Medical insurance brokers for small business are your secret weapon in navigating the often-confusing world of employee healthcare. Finding affordable, comprehensive coverage can feel like searching for a needle in a haystack, but the right broker can make all the difference. This guide breaks down everything you need to know, from understanding your options to negotiating the best rates, empowering you to make informed decisions for your team.

We’ll delve into the unique challenges small businesses face when securing medical insurance, exploring the different types of plans available and the crucial role brokers play in simplifying the process. From understanding deductibles and co-pays to ensuring HIPAA compliance, we’ll equip you with the knowledge to confidently choose a plan that fits your budget and your employees’ needs. Think of this as your ultimate survival guide to the world of small business healthcare.

Understanding the Small Business Insurance Market: Medical Insurance Brokers For Small Business

Source: texasborderbusiness.com

Navigating the world of medical insurance can feel like traversing a dense jungle, especially for small business owners. Unlike larger corporations with dedicated HR departments and substantial resources, small businesses often face unique challenges when it comes to securing affordable and comprehensive health coverage for their employees. Understanding these nuances is crucial for both business owners and brokers alike.

Small businesses have distinct insurance needs compared to their larger counterparts. Their limited budgets often necessitate a more strategic approach to risk management and cost control. They typically lack the bargaining power of larger corporations when negotiating with insurance providers, and their workforce size is often more volatile, influencing the types of plans that are both practical and financially viable.

Types of Medical Insurance Plans for Small Businesses

Small businesses typically have access to a range of medical insurance plans, each with its own set of benefits, costs, and eligibility requirements. Common options include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point of Service (POS) plans. HMOs usually offer lower premiums but restrict access to care within a network of providers. PPOs provide more flexibility with out-of-network access but typically come with higher premiums. POS plans offer a blend of HMO and PPO features, allowing for some out-of-network access but with higher costs for those choices. Understanding the specific needs and preferences of the employees is vital in selecting the most appropriate plan.

Factors Influencing the Cost of Small Business Medical Insurance

Several factors significantly impact the cost of small business medical insurance. The most prominent include the number of employees, the average age and health status of the workforce, the geographic location of the business, and the type of plan selected. For example, a business with a predominantly older workforce will generally face higher premiums than one with a younger, healthier workforce. Similarly, businesses located in areas with high healthcare costs will naturally experience higher insurance premiums. The chosen plan’s benefits package also plays a crucial role; richer benefit packages generally translate to higher premiums.

Challenges Small Businesses Face in Obtaining Affordable Medical Insurance

Securing affordable medical insurance is a significant hurdle for many small businesses. The high cost of premiums, the complexity of navigating different plan options, and the administrative burden of managing employee benefits all contribute to this challenge. Many small businesses struggle to find plans that offer a good balance between cost and comprehensive coverage, particularly if they have employees with pre-existing conditions. The lack of bargaining power compared to larger corporations further exacerbates the situation, limiting their ability to negotiate favorable rates. For example, a small bakery with five employees might find it difficult to compete with a large corporation in securing group discounts, resulting in higher premiums.

The Role of Medical Insurance Brokers

Navigating the world of small business medical insurance can feel like wading through a swamp of jargon and confusing options. That’s where medical insurance brokers step in – they’re the expert guides who help you find the right coverage without getting bogged down in the details. They act as your advocate, ensuring you get the best possible plan for your budget and your employees’ needs.

Brokers assist small businesses by simplifying the complex process of choosing a health insurance plan. They leverage their deep understanding of the market, access to numerous insurers, and negotiation skills to secure favorable rates and coverage options tailored to the specific needs of the business. This saves small business owners valuable time and resources, allowing them to focus on what they do best – running their business.

A Step-by-Step Guide to Broker Assistance

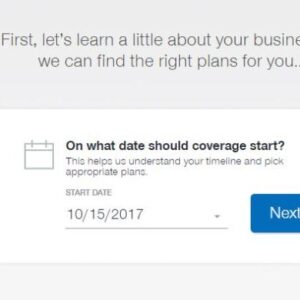

The process typically begins with a consultation where the broker assesses the business’s specific needs, including the number of employees, budget constraints, and desired coverage levels. Following this initial assessment, the broker will research and present a selection of suitable plans from various insurance providers. The broker then helps the business compare plans based on factors such as premiums, deductibles, co-pays, and network coverage. Finally, the broker assists with the enrollment process and ongoing plan management. This includes answering questions, handling claims issues, and providing ongoing support throughout the policy term.

Independent vs. Captive Brokers: A Comparison

Independent brokers represent a wide range of insurance companies, allowing them to offer a broader selection of plans and potentially better rates due to competition. Captive brokers, on the other hand, represent only one insurance company, limiting their options but potentially offering specialized expertise and streamlined service within that company’s offerings. The choice between the two depends on the specific needs and priorities of the small business. A small business with very specific needs might find a captive broker more efficient, while a business seeking the widest range of options would likely prefer an independent broker.

Ethical Considerations for Brokers Serving Small Businesses

Transparency and honesty are paramount. Brokers should clearly disclose any commissions or incentives they receive from insurance companies, ensuring the client understands the broker’s financial interests. They should also prioritize the client’s best interests, recommending plans based on their needs rather than solely on commission potential. Confidentiality is crucial, as brokers handle sensitive employee information. Maintaining the highest level of professional conduct and adherence to all relevant regulations is essential to building and maintaining trust with their small business clients. For example, a broker might need to disclose if a particular plan offers lower premiums but significantly restricts access to specialists, allowing the client to make an informed decision based on the full picture, not just the price tag.

Key Features of Small Business Medical Insurance Plans

Choosing the right medical insurance plan for your small business can feel like navigating a maze. Understanding the key features of different plans is crucial to ensuring your employees receive adequate coverage without breaking the bank. This section will break down the essential components you need to consider, helping you make an informed decision.

Comparison of Common Small Business Medical Insurance Plan Features

The right plan depends heavily on your budget and employee needs. Here’s a comparison of common features across different plan types. Remember, these are examples, and actual costs and benefits will vary based on location, insurer, and specific plan details.

| Feature | HMO | PPO | POS |

|---|---|---|---|

| Premiums | Generally lower | Generally higher | Moderate |

| Deductibles | Can vary widely | Can vary widely | Can vary widely |

| Co-pays | Typically lower for in-network care | Typically higher for out-of-network care | Lower for in-network care, higher for out-of-network |

| Network | Restricted to in-network providers | Larger network, including in- and out-of-network providers | Combination; in-network preferred, out-of-network possible with higher costs |

Common Plan Riders and Add-ons

Many insurers offer riders and add-ons to customize your small business health insurance plan. These can enhance coverage and provide additional benefits.

Examples include:

- Dental and Vision Coverage: Often sold separately, these riders provide essential preventative and restorative care.

- Prescription Drug Coverage: This covers the cost of prescription medications, often with tiered formularies (different cost levels based on drug classification).

- Critical Illness Insurance: This provides a lump-sum payment if an employee is diagnosed with a serious illness, such as cancer or heart attack.

- Short-Term Disability Insurance: This replaces a portion of an employee’s income if they are unable to work due to illness or injury.

These add-ons can significantly increase the overall cost of the plan, so carefully weigh the benefits against the additional expense.

Implications of Network Size for Small Business Employees

The size of the provider network significantly impacts employee access to care.

HMO plans offer lower premiums but restrict access to in-network providers only. This can limit choices and require employees to find doctors and specialists within the network. PPO plans offer greater flexibility, allowing employees to see out-of-network providers, though at a higher cost. POS plans offer a middle ground, with a preferred network but allowing access to out-of-network providers under specific circumstances. A smaller network might mean longer wait times for appointments or inconvenient locations for employees. A larger network offers greater choice and convenience.

Understanding Plan Limitations and Exclusions

Every health insurance plan has limitations and exclusions. These are specific services or conditions that are not covered by the plan. It’s crucial to carefully review the plan document to understand what is and isn’t covered. For example, some plans may exclude pre-existing conditions for a specified period, or they may have limitations on mental health coverage or certain types of treatments. Ignoring these limitations can lead to unexpected out-of-pocket expenses for your employees. Understanding these limitations is key to managing employee expectations and avoiding financial surprises.

Compliance and Legal Aspects

Source: imgpile.com

Navigating the legal landscape of employee health insurance can feel like wading through a swamp, but understanding the key regulations is crucial for small business owners. Non-compliance can lead to hefty fines and legal battles, so a proactive approach is essential. This section Artikels the critical legal and regulatory requirements, focusing on employer responsibilities and potential penalties.

Employer responsibilities concerning employee health information privacy are paramount, particularly under the Health Insurance Portability and Accountability Act (HIPAA). This act dictates how protected health information (PHI) must be handled, stored, and transmitted. Understanding and adhering to HIPAA is not merely a legal obligation; it’s about protecting the trust your employees place in you.

HIPAA Compliance for Small Businesses

HIPAA compliance isn’t just for large corporations; it applies to all employers who handle employee health information. This includes details like medical diagnoses, treatment plans, and prescription information. Key aspects of HIPAA compliance for small businesses include designating a privacy officer, implementing appropriate safeguards for electronic PHI (ePHI), providing employee training on HIPAA regulations, and establishing procedures for handling PHI breaches. Failure to comply can result in significant financial penalties and reputational damage. A robust HIPAA compliance program is an investment in your business’s long-term health and stability. Consider implementing a documented policy and procedure manual to ensure consistent adherence to the law.

Key Legal and Regulatory Requirements for Offering Medical Insurance

The Affordable Care Act (ACA) significantly impacts small businesses offering health insurance. While the ACA’s employer mandate doesn’t apply to all small businesses (those with fewer than 50 full-time equivalent employees are generally exempt), understanding its provisions is still crucial. These provisions include requirements related to offering affordable coverage, complying with minimum essential health benefits, and avoiding discrimination based on health status. State-specific regulations also exist and may vary, so consulting with legal counsel or an insurance broker is highly recommended to ensure full compliance. Failure to comply can lead to significant penalties, including substantial fines per employee.

Potential Penalties for Non-Compliance, Medical insurance brokers for small business

Penalties for non-compliance with insurance regulations can be severe, ranging from monetary fines to legal action. The amount of the fine often depends on the severity and nature of the violation, as well as the number of affected employees. For example, HIPAA violations can result in fines ranging from thousands to millions of dollars, depending on the circumstances. Similarly, failure to comply with ACA requirements can result in significant penalties assessed by the IRS. These penalties can severely impact a small business’s financial stability. Legal action could also be taken, potentially leading to even more substantial costs and reputational damage.

Compliance Checklist for Small Businesses

Establishing a comprehensive compliance checklist is vital for ensuring ongoing adherence to all relevant laws and regulations. This checklist should be reviewed and updated regularly to reflect changes in legislation.

- Designated Privacy Officer: Appoint a designated individual responsible for HIPAA compliance.

- Employee Training: Conduct regular HIPAA training for all employees who handle employee health information.

- Data Security: Implement robust security measures to protect electronic PHI (ePHI).

- HIPAA Policies and Procedures: Develop and maintain a written HIPAA compliance program.

- ACA Compliance Review: Regularly review your health insurance offerings to ensure compliance with the ACA.

- State Regulations: Research and comply with all applicable state insurance regulations.

- Record Keeping: Maintain accurate and up-to-date records of all insurance-related activities.

- Regular Audits: Conduct regular internal audits to identify and address any compliance gaps.

- Legal Counsel: Consult with legal counsel to ensure compliance with all relevant laws and regulations.

Cost Optimization Strategies

Navigating the complexities of small business healthcare can feel like a tightrope walk. Finding the right balance between comprehensive coverage and affordable premiums is crucial for both employee satisfaction and business sustainability. Smart cost optimization strategies can significantly ease this burden without sacrificing essential benefits. This section explores practical approaches to reduce medical insurance costs for small businesses.

Effective cost-containment hinges on a multifaceted approach. It’s not about slashing benefits, but about strategically managing expenses and leveraging available resources. This involves careful plan selection, employee engagement, and proactive negotiation with insurance providers. The strategies discussed below offer a blend of proactive measures and reactive adjustments, ultimately leading to a more sustainable healthcare budget.

Negotiating Favorable Rates with Insurance Providers

A skilled medical insurance broker acts as a powerful advocate, leveraging their expertise and established relationships with various insurance providers to negotiate the best possible rates for your small business. Brokers understand the intricacies of insurance contracts, allowing them to identify hidden costs and leverage competitive bids. They can also analyze your employee demographics and health needs to pinpoint the most cost-effective plan options. For example, a broker might secure a group discount by consolidating coverage with other small businesses or negotiating a lower premium in exchange for a higher deductible. This proactive approach can result in significant savings over the long term. The broker’s knowledge of the market ensures you’re not overpaying for comparable coverage.

Employee Wellness Programs and Preventative Care

Investing in employee wellness programs is a proactive approach that yields long-term cost savings. These programs, which might include on-site health screenings, wellness workshops, or gym memberships, encourage preventative care and healthier lifestyles. The direct result is a reduction in claims due to preventable illnesses. For instance, a program focused on weight management and healthy eating habits could decrease the incidence of diabetes and heart disease, significantly lowering healthcare costs. Subsidizing gym memberships or offering health coaching sessions can also demonstrate a commitment to employee well-being and promote a culture of health consciousness.

Plan Design Optimization

Careful selection of the right plan design is paramount. Exploring different plan structures—like high-deductible health plans (HDHPs) coupled with health savings accounts (HSAs)—can offer significant cost savings. HDHPs typically have lower premiums, but higher out-of-pocket costs. HSAs allow employees to contribute pre-tax dollars to a dedicated account to cover medical expenses. This allows employees more control over their healthcare spending and can reduce the overall burden on the business. However, it’s crucial to educate employees on how these plans work to ensure they understand the trade-offs and can effectively manage their healthcare spending. This careful selection process, guided by a broker, can strike the ideal balance between cost and coverage.

Effective Communication Strategies for Cost-Saving Measures

Open and transparent communication with employees is essential to the success of any cost-saving initiative. Regularly informing employees about available resources, such as wellness programs and cost-saving tips, is crucial. Using company newsletters, intranet updates, or even brief meetings to explain the rationale behind cost-saving measures fosters understanding and cooperation. For example, providing clear explanations of how HSAs work, along with resources for effective HSA management, can empower employees to make informed healthcare decisions and reduce overall healthcare costs. A well-informed workforce is a more engaged and cost-conscious workforce.

Choosing the Right Broker

Finding the perfect medical insurance broker for your small business can feel like navigating a maze. The right partner will not only find you competitive coverage but also act as a trusted advisor, guiding you through the complexities of healthcare insurance. Choosing poorly can lead to inadequate coverage, higher costs, and unnecessary headaches. This section will help you make an informed decision.

Questions to Ask Potential Brokers

Before committing to a broker, thorough questioning is crucial. This ensures they understand your specific needs and possess the expertise to meet them. The answers you receive will significantly impact your insurance decisions.

- The broker’s experience working with small businesses of similar size and industry should be clarified. This ensures they understand your unique challenges.

- A detailed explanation of their commission structure and how it might influence their recommendations is essential for transparency.

- Understanding their process for selecting insurance plans and the range of carriers they work with ensures a comprehensive search.

- Their approach to customer service and responsiveness, including how they handle claims and questions, is vital for ongoing support.

- A clear explanation of their service fees and any additional charges associated with their services should be obtained.

Evaluating Broker Qualifications and Experience

Assessing a broker’s credentials goes beyond simply checking their license. A robust evaluation ensures you’re working with a competent and reliable professional.

- Verify their licensing and certifications through the appropriate state regulatory bodies. This confirms their legal ability to operate and provides a baseline of competency.

- Investigate their years of experience in the industry, focusing on their specific experience with small business insurance. Longer experience often translates to greater expertise and a wider network of contacts.

- Review online testimonials and reviews from previous clients. These provide valuable insights into their reputation and the quality of their services. Look for consistent positive feedback across multiple platforms.

- Inquire about their continuing education and professional development. The insurance industry is constantly evolving; ongoing learning demonstrates a commitment to staying current.

- Assess their understanding of your industry’s specific insurance needs. A broker familiar with your sector will offer more tailored and effective solutions.

Verifying Broker Legitimacy and Reputation

Protecting your business from fraudulent or incompetent brokers requires due diligence. Taking proactive steps can save you considerable time and money in the long run.

- Check the broker’s standing with the Better Business Bureau (BBB) for any complaints or negative reviews. This provides an independent assessment of their reputation.

- Confirm their license and insurance with your state’s Department of Insurance. This verifies their legal authorization to sell insurance and provides a record of any disciplinary actions.

- Seek referrals from other small business owners in your network. Word-of-mouth recommendations are often a reliable indicator of a broker’s competence and trustworthiness.

- Review their website and online presence for professionalism and transparency. A well-maintained and informative website suggests a commitment to client service.

- Avoid brokers who pressure you into making quick decisions or who seem overly focused on commissions rather than your needs. A reputable broker will prioritize your best interests.

Building a Strong Working Relationship

The relationship with your broker extends beyond the initial plan selection. A strong partnership ensures ongoing support and effective risk management.

Open communication is paramount. Regular check-ins allow for proactive adjustments to your plan as your business grows and evolves. A responsive broker who readily answers your questions and addresses your concerns fosters trust and ensures you receive the support you need. Remember, choosing a broker is not just about finding the best insurance plan; it’s about establishing a long-term partnership focused on your business’s success.

Navigating the world of medical insurance for your small business can be a headache, but finding the right broker can make all the difference. However, sometimes you need expert legal counsel to handle tricky situations; that’s where checking out resources like lawyers for insurance issues comes in handy. Ultimately, a solid strategy involves both a savvy broker and, when needed, a legal eagle watching your back.

Illustrative Examples of Successful Broker-Client Relationships

Source: customhealthplans.com

Navigating the complex world of small business medical insurance can be daunting. A skilled broker acts as a crucial guide, ensuring businesses secure the best possible coverage at the most competitive price. The following case studies highlight the tangible benefits of a strong broker-client partnership.

Case Study 1: The Growing Tech Startup

Imagine a rapidly expanding tech startup, “Innovate Solutions,” with 25 employees. Their previous insurance plan, chosen independently, proved inadequate as their workforce grew and their employee needs evolved. High premiums, limited coverage options, and confusing administrative processes created significant challenges. They struggled to manage rising healthcare costs and employee dissatisfaction with their benefits. Their broker, recognizing these issues, analyzed their needs, conducted a thorough market analysis, and identified a plan with a significantly lower premium, broader coverage, including mental health benefits and telehealth options, which was highly valued by their employees. The result? Innovate Solutions experienced a 15% reduction in their annual insurance costs, a noticeable increase in employee satisfaction, and improved retention rates. The broker’s proactive approach and detailed understanding of the market were instrumental in achieving these positive outcomes.

Case Study 2: The Family-Owned Restaurant

“Luigi’s Pizzeria,” a family-owned restaurant with 10 employees, faced a different set of challenges. They operated on tight margins and needed affordable, yet comprehensive, coverage for their staff. Their initial attempts to secure insurance independently resulted in frustratingly high quotes that threatened their business viability. Their broker, understanding their financial constraints, explored various plan options, including smaller group plans and association health plans. They negotiated with insurers to secure a competitive premium while ensuring adequate coverage for essential medical services. The broker also provided valuable guidance on employee communication and benefits administration, simplifying the process for Luigi’s. The outcome? Luigi’s Pizzeria secured a plan that fit their budget without compromising employee benefits, contributing to a more stable and satisfied workforce. The broker’s expertise in navigating the complexities of small group insurance and their commitment to finding cost-effective solutions proved invaluable.

Outcome Summary

Securing the right medical insurance for your small business doesn’t have to be a headache. By understanding your options, partnering with a reputable broker, and employing smart cost-saving strategies, you can provide valuable healthcare benefits to your employees without breaking the bank. Remember, proactive planning and informed decisions are key to building a healthy and thriving business. So, ditch the insurance jargon overwhelm and start building a better future for your team – one healthy employee at a time!