New car insurance online? Yeah, we get it – navigating the world of car insurance can feel like driving through a minefield blindfolded. But fear not, intrepid driver! This isn’t your grandpa’s insurance process. Finding the right coverage is now easier than ever, thanks to the digital revolution. We’re here to break down the process, comparing providers, highlighting key features, and making sure you’re armed with the knowledge to snag the best deal.

From understanding the different types of coverage to navigating the online application process and securing your personal information, we’ll cover everything you need to know. We’ll even help you decipher those confusing policy documents and empower you to become a savvy insurance shopper. So buckle up, and let’s get started!

Understanding the Search Intent

Source: coverfox.com

The search term “new car insurance online” reveals a user actively seeking a specific solution: obtaining car insurance conveniently through a digital platform. This seemingly simple query hides a multitude of underlying motivations and expectations, varying significantly across different user demographics. Understanding these nuances is crucial for crafting effective online insurance offerings.

The reasons behind this search are multifaceted. It’s not simply about price comparison, though that’s a significant factor. Users are also seeking convenience, speed, and transparency in the insurance-buying process. The digital realm promises to streamline what’s traditionally perceived as a cumbersome and often confusing experience.

User Needs and Expectations

Users searching for “new car insurance online” have a diverse range of needs and expectations. Some are looking for the cheapest option, prioritizing affordability above all else. Others prioritize comprehensive coverage, seeking peace of mind and protection against potential risks. Still others are drawn to specific features like roadside assistance, accident forgiveness, or customizable policy options. The level of tech-savviness also influences expectations, with some users desiring a simple, intuitive interface while others appreciate advanced features like online policy management and claims filing. Ultimately, a positive user experience – clear information, easy navigation, and responsive customer service – is universally expected.

Demographics of Users, New car insurance online

The demographics of users searching for online car insurance are broad, encompassing a wide range of ages, income levels, and technological proficiency. However, certain trends are observable. Millennials and Gen Z, being digitally native, are more likely to search online and prefer digital interactions. Busy professionals, valuing convenience and efficiency, also frequently utilize online platforms. Furthermore, individuals in urban areas with readily available internet access are more likely to embrace online car insurance solutions. Finally, price-sensitive consumers, particularly those with lower incomes, may actively search for online options to compare prices and find the most affordable coverage.

User Persona: Sarah, the Busy Professional

Let’s consider a typical user: Sarah, a 32-year-old marketing manager living in a major city. She’s tech-savvy, values efficiency, and has limited free time. She recently purchased a new car and needs insurance quickly. Sarah’s search for “new car insurance online” is driven by her desire for a quick, streamlined process. She wants clear, concise information, easy online comparisons, and a straightforward application process. She’s willing to pay a reasonable price for comprehensive coverage but won’t tolerate complex jargon or frustrating interfaces. Her expectations include a user-friendly website, secure online payment options, and readily available customer support should she encounter any issues. Sarah represents a large segment of the online car insurance market – busy professionals seeking a convenient and efficient solution.

Comparing Online Car Insurance Providers

Choosing the right car insurance can feel like navigating a minefield, especially with so many online providers vying for your attention. This isn’t just about finding the cheapest option; it’s about finding a policy that offers the right coverage at a price you can afford, backed by a reputable company. Let’s dive into comparing three major players in the online car insurance market.

Online Car Insurance Provider Comparison

This table compares three popular online car insurance providers, highlighting their key features, pricing models, and customer feedback. Remember that rates and features can vary based on individual circumstances and location.

| Provider | Features | Pricing Model | Customer Reviews Summary |

|---|---|---|---|

| Progressive | Name Your Price® Tool, 24/7 customer support, mobile app, various discounts (e.g., bundling, safe driver), comprehensive coverage options. | Usage-based insurance options available (Snapshot®), competitive rates, discounts influence final price. | Generally positive, praising the Name Your Price® tool and ease of use, but some complaints about claims processing speed. |

| Geico | Easy online quote process, 24/7 customer service, mobile app, various discounts (e.g., good student, multi-car), strong financial stability. | Competitive rates, discounts significantly impact the final price, often highlighted for its affordability. | Mostly positive reviews, highlighting ease of use and quick claims processing, but some negative feedback regarding customer service responsiveness. |

| State Farm | Wide range of coverage options, strong reputation, extensive agent network (though online services are also available), various discounts, mobile app. | Rates can vary depending on location and risk assessment, competitive pricing, discounts available. | Mixed reviews, reflecting the broad customer base and regional variations in service quality; some praise the agent network, while others prefer a more streamlined online experience. |

Key Differentiating Factors

While all three providers offer online car insurance, key differences exist. Progressive’s Name Your Price® tool stands out for its unique approach to finding a policy that fits a budget. Geico often emphasizes its affordability and streamlined online experience. State Farm, while offering online services, retains a strong agent network, appealing to those who prefer personal interaction.

Pros and Cons of Each Provider

Understanding the strengths and weaknesses of each provider is crucial.

Progressive: Pros – innovative pricing tool, user-friendly app; Cons – claims processing speed can be a concern for some.

Geico: Pros – generally affordable, quick and easy online process; Cons – customer service responsiveness can be inconsistent.

State Farm: Pros – strong reputation, agent network for personalized service; Cons – online experience might not be as streamlined as competitors.

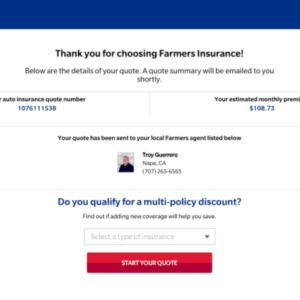

The Online Insurance Application Process: New Car Insurance Online

Navigating the world of online car insurance can feel like driving through a dense fog – until you understand the process. Applying for car insurance online is generally straightforward, but knowing what to expect can make the experience smoother and less stressful. This section breaks down the typical steps involved, highlighting common requirements and potential pitfalls along the way.

Applying for car insurance online typically involves a series of steps designed to gather the necessary information to assess your risk and determine your premium. The process is designed to be efficient, but some complexities might arise depending on your individual circumstances and the insurer’s specific requirements.

Navigating the world of new car insurance online can feel like a maze, but finding the right coverage is key. Think about the risks involved – similarly, businesses need robust protection, like finding the best workers comp insurance for construction to safeguard their workforce. Just as you want the best car insurance rates, construction firms need the best worker’s compensation to manage potential liabilities.

So, shop around for that perfect online car insurance deal!

Steps in the Online Application Process

The online application process usually follows a clear sequence of steps. While specifics vary between providers, the general flow remains consistent. Understanding these steps will prepare you for a smoother application.

- Personal Information: You’ll begin by providing basic personal details such as your name, address, date of birth, and contact information. Accuracy is crucial here, as any discrepancies can delay the process.

- Vehicle Information: Next, you’ll input details about your car, including the make, model, year, VIN (Vehicle Identification Number), and mileage. Having this information readily available will expedite the process.

- Driving History: This section often requires you to provide details of your driving history, including any accidents, tickets, or suspensions. Be completely honest and accurate in this section; omissions or inaccuracies can lead to policy denial or higher premiums.

- Coverage Selection: You’ll choose the level of coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Understanding the different types of coverage is key to making an informed decision.

- Payment Information: Finally, you’ll provide your payment information, typically a credit or debit card, to pay your initial premium. Some insurers may offer payment plan options.

- Review and Submission: Before submitting your application, carefully review all the information you’ve provided to ensure accuracy. Once you’re satisfied, submit your application.

Common Documents Required

Having the necessary documents ready before starting the application will significantly streamline the process. Gather these documents beforehand to avoid delays.

- Driver’s License: A valid driver’s license is essential for verifying your identity and driving history.

- Vehicle Registration: This document provides proof of ownership and details about your vehicle.

- Insurance History: If you have prior insurance coverage, providing details of your previous policies can help determine your eligibility and premiums.

- Proof of Address: Documents like utility bills or bank statements can be used to verify your address.

Potential Challenges During Online Application

While convenient, online applications can present some challenges. Being aware of these potential hurdles can help you navigate the process more effectively.

- Website Glitches: Technical issues on the insurer’s website can cause delays or prevent you from completing the application. Trying again later or contacting customer support may be necessary.

- Incomplete Information: Failing to provide all the required information will prevent the application from being processed. Double-check all fields before submitting.

- System Errors: Unexpected errors can occur during the application process. Contacting customer support is advisable in such cases.

- Understanding Coverage Options: Choosing the right coverage can be confusing. Taking the time to understand the different types of coverage is crucial before applying.

- High Premiums: You might find the quoted premium higher than expected. Exploring different insurers or adjusting your coverage options may be necessary.

Factors Affecting Insurance Premiums

Getting the best car insurance deal isn’t just about clicking the cheapest option. Understanding what influences your premium is key to saving money. Several factors, some within your control and others not, combine to determine how much you’ll pay. Let’s break down the key players.

Your car insurance premium isn’t plucked from thin air; it’s a carefully calculated figure based on a complex interplay of factors. Insurers assess your risk profile, essentially predicting how likely you are to file a claim. The higher the perceived risk, the higher your premium. This risk assessment isn’t arbitrary; it’s based on years of statistical data and actuarial analysis.

Driver Demographics

Age, driving history, and even your credit score can significantly impact your premiums. Younger drivers, statistically, are involved in more accidents, hence higher premiums. A clean driving record, conversely, suggests lower risk and lower premiums. Surprisingly, your credit score can also be a factor, as it reflects your overall financial responsibility. Insurers often see a correlation between responsible financial behavior and responsible driving.

Vehicle Information

The type of car you drive plays a substantial role. Luxury cars and high-performance vehicles are generally more expensive to repair, leading to higher insurance costs. The car’s safety features also matter; cars with advanced safety technology, such as anti-lock brakes and airbags, may qualify for discounts. The year and make of your vehicle also factor into the equation, reflecting the vehicle’s value and repair costs.

Location

Where you live significantly impacts your premiums. Areas with high crime rates or a higher frequency of accidents will generally have higher insurance rates. Insurers consider the likelihood of theft, vandalism, and collisions when setting premiums. This is because the frequency of claims in a specific geographic location directly affects the overall cost of insurance for that area.

Coverage Options

The type and amount of coverage you choose directly affect your premium. Comprehensive coverage, which covers damage from events outside of accidents, is more expensive than liability-only coverage. Higher coverage limits for liability and collision also mean higher premiums. Choosing a higher deductible, meaning you pay more out-of-pocket in the event of a claim, will lower your premium.

Hypothetical Scenario: The Impact of Changing Factors

Let’s imagine two drivers, Alex and Ben. Both are 30 years old and drive a 2018 Honda Civic. Alex has a clean driving record and lives in a suburban area with low crime rates, opting for comprehensive coverage with a $500 deductible. Ben, on the other hand, has had two accidents in the past three years, lives in a city with a high crime rate, and chooses comprehensive coverage with a $1000 deductible. Even with the same car and age, Ben’s premiums will likely be significantly higher than Alex’s due to his less favorable risk profile. This illustrates how even seemingly small differences in individual factors can drastically alter the final premium.

Insurance Policy Coverage Options

Source: fatberry.com

Navigating the world of car insurance can feel like driving through a dense fog, especially when faced with the various coverage options. Understanding what each type of coverage offers is crucial to securing the right protection without overspending. This section breaks down the key coverage types, allowing you to make informed decisions about your car insurance policy.

Choosing the right car insurance coverage is a balancing act between cost and protection. You need enough coverage to safeguard yourself financially in case of an accident, but you also don’t want to pay more than necessary. Let’s explore the main types of coverage and how they differ.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. This is usually broken down into bodily injury liability and property damage liability. For example, a 100/300/100 liability policy means $100,000 per person for bodily injury, $300,000 total for all bodily injuries in an accident, and $100,000 for property damage. The amounts you choose depend on your risk tolerance and financial situation. It’s essential to have adequate liability coverage, as the costs of serious accidents can quickly exceed your personal savings.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your insurance will cover the cost of fixing your car (less your deductible). For instance, if you hit a deer or a parked car, collision coverage would step in. However, keep in mind that this coverage usually has a deductible, meaning you’ll pay a certain amount out-of-pocket before the insurance company starts paying. The higher your deductible, the lower your premium, but the more you’ll pay if you need to file a claim.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail damage, and even damage from animals. Think of it as a broader safety net for your car. Similar to collision coverage, it typically has a deductible. While it offers more extensive protection, it often comes with a higher premium than collision coverage alone. Consider the age and value of your vehicle when deciding whether comprehensive coverage is worthwhile.

Coverage Levels and Associated Costs

The cost of your car insurance will vary significantly based on several factors, including your driving record, age, location, and the type of vehicle you drive. The following table illustrates hypothetical premium costs for different coverage levels. Remember that these are examples and your actual costs may differ.

| Coverage Type | Coverage Amount | Annual Premium (Hypothetical) |

|---|---|---|

| Liability | 100/300/100 | $500 |

| Liability + Collision | 100/300/100, $500 deductible | $800 |

| Liability + Collision + Comprehensive | 100/300/100, $500 deductible | $1000 |

| Liability + Collision + Comprehensive | 250/500/250, $1000 deductible | $700 |

Securing Your Information Online

Buying car insurance online offers incredible convenience, but it also introduces a new layer of responsibility: protecting your personal data. The internet, while a powerful tool, is also a landscape teeming with potential threats. Understanding these risks and taking proactive steps to safeguard your information is crucial for a secure and worry-free online insurance experience.

Sharing sensitive details like your driver’s license number, address, and financial information requires a heightened sense of caution. Failing to do so could expose you to identity theft, financial fraud, or other serious consequences. This section will Artikel the potential risks and provide practical advice to help you navigate the online insurance world safely.

Potential Security Risks in Online Insurance Transactions

Online insurance transactions, while generally secure, are not immune to security breaches. Phishing scams, malware infections, and unsecured websites are just a few of the threats you might encounter. Phishing emails, for example, often mimic legitimate insurance company communications, attempting to trick you into revealing your login credentials or other sensitive information. Malware, on the other hand, can secretly install itself on your computer and steal data as you browse. Finally, using unsecured websites (those without “https” in the address bar) leaves your information vulnerable to interception by malicious actors. These risks highlight the importance of vigilance and proactive security measures.

Protecting Your Personal Information During Online Insurance Purchases

Several steps can significantly reduce your risk of online data breaches. Firstly, always verify the website’s legitimacy before entering any personal information. Look for the “https” in the address bar, indicating a secure connection. Check for reviews and testimonials to gauge the site’s reputation. Secondly, use strong, unique passwords for all online accounts, including your insurance provider’s portal. Consider using a password manager to help generate and securely store complex passwords. Thirdly, be wary of unsolicited emails or phone calls requesting personal information. Legitimate insurance companies rarely solicit sensitive details through these channels. If you’re unsure about a communication’s authenticity, contact your insurance provider directly through their official website or phone number listed on your policy documents. Finally, keep your software updated, including your operating system, web browser, and antivirus software. Regular updates often include security patches that protect against known vulnerabilities.

Managing Your Online Insurance Policy

Source: ftcdn.net

Navigating the digital world of car insurance doesn’t end with purchasing your policy. Online platforms offer a wealth of tools to manage your coverage efficiently, allowing you to make changes and access information whenever needed, from the comfort of your couch. This streamlined approach to policy management saves you time and hassle compared to traditional methods.

Accessing Your Policy Information

Most online insurance portals provide a dedicated dashboard offering a centralized view of your policy details. This typically includes your policy number, coverage limits, payment schedule, renewal date, and contact information. You can usually download a copy of your policy documents directly from this dashboard, eliminating the need for phone calls or mailed requests. For example, many insurers provide an easily accessible digital ID card, perfect for keeping on your phone.

Making Policy Changes

Updating your information or making adjustments to your policy is often a straightforward process. Many online portals allow you to change your address, phone number, email address, or even add or remove drivers from your policy with just a few clicks. The process typically involves logging into your account, navigating to the relevant section (e.g., “Policy Details” or “Manage Drivers”), and making the necessary changes. Confirmation emails or updated policy documents will generally be sent to you to verify the changes. For instance, adding a new driver might involve providing their driver’s license information and driving history.

Online Tools and Resources

Beyond basic policy management, many insurers offer additional online tools and resources. These can include payment options (e.g., setting up automatic payments), claims reporting portals, and access to 24/7 customer support via live chat or email. Some companies might also offer mobile apps that provide even more convenient access to your policy information and features. For example, you might find a tool to calculate the impact of adding optional coverage or changing your deductible on your premium. These tools empower you to understand your policy better and make informed decisions.

Illustrative Example: A New Driver

Navigating the world of car insurance can feel overwhelming, especially for new drivers. The good news is that the process of securing online car insurance is generally straightforward, though it requires careful attention to detail. Let’s walk through a typical scenario for a new driver obtaining coverage online.

Getting car insurance as a new driver often involves a slightly steeper learning curve, but with a methodical approach, the process becomes manageable. The key is to understand the requirements and be prepared to provide accurate information.

The Online Car Insurance Application Process for New Drivers

The online application process typically involves several steps. First, you’ll need to select a provider by comparing quotes from different companies. Once you’ve chosen a provider, you’ll create an account and begin filling out the application. This will require a substantial amount of personal and vehicle information.

- Provider Selection and Quote Comparison: Start by using online comparison tools to get quotes from multiple insurers. This allows you to compare prices and coverage options before committing to a specific provider. Remember to input all relevant information accurately to ensure the quotes are as precise as possible.

- Account Creation: Once you’ve selected a provider, create an account on their website. This usually involves providing your email address and creating a password.

- Information Input: This is the most crucial step. You’ll need to provide comprehensive personal information, including your full name, date of birth, address, driving history (even if it’s limited), and contact details. For your vehicle, you’ll need the year, make, model, VIN (Vehicle Identification Number), and any relevant modifications. Be meticulous; inaccurate information can lead to delays or even policy rejection.

- Payment Information: You’ll need to provide your payment information, typically a credit or debit card, to pay your initial premium.

- Policy Review and Acceptance: Before finalizing, carefully review the policy details, including coverage amounts, deductibles, and premium costs. Once you’re satisfied, accept the terms and conditions to complete the process.

Challenges Faced by New Drivers and Solutions

New drivers often face unique challenges when obtaining car insurance. Their lack of driving history is a major factor influencing premium costs. They may also be unfamiliar with insurance terminology and the various coverage options available.

- High Premiums: Because of their lack of driving experience, new drivers are considered higher risk, resulting in higher premiums. To mitigate this, consider taking a defensive driving course; many insurers offer discounts for completing such courses. Maintaining a clean driving record is also crucial.

- Limited Driving History: Insurers rely heavily on driving history to assess risk. New drivers can overcome this by providing any relevant information, such as driver’s education completion or participation in a safe driving program.

- Understanding Policy Jargon: The insurance industry uses specialized terminology. Take your time to research and understand the different types of coverage (liability, collision, comprehensive, etc.) before making a decision. Don’t hesitate to contact the insurer’s customer service for clarification.

- Choosing the Right Coverage: Balancing affordability with adequate protection can be tricky. Consider your budget and the level of risk you’re willing to assume. Start with the minimum legally required coverage and consider adding optional coverage as your budget allows.

Last Word

So, there you have it – your ultimate guide to conquering the world of new car insurance online. Remember, finding the right coverage isn’t just about the price tag; it’s about finding a provider that fits your needs and offers the peace of mind you deserve. With a little research and our handy tips, you can confidently navigate the online landscape and secure the best car insurance for your ride. Happy driving!