Personal insurance meaning? Think of it as your financial safety net, a crucial layer of protection against life’s unexpected punches. From the fender bender to a sudden illness, personal insurance helps cushion the blow, preventing a minor mishap from becoming a major financial disaster. This isn’t about being pessimistic; it’s about smart planning for the inevitable uncertainties that life throws our way.

Understanding personal insurance goes beyond simply buying a policy; it’s about knowing what coverage best suits your needs and lifestyle. We’ll break down the different types of personal insurance, explain how they work, and help you navigate the sometimes confusing world of premiums, claims, and policy terms. Because peace of mind is priceless, and knowing you’re protected is invaluable.

Defining Personal Insurance

Source: automoblog.net

Personal insurance? Think of it as a safety net, a financial cushion to protect you and your loved ones from unexpected life events. It’s all about transferring the risk of potential financial losses to an insurance company in exchange for regular payments – your premiums. Essentially, you pay a small amount regularly to avoid potentially catastrophic financial hits later.

Personal insurance policies cover a wide range of potential problems, offering financial protection against things you can’t always predict. It’s a proactive way to manage risk and secure your future, offering peace of mind knowing you’re prepared for the unexpected.

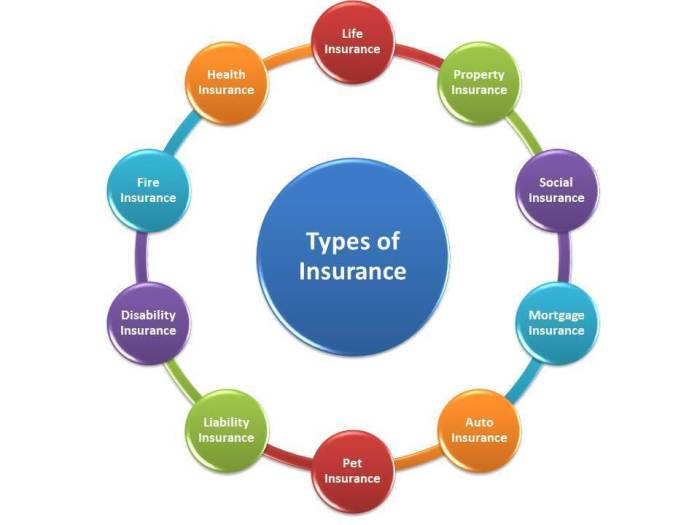

Types of Personal Insurance Policies

Several different types of personal insurance policies cater to various needs and risks. Understanding these options is crucial to choosing the right coverage for your specific circumstances. The most common types offer protection against significant financial burdens that could otherwise cripple your finances.

- Life Insurance: Provides a lump-sum payment to your beneficiaries upon your death, helping them cover expenses like funeral costs, outstanding debts, and ongoing living expenses.

- Health Insurance: Covers medical expenses, from doctor visits and hospital stays to prescription drugs and mental health services. This can significantly reduce the financial burden of unexpected illnesses or injuries.

- Disability Insurance: Replaces a portion of your income if you become unable to work due to illness or injury, ensuring you can still meet your financial obligations.

- Homeowners or Renters Insurance: Protects your property and belongings from damage or loss due to events like fire, theft, or natural disasters. Renters insurance is crucial even if you don’t own your home, as it covers your personal belongings.

- Auto Insurance: Covers damages to your vehicle and injuries to others involved in accidents you may cause. It also often provides liability protection, shielding you from significant financial repercussions.

A Concise Definition of Personal Insurance

Personal insurance is a contract between an individual and an insurance company where the individual pays premiums in exchange for financial protection against unforeseen events that could result in significant personal financial losses.

Key Characteristics of Personal Insurance

Personal insurance differs significantly from other insurance types, such as commercial insurance. The primary distinctions lie in the insured party and the nature of the risk covered. Personal insurance policies are specifically designed to protect individuals and their families, while commercial insurance protects businesses and their assets.

Personal insurance focuses on mitigating risks associated with an individual’s life and property, while commercial insurance addresses risks related to business operations and profitability.

Types of Personal Insurance Coverage

Navigating the world of personal insurance can feel like deciphering a complex code. But understanding the different types of coverage available is key to protecting yourself and your loved ones from life’s unexpected twists and turns. Choosing the right insurance isn’t just about ticking boxes; it’s about building a financial safety net tailored to your specific needs and circumstances.

Personal insurance is broadly categorized into several key areas, each designed to mitigate specific risks. While the specific policies and their features can vary between providers, understanding the core types will help you make informed decisions. This section will explore the most common types, highlighting their benefits and providing real-world examples to illustrate their importance.

Understanding personal insurance meaning boils down to protecting yourself from life’s unexpected curveballs. A big part of that is securing your home, and for New Jersey residents, a solid option is exploring what aaa home insurance nj offers. Ultimately, personal insurance is about peace of mind, knowing you’ve got a safety net in place for those unforeseen circumstances.

Common Types of Personal Insurance

| Type of Insurance | Coverage Details | Benefits | Example Scenarios |

|---|---|---|---|

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription drugs. Different plans offer varying levels of coverage and cost-sharing. | Protection against potentially catastrophic medical bills, access to preventative care, peace of mind knowing you’re covered in case of illness or injury. | A sudden illness requiring hospitalization, a chronic condition requiring ongoing medication, a car accident resulting in injuries. |

| Auto Insurance | Covers damage to your vehicle, injuries to yourself or others, and property damage caused by a car accident. Liability coverage protects others, while collision and comprehensive coverage protect your vehicle. | Financial protection against the costs associated with car accidents, legal defense in case of a lawsuit, replacement or repair of your vehicle. | Being involved in a car accident that causes damage to another vehicle and injuries to the other driver, having your car stolen or damaged in a storm. |

| Homeowners/Renters Insurance | Homeowners insurance covers damage to your home and belongings due to fire, theft, or other covered perils. Renters insurance protects your personal belongings and provides liability coverage. | Financial protection against loss or damage to your property, liability protection if someone is injured on your property, replacement of belongings after a disaster. | A fire damaging your home and its contents, a burglar stealing your electronics, a pipe bursting and causing water damage. |

| Life Insurance | Provides a death benefit to your beneficiaries upon your death. Different types of life insurance offer varying payout structures and premiums. | Financial security for your family after your death, paying off debts, funding children’s education, covering funeral expenses. | Providing financial support for a spouse and children after the death of the primary breadwinner, ensuring a mortgage is paid off even after the homeowner’s death. |

Comparing Three Key Types: Health, Auto, and Homeowners Insurance

These three types of insurance represent fundamental pillars of personal financial security. While distinct in their coverage, they share the common goal of mitigating significant financial risks. Let’s compare their features and benefits:

Health insurance focuses on protecting against the potentially devastating costs of medical care. Its benefits are directly tied to your health and well-being, offering access to necessary treatment and preventing financial ruin due to illness or injury. Auto insurance, on the other hand, addresses the risks associated with vehicle ownership and operation. Its primary function is to protect you and others from the financial consequences of accidents. Homeowners/Renters insurance safeguards your most valuable asset – your home and its contents – against various perils, offering both property protection and liability coverage. While all three are crucial, the specific needs and priorities of an individual will determine the level of coverage required for each.

For example, a young single professional might prioritize auto and renters insurance, while a family with young children might place a higher emphasis on health and homeowners insurance. The key is to assess your individual circumstances and tailor your insurance portfolio accordingly, ensuring you have adequate coverage to manage life’s unexpected events.

The Role of an Insurance Policy

Think of your insurance policy as a safety net. It’s a legally binding agreement between you and an insurance company, promising financial protection against unforeseen events. It Artikels the specific risks covered, the amount of coverage, and the conditions under which you can make a claim. Essentially, it’s your personalized shield against life’s unexpected punches.

Understanding the Claim Process

Filing a claim is straightforward, although the specifics vary depending on your policy and the insurer. The following flowchart illustrates a typical process:

[Imagine a flowchart here. The boxes would be: 1. Incident Occurs; 2. Contact Your Insurer; 3. File a Claim (Provide Necessary Documentation); 4. Insurer Investigates; 5. Claim Approved/Denied; 6. Payment (if approved). Arrows connect each box, showing the flow of the process. The flowchart visually represents the step-by-step procedure for submitting and processing a claim, emphasizing the interaction between the insured and the insurer.]

Insurer and Insured Responsibilities

The relationship between the insurer and the insured is a two-way street. The insurer is responsible for promptly investigating claims, fairly assessing the damages, and paying out benefits as Artikeld in the policy. They are also responsible for clearly communicating the terms and conditions of the policy and handling any disputes in a fair and transparent manner. Conversely, the insured is responsible for providing accurate and timely information when filing a claim, adhering to the terms and conditions of the policy, and cooperating fully with the insurer’s investigation. Failing to meet these responsibilities can lead to claim denials or policy cancellations.

The Importance of Policy Terms and Conditions

Understanding your policy’s terms and conditions is paramount. This seemingly tedious document holds the key to understanding your coverage, exclusions, and limitations. Reading it carefully, before signing, ensures you know exactly what you’re covered for and what you’re not. For instance, a homeowner’s insurance policy might exclude flood damage, requiring separate flood insurance. Overlooking such details can lead to costly surprises during a claim. Don’t hesitate to ask your insurer for clarification on anything you don’t understand.

Purchasing a Personal Insurance Policy

Buying a personal insurance policy is more than just signing a document. It’s about securing your financial future. The process typically involves: 1. Assessing your needs (identifying the risks you want to cover); 2. Comparing quotes from different insurers (considering factors like coverage, premiums, and reputation); 3. Choosing a policy that best suits your needs and budget; 4. Providing necessary information (such as personal details, property information, and driving history); 5. Paying the premium; and 6. Receiving your policy documents. Take your time, shop around, and don’t be afraid to ask questions. Remember, the right policy can provide peace of mind and financial security.

Factors Affecting Personal Insurance Costs

Understanding what influences your personal insurance premiums is key to securing the best coverage at a price you can afford. Many factors, intertwined and sometimes unpredictable, contribute to the final cost. Let’s break down the key elements that insurance companies consider.

Demographic Factors

Your age, location, and even your gender can significantly impact your insurance premiums. Insurance companies use actuarial data – extensive statistical analysis of historical claims – to predict the likelihood of you filing a claim. For example, younger drivers often pay more for car insurance due to statistically higher accident rates. Similarly, living in a high-crime area might lead to higher premiums for homeowners insurance because of increased risk of theft or vandalism. Gender can also play a role, although this is becoming less prevalent due to anti-discrimination laws. Historically, certain genders have been statistically associated with higher claim frequencies for specific types of insurance.

Lifestyle Factors

Your lifestyle choices significantly influence your insurance risk profile. For example, smokers typically pay more for health and life insurance because smoking increases the risk of various health problems. Similarly, individuals who engage in high-risk activities, such as motorcycling or extreme sports, may see increased premiums for their insurance policies. Driving habits also matter; a clean driving record with no accidents or traffic violations will generally result in lower car insurance premiums compared to someone with multiple incidents. Home security measures also affect homeowners insurance; having a security system can lead to discounts.

Risk Assessment Factors

Insurance companies conduct thorough risk assessments to determine your premium. This involves analyzing your credit score (in some jurisdictions), your occupation (certain jobs carry higher injury risk), and the specifics of the item being insured. A lower credit score might suggest a higher risk to the insurer, potentially leading to higher premiums for some types of insurance. Similarly, a hazardous occupation like construction might result in higher premiums for life or disability insurance. For homeowners insurance, the age and condition of your house, its location, and the value of its contents all influence the premium. A newer home with updated safety features will typically cost less to insure than an older home needing repairs.

Table Summarizing Impact of Factors on Insurance Costs, Personal insurance meaning

| Factor Category | Specific Factor | Impact on Cost | Example |

|---|---|---|---|

| Demographic | Age (young driver) | Higher | 20-year-old driver pays more for car insurance than a 40-year-old with a clean record. |

| Demographic | Location (high-crime area) | Higher | Homeowners insurance is more expensive in a city with high rates of burglary. |

| Lifestyle | Smoking | Higher | Life insurance premiums are higher for smokers due to increased health risks. |

| Lifestyle | Driving Record (multiple accidents) | Higher | Car insurance premiums increase significantly after multiple at-fault accidents. |

| Risk Assessment | Credit Score (low score) | Higher (in some jurisdictions) | Some insurers use credit scores to assess risk, potentially leading to higher premiums for those with low scores. |

| Risk Assessment | Home Condition (older home, poor maintenance) | Higher | Homeowners insurance for an older home with deferred maintenance will be more expensive than for a well-maintained newer home. |

Benefits and Importance of Personal Insurance

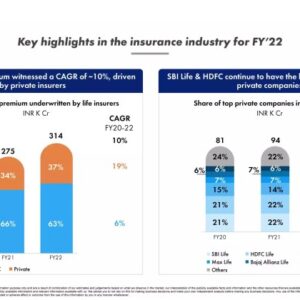

Source: niveshmarket.com

Personal insurance isn’t just a financial product; it’s a safety net, a crucial element of responsible financial planning that protects you and your loved ones from life’s unpredictable twists and turns. It offers a vital buffer against potentially devastating financial losses, providing peace of mind and security in the face of unexpected events. Investing in the right insurance coverage isn’t about expecting the worst; it’s about proactively mitigating risk and safeguarding your future.

Personal insurance offers robust financial protection in unexpected circumstances, preventing a single unforeseen event from derailing your entire financial life. It acts as a shield against significant financial burdens, allowing you to focus on recovery and rebuilding rather than grappling with overwhelming debt. This protection extends beyond just financial stability; it safeguards your emotional well-being, allowing you to navigate challenging times with greater resilience.

Financial Protection in Unexpected Circumstances

Imagine this: a sudden illness requires extensive medical treatment, leaving you with crippling medical bills. Without health insurance, this could lead to bankruptcy. Similarly, a car accident could result in costly repairs, legal fees, and lost income. Comprehensive auto insurance covers these expenses, preventing a financial catastrophe. Homeowners insurance protects your property against fire, theft, and other unforeseen damages, preventing you from losing your biggest investment. These are just a few examples of how personal insurance provides a critical financial safety net, protecting your assets and your future. The peace of mind that comes from knowing you’re protected is invaluable.

Real-World Scenarios Demonstrating Insurance Value

Consider Sarah, a young professional who recently experienced a devastating house fire. Thanks to her homeowners insurance, she was able to rebuild her life, recovering from the loss of her belongings and her home without falling into insurmountable debt. Or think of Mark, whose unexpected medical diagnosis led to extensive surgery and rehabilitation. His health insurance covered the vast majority of his medical expenses, allowing him to focus on his recovery rather than worrying about financial ruin. These real-life situations highlight the critical role insurance plays in mitigating the financial impact of unexpected events. Without insurance, both Sarah and Mark could have faced financial ruin.

Peace of Mind and Security Offered by Personal Insurance

The intangible benefits of personal insurance are equally important. Knowing you have a safety net in place provides unparalleled peace of mind. This peace of mind allows you to focus on your goals, your family, and your future without the constant worry of unforeseen financial burdens. It allows for greater financial freedom and security, knowing that even in the face of adversity, you have a plan in place. This security is priceless, offering a sense of stability and resilience in an uncertain world.

Consequences of Inadequate Personal Insurance Coverage

The absence of adequate personal insurance coverage can have severe consequences. A major illness or accident without health insurance could lead to crippling debt, impacting your credit score and your financial stability for years to come. Similarly, a car accident without sufficient liability coverage could leave you financially responsible for the other party’s injuries and damages, leading to potential bankruptcy. Without homeowners or renters insurance, a fire or theft could wipe out your savings and leave you homeless. These scenarios highlight the critical importance of having appropriate insurance coverage to protect your financial well-being and your future.

Choosing the Right Personal Insurance

Navigating the world of personal insurance can feel like wading through a swamp of jargon and fine print. But making informed choices is crucial to protecting your financial well-being. Understanding your needs and comparing different policies is key to finding the right coverage at the right price. This section will equip you with the tools and knowledge to confidently select the personal insurance that best suits your individual circumstances.

Questions to Ask When Selecting a Personal Insurance Policy

Before you even start comparing quotes, it’s vital to assess your specific needs. Asking yourself the right questions upfront saves time and ensures you’re comparing apples to apples. Consider these key factors to help you determine your insurance requirements.

- What are my biggest financial risks? (e.g., homeownership, car ownership, health concerns, potential lawsuits)

- What level of coverage do I need to adequately protect myself and my assets from these risks?

- What is my budget for insurance premiums? This helps narrow down options and prevent sticker shock.

- What are the deductibles and co-pays associated with different policy options? Understanding these costs is crucial in case of a claim.

- What are the policy’s limitations and exclusions? Knowing what’s not covered can prevent unpleasant surprises.

- What is the insurer’s reputation for claims processing and customer service? Check independent ratings and reviews.

- What types of discounts are available? (e.g., bundling policies, safe driving records, security systems)

Comparing Insurance Providers and Their Offerings

Once you’ve identified your needs, it’s time to shop around. Don’t settle for the first quote you receive. Comparing different providers is essential to securing the best value for your money.

- Gather quotes: Contact multiple insurance providers directly or use online comparison tools. Be sure to provide consistent information to ensure accurate comparisons.

- Analyze policy details: Don’t just focus on the premium. Scrutinize the coverage details, deductibles, and exclusions of each policy. A slightly higher premium might be worth it if it offers significantly better coverage.

- Check insurer ratings: Look at independent ratings agencies like A.M. Best to assess the financial stability and claims-handling reputation of each insurer. A financially sound insurer is less likely to fail when you need them most.

- Read reviews: See what other customers say about their experiences with different insurance providers. Online reviews can offer valuable insights into customer service and claims processing.

Understanding Policy Exclusions and Limitations

Every insurance policy has limitations and exclusions – things that are specifically not covered. Understanding these is crucial to avoid disappointment and financial hardship if a claim arises.

For example, a homeowner’s insurance policy might exclude flood damage (requiring separate flood insurance) or damage caused by earthquakes. Similarly, car insurance may have limitations on liability coverage or exclude certain types of damage. Carefully review the policy document to understand these limitations and consider whether supplemental coverage is needed. Ignoring these exclusions could leave you financially exposed.

Reviewing and Updating Insurance Coverage Periodically

Your insurance needs change over time. Life events like marriage, having children, buying a home, or changing jobs can significantly impact your insurance requirements. Regularly reviewing and updating your coverage ensures you maintain adequate protection.

Consider reviewing your policies annually or whenever a significant life event occurs. This allows you to adjust coverage amounts, add or remove coverage, and ensure your premiums reflect your current needs and risk profile. Ignoring this crucial step could leave you underinsured and vulnerable.

Wrap-Up: Personal Insurance Meaning

Source: co.uk

Ultimately, the meaning of personal insurance boils down to financial security and peace of mind. It’s about protecting what matters most – your health, your family, your assets – from the unpredictable twists and turns of life. By understanding the different types of coverage, carefully choosing a policy, and regularly reviewing your needs, you can build a strong financial foundation that will safeguard your future against the unexpected. Don’t wait for a crisis to hit; take control of your financial well-being today.