My Insurance Portal: Imagine a world where managing your insurance is as easy as scrolling through your favorite app. No more endless phone calls, lost paperwork, or confusing jargon. This is the promise of a well-designed insurance portal, a digital haven where you’re in complete control of your policies, claims, and everything in between. We’re diving deep into what makes a truly great portal tick – from intuitive design and ironclad security to seamless functionality and inclusive accessibility.

This deep dive explores the key components of a successful My Insurance Portal, examining user experience, security protocols, core functionalities, accessibility considerations, and effective marketing strategies. We’ll unpack the technical aspects alongside the crucial human-centered design elements that make all the difference. Get ready to rethink your relationship with insurance.

User Experience on “My Insurance Portal”

Source: com.au

Navigating the world of insurance can feel like traversing a dense jungle. But what if your insurance portal was a breezy, well-lit clearing? That’s the goal of a truly user-centered design. A good insurance portal shouldn’t just provide information; it should empower users to understand and manage their policies with ease and confidence. This section dives into the crucial aspects of creating a seamless and intuitive experience for users interacting with their insurance information online.

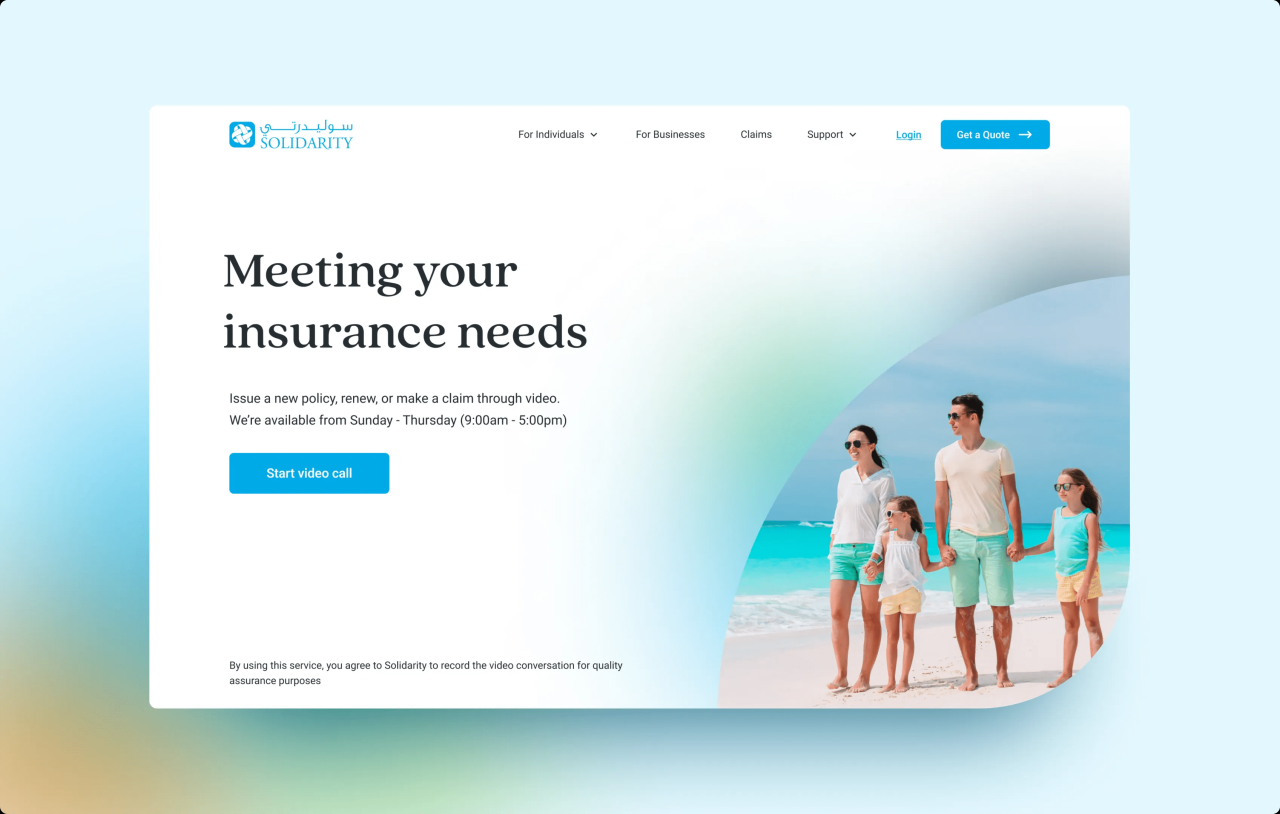

My Insurance Portal Homepage Mockup

Imagine a homepage that immediately greets you with a personalized welcome message and a clear overview of your key policy details. This isn’t just about aesthetics; it’s about prioritizing the information most relevant to the user. The design should be clean, uncluttered, and visually appealing, employing a consistent color scheme and typography for a cohesive look and feel. Here’s a possible layout:

| Feature | Location on Page |

|---|---|

| Personalized Welcome Message & Policy Summary | Top Section, prominent display |

| Quick Links (View Policy, Make Payment, File a Claim) | Below Summary, clearly labeled buttons |

| Upcoming Renewal Date & Amount Due | Prominent display within the Policy Summary |

| Recent Activity (e.g., payments, claim updates) | Below Quick Links, concise and visually appealing display |

| Contact Information & Support Resources | Footer, easily accessible |

| Account Settings & Profile Management | Top right corner, accessible via a user icon |

User Story: Updating Policy Information

As a policyholder, I want to easily access and update my contact information, so I can ensure my policy details are always current and accurate. I want a straightforward process that doesn’t require me to navigate through multiple screens or fill out lengthy forms. I expect clear instructions and immediate confirmation of my updates. This streamlined process should minimize the time and effort required to maintain accurate policy information. For example, I should be able to directly edit my address or phone number within my profile section.

Comparative Analysis of My Insurance Portal Designs

Three different insurance portals were analyzed for their usability, focusing on ease of navigation, clarity of information, and overall user experience.

| Portal Name | Strength | Weakness | Overall Score (1-5, 5 being best) |

|---|---|---|---|

| InsureEasy | Intuitive navigation, clear policy summaries | Limited search functionality, lack of visual appeal | 3 |

| SecureShield | Comprehensive information, excellent customer support integration | Overly complex design, slow loading times | 2 |

| PolicyPro | Visually appealing design, fast loading times, robust search | Some information is difficult to locate | 4 |

Security Features of “My Insurance Portal”

Source: dribbble.com

Your insurance information is personal and sensitive. That’s why we’ve built “My Insurance Portal” with robust security features to protect your data from unauthorized access and breaches. We understand the importance of keeping your details safe and secure, and we’ve implemented multiple layers of protection to ensure your peace of mind.

Protecting your data is our top priority. We employ a multi-layered approach to security, combining industry-standard practices with cutting-edge technologies to safeguard your personal and financial information. This commitment ensures that your interactions with our portal are not only convenient but also secure.

Essential Security Protocols

Several key security protocols are in place to protect user data within “My Insurance Portal.” These protocols work together to create a robust security system, minimizing the risk of data breaches and unauthorized access.

- Data Encryption: All data transmitted to and from the portal is encrypted using industry-standard encryption protocols, such as HTTPS with TLS 1.3 or higher. This ensures that even if data is intercepted, it remains unreadable without the correct decryption key.

- Regular Security Audits: Our security systems undergo regular audits and penetration testing by independent security experts. These audits identify vulnerabilities and help us proactively address potential security risks before they can be exploited.

- Firewall Protection: A robust firewall system acts as a barrier, preventing unauthorized access to our servers and the data they contain. This firewall constantly monitors network traffic, blocking malicious attempts to penetrate our security defenses.

- Intrusion Detection and Prevention System (IDPS): An IDPS monitors network activity for suspicious patterns, alerting us to potential intrusions in real-time. This allows us to respond quickly and effectively to any threats.

- Multi-Factor Authentication (MFA): We utilize MFA to add an extra layer of security to your login process. This requires you to provide multiple forms of authentication, such as a password and a one-time code sent to your registered email or mobile device, before granting access.

User Authentication and Authorization

The process of accessing and using “My Insurance Portal” is designed with security at its core. We employ a robust system to verify your identity and ensure you only have access to the information relevant to your account.

Authentication verifies your identity using your username and password (and potentially a one-time code via MFA). Authorization then determines what specific actions you’re permitted to perform within the portal based on your role and account permissions. For example, a policyholder might have access to view their policy details and make payments, while an agent might have broader access to manage multiple policies.

Measures to Prevent Unauthorized Access and Data Breaches

We’ve implemented a range of measures to proactively prevent unauthorized access and data breaches. These measures go beyond the basic security protocols and focus on creating a highly secure environment.

- Regular Software Updates: We regularly update our software and applications to patch security vulnerabilities and ensure our systems are protected against the latest threats. This includes operating systems, databases, and all applications used within the portal.

- Data Loss Prevention (DLP): DLP tools monitor data movement within the portal, preventing sensitive information from leaving the system without proper authorization. This helps protect against accidental or malicious data leaks.

- Employee Training: Our employees undergo regular security awareness training to understand and mitigate potential security risks. This includes training on phishing scams, password security, and other common threats.

- Access Control: We employ a principle of least privilege, granting users only the access they need to perform their tasks. This limits the potential damage from a compromised account.

Functionality of “My Insurance Portal”

Navigating the world of insurance can feel like deciphering a cryptic code, but a well-designed insurance portal aims to simplify the process. Think of it as your personal insurance command center, accessible 24/7, putting you in control of your policies and claims. This section dives into the practical features and benefits of a typical My Insurance Portal.

Policy Management Features

A robust My Insurance Portal empowers you to manage your policies with ease. This includes accessing crucial details, making changes, and understanding your coverage comprehensively.

| Feature Name | Description | Access Method | User Benefit |

|---|---|---|---|

| Policy Details | View your policy number, coverage details, effective dates, premium amounts, and other relevant information. | Login to the portal and navigate to the “My Policies” section. | Quick access to essential policy information, eliminating the need to search through paperwork. |

| Payment Management | View payment history, make payments online, set up automatic payments, and manage payment methods. | Login to the portal and access the “Payments” or “Billing” section. | Convenient and secure online payment options, reducing administrative hassle and potential late payment fees. |

| Policy Updates | Update your contact information, address, vehicle information (for auto insurance), or other relevant details. | Login to the portal and navigate to the “Profile” or “Account Information” section. | Ensures your information is always up-to-date, preventing delays or issues with claims processing. |

| Policy Documents | Access and download your policy documents, including declarations pages, endorsements, and other relevant paperwork. | Login to the portal and access the “Documents” or “Policy Documents” section. | Easy access to important policy documents whenever needed, reducing the need for physical storage and retrieval. |

Claims Filing Process, My insurance portal

Filing a claim shouldn’t be a stressful ordeal. A user-friendly My Insurance Portal streamlines the process, guiding you through each step with clear instructions and readily available support.

| Feature Name | Description | Access Method | User Benefit |

|---|---|---|---|

| Online Claim Submission | Report a claim online, providing necessary details and uploading supporting documents. | Login to the portal and access the “File a Claim” section. | Convenient and efficient claim reporting from anywhere, anytime, with immediate acknowledgement of the claim. |

| Claim Status Tracking | Monitor the progress of your claim, view updates, and communicate with the claims adjuster. | Login to the portal and access the “My Claims” section. | Transparency into the claims process, reducing uncertainty and anxiety. |

| Claim Documentation Upload | Upload supporting documents such as photos, police reports, or medical records. | Within the online claim submission process or through the “My Claims” section. | Efficient and organized submission of necessary documentation, expediting the claims process. |

Customer Support Integration

Access to immediate assistance is crucial. A My Insurance Portal typically integrates multiple customer support channels for seamless interaction.

| Feature Name | Description | Access Method | User Benefit |

|---|---|---|---|

| FAQ Section | Access a comprehensive library of frequently asked questions and answers. | Directly accessible from the portal’s homepage or a dedicated “Help” section. | Quick answers to common questions, reducing the need to contact customer service directly. |

| Live Chat | Connect with a customer service representative through live chat for immediate assistance. | Typically found in a “Help” or “Contact Us” section. | Real-time assistance for immediate answers and resolution of urgent issues. |

| Email Support | Send an email to customer service for non-urgent inquiries or to follow up on existing issues. | Contact details usually provided in a “Contact Us” section. | Convenient option for non-urgent questions or for issues requiring detailed explanations. |

| Phone Support | Contact customer service by phone for immediate assistance. | Phone number typically prominently displayed on the portal’s homepage or “Contact Us” section. | Traditional customer service option for those who prefer voice communication. |

Self-Service Options and Enhanced Customer Experience

My Insurance Portals significantly enhance the customer experience by empowering self-service options. For instance, instead of waiting on hold for hours to update your address, you can quickly do it yourself online. Similarly, accessing policy documents or tracking claim statuses is significantly faster and more convenient online. This reduces wait times, eliminates the need for phone calls or emails for simple requests, and promotes a sense of control and independence for the policyholder. For example, imagine needing to update your car’s information after a recent purchase; a portal lets you do this instantly, without the hassle of paperwork or phone calls.

Functionality Across Different Insurance Types

While the core functionalities remain similar, the specific features offered on a My Insurance Portal vary depending on the type of insurance. For example, a car insurance portal will heavily focus on accident reporting, vehicle details, and coverage for damages. A home insurance portal might concentrate on claims related to property damage, theft, or liability. A health insurance portal will likely feature tools for managing benefits, finding providers, and viewing claims related to medical services. However, the underlying principle of providing a centralized, convenient platform for policy management, claims filing, and customer support remains consistent across all types.

Accessibility and Inclusivity on “My Insurance Portal”

Making your insurance portal accessible and inclusive isn’t just about ticking boxes; it’s about ensuring everyone can easily manage their insurance, regardless of their abilities or background. A truly inclusive portal fosters trust and empowers users, leading to a better overall experience. This section details how we can achieve that.

Designing an accessible portal requires careful consideration of various factors, ensuring it meets the needs of a diverse user base. This includes individuals with visual, auditory, motor, cognitive, and neurological disabilities, as well as those who may have limited digital literacy or speak a different language.

WCAG Design Guidelines for Accessibility

Adhering to Web Content Accessibility Guidelines (WCAG) is crucial for creating a truly accessible portal. These guidelines provide a structured approach to ensure usability for people with disabilities. Following these guidelines ensures compliance and creates a more inclusive experience for everyone.

- Provide alternative text for all images and multimedia: Descriptive alt text allows screen readers to convey the image’s content to visually impaired users. For example, instead of “image.jpg,” use “A smiling insurance agent helping a customer.”

- Ensure sufficient color contrast: The contrast between text and background colors must meet WCAG standards to ensure readability for users with low vision. For instance, dark text on a light background generally offers better contrast than light text on a dark background.

- Use clear and concise language: Avoid jargon and technical terms. Write in plain language, making the information easy to understand for users with cognitive disabilities or limited technical literacy.

- Provide keyboard navigation: All interactive elements should be accessible via keyboard, enabling users with motor impairments to navigate the portal without a mouse.

- Offer captioning and transcripts for videos and audio content: This allows users who are deaf or hard of hearing to access the information.

- Implement ARIA attributes: Accessible Rich Internet Applications (ARIA) attributes provide additional information to assistive technologies, enhancing accessibility for screen readers and other tools.

Multilingual Support and Culturally Sensitive Design

Offering multilingual support and incorporating culturally sensitive design elements significantly broadens the portal’s reach and enhances user experience. This shows respect for the diverse cultural backgrounds of your user base and promotes inclusivity.

Implementing multilingual support involves translating all content into multiple languages, ensuring consistency and accuracy. Consider using professional translation services to maintain quality. For culturally sensitive design, research the cultural nuances of your target audience and adapt the design accordingly. For example, color choices, imagery, and even the layout of the page can have different cultural meanings.

- Example: Offer the portal in Spanish and Mandarin in addition to English, ensuring all text, buttons, and error messages are accurately translated.

- Example: Use imagery that reflects the diversity of your user base, avoiding stereotypes and showcasing people from different backgrounds and abilities.

Clear, Concise, and Easily Understandable Information

The language used on the portal should be clear, concise, and easy to understand for all users, regardless of their technical literacy. Complex information should be broken down into smaller, manageable chunks. Using plain language and avoiding jargon is essential. Providing visual aids like diagrams and infographics can also improve understanding.

Consider using a readability testing tool to assess the complexity of your text. Aim for a readability score appropriate for a broad audience. Furthermore, provide definitions for any technical terms that are used, ensuring everyone can understand the information presented.

- Example: Instead of “premium calculation methodology,” use “how your insurance cost is determined.”

- Example: Use bullet points and numbered lists to break down complex information into easily digestible parts.

Marketing and Communication Strategies for “My Insurance Portal”

Source: co.id

Launching a successful insurance portal requires a savvy marketing and communication plan to reach both existing and potential customers. This involves highlighting the portal’s convenience, security, and ease of use, ultimately driving adoption and increasing customer satisfaction. A multi-pronged approach, encompassing digital marketing, targeted outreach, and proactive communication, is key.

Marketing Campaign to Promote “My Insurance Portal”

This campaign aims to showcase the numerous benefits of using the My Insurance Portal. We’ll leverage a mix of digital channels and traditional methods to reach our target audience. The core message will focus on saving time, improving accessibility, and enhancing the overall customer experience.

- Digital Marketing: We’ll run targeted social media ads (Facebook, Instagram, LinkedIn) featuring short, engaging videos demonstrating the portal’s key features. These ads will link directly to the portal and offer a free trial or introductory incentive. Search engine optimization () will ensure the portal ranks highly in relevant search results. Email marketing campaigns will be implemented, personalized based on customer segments and their specific needs. For example, customers with upcoming policy renewals will receive emails highlighting the convenience of managing renewals through the portal.

- Traditional Marketing: Print materials (brochures, inserts in policy statements) will provide a concise overview of the portal’s features and benefits. We’ll also consider partnerships with complementary businesses (e.g., financial advisors) to expand our reach and credibility.

- Incentivized Adoption: We’ll offer incentives such as exclusive discounts or rewards for users who actively utilize the portal. This could include points towards a gift card, a small discount on their next policy, or entry into a draw for a larger prize.

Communication Plan for Notifying Users of Updates and Changes

Keeping users informed about updates and changes to the portal is crucial for maintaining trust and ensuring a smooth user experience. Our communication plan prioritizes clarity, timeliness, and multiple channels to reach all users effectively.

- In-Portal Notifications: Prominent notifications will appear within the portal itself, alerting users to any significant updates or changes. These notifications will be clear, concise, and provide links to more detailed information.

- Email Updates: Regular email newsletters will keep users informed about new features, improvements, and any planned maintenance or downtime. These emails will be personalized to ensure relevance to individual users.

- Social Media Announcements: Social media platforms will be used to announce major updates and changes, providing a broader reach and engaging with users through comments and questions.

- FAQ Section: A comprehensive and frequently updated FAQ section on the portal will address common questions and concerns.

Illustrative Examples of Positive Impact

Here are some examples showcasing how the My Insurance Portal improves customer satisfaction and engagement.

- Example 1: Faster Claim Processing: Imagine Sarah, a busy professional, who previously spent hours on the phone filing a claim. Now, using the portal, she can upload all necessary documents in minutes, receiving an update on her claim’s progress in real-time. This saves her valuable time and reduces stress, significantly enhancing her overall satisfaction.

- Example 2: Proactive Policy Management: John, a retiree, uses the portal to easily view his policy details, upcoming renewal dates, and make payments. The portal also sends him personalized reminders, preventing potential lapses in coverage and ensuring peace of mind. This proactive approach strengthens his engagement with the company and reduces the likelihood of policy cancellation.

- Example 3: Improved Customer Service: Maria, a new customer, finds the portal’s intuitive interface easy to navigate. She can access FAQs, contact customer support through live chat, and find answers to her questions quickly and efficiently. This positive first experience fosters trust and loyalty towards the company.

Epilogue

Ultimately, a successful My Insurance Portal isn’t just about technology; it’s about empowerment. It’s about putting the customer firmly in the driver’s seat, offering transparency, control, and a genuinely positive experience. By prioritizing user-centric design, robust security, and accessible functionality, insurance providers can transform the often-dreaded process of managing insurance into something simple, efficient, and even…dare we say…enjoyable? The future of insurance is digital, and it’s all about putting the power back where it belongs: in your hands.