NYS spousal car insurance: Navigating the world of car insurance in New York can feel like driving through a blizzard – confusing and potentially costly. But don’t worry, we’re here to clear the road. Adding your spouse to your car insurance policy in New York isn’t just about ticking a box; it’s about understanding the legal requirements, the financial implications, and how to snag the best possible deal. This guide breaks down everything you need to know, from minimum coverage to maximizing your discounts.

We’ll explore the key factors that affect your rates, like driving history and age, and unpack the different types of coverage available. Think of this as your ultimate survival kit for navigating the often-tricky terrain of New York State’s spousal car insurance rules. We’ll even help you compare providers and find the best fit for your family’s needs, ensuring you’re not overpaying for the protection you deserve.

New York Spousal Insurance Requirements: Nys Spousal Car Insurance

Navigating the world of car insurance in New York can feel like driving through a blizzard – confusing and potentially costly. Understanding the rules around spousal coverage is crucial to avoid unexpected financial headaches. This guide clarifies the legal requirements and practical implications of adding your spouse to your car insurance policy.

Adding a spouse to your New York car insurance policy isn’t simply a matter of convenience; it’s often a legal necessity. New York is a no-fault state, meaning your own insurance covers your injuries regardless of who caused the accident. However, this doesn’t negate the need for proper coverage for your spouse. Failure to adequately insure your spouse could lead to significant financial liability in the event of an accident.

Adding a Spouse to an Existing Policy

The process of adding your spouse to your existing car insurance policy is generally straightforward. You’ll need to contact your insurance provider and provide their driver’s license information, driving history, and other relevant details. The insurer will then assess their risk profile and adjust your premium accordingly. Expect to provide information about their driving record, including any accidents or violations. Some insurers offer online portals where you can manage this process digitally.

Situations Requiring or Benefiting from Spousal Coverage

Several scenarios highlight the importance of spousal coverage. If your spouse regularly drives your vehicle, adding them to your policy is essential for legal compliance and financial protection. This ensures coverage for both of you in case of accidents, regardless of who’s at fault. Even if your spouse owns their own car, adding them to your policy might result in lower premiums due to potential discounts. Furthermore, if your spouse is a frequent passenger in your vehicle, their inclusion on the policy offers protection in case of an accident.

Cost Comparison: Separate vs. Joint Policies

The financial implications of adding a spouse versus maintaining separate policies vary significantly depending on several factors, including driving history, age, and the type of coverage. Generally, adding your spouse to your existing policy often leads to lower overall costs compared to two separate policies. This is because insurance companies frequently offer discounts for multiple vehicles or drivers under a single policy.

| Factor | Separate Policies | Joint Policy |

|---|---|---|

| Cost | Potentially higher due to multiple premiums and administrative fees. | Generally lower due to multi-policy discounts. |

| Coverage | Identical coverage if similar policies are chosen. | Comprehensive coverage for both spouses under a single policy. |

| Discounts | Limited discounts, possibly only for individual driver characteristics. | Access to multi-vehicle and multi-driver discounts. |

Factors Affecting Spousal Car Insurance Rates in NY

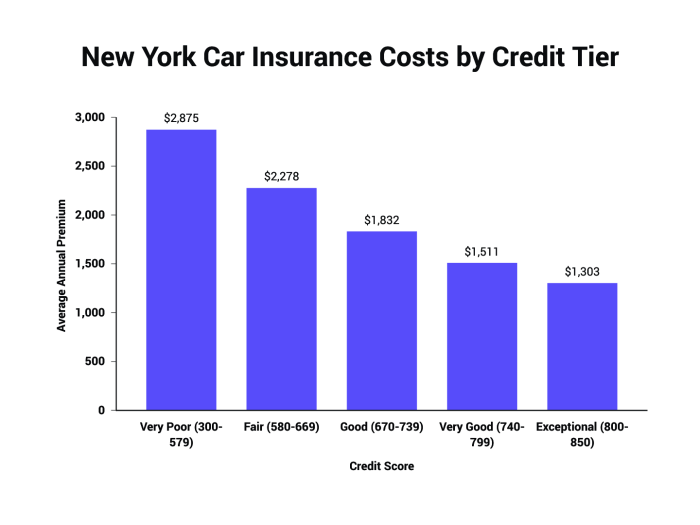

Source: thezebra.com

Getting married and adding your spouse to your car insurance policy in New York might seem like a simple formality, but it can significantly impact your premiums. Several factors go into determining how much your insurance company will charge. Understanding these factors can help you prepare for potential changes and even shop around for better rates.

Insurance companies in New York use a complex algorithm to calculate your rates, taking into account a variety of factors related to both you and your spouse. This isn’t just about adding another driver; it’s about assessing the overall risk associated with having them on your policy. The goal is to accurately reflect the probability of an accident or claim involving either vehicle or driver.

Driving History’s Impact on Spousal Rates

Your spouse’s driving history is a major determinant of your combined insurance costs. A clean record generally translates to lower premiums, while accidents and violations significantly increase the risk profile, leading to higher rates. Insurance companies meticulously track accidents, speeding tickets, DUIs, and other moving violations. Even minor infractions can add up and affect your overall rate. The severity and frequency of incidents heavily influence the premium increase. For instance, a single speeding ticket might lead to a modest increase, while a DUI or an at-fault accident resulting in significant damages will likely result in a substantial jump in your premium.

Age and Driving Experience’s Influence on Premiums

Age and driving experience are strongly correlated with accident risk. Younger drivers, particularly those with less experience behind the wheel, are statistically more likely to be involved in accidents. Therefore, adding a young, inexperienced spouse to your policy can lead to higher premiums compared to adding a more seasoned, older driver with a proven track record of safe driving. Conversely, adding a spouse with extensive driving experience and a clean record can sometimes even lower your overall rate, especially if they are significantly older than the primary policyholder.

Rate Differences: Clean Record vs. Violations

The difference in insurance rates between adding a spouse with a clean driving record versus one with violations can be substantial.

- Clean Driving Record: Adding a spouse with a pristine driving record, meaning no accidents or tickets in several years, will likely result in a modest increase or even a slight decrease in your overall premium, depending on other factors like age and vehicle type.

- Driving Violations: Conversely, adding a spouse with a history of accidents, speeding tickets, or other violations will undoubtedly increase your insurance rates. The increase can be significant, especially if the violations are serious or frequent. The insurer considers the severity and frequency of the violations to calculate the additional risk.

Types of Coverage for Spouses in NY

Source: wikihow.com

Choosing the right car insurance coverage for your spouse in New York is crucial for financial protection in case of accidents. Understanding the different types of coverage and the state’s minimum requirements will help you make an informed decision that best suits your needs and budget. This section breaks down the key coverage options and their implications.

New York’s Minimum Car Insurance Requirements for Spouses

New York State mandates minimum liability coverage for all drivers, including spouses. This means that even if your spouse is listed on your policy, they must meet the state’s minimum requirements. These requirements include bodily injury liability coverage and property damage liability coverage. Failure to maintain the minimum coverage can result in significant penalties. The minimums are designed to protect others involved in an accident caused by your spouse, not necessarily to fully cover your spouse’s vehicle or medical expenses.

Liability Coverage

Liability coverage protects you and your spouse if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. The minimum liability coverage in New York is 25/50/10, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $10,000 for property damage. For example, if your spouse causes an accident resulting in $30,000 in medical bills for one person, you would be personally liable for the extra $5,000. Higher liability limits offer greater protection against substantial financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your spouse’s vehicle if it’s damaged in an accident, regardless of who is at fault. This is crucial if you want to ensure your vehicle is repaired or replaced after an accident, even if your spouse is at fault. For example, if your spouse crashes into a tree, collision coverage will cover the cost of repairing or replacing their car. This coverage is optional, but highly recommended.

Comprehensive Coverage

Comprehensive coverage protects your spouse’s vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. This is particularly beneficial for protecting against non-accident related damage. For example, if a tree falls on your spouse’s car during a storm, comprehensive coverage will cover the repairs. Like collision, it is an optional but valuable addition to a policy.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your spouse if you’re involved in an accident caused by an uninsured or underinsured driver. In New York, many drivers carry minimum liability coverage, which may not be sufficient to cover significant medical expenses or property damage. This coverage helps bridge that gap. For example, if an uninsured driver hits your spouse’s car, this coverage will help pay for medical bills and vehicle repairs.

Personal Injury Protection (PIP)

PIP coverage pays for medical expenses and lost wages for you and your spouse, regardless of fault, after a car accident. This coverage is often mandated in New York. It covers medical bills, lost wages, and other related expenses, even if the accident was your spouse’s fault. This is especially helpful for covering medical costs quickly after an accident, without having to determine fault.

| Coverage Type | Benefits | Drawbacks | Example Scenario |

|---|---|---|---|

| Liability | Protects others if your spouse causes an accident. | Doesn’t cover your spouse’s vehicle or medical expenses. | Spouse causes accident, injuring another driver. Liability covers the other driver’s medical bills. |

| Collision | Covers damage to your spouse’s vehicle in an accident, regardless of fault. | Higher premiums. | Spouse crashes into a parked car. Collision covers repairs to their vehicle. |

| Comprehensive | Covers damage to your spouse’s vehicle from non-collision events. | Higher premiums. | Spouse’s car is damaged by a hailstorm. Comprehensive covers repairs. |

| Uninsured/Underinsured Motorist | Protects against accidents caused by uninsured or underinsured drivers. | May require a separate premium. | Spouse is hit by an uninsured driver. This coverage helps cover medical expenses and vehicle repairs. |

Discounts and Savings on Spousal Car Insurance

Adding your spouse to your car insurance policy in New York doesn’t have to break the bank. Several discounts and strategies can significantly reduce your overall premium. Smart shopping and leveraging available options can lead to substantial savings, freeing up your budget for other priorities. Let’s explore the avenues available to lower your spousal insurance costs.

Many insurance companies offer a variety of discounts designed to reward responsible driving and financial prudence. These discounts can stack, leading to considerable savings when combined. Understanding these options and actively pursuing them is key to securing the best possible rate for your family’s car insurance needs.

Bundling Discounts

Bundling your home and auto insurance policies with the same provider is a classic way to save money. Insurance companies often offer significant discounts for bundling, recognizing the reduced risk associated with insuring multiple policies with a single customer. For example, a 10% discount on both your home and auto insurance could translate to substantial savings annually, especially for those with valuable homes or multiple vehicles. The exact discount percentage varies depending on the insurer and your specific policy details, so it’s always worth inquiring about the potential savings.

Safe Driver Discounts and Defensive Driving Courses

Maintaining a clean driving record is paramount for securing lower insurance premiums. Many insurers offer discounts for drivers with accident-free driving histories. Furthermore, completing a state-approved defensive driving course can often lead to additional discounts, demonstrating your commitment to safe driving practices. These courses often cover techniques to avoid accidents and improve your driving skills, which insurers view favorably. For instance, completing a course might result in a 5-10% discount, varying based on the insurer and the course’s accreditation.

Strategies for Obtaining the Lowest Rates for Spousal Coverage

Securing the lowest possible rates requires a proactive approach. Don’t simply accept the first quote you receive. Shop around, compare quotes from multiple insurers, and leverage all available discounts. A little effort can yield significant rewards.

- Bundle your home and auto insurance: Combine your home and auto insurance policies with the same company to unlock significant discounts.

- Maintain a clean driving record: Avoid accidents and traffic violations to qualify for safe driver discounts.

- Complete a defensive driving course: Demonstrate your commitment to safe driving and earn additional discounts.

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive; shop around for the best rates.

- Consider increasing your deductible: A higher deductible usually translates to lower premiums, but make sure you can comfortably afford the higher out-of-pocket expense in case of an accident.

- Ask about additional discounts: Inquire about discounts for good students, multiple vehicles, or other factors that might apply to your situation.

- Pay your premiums on time: Prompt payment can sometimes lead to small discounts or avoid late payment fees.

- Install anti-theft devices: Installing anti-theft devices in your vehicles can reduce your insurance premiums.

Filing a Claim with Spousal Coverage in NY

Navigating the insurance claim process after an accident involving your spouse can be stressful, but understanding the steps involved can make the experience significantly smoother. This section Artikels the process, the insurer’s role, potential complications, and a step-by-step guide to help you through it.

Filing a claim when your spouse is involved in a car accident in New York generally follows a similar process to filing a claim for any other accident. However, the fact that the involved parties are married can introduce unique considerations and complexities. The insurance company’s investigation will thoroughly examine the circumstances surrounding the accident, including the relationship between the drivers.

The Insurance Company’s Role in Investigating and Settling Spousal Claims

The insurance company’s primary role is to investigate the accident to determine liability and assess damages. This investigation may include reviewing police reports, interviewing witnesses, inspecting the vehicles involved, and reviewing medical records. In cases involving spouses, the insurer might scrutinize the details more closely to ensure there’s no attempt to defraud the company, such as exaggerating injuries or damages. They will aim to determine who was at fault and the extent of the financial losses. The insurer then uses this information to determine the settlement amount.

Scenarios Where Spousal Claims Might Be Complicated or Disputed

Several situations can complicate or lead to disputes in spousal car insurance claims. For instance, if both spouses are at fault in an accident, determining the appropriate apportionment of liability can be complex. Another challenging scenario involves accidents occurring during a domestic dispute, where pre-existing tensions might affect the claim’s handling. Cases where the claim amount significantly exceeds the policy’s limits can also result in disputes, especially if additional coverage isn’t available. Finally, claims involving intentional acts or fraud, even if unintentional, can lead to significant complications and potential denial of coverage. For example, if one spouse intentionally caused the accident to obtain insurance money, the claim will likely be denied.

A Step-by-Step Guide for Filing a Spousal Car Insurance Claim in NY

Prompt reporting and accurate documentation are crucial. Here’s a step-by-step guide:

- Report the Accident: Immediately report the accident to the police and your insurance company. Obtain a police report number.

- Gather Information: Collect all relevant information from the accident scene, including contact details of all parties involved, witnesses, and details of the vehicles involved. Take photos of the damage to the vehicles and the accident scene if possible.

- Seek Medical Attention: If anyone is injured, seek immediate medical attention. Document all medical treatments and expenses.

- File a Claim: Contact your insurance company and file a formal claim. Provide all the information you’ve gathered, including the police report, medical records, and photos.

- Cooperate with the Investigation: Fully cooperate with your insurance company’s investigation. Be truthful and provide all requested information promptly.

- Review the Settlement Offer: Once the investigation is complete, your insurance company will offer a settlement. Carefully review the offer and consult with an attorney if necessary before accepting it.

Comparing Insurance Providers for Spousal Coverage

Source: everwalk.com

Choosing the right car insurance provider in New York can significantly impact your overall cost and the level of protection you receive, especially when it comes to spousal coverage. Several major insurers offer policies in NY, each with its own strengths and weaknesses. Understanding these differences is crucial for securing the best value for your needs.

Key Differences in Policy Features Among Providers

Major providers like Geico, State Farm, and Progressive offer spousal coverage as standard, but the specific features and limitations can vary. For instance, Geico might offer more comprehensive accident forgiveness programs, while State Farm may have a broader network of preferred repair shops. Progressive, known for its online tools, could provide a more streamlined claims process. These differences aren’t always immediately apparent and require careful comparison of policy documents. It’s vital to read the fine print to understand the nuances of each policy’s coverage limits, deductibles, and exclusions.

Pricing Structures and Customer Service Comparisons, Nys spousal car insurance

Insurance pricing is dynamic and depends on several factors including driving history, vehicle type, location, and the specific coverage selected. However, general trends can be observed. Geico often advertises competitive rates, particularly for drivers with clean records. State Farm, known for its extensive agent network, might offer personalized service and potentially higher rates reflecting this personalized attention. Progressive’s online focus often translates to potentially lower overhead costs, which might be reflected in their pricing. Customer service quality varies across providers; online reviews and independent ratings can offer valuable insights into customer satisfaction with each insurer’s claims handling and responsiveness.

Effective Comparison of Insurance Quotes

To find the best value, gather quotes from at least three providers using a consistent set of parameters. This means specifying the same coverage levels (liability, collision, comprehensive, etc.), deductibles, and driver information for each quote request. Don’t just focus on the premium price; compare the coverage details to ensure you’re comparing apples to apples. Look for discounts offered for bundling policies (home and auto), safe driving records, or other factors applicable to your situation. Utilize online comparison tools cautiously, as they may not always include every provider or the full range of available options.

Summary of Key Features and Pricing

| Provider | Average Annual Premium (Estimate) | Key Features | Customer Service Highlights |

|---|---|---|---|

| Geico | $1200 – $1800 | Competitive pricing, strong online tools, accident forgiveness programs. | Generally positive online reviews, efficient online claims process. |

| State Farm | $1400 – $2000 | Extensive agent network, personalized service, potentially broader coverage options. | High customer satisfaction ratings, strong local agent support. |

| Progressive | $1100 – $1700 | Name-Your-Price® Tool, online quote and management, various discounts. | Mixed reviews, strong online tools but potentially longer wait times for phone support. |

*Note: Premium estimates are illustrative and will vary based on individual circumstances. Actual rates should be obtained through direct quotes from each provider.*

Conclusion

So, there you have it – a comprehensive look at NYS spousal car insurance. Remember, understanding the intricacies of your policy isn’t just about saving money; it’s about ensuring you and your spouse are adequately protected on the road. By understanding the factors influencing your rates, exploring coverage options, and strategically seeking discounts, you can navigate the system confidently and find a policy that offers both peace of mind and financial sense. Now get out there and drive safely!