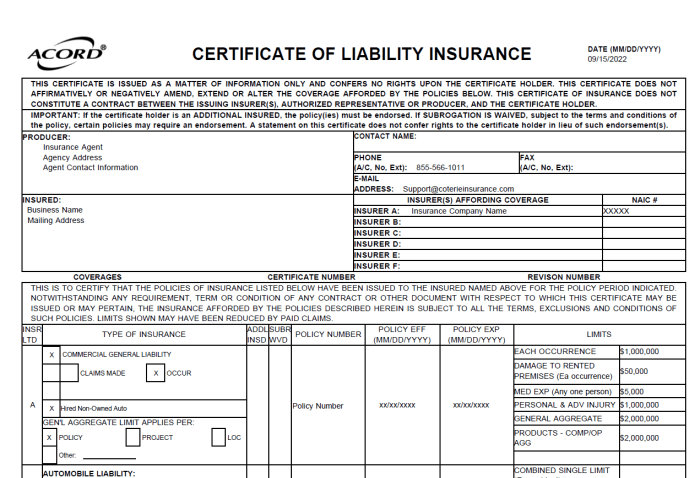

Source: coterieinsurance.com

Navigating the world of insurance can feel like deciphering a complex code. But understanding the basics is crucial for protecting yourself and your loved ones from life’s unexpected twists and turns. This guide breaks down common insurance types, helping you make informed decisions about your financial well-being.

Life Insurance

Life insurance provides a financial safety net for your dependents in the event of your death. The payout, or death benefit, helps cover expenses like funeral costs, outstanding debts, and ongoing living expenses for your family. There are several types of life insurance, each with its own set of features and costs.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period (the term), typically ranging from 10 to 30 years. It’s generally more affordable than whole life insurance, making it a popular choice for those on a budget or needing coverage for a specific period, such as paying off a mortgage. Whole life insurance, on the other hand, provides lifelong coverage, and often includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn, but it reduces the death benefit. The choice between term and whole life depends heavily on individual financial goals and risk tolerance. For example, a young family starting out might opt for term life insurance to cover their mortgage, while someone with significant wealth might prefer the lifelong coverage and cash value accumulation of whole life insurance.

Homeowners Insurance vs. Renters Insurance

Homeowners insurance protects your home and its contents from various perils, including fire, theft, and weather damage. It also provides liability coverage if someone is injured on your property. Renters insurance, conversely, covers your personal belongings within a rented property and provides liability protection for accidents that occur in your rented space. While homeowners insurance protects the structure of the house itself, renters insurance focuses on protecting your personal assets and offering liability coverage. Imagine a scenario where a fire damages your apartment. Homeowners insurance would cover the building’s repairs, while your renters insurance would cover the replacement of your damaged furniture and personal belongings.

| Insurance Type | Coverage | Target Audience | Key Benefits |

|---|---|---|---|

| Auto Insurance | Liability, collision, comprehensive | Car owners | Financial protection in accidents, legal representation |

| Health Insurance | Medical expenses, hospitalization | Individuals, families | Access to affordable healthcare, reduced financial burden during illness |

| Disability Insurance | Income replacement during disability | Working individuals | Maintain financial stability during periods of inability to work |

| Umbrella Insurance | Additional liability coverage | High-net-worth individuals | Enhanced protection against significant liability claims |

Insurance Premiums and Factors

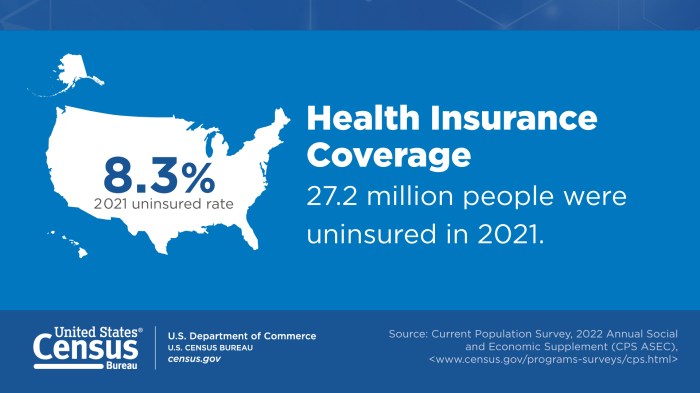

Source: census.gov

Understanding your insurance premium isn’t rocket science, but it does involve a few key factors. Think of it like this: insurance companies assess risk, and your premium reflects how much risk you represent. The higher the perceived risk, the higher your premium. Let’s break down what influences those costs.

Several interconnected elements contribute to the final figure you see on your insurance bill. It’s a complex calculation, but understanding the basics can empower you to make informed decisions and potentially save money.

Factors Influencing Insurance Premium Costs

A multitude of factors feed into the insurance premium calculation. These range from easily quantifiable aspects like your driving record to more nuanced considerations like your location and the type of coverage you choose. The insurer uses statistical models and historical data to assess the probability of you filing a claim. This probability directly impacts the premium you pay.

Age, Health Status, and Driving Record Impact on Premiums

Your age often plays a significant role. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. As you age and gain experience, your premiums typically decrease. Similarly, your health status can affect premiums for health insurance. Pre-existing conditions or a family history of certain illnesses might lead to higher premiums, reflecting the increased likelihood of needing costly medical care. For car insurance, a clean driving record translates to lower premiums. Accidents, speeding tickets, and DUI convictions significantly increase your perceived risk and thus your premium.

Impact of Deductibles and Coverage Limits on Premium Costs

Deductibles and coverage limits are two sides of the same coin. Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible means a lower premium because you’re taking on more financial responsibility. Conversely, a lower deductible translates to a higher premium, as the insurance company bears more of the risk upfront. Coverage limits define the maximum amount your insurance will pay for a claim. Higher coverage limits naturally mean higher premiums, as the insurer is committing to pay more in the event of a significant loss.

Hypothetical Scenario: Premium Calculation Variations

Let’s imagine Sarah, a 25-year-old with a clean driving record. She’s considering two car insurance options:

Option A: $1,000 deductible, $100,000 liability coverage – Premium: $1,200 annually.

Option B: $500 deductible, $100,000 liability coverage – Premium: $1,400 annually.

Notice that Option A, with the higher deductible, results in a lower annual premium. Sarah is effectively paying less upfront in exchange for assuming more risk if she were to be involved in an accident. She’d pay $500 more out-of-pocket in the event of a claim, but save $200 annually on her premium. This is a classic trade-off many people face when choosing insurance plans.

Claims Process and Procedures

Navigating the insurance claims process can feel like wading through treacle, but understanding the steps involved can significantly ease the frustration. Knowing what to expect and how to prepare your documentation can make all the difference between a smooth resolution and a drawn-out battle. This section Artikels the typical claims process, common reasons for denial, and best practices for a successful claim.

Filing an Insurance Claim: A Step-by-Step Guide

The first step is always reporting the incident to your insurer as soon as possible. This usually involves contacting them by phone or through their online portal. Next, you’ll need to gather all relevant documentation, including police reports (if applicable), medical records, repair estimates, and photos of the damage. Then, you’ll complete a claim form, providing detailed information about the incident and the damages incurred. The insurer will then review your claim, potentially requesting further information or conducting an investigation. Finally, once the investigation is complete and the claim is approved, you’ll receive payment or reimbursement. Remember, response times vary depending on the insurer and the complexity of the claim.

Common Reasons for Insurance Claim Denials

Claims can be denied for several reasons, often stemming from policy exclusions, insufficient documentation, or fraudulent activity. For example, a claim might be denied if the damage is deemed pre-existing, if the policyholder failed to meet their reporting obligations, or if the claim involves a situation explicitly excluded in the policy wording (like damage caused by a pre-existing condition not disclosed during application). Another frequent reason is inadequate documentation; failing to provide sufficient evidence to support the claim can lead to denial. Finally, attempts to defraud the insurer, such as exaggerating damages or filing a false claim, will almost certainly result in denial and potential legal consequences.

Best Practices for Documenting and Supporting an Insurance Claim

Thorough documentation is crucial for a successful claim. This includes detailed records of the incident, such as dates, times, locations, and witnesses. Maintain meticulous records of all communication with the insurer, including email correspondence, phone call notes, and claim numbers. Gather comprehensive evidence supporting your claim, such as photos, videos, repair estimates, and medical bills. The more complete and well-organized your documentation, the stronger your case will be. Consider keeping all documentation in a dedicated file, both physical and digital, for easy access.

Handling a Car Accident Claim

Following a car accident, immediately prioritize safety: check for injuries, call emergency services if needed, and move vehicles to a safe location if possible. Then, exchange information with the other driver(s), including names, addresses, phone numbers, driver’s license numbers, insurance information, and vehicle details. Take photos and videos of the accident scene, including damage to all vehicles, surrounding environment, and any visible injuries. Obtain contact information from any witnesses. Report the accident to your insurer as soon as possible, and follow their instructions for submitting your claim. Necessary documentation includes the police report (if applicable), photos and videos of the accident scene and vehicle damage, medical records (if any injuries occurred), repair estimates, and communication records with the other driver and the insurance company. Remember, accuracy and completeness are key.

Insurance Regulations and Compliance

Navigating the world of insurance isn’t just about premiums and payouts; it’s also about understanding the intricate web of regulations designed to protect both consumers and the industry’s stability. These rules, set at various levels of government, are crucial for ensuring fair practices and preventing market instability.

Government regulations play a vital role in maintaining order and trust within the insurance industry. They act as a safety net, preventing unfair practices and ensuring insurers operate responsibly. This involves setting minimum capital requirements, licensing insurers, and overseeing their financial solvency. Without these regulations, the industry could be vulnerable to collapse, leaving policyholders unprotected. These regulations also establish standards for policy language, preventing ambiguity and ensuring clarity for consumers.

The Role of Government Regulations in the Insurance Industry

Government oversight of the insurance sector is multifaceted. It encompasses aspects like setting minimum capital and reserve requirements to ensure insurers can meet their obligations. This prevents situations where an insurer becomes insolvent and unable to pay out legitimate claims. Furthermore, regulations dictate the types of insurance products that can be offered, ensuring a certain level of standardization and consumer protection. Licensing requirements for insurers and agents also ensure a level of competency and professionalism within the industry. Regular audits and inspections further maintain compliance and identify potential risks. The specific regulatory bodies vary by country and state, but the overall aim remains consistent: to protect consumers and maintain market stability.

The Importance of Consumer Protection Laws in Insurance

Consumer protection laws in insurance are paramount. They aim to prevent unfair or deceptive practices by insurers, such as misleading advertising or discriminatory underwriting. These laws often include provisions for clear and concise policy language, ensuring consumers understand the terms and conditions of their coverage. They also typically establish procedures for handling complaints and resolving disputes, offering avenues for redress if an insurer acts unfairly. Examples of consumer protection measures include regulations regarding the disclosure of policy information, restrictions on unfair claims practices, and the establishment of consumer protection agencies to handle complaints. These laws ensure a fair playing field and protect vulnerable individuals from exploitative practices.

Potential Legal Issues Related to Insurance Fraud

Insurance fraud, encompassing both acts committed by policyholders and insurers, represents a significant legal challenge. For policyholders, this can involve exaggerating claims, providing false information to obtain coverage, or even staging accidents to receive payouts. Insurers, on the other hand, might engage in practices like denying legitimate claims or unfairly increasing premiums. The legal consequences of insurance fraud can be severe, including hefty fines, imprisonment, and a damaged reputation. Investigations often involve detailed forensic accounting and evidence gathering, with legal proceedings following established procedures. Examples of common insurance fraud schemes include staged car accidents, fraudulent medical claims, and arson for insurance purposes. These actions not only harm individuals but also destabilize the insurance market as a whole, leading to increased premiums for everyone.

A Comparison of Insurance Regulations Across Different Jurisdictions

Insurance regulations vary significantly across countries and even within different states of a single country. For instance, the level of government oversight, the specific consumer protection laws, and the penalties for insurance fraud can differ considerably. Some countries may have a more heavily regulated insurance market with stricter rules and more stringent enforcement, while others may have a more liberal approach. These differences reflect varying philosophies on the balance between promoting competition and protecting consumers. Comparing the regulatory frameworks of, say, the United States and the European Union, reveals significant disparities in the approaches to consumer protection, licensing requirements, and market oversight. This highlights the importance of understanding the specific regulations in the relevant jurisdiction when dealing with insurance matters.

The Future of Insurance

Source: etb2bimg.com

The insurance landscape is undergoing a dramatic transformation, driven by rapid technological advancements and evolving customer expectations. No longer a static industry relying on paperwork and manual processes, insurance is embracing innovation at a breakneck pace, leading to more efficient operations, personalized services, and entirely new product offerings. This shift promises a future where insurance is more accessible, affordable, and relevant to the needs of individuals and businesses alike.

The integration of technology is reshaping every facet of the insurance industry, from how risks are assessed to how claims are handled. This evolution isn’t just about incremental improvements; it’s about fundamental changes in how insurance operates and interacts with its customers.

Telematics and AI in Insurance

Telematics, the use of technology to monitor and analyze vehicle usage, is already transforming the auto insurance sector. Devices installed in cars collect data on driving behavior, such as speed, braking, and acceleration. This data allows insurers to offer usage-based insurance (UBI) programs, rewarding safer drivers with lower premiums. AI plays a crucial role here, analyzing the vast amounts of telematics data to identify patterns and predict risks more accurately. For example, a driver consistently maintaining a safe speed and avoiding harsh braking might receive a significant discount, while a driver with a history of risky driving behavior might face higher premiums. This personalized approach to risk assessment is fairer and more efficient than traditional methods.

Technological Impact on Claims Processing and Risk Assessment

The impact of technology on claims processing is equally significant. AI-powered systems can automate many aspects of the claims process, from initial claim registration to damage assessment and fraud detection. Image recognition software can analyze photos of damaged vehicles or properties to estimate repair costs, speeding up the claims settlement process and reducing processing times. Furthermore, AI algorithms can analyze vast datasets to identify patterns of fraudulent claims, helping insurers mitigate losses and protect their financial stability. For instance, a system might flag a claim as potentially fraudulent if it detects inconsistencies between the reported damage and the photographic evidence.

Future Innovations in Insurance Products and Services

The future of insurance promises a range of innovative products and services tailored to individual needs. Predictive analytics, powered by AI and machine learning, will enable insurers to offer personalized risk assessments and tailored coverage options. For example, insurers might offer customized health insurance plans based on an individual’s genetic predisposition to certain diseases. Blockchain technology could revolutionize the claims process, making it more transparent and secure. Micro-insurance, offering smaller, more affordable coverage options, will become increasingly prevalent, expanding insurance access to underserved populations. Insurtech startups are constantly developing innovative solutions, pushing the boundaries of traditional insurance models and creating a more dynamic and competitive market.

The Evolution of Insurance: An Infographic

The infographic would be structured chronologically, showing the evolution of insurance from its early forms to its anticipated future state.

Panel 1: Early Insurance (circa 17th Century): This panel would depict a simple illustration of a merchant ship at sea, representing the early forms of marine insurance, with text describing the rudimentary risk-sharing agreements between merchants to protect against losses at sea. Key features would include the limited scope of coverage, primarily focused on maritime trade, and the manual processes involved in managing risks and settling claims.

Panel 2: The Rise of Modern Insurance (19th-20th Centuries): This panel would illustrate the establishment of large insurance companies, perhaps with a stylized image of a grand insurance building, and the expansion of insurance products to cover a wider range of risks. The text would highlight the development of standardized contracts, the growth of actuarial science, and the increasing importance of regulatory frameworks.

Panel 3: The Digital Age of Insurance (Late 20th-Early 21st Centuries): This panel would depict a computer screen with data streams and charts, symbolizing the introduction of computers and digital technologies in insurance operations. The text would describe the automation of processes, the emergence of online insurance platforms, and the initial use of data analytics in risk assessment.

Panel 4: The Future of Insurance (21st Century and Beyond): This panel would showcase a futuristic scene, possibly featuring interconnected devices and AI-powered systems, symbolizing the integration of advanced technologies like AI, blockchain, and IoT in insurance. The text would highlight personalized insurance products, predictive risk assessment, and the use of AI for claims processing and fraud detection. It would also emphasize the growing importance of data security and ethical considerations in the use of AI in the insurance industry.

Insurance and Financial Planning

Insurance isn’t just about avoiding hefty repair bills after a car accident; it’s a cornerstone of a solid financial plan. Think of it as a safety net, protecting your hard-earned assets and future goals from the unpredictable punches life throws. A comprehensive financial plan incorporates insurance to safeguard against significant financial setbacks, allowing you to weather storms and stay on track towards your long-term objectives.

A well-structured financial plan considers various life stages and potential risks. Insurance plays a crucial role in mitigating these risks, transforming potential catastrophes into manageable inconveniences. By strategically allocating resources to different insurance types, individuals can effectively protect their financial well-being and ensure their families’ future security.

The Role of Insurance in Financial Security

Insurance acts as a buffer against unexpected expenses. Without it, a single catastrophic event – a serious illness, a house fire, or a lawsuit – could wipe out years of savings and derail carefully laid financial plans. Different insurance policies address specific risks, creating a layered protection that ensures financial stability. For instance, health insurance protects against medical costs, life insurance provides for dependents after death, and property insurance covers damage to your home or belongings. This diversified approach minimizes the impact of unforeseen circumstances, allowing individuals to maintain financial stability and continue pursuing their goals.

Insurance Protection Against Various Financial Risks

Different insurance types offer protection against a wide range of financial risks. Life insurance, for example, replaces lost income if the primary breadwinner passes away, ensuring financial support for dependents. Disability insurance provides income replacement if an illness or injury prevents someone from working. Homeowners or renters insurance protects against property damage from fire, theft, or natural disasters. Auto insurance covers liability and damage related to car accidents. Health insurance mitigates the high cost of medical care, preventing financial ruin from unexpected illnesses or injuries. Each policy serves a specific purpose, contributing to a comprehensive safety net.

Mitigating the Impact of Unexpected Events

Let’s imagine a scenario: Sarah loses her job unexpectedly. Without unemployment insurance, she faces immediate financial hardship. However, unemployment benefits provide temporary income, allowing her to pay bills and search for a new position without depleting her savings. Or consider John, diagnosed with a serious illness. Without health insurance, the medical bills could be devastating. But with comprehensive health coverage, the financial burden is significantly reduced, allowing him to focus on his recovery. These examples highlight how insurance can cushion the blow of unforeseen events, preventing financial ruin and allowing individuals to navigate challenging times.

Steps to Build a Robust Insurance Portfolio

Building a robust insurance portfolio is a crucial step in securing your financial future. It’s a process that requires careful consideration of your individual needs and circumstances. Here’s a step-by-step guide:

- Assess your risks: Identify potential financial threats, such as illness, accidents, job loss, and property damage.

- Determine your insurance needs: Based on your risk assessment, decide what types of insurance are necessary to protect your assets and income.

- Compare policies: Shop around and compare coverage options and premiums from different insurers.

- Choose appropriate coverage levels: Select coverage amounts that adequately protect against potential losses.

- Regularly review your policies: As your life circumstances change, review your insurance needs and adjust your coverage accordingly.

Last Recap

So, there you have it – a whirlwind tour of the insurance landscape. From understanding the various types of coverage to mastering the claims process, we’ve covered the essentials. Remember, insurance isn’t just about paying premiums; it’s about investing in your future security. By understanding your options and making informed choices, you can build a robust insurance portfolio that protects you from life’s curveballs. Don’t wait for disaster to strike – take control of your financial well-being today. Your future self will thank you.