Perfect policy insurance: Sounds dreamy, right? Finding the *perfect* insurance policy feels like searching for a unicorn – mythical, maybe even impossible. But what if we told you it’s closer than you think? This isn’t about finding a magical policy that covers everything; it’s about understanding your needs, knowing what to look for, and making informed choices. We’ll unpack the secrets to finding a policy that truly fits your life, from understanding coverage nuances to navigating the fine print.

This guide dives deep into the world of insurance, breaking down complex jargon and revealing hidden costs. We’ll explore how different factors – like age, lifestyle, and risk tolerance – influence your ideal policy. Get ready to ditch the insurance confusion and empower yourself to make smart decisions.

Defining “Perfect Policy Insurance”

Source: researchgate.net

Finding the perfect insurance policy feels like searching for the mythical unicorn – everyone wants it, but nobody’s quite sure it exists. The truth is, “perfect” is subjective and depends entirely on your individual needs and risk tolerance. There’s no one-size-fits-all solution, but we can define what characteristics contribute to a policy feeling truly perfect for *you*.

A perfect insurance policy comprehensively protects you against the specific risks you face, while remaining affordable and easy to understand. It balances adequate coverage with reasonable premiums, offering a safety net without breaking the bank. Beyond the financial aspects, a perfect policy also includes a straightforward claims process and a responsive, reliable insurer. Think of it as a personalized shield, tailored to your life’s unique vulnerabilities.

Key Characteristics of a Perfect Policy from a Consumer Perspective

Several key elements contribute to a consumer’s perception of a “perfect” insurance policy. These include the comprehensiveness of coverage, the clarity and simplicity of the policy documents, the affordability of the premiums, the ease and speed of the claims process, and the reputation and responsiveness of the insurance provider. A policy that excels in all these areas is more likely to be viewed as perfect by the policyholder. For example, a comprehensive health insurance policy with low deductibles, a streamlined claims process, and a highly-rated insurer would be considered “perfect” by many individuals concerned about healthcare costs. Similarly, a homeowner’s insurance policy with broad coverage, including flood and earthquake protection in high-risk areas, would be considered perfect for someone living in a vulnerable location.

Comparison of Insurance Types and Perceived “Perfection” Levels

The concept of “perfection” varies significantly across different insurance types. What constitutes a perfect car insurance policy differs greatly from a perfect life insurance policy. The following table provides a comparison:

| Insurance Type | Coverage Adequacy | Affordability | Claims Process |

|---|---|---|---|

| Auto Insurance | High (Comprehensive & Collision) – Moderate (Liability Only) | Highly Variable, depends on driver profile and coverage level. | Generally efficient, but can vary by insurer. |

| Homeowners Insurance | High (Broad coverage) – Moderate (Basic coverage) | Moderate to High, dependent on location and home value. | Can be lengthy depending on claim complexity. |

| Health Insurance | High (Comprehensive plans) – Low (Catastrophic plans) | Highly Variable, depends on plan type and deductible. | Can be complex, often involving multiple parties. |

| Life Insurance | High (Term and Whole life) – Low (Limited coverage) | Moderate to High, depending on coverage amount and policy type. | Generally straightforward upon death claim. |

Factors Influencing Policy Selection

Source: newhorizonsmedical.org

Finding the perfect policy insurance is all about understanding your needs. This means researching thoroughly, comparing quotes, and making sure you’re covered for everything important. For those in the Lafayette, TN area, checking out options for lafayette tn insurance is a great starting point. Ultimately, the perfect policy is the one that gives you peace of mind knowing you’re protected.

Choosing the right insurance policy can feel like navigating a minefield. With so many options and varying levels of coverage, understanding the key factors influencing your decision is crucial to securing the best protection for your needs and budget. Ultimately, the perfect policy is the one that best balances your priorities and risk tolerance.

Choosing an insurance policy involves a careful weighing of several interconnected factors. Consumers prioritize different aspects depending on their individual circumstances, financial situation, and risk perception. While price is often the initial consideration, a deeper dive reveals a more nuanced picture involving coverage details, the insurer’s reputation, and even the ease of filing a claim.

Price and Affordability

Price is undeniably a major factor for most consumers. The cost of premiums directly impacts a household’s budget, and finding affordable coverage is often the first hurdle. However, the cheapest option isn’t always the best. A seemingly low premium might come with limited coverage, leaving you vulnerable in the event of a significant claim. Young adults, for example, might prioritize affordability over extensive coverage, opting for basic plans until their financial stability improves. Families, on the other hand, may prioritize comprehensive coverage even if it means paying higher premiums, as they have more to protect.

Coverage and Benefits

The extent of coverage offered is equally important. This includes the types of events covered (accidents, illnesses, theft, etc.), the limits on payouts, and any exclusions. A comprehensive policy provides broader protection but comes at a higher price. Consumers need to carefully evaluate their risk profile and choose a policy that aligns with their needs. For instance, a young, healthy individual might opt for a basic health insurance plan, focusing on essential coverage, while a family with young children might seek a plan with extensive pediatric care and hospitalization benefits.

Insurer Reputation and Financial Stability, Perfect policy insurance

The reputation and financial stability of the insurance provider are often overlooked but are critical. Choosing a reputable insurer with a strong track record of paying claims promptly and fairly minimizes the risk of encountering problems when you need to file a claim. Checking the insurer’s ratings from independent agencies can provide valuable insight into their financial health and customer service. This factor tends to be more important for consumers with higher risk profiles or significant assets to protect. Older individuals, for example, might prioritize a well-established insurer known for its reliability, whereas younger consumers might be more willing to consider newer companies offering competitive pricing.

Ease of Claim Filing and Customer Service

The process of filing a claim and the quality of customer service offered by the insurer are increasingly important factors. A smooth and efficient claims process can significantly reduce stress during a difficult time. Reading customer reviews and comparing the insurer’s claims handling procedures can provide valuable insights. Busy professionals might prioritize insurers known for their user-friendly online portals and quick claim processing times, while those with less tech-savviness might prefer insurers with responsive customer service representatives.

Hierarchical Structure of Importance

While the relative importance of these factors varies from person to person, a general hierarchical structure might look like this:

Coverage and Benefits > Insurer Reputation and Financial Stability > Price and Affordability > Ease of Claim Filing and Customer Service

This hierarchy reflects the fact that while price is a primary concern, adequate coverage and a trustworthy insurer are paramount to ensuring that the policy effectively serves its purpose. Ease of claim filing, while important, is often secondary to the core elements of coverage and insurer reliability.

Analyzing Policy Features

Finding the “perfect” insurance policy isn’t about finding a unicorn; it’s about understanding the trade-offs inherent in different policy features and making informed choices based on your individual needs and risk tolerance. This involves carefully analyzing the core components of any insurance plan and understanding how they interact to create a package that best suits you.

Policy features, at their core, are the building blocks of your protection. Understanding how deductibles, premiums, and coverage limits interact is crucial to making an informed decision. A seemingly small change in one area can significantly impact the overall cost and effectiveness of your insurance. Let’s dive into the details.

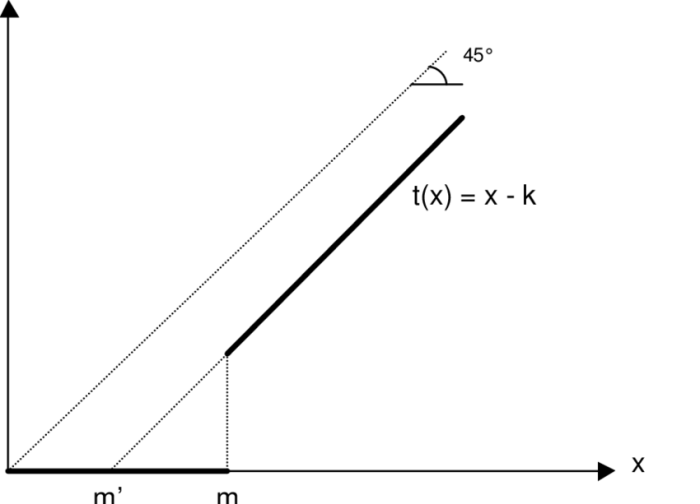

Deductibles, Premiums, and Coverage Limits: A Comparative Analysis

The interplay between deductibles, premiums, and coverage limits forms the cornerstone of any insurance policy. A higher deductible typically translates to a lower premium. This is because you’re accepting more financial responsibility upfront, reducing the insurer’s payout risk. Conversely, a lower deductible means a higher premium as the insurer anticipates potentially higher payouts. Coverage limits define the maximum amount the insurer will pay out for a covered claim. A higher coverage limit usually equates to a higher premium, reflecting the increased risk for the insurer. The “perfect” balance involves finding the sweet spot where the premium is affordable while the coverage is sufficient to protect against significant financial losses. For example, a young, healthy individual might opt for a higher deductible and lower premium on their health insurance, confident in their ability to handle smaller medical expenses. Conversely, an older individual with pre-existing conditions might prioritize a lower deductible and higher premium for greater financial protection.

Common Pitfalls and Hidden Costs in Insurance Policies

Navigating the world of insurance policies can be tricky. Many policies come with hidden costs or clauses that can catch you off guard. One common pitfall is insufficient coverage. While a lower premium might seem attractive, inadequate coverage could leave you with substantial out-of-pocket expenses in the event of a significant claim. Another common issue is failing to understand exclusions. Carefully reviewing the policy document to identify what is *not* covered is just as important as understanding what *is* covered. For instance, some home insurance policies might exclude flood damage, requiring separate flood insurance. Finally, be aware of potential increases in premiums based on claims history or changes in risk assessment. Understanding these factors helps you make informed choices and avoid unpleasant surprises.

Essential Features of a Perfect Insurance Policy

Choosing the right policy requires careful consideration of several key features. The “perfect” policy will vary depending on individual circumstances, but some features are consistently desirable.

- Comprehensive Coverage: The policy should offer broad coverage to protect against a wide range of potential risks. This minimizes the chance of encountering unexpected out-of-pocket expenses.

- Competitive Premiums: The cost of the policy should be affordable and reflect a fair balance between cost and coverage.

- Transparent Policy Language: The policy should be easy to understand, with clear and concise language, avoiding jargon and legalistic complexities.

- Strong Financial Stability of the Insurer: Choosing a financially sound insurer reduces the risk of claims being denied due to the insurer’s insolvency.

- Excellent Customer Service: A responsive and helpful customer service team can be invaluable in resolving issues and processing claims efficiently.

The Role of the Insurer

Finding the “perfect” insurance policy is only half the battle. The other half rests squarely on the shoulders of the insurer itself. A fantastic policy on paper becomes meaningless if the company behind it fails to deliver on its promises. Choosing the right insurer is as crucial as selecting the right coverage.

The insurer’s role extends far beyond simply processing claims. It’s about building a relationship built on trust, reliability, and exceptional customer service. This trifecta – reputation, financial stability, and customer service – forms the bedrock of a truly positive insurance experience. Without these key elements, even the most comprehensive policy can feel inadequate.

Insurer Reputation and Financial Stability, Perfect policy insurance

A strong reputation precedes any successful insurer. Years of ethical practices, fair claims handling, and positive customer interactions contribute to a company’s overall standing. This reputation isn’t built overnight; it’s earned through consistent performance and a commitment to transparency. Financial stability is equally critical. A financially sound insurer can withstand market fluctuations and economic downturns, ensuring they’ll be there to pay out claims when needed. Consumers should research an insurer’s financial ratings (from agencies like AM Best or Moody’s) to gauge their long-term viability. Consider this scenario: imagine relying on a smaller, less established insurer only to find them insolvent when you need them most – a catastrophic situation that underscores the importance of due diligence. A strong financial position means the insurer has the resources to handle large claims and remain solvent, providing customers with the security they need.

Best Practices for Building Trust and Improving Customer Satisfaction

Building trust requires proactive measures. Insurers can foster trust through clear and concise communication, readily available customer support channels (phone, email, online chat), and prompt responses to inquiries. Proactive communication, such as sending regular policy updates or preventative maintenance tips, can further solidify the insurer-customer relationship. Furthermore, transparent claims processes, where customers are kept informed every step of the way, demonstrate commitment to fairness and efficiency. For example, a clear and easily accessible online portal that allows customers to track their claims, submit documents, and communicate directly with their assigned claims adjuster, significantly improves customer satisfaction. Regular customer satisfaction surveys and feedback mechanisms provide valuable insights into areas for improvement, allowing insurers to continuously refine their services and processes.

Hypothetical Scenario: A Perfect Policy Experience

Imagine Sarah, a new homeowner, purchasing home insurance. From the start, the insurer, “SecureHomes,” provides an exceptional experience. Their website is user-friendly, allowing Sarah to easily obtain quotes and compare different policy options. The application process is straightforward, and a dedicated representative contacts Sarah promptly to answer any questions. When a tree falls on Sarah’s roof during a storm, SecureHomes’s claims process is seamless. A claims adjuster contacts Sarah within hours, and the entire repair process is managed efficiently and transparently, keeping Sarah informed every step of the way. Throughout the process, Sarah feels valued and supported, reinforcing her trust in SecureHomes. This proactive, transparent, and efficient approach transforms what could be a stressful situation into a positive reflection on the insurer, showcasing the potential of a truly “perfect” policy experience.

Future Trends in Insurance

The insurance landscape is undergoing a dramatic transformation, driven by rapid technological advancements and evolving consumer expectations. These shifts are fundamentally reshaping what constitutes a “perfect policy,” moving beyond simple coverage to encompass personalized experiences, proactive risk management, and seamless digital interactions. The future of insurance is less about reactive claims processing and more about predictive analytics and preventative measures.

The convergence of big data, artificial intelligence, and the Internet of Things (IoT) is creating a new era of personalized and proactive insurance solutions. This means moving away from the one-size-fits-all approach to a model where policies are tailored to individual needs and risk profiles, dynamically adjusting as circumstances change.

Personalized Insurance and AI-Powered Risk Assessment

Personalized insurance utilizes data analytics to create highly customized policies. Instead of relying on broad demographic categories, insurers will leverage individual data points – from driving habits tracked by telematics to wearable sensor data indicating health metrics – to assess risk with unprecedented accuracy. This allows for more precise pricing, reflecting the individual’s actual risk, and the creation of policies with features directly addressing their specific needs. For example, a driver with a consistently safe driving record, as monitored by a telematics device, might receive a significantly lower premium than a driver with a history of accidents. Similarly, individuals who actively track their health data and demonstrate healthy lifestyle choices could qualify for lower premiums on health insurance. AI plays a crucial role in processing and analyzing this vast amount of data, identifying patterns and predicting future risks more efficiently than traditional methods. This leads to more accurate risk assessment, potentially lowering premiums for low-risk individuals and providing more targeted coverage for high-risk individuals.

Technological Advancements Reshaping the Insurance Landscape

Technological advancements are not only changing how risk is assessed but also how policies are purchased, managed, and claimed. Blockchain technology offers the potential for increased transparency and security in claims processing, reducing fraud and speeding up payouts. The rise of Insurtech companies is disrupting traditional insurance models, introducing innovative products and services that are often more customer-centric and digitally driven. For example, micro-insurance products, offered through mobile apps, are expanding access to insurance for underserved populations. These advancements are leading to a more efficient and transparent insurance ecosystem, creating opportunities for better customer experiences and more affordable coverage. The use of chatbots and AI-powered virtual assistants is streamlining customer service, providing instant answers to queries and resolving issues quickly.

The Future of Insurance: A Visual Representation

Imagine a vibrant, interactive infographic. The central image is a stylized globe, pulsing with interconnected data streams representing the flow of information from various sources: wearables, connected cars, smart homes, and more. These data streams converge on a central processing unit, representing AI-powered risk assessment. Around the globe, individual profiles are depicted as customizable avatars, each reflecting unique risk profiles and personalized policy features. The color scheme shifts from muted tones representing traditional insurance to bright, dynamic colors representing the personalized and tech-driven future. Smaller icons illustrate key technological advancements – blockchain for secure transactions, mobile apps for easy access, and AI for intelligent risk management. The overall impression is one of dynamism, personalization, and seamless integration of technology into the insurance experience. This visual emphasizes the shift from a static, one-size-fits-all approach to a dynamic, personalized model, where the “perfect policy” is defined by its adaptability and responsiveness to individual needs and real-time risk assessments. The infographic clearly shows how technology empowers both insurers and consumers, leading to a more efficient, transparent, and customer-centric insurance ecosystem.

Case Studies of “Near-Perfect” Policies

Finding the perfect insurance policy is a bit like searching for the mythical unicorn – it’s often talked about, but rarely found. However, some policies come remarkably close to achieving that ideal, offering comprehensive coverage, competitive pricing, and excellent customer service. Examining these “near-perfect” policies allows us to understand what constitutes a truly effective and consumer-friendly insurance product. We’ll delve into specific examples, highlighting their strengths and weaknesses to illustrate best practices in the insurance industry.

Analysis of a High-Rated Term Life Insurance Policy

Term life insurance, offering coverage for a specific period, often stands out for its simplicity and affordability. A strong example would be a policy from a reputable company like MassMutual or Northwestern Mutual, known for their financial strength and customer reviews. These policies often boast competitive premiums, clear terms and conditions, and a straightforward claims process. A key strength lies in their transparency; the policy documents are easy to understand, avoiding complex jargon. However, a potential weakness is the limited coverage duration; once the term expires, renewal might be significantly more expensive or unavailable. The lack of cash value accumulation is another factor to consider, making it less versatile than whole life insurance.

Examination of a Comprehensive Health Insurance Plan

In the realm of health insurance, a “near-perfect” policy might be a gold-tier plan offered by a major provider like UnitedHealthcare or Kaiser Permanente, depending on regional availability and individual needs. These plans typically offer broad network access, low out-of-pocket maximums, and comprehensive coverage for various medical services. Their strength lies in providing extensive protection against high medical costs, offering peace of mind to policyholders. Weaknesses could include higher premiums compared to lower-tier plans and potential limitations on specific specialists or treatments. Navigating the extensive plan details and understanding the nuances of coverage can also present a challenge for some consumers.

| Policy Type | Provider Example | Strengths | Weaknesses |

|---|---|---|---|

| Term Life Insurance | MassMutual, Northwestern Mutual | Competitive premiums, clear terms, straightforward claims | Limited coverage duration, no cash value accumulation |

| Comprehensive Health Insurance | UnitedHealthcare, Kaiser Permanente (depending on region) | Broad network, low out-of-pocket maximums, comprehensive coverage | Higher premiums, potential limitations on specialists/treatments, complex plan details |

| Auto Insurance with Comprehensive Coverage | Progressive, Geico (depending on region and driving history) | Extensive coverage options, robust online tools, competitive pricing (often) | Potential for higher premiums based on risk factors, variations in coverage across states |

| Homeowners Insurance with Flood and Earthquake Add-ons | State Farm, Allstate (depending on region and property specifics) | Comprehensive protection, potential for bundled discounts, established reputation | Higher premiums in high-risk areas, detailed claims process, potential for exclusions |

Review of an Auto Insurance Policy with Robust Coverage

A “near-perfect” auto insurance policy often combines comprehensive and collision coverage with additional benefits like roadside assistance and rental car reimbursement. Companies like Progressive and Geico are known for offering a range of options and competitive pricing, though rates vary significantly based on individual risk profiles and location. The strength of such policies is the extensive protection they offer against various risks, including accidents, theft, and vandalism. However, a weakness might be the higher premiums associated with comprehensive coverage, especially for drivers with less-than-perfect driving records.

Last Recap: Perfect Policy Insurance

Source: ibx.com

So, is there a truly “perfect” insurance policy? The answer, as with most things in life, is nuanced. There’s no one-size-fits-all solution. But by understanding your needs, prioritizing key features, and choosing a reputable insurer, you can significantly increase your chances of finding a policy that feels just right. This guide equips you with the knowledge to navigate the insurance landscape confidently, turning the search for coverage from a daunting task into a strategic decision. Now go forth and find your perfect match!