Is proliability good insurance? That’s the million-dollar question, especially in today’s unpredictable world. We’re diving deep into the world of proliability insurance – what it is, its perks, potential pitfalls, and whether it’s the right financial safety net for you or your business. Think of it as your ultimate guide to navigating the sometimes murky waters of risk management.

From defining exactly what proliability insurance covers to dissecting the fine print and comparing it to similar insurance types, we’ll leave no stone unturned. We’ll also explore real-world scenarios, showcasing both the triumphs and tribulations of having (or not having!) this type of coverage. Get ready to become a proliability insurance expert!

Defining “Proliability” Insurance

Proliability insurance, while not a standard term in the insurance industry, likely refers to a broad category encompassing various types of liability coverage designed to protect professionals and businesses from financial losses resulting from their actions or inactions. Understanding its nuances requires careful consideration of the specific risks involved and the available policy options. Think of it as a catch-all term for insurance that protects against liability, but the precise definition depends heavily on the context.

Proliability insurance policies typically cover a range of risks associated with professional activities or business operations. These policies aim to compensate for financial losses arising from claims of negligence, errors, omissions, or breaches of duty. The core feature is the provision of legal defense and financial compensation should a third party successfully sue the insured party for damages.

Types of Risks Covered by Proliability Insurance

The specific risks covered vary significantly depending on the nature of the insured’s profession or business. However, common covered risks often include claims of professional negligence, malpractice, errors and omissions, breach of contract, and even reputational damage. For instance, a doctor’s proliability insurance might cover claims of medical malpractice, while a lawyer’s policy might cover claims of legal malpractice or breach of fiduciary duty. A business might secure coverage for product liability or advertising injury. The policy wording will explicitly Artikel the covered perils.

Comparison with Similar Insurance Types

Proliability insurance is often conflated with professional liability insurance and general liability insurance. While there’s significant overlap, key differences exist. Professional liability insurance specifically targets professionals like doctors, lawyers, and engineers, covering claims related to their professional services. General liability insurance, on the other hand, protects businesses from claims of bodily injury or property damage caused by their operations or products. Proliability insurance, as a broader term, could encompass both, or it might represent a specialized policy tailored to a particular industry with unique risks. The key is in the specific wording of the policy.

Examples of Beneficial Proliability Insurance Applications

Imagine a software developer whose program contains a critical bug that causes significant financial losses to a client. Proliability insurance could cover the legal costs and potential damages awarded to the client. Or consider a consultant who provides faulty advice leading to financial losses for their client. Again, proliability insurance could step in to protect the consultant from financial ruin. A construction company facing a lawsuit due to a structural defect in a building they constructed would also find proliability insurance invaluable. The specific scenarios are limitless, depending on the type of proliability coverage secured.

Benefits of Proliability Insurance: Is Proliability Good Insurance

Proliability insurance, often overlooked, provides a crucial safety net in today’s unpredictable world. Whether you’re a freelancer crafting websites or a bustling bakery churning out croissants, this type of insurance offers peace of mind and financial protection against unforeseen circumstances. Understanding its advantages can significantly impact your personal and professional well-being.

Protecting your assets and reputation is paramount, and proliability insurance is a key tool in achieving that goal. Its benefits extend far beyond simply avoiding financial ruin; it fosters confidence, allows for strategic risk-taking, and ultimately contributes to long-term success.

Advantages for Individuals

For individuals, proliability insurance offers a shield against the financial repercussions of accidental harm or damage caused to others. Imagine, for instance, a freelance photographer accidentally damaging a client’s expensive camera during a photoshoot. Proliability insurance would cover the costs of repair or replacement, preventing a potentially devastating financial blow. Beyond financial protection, it also safeguards your reputation, ensuring you maintain professional credibility even in the face of unexpected incidents. This is particularly valuable for professionals like consultants, contractors, and tutors who operate independently.

Advantages for Businesses

In the business world, proliability insurance is not just a good idea; it’s often a necessity. It acts as a critical risk mitigation strategy, protecting your business from potentially crippling lawsuits. Consider a small coffee shop where a customer slips and falls, injuring themselves. Without proliability insurance, the business could face significant legal fees and compensation claims, potentially leading to closure. The insurance acts as a buffer, absorbing these costs and allowing the business to continue operations. This protection extends to various scenarios, including product liability, professional negligence, and advertising injury. Furthermore, having proliability insurance can improve your business’s reputation, demonstrating a commitment to responsible operation and customer safety. This can attract more clients and partners who value reliability and trust.

Financial Implications: A Hypothetical Scenario

| Scenario | With Proliability Insurance | Without Proliability Insurance |

|---|---|---|

| Customer injury on business premises (legal fees & compensation) | $5,000 (insurance payout) | $50,000 (out-of-pocket expense) |

| Professional negligence claim (legal fees & damages) | $10,000 (insurance payout) | $100,000 (business closure possible) |

| Product liability claim (damaged goods & compensation) | $2,000 (insurance payout) | $20,000 (potential business bankruptcy) |

| Total Costs | $17,000 | $170,000+ |

Case Study: The “Accidental Artist”

Imagine Sarah, a freelance graphic designer, who accidentally damaged a client’s computer during a remote troubleshooting session. The client’s computer contained irreplaceable project files, and the damage resulted in significant financial losses for the client. However, because Sarah had proliability insurance, the insurance company covered the cost of replacing the computer and the value of the lost project files. This prevented a costly legal battle and preserved Sarah’s reputation, allowing her to maintain strong working relationships with clients. The incident, while unfortunate, highlighted the value of having proactive risk management strategies in place. Without the insurance, Sarah could have faced significant financial hardship and potentially irreparable damage to her business.

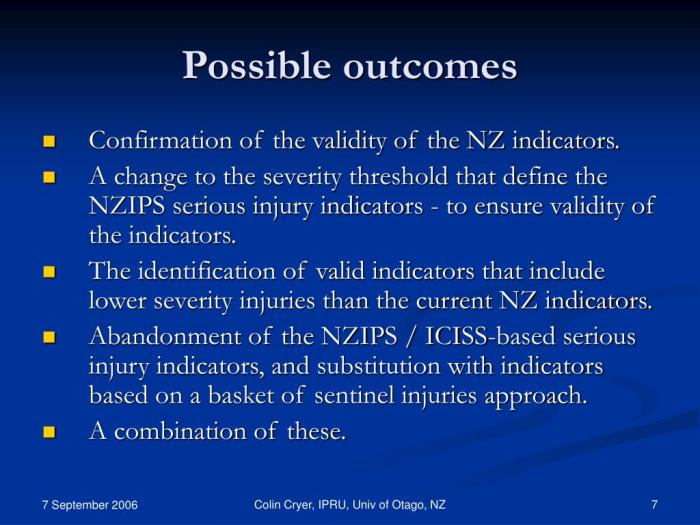

Potential Drawbacks of Proliability Insurance

Source: slideserve.com

While proliability insurance offers a crucial safety net for businesses, it’s not without its potential downsides. Understanding these limitations is key to making an informed decision about whether or not this type of coverage is right for your specific needs and risk profile. Ignoring potential drawbacks can lead to unexpected financial burdens and disappointment when a claim is made.

Proliability insurance, like any insurance product, comes with certain limitations and costs that need careful consideration. The perceived benefits need to be weighed against the financial outlay and potential exclusions before committing to a policy. This is particularly important for smaller businesses with tighter budgets, where the cost of insurance can represent a significant portion of their operational expenses.

Factors Influencing Proliability Insurance Costs

Several factors significantly impact the premium you’ll pay for proliability insurance. These factors are often assessed by insurance companies to determine the level of risk associated with your business and, consequently, the price of the coverage. Higher risk translates to higher premiums, a fundamental principle of insurance pricing. For instance, a high-risk industry like construction will generally face significantly higher premiums than a lower-risk industry such as a bookstore. The size of your business, your claims history, the specific services you offer, and even your location can all influence the final cost. A business with a history of claims will naturally be considered higher risk and therefore face higher premiums than a business with a clean record. Similarly, businesses operating in areas prone to natural disasters might see higher premiums to reflect the increased likelihood of claims related to such events.

Cost-Benefit Analysis Across Industries

The cost-benefit analysis of proliability insurance varies dramatically across different industries. High-risk industries, such as construction, manufacturing, and healthcare, often face significantly higher premiums due to the increased likelihood of accidents and resulting lawsuits. However, the potential financial exposure in these industries is also substantially greater, making the insurance a more crucial investment. Conversely, lower-risk industries might find the premiums less burdensome, but the potential need for coverage might also be lower. A small bakery, for example, might face lower premiums but the potential cost of a lawsuit stemming from food poisoning could still be financially devastating, highlighting the importance of considering the potential severity of a claim regardless of industry. A detailed analysis of potential losses versus the cost of insurance is essential for each business to determine the appropriate level of coverage.

Common Exclusions and Limitations in Proliability Insurance Contracts

It’s crucial to carefully review your proliability insurance policy to understand its exclusions and limitations. These clauses specify situations or circumstances where coverage will not be provided. Common exclusions might include intentional acts, damage caused by employees acting outside the scope of their employment, or claims arising from specific activities not explicitly covered in the policy. Many policies also have limitations on the amount of coverage provided per incident or per year. For example, a policy might cap liability coverage at $1 million per incident, meaning any liability exceeding this amount would be the responsibility of the insured business. Understanding these exclusions and limitations is paramount to avoid unpleasant surprises in the event of a claim. A thorough understanding of the policy’s fine print is essential to ensure that you have the appropriate level of protection. Consulting with an insurance professional can help you navigate these complexities and ensure you choose a policy that adequately addresses your business’s specific risks.

Choosing the Right Proliability Insurance

Source: europa.eu

So, is professional liability insurance a good investment? Absolutely, especially in high-risk fields. For real estate agents, that means considering specialized coverage like errors and omissions (E&O) insurance, as detailed in this helpful resource on e&o insurance for real estate agents. Ultimately, proliability insurance provides crucial protection against costly lawsuits, making it a smart move for anyone who wants to sleep soundly at night.

Navigating the world of professional liability insurance can feel like wading through a swamp of jargon. But finding the right policy is crucial for protecting your career and financial well-being. The right policy offers peace of mind, knowing you’re covered in case of a professional mishap. Choosing poorly, however, could leave you exposed to significant financial risk.

Choosing a proliability insurance provider requires careful consideration of several key factors. A hasty decision could lead to inadequate coverage or unexpectedly high premiums. Taking the time to research and compare options is an investment that pays off in the long run.

Factors to Consider When Selecting a Provider

Several critical factors influence the suitability of a proliability insurance provider. These include the insurer’s financial stability, the breadth and depth of their coverage, and the responsiveness of their customer service. Ignoring these aspects could lead to significant problems down the line.

- Financial Strength: Look for insurers with high ratings from independent agencies like A.M. Best. A financially strong insurer is more likely to be able to pay out claims when needed.

- Coverage Limits: Ensure the policy’s coverage limits are sufficient to cover potential losses. Consider the potential severity of claims in your profession.

- Policy Exclusions: Carefully review the policy’s exclusions to understand what isn’t covered. Some policies may exclude certain types of claims or specific situations.

- Customer Service: A responsive and helpful customer service team can be invaluable if you ever need to file a claim. Check online reviews and testimonials to gauge the insurer’s reputation for customer service.

- Premium Costs: Compare premiums from multiple insurers, but don’t solely focus on price. Consider the value and breadth of coverage offered in relation to the cost.

Importance of Reading and Understanding Policy Terms and Conditions

Before signing on the dotted line, thoroughly read and understand every aspect of the policy. Don’t hesitate to ask for clarification on anything unclear. A common mistake is glossing over the fine print, which can lead to unpleasant surprises later.

Ignoring the policy’s terms and conditions could leave you vulnerable to unexpected costs and legal liabilities.

Questions to Ask Potential Providers

Asking the right questions can help you make an informed decision. These questions should focus on coverage specifics, claims processes, and the insurer’s financial stability. Don’t be afraid to press for detailed answers.

- What are the specific coverage limits for different types of claims?

- What is the claims process, and how long does it typically take to resolve a claim?

- What is the insurer’s financial strength rating from independent agencies?

- What are the policy’s exclusions and limitations?

- What is the insurer’s reputation for customer service?

- Are there any discounts available?

Step-by-Step Guide to Obtaining Proliability Insurance

Securing the right proliability insurance involves a systematic approach. This process ensures you obtain adequate coverage tailored to your specific needs. Rushing through this process could result in inadequate protection.

- Assess Your Needs: Determine the level of coverage you require based on your profession and potential risks.

- Obtain Quotes: Contact multiple insurers to obtain quotes and compare coverage options.

- Review Policies: Carefully review the policy documents from each insurer, paying close attention to the terms and conditions, exclusions, and coverage limits.

- Ask Questions: Don’t hesitate to ask questions to clarify anything you don’t understand.

- Choose a Provider: Select the insurer that best meets your needs and budget.

- Complete the Application: Complete the application accurately and provide all necessary information.

- Pay the Premium: Pay the premium to activate your policy.

Proliability Insurance Claims Process

Source: hdatasystems.com

Navigating the claims process for proliability insurance can feel like wading through treacle, but understanding the steps involved can significantly ease the stress. A smooth claim process hinges on prompt action, clear communication, and meticulous record-keeping. This section Artikels the typical process, offering best practices and highlighting crucial documentation.

The typical claims process begins with reporting the incident to your proliability insurer as soon as possible. This initial report triggers the insurer’s investigation, which might involve reviewing contracts, gathering witness statements, and assessing the extent of the damages. Following the investigation, the insurer will determine liability and, if covered under your policy, proceed with the settlement or defense of the claim.

Reporting a Proliability Insurance Claim, Is proliability good insurance

Prompt reporting is paramount. Delaying notification can jeopardize your claim. The initial report should include a concise description of the incident, including dates, times, locations, and individuals involved. Providing contact information for all parties is also essential. Many insurers offer online portals or dedicated phone lines for reporting claims, streamlining the initial process. Remember to retain copies of all communication with your insurer.

Documentation Required During the Claims Process

Comprehensive documentation is the backbone of a successful claim. This includes but isn’t limited to: copies of contracts, invoices, receipts, police reports (if applicable), medical records (if injuries are involved), photos and videos documenting damages, and witness statements. The more thorough your documentation, the stronger your claim. Consider creating a detailed timeline of events, including dates, times, and actions taken.

Resolving Disputes with a Proliability Insurance Provider

Disputes can arise, even with the best-prepared claims. If you disagree with your insurer’s decision, explore all avenues for resolution. Start with a formal letter outlining your concerns and supporting evidence. If this doesn’t resolve the issue, consider mediation, a neutral third-party process to facilitate agreement. As a last resort, litigation might be necessary, but it’s usually a costly and time-consuming option. Before initiating legal action, carefully weigh the costs and potential benefits against the value of your claim. Reviewing your policy carefully to understand your rights and obligations is also crucial. For example, some policies specify mandatory mediation before litigation can be pursued. Understanding these stipulations can significantly influence your approach to resolving the dispute.

Illustrative Scenarios

Let’s paint some pictures to illustrate the real-world impact of proliability insurance – both the good and the bad. These scenarios highlight the critical role this type of insurance plays in protecting your financial well-being.

Scenario: Proliability Insurance Proves Invaluable

Imagine a freelance graphic designer, Sarah, working on a logo design for a major corporation. She meticulously crafts the design, exceeding the client’s expectations. However, after the logo is launched, the corporation discovers a striking similarity to a pre-existing logo, leading to a costly lawsuit alleging copyright infringement. Sarah, despite her innocence, faces potential legal fees and compensation claims that could easily exceed her savings. However, her comprehensive proliability insurance policy steps in, covering her legal defense costs and any resulting settlements, protecting her from financial ruin. The visual representation would show Sarah calmly working at her computer, a subtle image of a legal document and an insurance policy visible in the background, contrasting with a looming, stressful image of a courtroom in the distance, but significantly diminished in size and impact.

Scenario: Absence of Proliability Insurance Leads to Financial Hardship

Contrast Sarah’s situation with Mark, a small-scale contractor who undertakes a home renovation project without proliability insurance. During the project, a worker accidentally damages a valuable antique piece belonging to the homeowner. The homeowner demands compensation far exceeding Mark’s financial capacity. Without insurance, Mark faces crippling debt, potentially jeopardizing his business and personal finances. The visual would depict Mark, stressed and overwhelmed, facing a large, imposing bill, his tools and equipment in the background appearing small and insignificant compared to the size of the financial burden. His home, potentially foreclosed, is visible in the far background, a symbol of his potential loss.

Scenario: Importance of Adequate Coverage Limits

Consider a large-scale event planner, Alex, who organizes a major music festival. Due to unforeseen circumstances, a stampede occurs, resulting in several injuries. The resulting lawsuits demand significant compensation. Alex initially opted for a low-coverage proliability policy to save on premiums. However, the claims far exceed his coverage limit, leaving him personally liable for the substantial shortfall, creating a major financial crisis. The visual here would show Alex surrounded by numerous legal documents, each representing a significant claim. The limited coverage policy is shown as a small, insignificant document compared to the towering pile of claims, illustrating the inadequacy of his protection.

Scenario: Claim Handling with and Without Proliability Insurance

Let’s compare two scenarios involving a similar incident: a photographer, David, accidentally damages a client’s expensive camera during a photoshoot. With proliability insurance, David simply reports the incident to his insurer. The insurance company handles all communication with the client, investigates the claim, and negotiates a settlement or arranges for repairs, relieving David of significant stress and financial burden. Without insurance, David would have to handle all communications, negotiations, and potential legal battles himself, a stressful and potentially costly process. The visual would show two panels: one showing David calmly talking to an insurance representative, the other showing him stressed, navigating a complex legal process alone, surrounded by paperwork.

Last Recap

So, is proliability insurance the right choice for you? The answer, like most things in life, depends. Weighing the potential benefits against the costs, understanding your specific risks, and carefully choosing a provider are all crucial steps. By understanding the ins and outs of proliability insurance, you can make an informed decision that protects your financial future and provides peace of mind. Don’t let unexpected events derail your plans – arm yourself with knowledge and the right coverage.