Insurance options for small business owners: navigating the world of policies can feel like decoding ancient hieroglyphs. But fear not, fellow entrepreneurs! This isn’t about wading through endless jargon; it’s about understanding how the right coverage can protect your hustle, your dreams, and your hard-earned cash. We’re diving deep into the various types of insurance—from the everyday essentials to the specialized shields you might need, depending on your unique business. Get ready to arm your business with the protection it deserves.

This guide breaks down the complexities of small business insurance into digestible chunks. We’ll explore the different types of insurance, the factors that influence costs, how to find the right provider, and how to manage your policies effectively. We’ll also look at specific industry needs and the legal side of things, making sure you’re not just covered, but confidently covered.

Types of Insurance

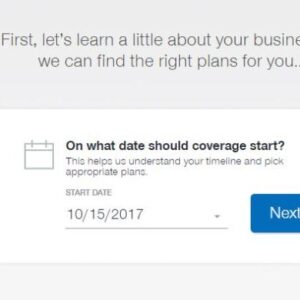

Source: medium.com

Navigating the world of small business insurance can feel like a maze, but understanding your options is key. For legal professionals, a crucial component is securing adequate coverage, and you can easily get started by checking out a legal malpractice insurance quote to see what fits your needs. This is just one piece of the puzzle when it comes to protecting your business; remember to explore other vital insurance types as well.

Navigating the world of insurance as a small business owner can feel like deciphering a complex code. But understanding the different types of insurance available is crucial for protecting your business from unforeseen risks and financial setbacks. Choosing the right coverage can mean the difference between weathering a storm and being completely wiped out. Let’s break down the essential types of insurance you should consider.

General Liability Insurance

General liability insurance protects your business from financial losses due to accidents, injuries, or property damage that occur on your premises or as a result of your business operations. This is a cornerstone of small business insurance, covering things like a customer slipping and falling in your store, or damage caused by your employee to a client’s property. It typically covers medical expenses, legal fees, and settlements. The amount of coverage varies depending on your business’s specific needs and risk profile. A bakery, for example, might need less coverage than a construction company.

Professional Liability Insurance (Errors and Omissions Insurance)

Also known as Errors and Omissions (E&O) insurance, this policy protects professionals from claims of negligence or mistakes in their services. If you’re a consultant, lawyer, accountant, or other professional providing services, this insurance is vital. It covers costs associated with defending against lawsuits alleging errors or omissions in your professional work, protecting your reputation and financial stability. For instance, an architect could be sued if a design flaw leads to structural problems in a building.

Property Insurance

Property insurance safeguards your physical assets, such as your office building, equipment, inventory, and even furniture. This coverage protects against losses from events like fire, theft, vandalism, and natural disasters. The policy typically covers the cost of repairing or replacing damaged property, helping you get back on your feet quickly after a disaster. A small retail store, for example, would want to insure its inventory and storefront against fire damage.

Workers’ Compensation Insurance, Insurance options for small business owners

If you have employees, workers’ compensation insurance is mandatory in most states. This insurance covers medical expenses and lost wages for employees injured on the job. It also protects your business from lawsuits related to workplace injuries. The premiums are based on factors like the number of employees, the type of work, and the company’s claims history. A landscaping business, for example, might have higher premiums than a software company due to the higher risk of physical injury.

Health Insurance

While not strictly a business insurance policy, offering health insurance to your employees can be a powerful recruitment and retention tool, boosting morale and attracting top talent. The Affordable Care Act (ACA) provides guidelines and potential tax credits for small businesses offering health insurance to their employees. The cost of health insurance varies greatly depending on the plan chosen and the number of employees.

Business Interruption Insurance

Business interruption insurance covers your lost income and ongoing expenses if your business is forced to shut down due to a covered event, such as a fire, flood, or other disaster. This policy helps bridge the gap until your business can resume operations, preventing financial ruin during a period of inactivity. A restaurant facing a temporary closure due to a fire, for instance, could use this insurance to cover rent and employee salaries.

Comparison of Insurance Types

| Insurance Type | Coverage Details | Cost Factors | Example of Covered Loss |

|---|---|---|---|

| General Liability | Bodily injury, property damage, advertising injury | Business size, industry, claims history | Customer injured on premises |

| Professional Liability | Negligence, errors, omissions in professional services | Professional services provided, claims history | Accountant makes a mistake on a tax return |

| Property Insurance | Building damage, equipment loss, inventory damage | Value of assets, location, building type | Fire damage to office building |

| Workers’ Compensation | Medical expenses, lost wages for employee injuries | Number of employees, industry, claims history | Employee injured while operating machinery |

| Business Interruption | Lost income, ongoing expenses during business interruption | Business revenue, length of potential interruption | Lost revenue due to a flood |

Factors Affecting Insurance Costs

Securing the right insurance for your small business is crucial, but understanding the factors that influence the cost is just as important. Premiums aren’t arbitrary; they’re calculated based on a variety of factors, some within your control and others not. Knowing these influences can help you make informed decisions and potentially save money.

Industry, location, and business size are key elements that significantly impact your insurance premiums. These broad factors set the stage for a more detailed risk assessment, influencing the overall cost of your coverage. Beyond these basics, your claims history and the insurer’s risk assessment play a pivotal role in determining your final premium.

Industry

The type of business you operate significantly affects your insurance costs. High-risk industries, like construction or manufacturing, typically face higher premiums due to the increased likelihood of accidents and liability claims. Conversely, businesses in lower-risk sectors, such as administrative services, might enjoy lower premiums. This difference reflects the inherent risks associated with each industry. For example, a construction company will likely pay more for liability insurance than a consulting firm due to the higher potential for workplace injuries and property damage.

Location

Your business’s geographic location is another critical factor. Areas with higher crime rates or a greater frequency of natural disasters (earthquakes, hurricanes, floods) will generally result in higher premiums. Insurers consider the statistical likelihood of claims in specific locations when setting rates. A bakery located in a high-crime area might pay more for property insurance than one in a safer neighborhood, reflecting the increased risk of theft or vandalism. Similarly, a bakery situated in a hurricane-prone region would likely pay more for property insurance than one in a less vulnerable area.

Business Size

The size of your business, measured by factors like employee count and revenue, directly impacts your insurance costs. Larger businesses, with more employees and higher revenue, typically face higher premiums because they present a greater potential for claims. This is simply due to the increased exposure to risk. A small bakery with two employees will likely have lower premiums than a large chain bakery with hundreds of employees. The larger operation presents a larger target for potential liability claims and greater potential for property damage.

Claims History

Your past claims history is a significant factor in determining future premiums. A history of frequent or substantial claims will likely lead to higher premiums, reflecting the increased risk you pose to the insurer. Conversely, a clean claims history can result in lower premiums, as you’re demonstrating a lower risk profile. Insurers use this data to predict the likelihood of future claims, which directly affects the cost of your coverage. A bakery with a history of numerous slip-and-fall claims might see a significant increase in their liability insurance premiums compared to a bakery with a spotless record.

Risk Assessment

Insurance companies conduct thorough risk assessments to evaluate the potential for claims. This involves examining various aspects of your business, including safety procedures, security measures, and overall risk management practices. A bakery with robust safety protocols, comprehensive security systems, and a strong commitment to risk management may receive lower premiums compared to a bakery lacking these measures. The assessment process identifies potential hazards and assesses the likelihood of incidents, ultimately impacting the premium calculation.

Hypothetical Scenario: The “Sweet Success” Bakery

Imagine two bakeries: “Sweet Success A” and “Sweet Success B.” Both are located in the same city but differ in several key aspects. Sweet Success A is a small bakery with two employees, located in a low-crime area with a spotless claims history. They have implemented robust safety measures. Sweet Success B is a larger bakery with ten employees, located in a high-crime area, with a history of several liability claims due to minor accidents. Sweet Success B also has weaker security measures. Sweet Success A will undoubtedly enjoy significantly lower insurance premiums compared to Sweet Success B, reflecting the differences in risk profiles. This difference highlights how multiple factors interact to determine the final cost.

Finding the Right Insurance Provider

Navigating the world of small business insurance can feel like wading through a swamp of jargon and confusing policies. But finding the right provider doesn’t have to be a headache. With a little strategic planning and the right approach, you can secure the coverage your business needs at a price that works for you. This section will equip you with the tools to confidently choose the best insurance provider for your unique needs.

Finding the perfect insurance provider is a multi-step process that requires research, comparison, and careful consideration. It’s an investment in your business’s future, so taking the time to do it right is crucial. Think of it like choosing the right business partner – you need someone reliable, trustworthy, and capable of supporting you when things get tough.

Steps to Finding a Suitable Insurance Provider

Begin your search by identifying your insurance needs. Do you need general liability, professional liability, commercial auto, or workers’ compensation insurance? Once you have a clear understanding of your requirements, you can start your search. Next, leverage online resources and recommendations. Many websites allow you to compare quotes from multiple providers simultaneously. Word-of-mouth referrals from other business owners in your industry can also be invaluable. Finally, don’t hesitate to reach out to several providers directly. Schedule consultations to discuss your needs and ask questions. This allows you to assess their responsiveness and expertise firsthand.

Comparing Insurance Quotes and Evaluating Companies

Once you’ve gathered quotes from several providers, it’s time to compare apples to apples. Don’t just focus on the premium; look at the coverage details. A lower premium might mean less comprehensive protection. Consider factors like deductibles, policy limits, and exclusions. Also, research the financial stability and reputation of each company. Check their ratings with organizations like AM Best or Standard & Poor’s. These ratings reflect the insurer’s ability to pay claims. For example, a company with a high rating indicates a greater financial stability, giving you more confidence in their ability to fulfill their obligations should you need to file a claim. Compare customer service reviews as well; a responsive and helpful insurer can make a significant difference during a claim.

Importance of Reading Policy Documents Carefully

Before signing on the dotted line, thoroughly review the policy documents. Don’t just skim; read each section carefully. Pay close attention to the definitions of covered events, exclusions, and limitations. Understanding the fine print is essential to avoid unpleasant surprises later. For instance, a seemingly minor exclusion could significantly impact your coverage in the event of a claim. If you find anything unclear, don’t hesitate to contact the provider for clarification. It’s better to ask questions now than to regret it later. Imagine discovering a crucial exclusion after a significant loss – that’s a scenario you definitely want to avoid.

Questions to Ask Potential Insurance Providers

Asking the right questions is key to making an informed decision. Here are some crucial questions to ask potential providers: What types of coverage do you offer? What are your policy limits and deductibles? What is your claims process like? What is your customer service record like? How long have you been in business? What is your financial stability rating? Do you offer any discounts? What are your cancellation policies? These questions will help you assess the provider’s suitability and ensure you’re getting the best possible coverage for your needs. Don’t be afraid to ask follow-up questions to gain a deeper understanding of their responses. Remember, this is a significant investment for your business, so thorough due diligence is essential.

Managing Insurance Policies

So you’ve got your small business insurance sorted – great! But don’t think that’s the end of the story. Just like your business itself, your insurance needs constant attention to ensure it remains relevant, effective, and cost-efficient. Regular review and proactive management are key to protecting your hard-earned investment.

Regularly reviewing and updating your insurance policies isn’t just a good idea; it’s a necessity. Your business landscape is constantly shifting – new equipment, expanding operations, changing employee numbers – and your insurance needs to keep pace. Failing to do so could leave you significantly underinsured and vulnerable to substantial financial losses.

Policy Review and Updates

Regularly reviewing your policies ensures your coverage aligns with your current business needs and risk profile. This involves checking policy limits, deductibles, and coverage details against your current assets, liabilities, and potential risks. For example, if your business has expanded significantly, your current liability coverage might be insufficient. Annual reviews are recommended, but more frequent checks are advisable if your business undergoes major changes. Consider scheduling reminders in your calendar to ensure timely reviews. This proactive approach prevents gaps in coverage and potential financial headaches down the line.

Filing a Claim

Navigating the claims process can feel daunting, but being prepared can significantly ease the burden. The first step is to promptly report the incident to your insurer, following the instructions Artikeld in your policy documents. Gather all relevant documentation, including photos, police reports (if applicable), and any other evidence supporting your claim. Maintain clear and concise communication with your insurer throughout the process, promptly responding to any requests for information. Remember, detailed record-keeping is crucial. For instance, if a fire damages your business, having a detailed inventory of lost assets will expedite the claims process and ensure you receive fair compensation.

Minimizing Insurance Costs

While comprehensive coverage is crucial, finding ways to manage costs is equally important. Implementing robust risk management strategies can significantly impact your premiums. This might involve investing in security systems, implementing employee safety training, or regularly maintaining equipment to reduce the likelihood of accidents or damage. Shop around and compare quotes from different insurers. Don’t hesitate to negotiate premiums – insurers are often willing to work with businesses to find mutually beneficial arrangements. Bundling different types of insurance, such as property and liability, can also lead to potential savings. For example, opting for a comprehensive package instead of separate policies can offer discounts.

Small Business Insurance Policy Management Checklist

A well-organized approach is essential for managing your insurance effectively. Here’s a checklist to guide you:

- Annual Policy Review: Schedule a yearly review to assess your coverage needs.

- Documentation: Maintain a central, organized file containing all policy documents, claims information, and relevant correspondence.

- Risk Assessment: Regularly assess potential risks to your business and adjust your coverage accordingly.

- Premium Comparison: Shop around for competitive premiums from different insurers at least every two years.

- Emergency Contact Information: Keep your insurer’s emergency contact information readily available.

- Claims Process Understanding: Familiarize yourself with your insurer’s claims process to ensure a smooth and efficient experience.

Following this checklist helps ensure you’re adequately protected while minimizing unnecessary expenses. Remember, proactive management is key to safeguarding your business’s future.

Specific Industry Needs

Your small business is unique, and so are its insurance needs. One size doesn’t fit all when it comes to protecting your livelihood. Understanding the specific risks inherent in your industry is crucial to securing the right coverage and avoiding costly surprises down the road. Ignoring industry-specific needs can leave significant gaps in your protection, potentially jeopardizing your entire operation.

Different industries face vastly different risks. A tech startup’s concerns differ wildly from those of a restaurant or a construction company. This means their insurance needs will also vary significantly. Let’s delve into some examples to illustrate this point.

Insurance Needs for Restaurants

Restaurants face a unique set of risks, including foodborne illnesses, slip-and-fall accidents, and even fire damage from kitchen equipment. Comprehensive General Liability insurance is essential to cover claims arising from customer injuries or property damage. Product Liability insurance protects against claims related to food poisoning or contaminated food. Business interruption insurance can help cover lost revenue if the restaurant is forced to close due to an unforeseen event, like a fire or a health code violation. Workers’ compensation insurance is also crucial to protect employees injured on the job. A restaurant might also consider liquor liability insurance if they serve alcohol.

Insurance Needs for Tech Startups

Tech startups, on the other hand, face risks related to data breaches, intellectual property theft, and professional liability. Cyber liability insurance is paramount to cover the costs associated with data breaches, including notification costs, legal fees, and credit monitoring for affected customers. Errors and omissions insurance (E&O) protects against claims of negligence or mistakes in professional services. Intellectual property insurance can protect valuable software or designs from infringement. General liability insurance remains important, covering potential accidents or injuries on the premises.

Insurance Needs for Retail Businesses

Retail businesses face risks associated with shoplifting, property damage, and product liability. General liability insurance is a must-have, covering accidents on the premises and claims related to customer injuries or property damage. Crime insurance can protect against losses due to theft or burglary. Product liability insurance protects against claims arising from defective products sold to customers. Business interruption insurance can help cover lost income if the store is temporarily closed due to a covered event.

Comparing Construction and Online Retail

Let’s compare a small construction company and a small online retail business. A construction company faces significant risks related to worker injuries, property damage, and potential liability for faulty workmanship. They need robust workers’ compensation insurance, comprehensive general liability insurance, and potentially commercial auto insurance. An online retailer, conversely, faces different challenges, such as data breaches, payment processing errors, and product liability. They need cyber liability insurance, general liability insurance, and potentially product liability insurance. While both businesses need general liability, the specific types and levels of coverage will differ significantly based on their unique operational risks.

Illustrative Examples of Risk and Insurance Needs

Here are three examples illustrating the connection between business type, potential risks, and necessary insurance:

* Example 1: A bakery: A fire in the kitchen could destroy equipment, inventory, and the building itself. Business interruption insurance would cover lost income while repairs are made. Product liability insurance protects against claims if a customer gets sick from contaminated baked goods.

* Example 2: A freelance graphic designer: A client accuses the designer of copyright infringement. Errors and omissions insurance (E&O) would cover legal fees and potential settlements. General liability insurance would cover accidents that occur at client meetings or in the designer’s workspace.

* Example 3: A landscaping company: An employee is injured while operating machinery. Workers’ compensation insurance would cover medical expenses and lost wages. General liability insurance would cover property damage if a client’s property is accidentally damaged during landscaping work.

Government Regulations and Compliance: Insurance Options For Small Business Owners

Source: haddockins.com

Navigating the world of small business insurance isn’t just about finding the best coverage; it’s also about understanding and adhering to the legal requirements set by the government. Non-compliance can lead to hefty fines and even business closure, so a solid grasp of these regulations is crucial for your peace of mind and the long-term success of your venture.

Understanding the legal landscape of business insurance is vital for responsible operation. This section Artikels key aspects of government regulations and compliance, helping you stay on the right side of the law and protect your business.

Legal Requirements for Small Business Insurance

Many states and municipalities have specific regulations regarding the types of insurance small businesses must carry. These requirements often depend on the industry, number of employees, and the nature of the business’s operations. For instance, businesses handling hazardous materials usually face stricter regulations and higher insurance requirements than those in less risky sectors. Failure to meet these minimum requirements can result in significant penalties. Common legally mandated insurance types include workers’ compensation insurance (to cover employee injuries), and commercial auto insurance (to protect against accidents involving company vehicles). Specific requirements vary widely by location and industry; consulting with a legal professional or insurance specialist familiar with your area is highly recommended.

Implications of Non-Compliance with Insurance Regulations

Non-compliance with insurance regulations can have serious repercussions for small businesses. These consequences can range from financial penalties and legal action to business license suspension or revocation. For example, a construction company operating without the required workers’ compensation insurance could face substantial fines if an employee is injured on the job. In some cases, non-compliance could even lead to criminal charges, particularly if the lack of insurance directly contributes to harm or injury. The severity of penalties depends on the specific violation, the jurisdiction, and the circumstances surrounding the non-compliance. Maintaining accurate records and proactively addressing any potential compliance issues is key to avoiding these negative outcomes.

Role of Government Agencies in Regulating the Insurance Industry

Government agencies at both the state and federal levels play a vital role in regulating the insurance industry. These agencies are responsible for ensuring that insurance companies operate fairly and responsibly, protecting consumers and maintaining the stability of the insurance market. At the state level, insurance departments oversee the licensing and solvency of insurance companies, investigate consumer complaints, and enforce state insurance laws. At the federal level, agencies like the National Association of Insurance Commissioners (NAIC) work to promote uniformity in insurance regulations across states and address issues of national significance. These agencies contribute to a more transparent and reliable insurance market, benefiting both businesses and consumers. Staying informed about updates and changes from these agencies is essential for maintaining compliance.

Epilogue

Source: starsfact.com

Protecting your small business is a marathon, not a sprint. Choosing the right insurance isn’t just about ticking boxes; it’s about strategically safeguarding your future. By understanding the different options, factors influencing costs, and best practices for managing your policies, you can confidently navigate the insurance landscape and focus on what truly matters: growing your business. Remember, a little proactive planning goes a long way in ensuring your business thrives, even amidst unexpected challenges. So, go forth and protect your empire!