Ohio insurance rates: Navigating the world of car insurance in the Buckeye State can feel like a minefield. From understanding the bewildering array of coverage options to deciphering the impact of your driving history and credit score, finding affordable insurance can be a real headache. But don’t worry, we’re here to break it all down, offering practical tips and strategies to help you secure the best possible rates without sacrificing coverage.

This guide dives deep into the factors that influence your Ohio insurance premiums, offering insights into everything from demographic details and vehicle type to location and the often-mysterious role of your credit score. We’ll also explore ways to save money, compare quotes effectively, and understand your rights as a policyholder. Get ready to become an insurance pro!

Factors Influencing Ohio Insurance Rates

Securing affordable car insurance in Ohio involves understanding the numerous factors that influence your premiums. These factors are not arbitrary; they reflect the risk insurers assess based on your profile and driving habits. This detailed breakdown illuminates the key elements determining your Ohio car insurance costs.

Driver Demographics and Driving History

Your age and driving history significantly impact your insurance rates. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Conversely, older drivers with clean records often enjoy lower rates due to their reduced risk profile. A history of accidents, speeding tickets, or DUI convictions will invariably increase your premiums, reflecting the increased risk you present to the insurer. The severity and frequency of past incidents heavily influence the rate increase. For instance, a single minor accident might result in a modest increase, while multiple serious accidents or DUI convictions could lead to significantly higher premiums or even policy rejection.

Types of Coverage and Their Cost

The types of coverage you choose directly affect your premium. Liability coverage, which is legally mandated in Ohio, pays for damages to others in case of an accident you cause. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage protects against non-collision damages like theft or weather-related events. Higher coverage limits generally mean higher premiums. Opting for only the state-minimum liability coverage will result in the lowest premiums, but leaves you vulnerable to significant financial losses in the event of a serious accident. Conversely, comprehensive and collision coverage, while more expensive, offer greater financial protection.

Location and Insurance Rates

Your location within Ohio plays a significant role in determining your insurance rates. Urban areas tend to have higher rates due to increased traffic congestion, higher accident rates, and a greater likelihood of vehicle theft. Rural areas generally have lower rates due to the opposite factors. Cities like Columbus and Cleveland, with their dense populations and higher accident frequency, will likely have higher insurance premiums compared to smaller towns or rural counties. This reflects the increased risk insurers perceive in these higher-density areas.

The Role of Credit Scores

In Ohio, as in many states, your credit score can be a factor in determining your insurance premiums. Insurers often use credit-based insurance scores (CBIS) as an indicator of risk. A good credit score generally correlates with lower premiums, while a poor credit score can result in significantly higher rates. This is based on the statistical correlation between credit history and insurance claims. However, it’s important to note that Ohio law mandates insurers to consider other factors beyond credit score alone.

Vehicle Features and Insurance Costs

The make, model, and safety features of your vehicle directly influence your insurance rates. Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, tend to have lower premiums due to their reduced accident risk. Similarly, vehicles with higher safety ratings from organizations like the IIHS (Insurance Institute for Highway Safety) often result in lower premiums. Conversely, high-performance vehicles or those with a history of theft or accidents tend to have higher premiums. The cost of repairs also plays a significant role; vehicles with expensive parts and repair costs will naturally lead to higher insurance premiums.

Insurance Rates for Different Vehicle Types in Major Ohio Cities

| City | Sedan (Mid-size) | SUV (Mid-size) | Truck (Pickup) |

|---|---|---|---|

| Columbus | $1200 – $1800 (Annual) | $1500 – $2200 (Annual) | $1800 – $2500 (Annual) |

| Cleveland | $1300 – $1900 (Annual) | $1600 – $2300 (Annual) | $1900 – $2600 (Annual) |

| Cincinnati | $1100 – $1700 (Annual) | $1400 – $2100 (Annual) | $1700 – $2400 (Annual) |

*Note: These are estimated ranges and actual rates will vary based on individual factors.*

Finding Affordable Ohio Insurance

Source: ezelogs.com

Ohio insurance rates can vary wildly depending on location and coverage, but comparing them to other states offers valuable perspective. For instance, understanding the pricing structures in places like Arizona, where you might find deals like those offered by allstate insurance phoenix az , helps illustrate the broader national picture of insurance costs. Ultimately, thorough research is key to finding the best Ohio insurance rates for your needs.

Navigating the world of Ohio insurance rates can feel like a maze, but finding affordable coverage is entirely possible with the right strategies. This section breaks down practical tips and techniques to help you secure the best insurance rates without compromising on necessary protection. Remember, shopping around and understanding your options are key to saving money.

Comparing Insurance Quotes

Effectively comparing insurance quotes requires a systematic approach. Start by gathering information about your needs – coverage amounts, vehicle details (if applicable), and your personal risk profile. Then, use online comparison tools or contact multiple insurance providers directly, ensuring you’re providing consistent information to each for accurate comparisons. Pay close attention to the details of each quote, including deductibles, coverage limits, and any exclusions. Don’t just focus on the price; consider the overall value and level of protection offered.

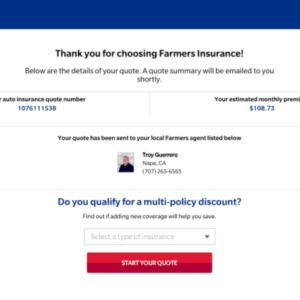

Bundling Insurance Policies

Bundling your auto and home insurance policies with the same provider often leads to significant savings. Insurance companies incentivize bundling by offering discounts, recognizing the reduced risk associated with insuring multiple policies for the same customer. However, the drawback is that you’re committing to a single provider, potentially limiting your options for finding the best individual rates for either auto or home insurance. Carefully weigh the potential savings against the convenience and flexibility of having separate policies.

Obtaining Insurance Quotes Online

Getting insurance quotes online is straightforward. First, visit the websites of various insurance companies operating in Ohio. Second, fill out the required information accurately and completely, typically including personal details, vehicle information (for auto insurance), and property details (for home insurance). Third, review the quotes you receive, paying close attention to the details of coverage and pricing. Finally, compare the quotes side-by-side before making a decision. Many comparison websites streamline this process by allowing you to input your information once and receive multiple quotes simultaneously.

Discounts for Ohio Drivers

Several discounts can lower your Ohio insurance premiums. Good student discounts are commonly available for students maintaining a high GPA. Safe driver discounts reward those with clean driving records, often involving years without accidents or traffic violations. Other potential discounts include multi-car discounts (for insuring multiple vehicles), and discounts for installing anti-theft devices or completing defensive driving courses. Contact insurers directly to inquire about available discounts and the specific requirements to qualify.

Impact of Increasing Deductibles

Increasing your deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—directly impacts your premium cost. A higher deductible generally leads to lower premiums. This is because you’re assuming more of the risk, reducing the insurer’s potential payout. However, it’s crucial to balance affordability with your financial capacity to handle a higher deductible in case of an accident or claim. Consider your emergency fund and overall financial situation before making this decision. For example, increasing your deductible from $500 to $1000 might save you $100 annually, but you’ll need to be prepared to cover $500 more out-of-pocket if you need to file a claim.

Questions to Ask Insurance Agents

Before committing to a policy, thoroughly understand the terms and conditions. Ask about the specific coverage details, including what is and isn’t covered. Inquire about the claims process, including how to file a claim and what documentation is required. Clarify any exclusions or limitations on coverage. Finally, ask about the renewal process and any potential increases in premiums. Thorough questioning empowers you to make an informed decision and avoid unexpected costs or complications down the line.

Understanding Ohio Insurance Regulations

Source: insuraviz.com

Navigating the world of insurance in Ohio can feel like traversing a maze, but understanding the state’s regulations is key to protecting yourself and your assets. This section breaks down the essential aspects of Ohio insurance law, offering clarity and empowering you to make informed decisions.

Minimum Liability Insurance Requirements in Ohio, Ohio insurance rates

Ohio mandates minimum liability coverage for drivers. This means you must carry a certain level of insurance to protect others in case you cause an accident. Failing to meet these requirements can result in significant penalties, including license suspension and hefty fines. The minimum liability coverage typically includes bodily injury liability and property damage liability. Specifically, the minimum requirement is $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $25,000 for property damage. It’s crucial to understand that these are minimums; carrying higher liability limits offers significantly greater protection.

The Process for Filing an Insurance Claim in Ohio

Filing an insurance claim in Ohio generally involves reporting the incident to your insurance company as soon as possible. This usually involves a phone call, followed by submitting a written claim form, along with any supporting documentation such as police reports, medical bills, or repair estimates. The insurer will then investigate the claim, which may include contacting witnesses or conducting an inspection of the damaged property. Once the investigation is complete, the insurer will make a determination on the claim, either approving or denying it, and will provide a written explanation of their decision. Remember to keep detailed records of all communication and documentation throughout the process.

Ohio Bureau of Workers’ Compensation

The Ohio Bureau of Workers’ Compensation (BWC) is a state agency responsible for providing medical benefits and wage replacement to workers injured on the job. Employers are required to carry workers’ compensation insurance, which covers medical expenses, lost wages, and rehabilitation costs for injured employees. The BWC also works to prevent workplace injuries through education and safety programs. If you are injured at work in Ohio, your employer’s insurance provider will be responsible for your medical care and lost wages as per the Ohio BWC guidelines. Workers can directly contact the BWC to file a claim or to find out more about their rights.

Comparison of Auto and Homeowners Insurance Regulations in Ohio

While both auto and homeowners insurance are regulated in Ohio, the specific requirements differ. Auto insurance, as discussed above, focuses on liability coverage to protect others in the event of an accident, as well as optional coverages like collision and comprehensive. Homeowners insurance, on the other hand, protects your property from damage or loss due to various perils, such as fire, theft, or windstorms. While minimum liability requirements are mandated for auto insurance, there’s no mandated minimum coverage for homeowners insurance. However, lenders often require a certain level of coverage as a condition of a mortgage. Both types of insurance are subject to state regulations regarding policy terms, pricing, and claim handling procedures.

Resources for Understanding Ohio Insurance Policies

Ohio residents needing assistance understanding their insurance policies have several resources at their disposal. The Ohio Department of Insurance (ODI) website provides valuable information on consumer rights, insurance regulations, and frequently asked questions. They also offer assistance with filing complaints against insurance companies. Additionally, many non-profit organizations and consumer advocacy groups offer free or low-cost assistance with navigating insurance issues. Seeking help from an independent insurance agent can also provide valuable insight and guidance in selecting the right policy.

Resolving Disputes with an Insurance Company

Disputes with insurance companies can be frustrating, but there are steps you can take to resolve them.

- Review your policy carefully to understand your coverage and rights.

- Document all communication with the insurance company, including dates, times, and names of individuals you spoke with.

- Attempt to resolve the dispute informally with the insurance company’s customer service department.

- If informal attempts fail, file a formal complaint with the Ohio Department of Insurance.

- Consider seeking legal counsel if the dispute remains unresolved.

- In some cases, mediation or arbitration may be an option to reach a mutually agreeable solution.

Types of Insurance in Ohio

Navigating the world of insurance in Ohio can feel overwhelming, given the variety of policies available. Understanding the different types of insurance and their coverage is crucial for protecting yourself and your assets. This section breaks down the key insurance types commonly found in Ohio, offering clarity on their respective benefits and considerations.

Auto Insurance Coverage in Ohio

Ohio requires drivers to carry minimum liability coverage, protecting others in the event of an accident you cause. However, many drivers opt for more comprehensive coverage. Liability insurance covers bodily injury and property damage to others. Collision coverage repairs your vehicle after an accident, regardless of fault. Comprehensive coverage protects against non-collision damage, such as theft or hail. Uninsured/underinsured motorist coverage protects you if you’re hit by a driver without sufficient insurance. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Choosing the right level of coverage depends on your risk tolerance and financial situation. A higher deductible will lower your premiums, but you’ll pay more out-of-pocket in the event of a claim.

Homeowners Insurance in Ohio

Homeowners insurance protects your home and belongings from various perils. Standard policies typically cover damage from fire, wind, hail, and theft. Additional coverage options include flood insurance (often purchased separately), earthquake insurance, and personal liability protection, which covers lawsuits if someone is injured on your property. The cost of homeowners insurance varies based on factors like your home’s location, age, and value, as well as the level of coverage you choose. Higher coverage limits mean higher premiums but greater protection in case of significant damage or loss. Consider factors like the value of your possessions and the potential cost of rebuilding your home when selecting your coverage.

Health Insurance Plans in Ohio

Ohio offers a range of health insurance plans through the Affordable Care Act (ACA) marketplace and private insurers. These plans vary in coverage and cost. HMOs (Health Maintenance Organizations) typically require you to choose a primary care physician (PCP) within their network, while PPOs (Preferred Provider Organizations) offer more flexibility to see out-of-network doctors, though at a higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs but generally offer fewer choices of providers. The level of coverage, including deductibles, co-pays, and out-of-pocket maximums, significantly impacts the cost and your financial responsibility for medical care. Choosing a plan depends on your individual health needs, budget, and preference for provider choice. Consider your expected healthcare utilization when selecting a plan; those anticipating frequent medical visits may benefit from a plan with lower out-of-pocket costs.

Life Insurance and its Importance

Life insurance provides financial protection for your loved ones in the event of your death. Term life insurance provides coverage for a specific period, offering a lower premium than permanent life insurance, which offers lifelong coverage. Whole life insurance builds cash value that can be borrowed against, while universal life insurance offers flexibility in premium payments and death benefit amounts. The amount of life insurance needed depends on your income, debts, and the number of dependents you support. Consider factors such as outstanding mortgages, children’s education expenses, and your spouse’s income when determining the appropriate coverage amount. For example, a young family with a mortgage and young children would likely need significantly more coverage than a single individual without dependents.

Situations Requiring Different Insurance Types

Various life events necessitate different types of insurance. Buying a home requires homeowners insurance; owning a car necessitates auto insurance; starting a family often leads to the need for life insurance; and health concerns necessitate health insurance. Starting a business may require liability insurance to protect against lawsuits. Furthermore, renting an apartment may require renter’s insurance to protect your belongings. Each situation presents unique risks requiring tailored insurance protection.

Choosing Appropriate Coverage Levels

Determining the appropriate level of coverage involves careful consideration of your risk tolerance and financial capacity. Higher coverage limits provide greater protection but come with higher premiums. Assess your assets, liabilities, and potential losses to determine the minimum coverage needed. Consider consulting with an insurance professional to determine the optimal balance between protection and affordability. For instance, someone with significant assets might opt for higher liability limits on their homeowners and auto insurance, while someone with limited assets might prioritize affordability and choose lower coverage limits with higher deductibles.

Illustrative Examples of Ohio Insurance Costs

Source: cloudinary.com

Understanding the nuances of Ohio insurance pricing requires looking beyond the average rate. Several factors significantly impact your final premium, creating a wide range of possibilities. Let’s examine some specific scenarios to illustrate these variations.

Young Driver vs. Older Driver Insurance Costs

A 16-year-old driver in Ohio with a clean driving record can expect to pay significantly more for car insurance than a 40-year-old with a similar record. Insurance companies consider young drivers statistically higher risk due to inexperience and a greater tendency towards accidents. For instance, a hypothetical 16-year-old might pay around $3,000 annually for basic liability coverage, while a 40-year-old with the same coverage could pay closer to $1,200. This difference reflects the increased risk associated with youth and the accumulation of safe driving experience over time.

Impact of Traffic Violations on Insurance Premiums

Let’s imagine Sarah, a 30-year-old Ohio resident with a clean driving record, receives a speeding ticket. Her premium for the following year will likely increase. The severity of the violation directly correlates with the premium hike. A minor speeding ticket might increase her premium by 10-15%, adding roughly $100-$150 to her annual cost if her initial premium was $1000. A more serious offense, like a DUI, could lead to a much steeper increase, potentially doubling or even tripling her premium.

Different Coverage Levels and Total Cost

Consider two Ohio drivers, both 25 years old with similar driving records. Driver A chooses minimum liability coverage, while Driver B opts for comprehensive and collision coverage. Driver A’s annual premium might be around $800, covering only the legal minimums. Driver B, however, might pay $1,600 annually, accounting for the added protection against damage to their own vehicle. This illustrates how the extent of coverage directly influences the total cost.

Potential Insurance Claim Scenario and Resolution

Suppose Mark, an Ohio resident, is involved in an accident where he is at fault. His vehicle sustains $5,000 in damages, and the other driver’s vehicle has $3,000 in damages. Mark’s comprehensive and collision coverage will cover his vehicle repairs, while his liability coverage will cover the other driver’s repairs. His insurance company will likely investigate the accident, assess the damages, and handle the claim. Depending on his policy and deductible, Mark may have to pay a portion of the repair costs out-of-pocket. The claim process might involve filing paperwork, providing statements, and potentially dealing with an adjuster. The entire process could take several weeks.

High-Performance vs. Fuel-Efficient Vehicle Costs

A high-performance sports car, such as a Porsche 911, will typically command a much higher insurance premium than a fuel-efficient compact car, such as a Honda Civic. This is because high-performance vehicles are more expensive to repair and replace, and they are often associated with a higher risk of accidents due to their power and handling characteristics. The cost difference can be substantial; the annual premium for the Porsche could be double or even triple that of the Honda, reflecting the higher risk and repair costs.

Breakdown of a Typical Auto Insurance Premium

A pie chart visually representing a typical auto insurance premium might show the following breakdown: Liability coverage (40%), Collision coverage (25%), Comprehensive coverage (15%), Uninsured/underinsured motorist coverage (10%), and administrative fees/overhead (10%). The exact percentages will vary based on individual factors, but this illustrates the relative proportions of the various components contributing to the overall premium.

Epilogue: Ohio Insurance Rates

So, you’ve navigated the complexities of Ohio insurance rates. Remember, securing the best deal isn’t about luck; it’s about knowledge and strategy. By understanding the factors that impact your premiums and employing the tips Artikeld above, you can confidently choose a policy that fits your needs and budget. Don’t be afraid to shop around, ask questions, and leverage those discounts! Happy driving (and saving).