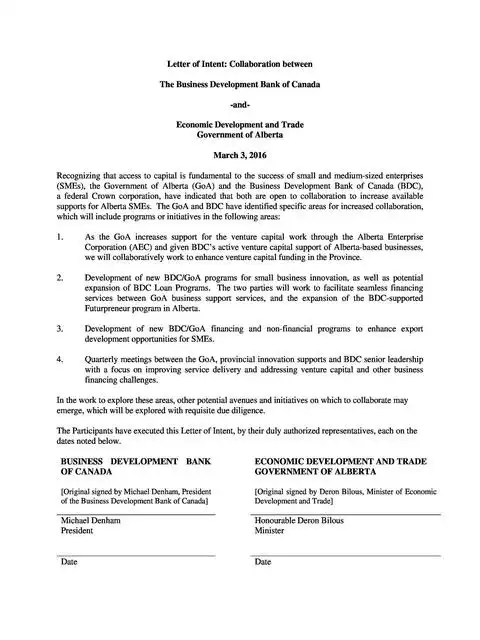

A letter of Intent example (“LOI”) is an example official document that outlines the desire of the parties to sign an agreement in writing.

A letter of intent does not constitute a formal arrangement or a legally binding contract. It serves the crucial function of defining the agreed-upon terms of a transaction to ensure there are no miscommunications between the parties, however, it is not able to give the details that can be that is required in the Purchase Sale Agreement.

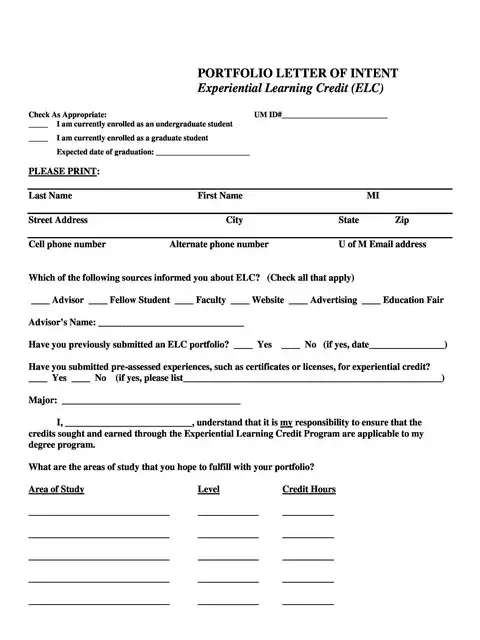

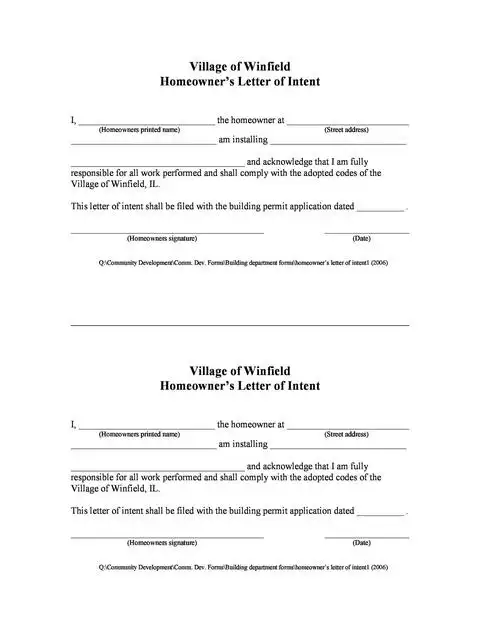

Letter of Intent Example

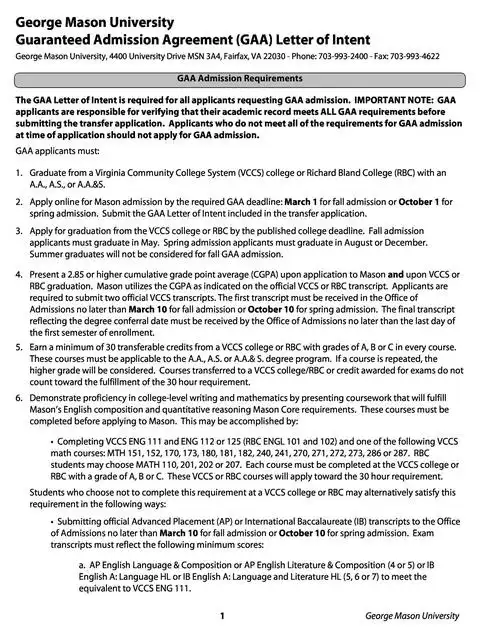

Letters of Intent example differ in length and specifics However, the aim is to provide sufficient detail so that the most important issues are clarified, but not in enough details that they border upon a purchase agreement.

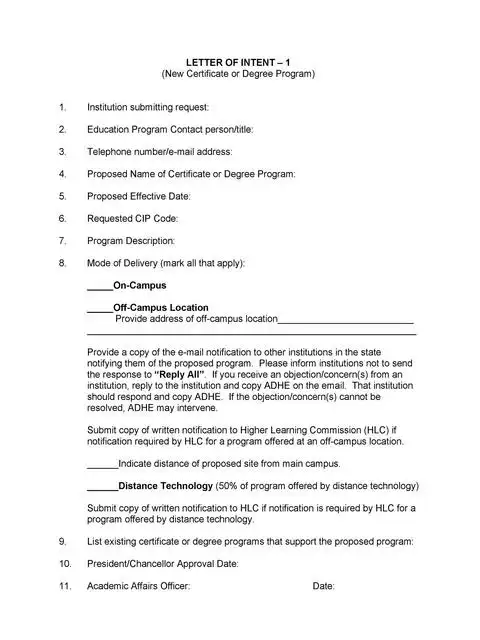

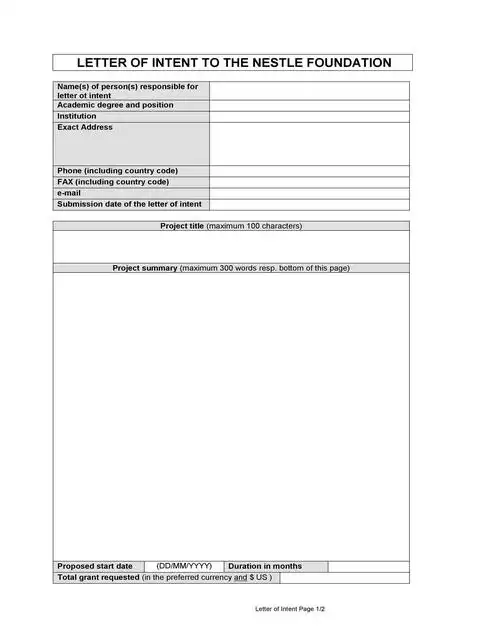

Important Structure Should Include on Letter of Intent Example

The following information can be contained in a well-organized letter of intent:

1. The date of this letter of intent.

This Section Should Include the date of letter of intent

2. Names and Titles

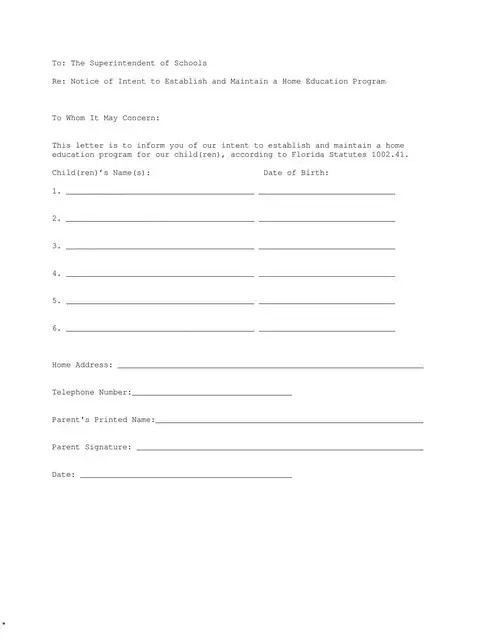

This section should contain the full names of the selling, buying and brokerage companies , along with the signatories of each one of them as well as their corporate titles… Secretary, President Secretary, Partner the Managing Member… etc.

3. Contact details

Contact details for each company and the representatives of each.

4. Asset Identification

The letter of intent example should define the assets to be purchased and sold as part of the deal. For instance: Assets belonging to ABC Childcare, Inc. and real estate that is held under the name of XYZ, LLC and used to run the operation that are part of ABC Childcare, Inc. The properties and assets are situated at The address is 123 Main Street, Any Town, Any State, 12345.

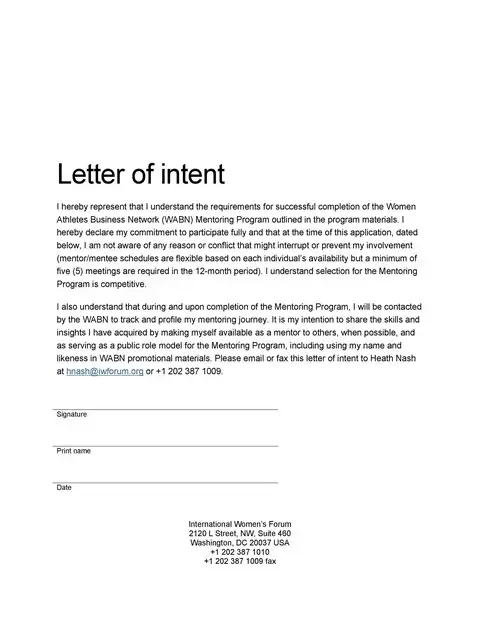

5. The Purchase Price.

6. Deposit Amount

Amount of buyer’s trust deposit as well as the company responsible for the escrowing of the deposit.

7. Examples of Terms of the Transaction

All Cash at Closing… or $2,000,000 Cash and $250,000 Promissory Note at Closing.

8. Information about the lease that is to be signed with the purchaser.

Example A: Buyer and Seller will enter into an agreement for a triple net lease, with the initial term of 10 years , and 3 five-year option. The lease will be renewed annually. rates will amount to the lower than CPI or 2.5 percent of the prior year’s rent. The LOI does not draft the lease. It’s merely setting the basic conditions.

9. Transaction Contingencies.

Contingencies are those that could likely result in the seller, the buyer or both to withdraw from the deal should there any disagreement. For example:

- All cash and Accounts that are due to be paid up until the closing date remain the possession of the seller.

- the Buyer’s Good-faith Deposit is returned in full in the event that the buyer’s due diligence uncovers unacceptable conditions.

- The Buyer and Seller each agree to each pay for their own closing expenses.

- Good Faith Deposit will be returned in full in the event that the buyer’s financing is rejected and a written confirmation is provided at XYZ Brokerage, Inc. by July 1st 20XX.

- Buyer must submit a written proof of the down payment in the amount not less than $XXXX,XXX prior to the signing of the an LOI.

- Seller and buyer agree that the seller will be responsible for payment of brokerage charges in the amount of XYZ Brokerage, Inc. in the amount $XXX,XXX.

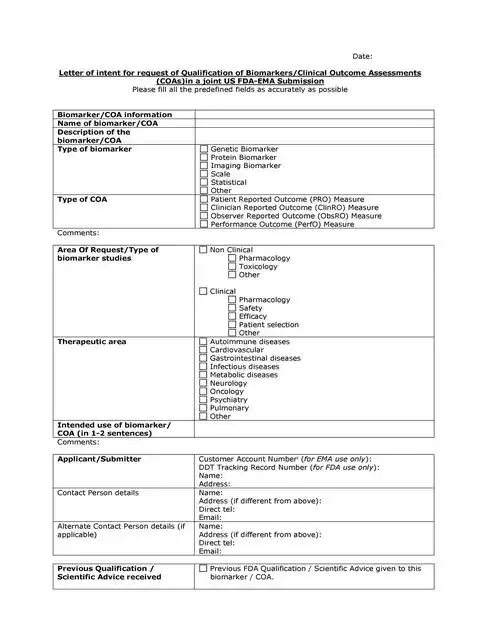

10. Closing Date

The Closing Date must be stated as being on or before… on or before the date of the Closing to give some flexibility for the parties involved. Except for any specific terms in the opposite direction such as “timeline contingencies”, it should be noted that both the seller and the buyer have agreed that the buyer will have the sole right to purchase the assets, up to and including the date of closing.

11. Timeline Contingencies

These contingencies are those that ensure that transactions move forward in a timely manner. While almost every transaction will come with its own challenges, it’s crucial to be attentive to the amount of time needed to complete the various sub-processes, such as finalizing the purchase agreement as well as securing financing, authorization for licensing, completing the Phase One inspections, obtaining an appraisal of real estate or having staff fingerprinted (in certain states), )… and some states), etc. Any delay in one of these processes could cause delays in the other processes until the transaction is extended to an extended period of nine months, instead of usual 90 days. Examples of time-related contingencies are:

- The LOI is invalid if it is not executed in full prior to the date.

- Buyer agrees to submit the first draft of the purchase sale agreement before or on the date.

- Buyer agrees to send completed finance application to lender by the X date.

- The lending institution of the buyer will inform XYZ Brokerage, Inc. of its preliminary approval of the buyer’s loan on or before the date.

- The lender of the buyer will notify XYZ Brokerage, Inc. of the final approval for the buyer’s loan two weeks prior to the closing date.

- Seller accepts to notify the state licensing authorities of any an pending transaction within three days of receiving the fully completed purchase purchase contract as well as notification of the receipt by buyer of the Commitment Letter from the buyer’s lender.

12. An easy, but often overlooked item that is often forgotten.

Include language that allows for the LOI for signing counter-parts. This is, of course, an insignificant thing, however it can save hours in the process.

An intent letter example can be an excellent tool to help to get your transaction off to a the right foot and moving towards closing with greater efficiency. Article Source: http://EzineArticles.com/9842134

Although the above information isn’t complete, it offers an excellent foundation. As we’ve said before, it is important to seek the advice of a professional prior to taking any action.