Trustage Auto Insurance Personal Invitation Number: Unlocking the secrets to snagging sweet deals and exclusive perks. This isn’t your grandma’s insurance referral program; we’re diving deep into the world of personalized invites, exploring how this unique identifier impacts your Trustage experience, from securing better rates to navigating the complexities of sharing sensitive information. We’ll unpack the benefits, the risks, and everything in between, ensuring you’re armed with the knowledge to make the most of your invitation.

We’ll cover the ins and outs of Trustage’s unique system, comparing it to competitors, dissecting marketing strategies, and even addressing potential legal snags. Think of it as your ultimate guide to navigating the world of Trustage Auto Insurance – invitation number in hand.

Trustage Auto Insurance

Source: insuranceblogbychris.com

Trustage Auto Insurance aims to provide affordable and reliable car insurance to a specific segment of the market. Understanding their target demographic and the specifics of their policies is key to determining if it’s the right fit for you.

Trustage Auto Insurance Target Demographic

Trustage likely targets a demographic seeking value-driven insurance options. This could include young adults entering the workforce, families on a budget, or individuals prioritizing affordability over extensive coverage options. They may be less focused on luxury add-ons and more concerned with securing essential coverage at a competitive price. The specific target may vary depending on Trustage’s geographic location and marketing strategies.

Key Features and Benefits of Trustage Auto Insurance Policies

Trustage Auto Insurance policies likely offer a range of standard coverages such as liability, collision, and comprehensive insurance. Benefits may include competitive pricing, straightforward policy options, and potentially convenient online tools for managing accounts and making payments. Additional benefits might include discounts for safe driving, bundling policies, or affiliations with certain organizations. The specific features and benefits would be detailed in their policy documents and online resources.

Comparison of Trustage Auto Insurance with Competitors

To accurately compare Trustage Auto Insurance with its competitors, we need to specify three major competitors. Let’s hypothetically compare it to Geico, Progressive, and State Farm. Direct comparisons are difficult without access to specific policy quotes and details, as pricing and coverage vary greatly based on location, driving history, and the specifics of the chosen policy. However, we can illustrate potential differences. Geico is often known for its competitive pricing, Progressive for its customizable options and online tools, and State Farm for its extensive network of agents and personalized service. Trustage might differentiate itself through a focus on a particular niche or a simplified, transparent policy structure.

Comparison Table: Trustage vs. Competitors

| Feature | Trustage | Geico | Progressive | State Farm |

|---|---|---|---|---|

| Average Premium (Hypothetical) | $1,000/year | $950/year | $1,100/year | $1,050/year |

| Online Tools & Management | Moderate | Excellent | Excellent | Good |

| Customer Service | Average | Average | Good | Excellent |

| Coverage Options | Standard | Standard to Extensive | Standard to Extensive, Customizable | Standard to Extensive |

Note: The pricing and features listed above are hypothetical examples and may not reflect actual market conditions or specific policy offerings. Actual quotes should be obtained directly from each insurance provider.

The Role of the “Personal Invitation Number”

Your Trustage Auto Insurance personal invitation number is more than just a string of digits; it’s your key to accessing personalized offers and streamlining the insurance process. Think of it as your VIP pass to a smoother, more efficient insurance experience. This unique number acts as a secure identifier, linking you directly to your specific application and allowing for personalized communication and service.

This number plays a crucial role in maintaining the security and privacy of your information. Sharing it with unauthorized individuals could expose your personal data to potential risks, including identity theft or fraudulent activity. Protecting your personal invitation number is paramount to ensuring the integrity of your insurance application and safeguarding your personal information.

Personal Invitation Number Usage Scenarios

The personal invitation number serves several key functions throughout your interaction with Trustage Auto Insurance. It’s used in various stages of the insurance process, from initial application to policy management.

For example, you’ll need your personal invitation number to access your online account, where you can view policy details, make payments, and manage your coverage. It also verifies your identity when contacting customer support, ensuring that only you can access your sensitive information. Additionally, it might be used to track the progress of your application or to receive personalized offers and discounts tailored specifically to your needs. Consider it your personalized access code to all things Trustage Auto Insurance, related to your specific policy.

Security Implications of Sharing the Personal Invitation Number

Sharing your personal invitation number with anyone other than authorized Trustage representatives poses significant security risks. Unauthorized access could lead to several negative consequences. For instance, someone could potentially alter your policy details, file fraudulent claims, or even steal your identity. Think of it like your online banking password – treat it with the utmost care and discretion. Never share it via email, text message, or any other unsecured method.

Obtaining and Using a Personal Invitation Number: A Flowchart

Imagine a flowchart. The process begins with your initial application for Trustage Auto Insurance. This application, once submitted, generates a unique personal invitation number. The number is then sent to you via a secure method, such as registered mail or a secure email portal. You can then use this number to access your online account, make changes to your policy, or contact customer support. If you lose or forget your number, the flowchart would show a path to contacting Trustage customer service to retrieve it – following their established security protocols. The final step depicts successful policy management and secure access to your account. The entire process emphasizes secure handling of your personal invitation number.

Marketing and Customer Acquisition Strategies

Source: medium.com

Snag that Trustage auto insurance personal invitation number – you’ll thank yourself later. Seriously, the peace of mind it offers is priceless, especially considering the potential headaches of getting into car accident without insurance. That invitation number unlocks access to affordable coverage, so don’t let it slip through your fingers; secure your future and your wallet.

Trustage Auto Insurance’s personal invitation number program offers a unique opportunity to boost customer acquisition and brand loyalty. Leveraging this system effectively requires a multi-pronged marketing approach that combines digital strategies with traditional methods, all while carefully considering the rewards structure to maximize impact.

The success of any referral program hinges on a compelling value proposition for both the referrer and the referee. A well-designed campaign will not only attract new customers but also foster a sense of community and brand advocacy among existing policyholders. This section will explore various marketing strategies, analyze the advantages and disadvantages of referral programs, compare reward systems, and Artikel potential marketing channels for Trustage.

Marketing Strategies Utilizing Personal Invitation Numbers

Personal invitation numbers can be integrated into various marketing initiatives to enhance their effectiveness. For instance, Trustage could launch targeted email campaigns featuring the unique number, highlighting the benefits for both the referrer and the referee. Social media campaigns could also incorporate the number, encouraging users to share their referral links with friends and family. Furthermore, Trustage could offer incentives for policyholders who actively promote their personal invitation number, such as entering them into prize draws or offering exclusive discounts. These initiatives should be supported by clear and concise messaging that emphasizes the ease of use and the tangible benefits of the program. The key is to make it effortless for existing customers to share their number and for potential customers to use it.

Advantages and Disadvantages of Referral Programs Using Personal Invitation Numbers

Referral programs, while effective, present both opportunities and challenges. Advantages include a cost-effective customer acquisition method compared to traditional advertising, increased brand awareness through word-of-mouth marketing, and improved customer loyalty due to the involvement of existing customers. However, disadvantages include the potential for fraud if not properly monitored, the dependence on existing customers’ willingness to participate, and the need for effective tracking and attribution to accurately measure the success of the program. For instance, a poorly designed tracking system might fail to attribute new customers to the correct referrer, undermining the program’s effectiveness. Therefore, robust tracking and anti-fraud measures are crucial.

Comparison of Referral Reward Systems

Different reward systems can significantly impact the success of a referral program. A simple discount for both the referrer and the referee is a common approach. Alternatively, Trustage could offer tiered rewards, increasing the incentive for referring multiple customers. Another option is to offer non-monetary rewards, such as exclusive merchandise or priority customer service. The optimal reward system depends on Trustage’s budget and target audience. For example, a younger demographic might respond better to non-monetary rewards, while an older demographic might prefer a direct discount. A/B testing different reward systems is crucial to determine the most effective approach.

Potential Marketing Channels for Trustage Auto Insurance

Trustage can utilize various marketing channels to promote its personal invitation number program. These include email marketing, social media marketing (Facebook, Instagram, Twitter), paid advertising (Google Ads, social media ads), partnerships with local businesses or community organizations, inclusion in customer service communications (e.g., email confirmations, policy renewals), and print advertising in local newspapers or magazines. Each channel requires a tailored approach, with messaging and visuals adapted to the specific platform and audience. For instance, a social media campaign might utilize engaging visuals and short, impactful copy, while an email campaign could focus on providing detailed information and clear calls to action. The key is to maintain consistent branding and messaging across all channels.

Customer Experience and Support

Providing exceptional customer service is paramount for Trustage Auto Insurance, especially when dealing with the sensitive information associated with personal invitation numbers. A smooth and efficient process builds trust and loyalty, ultimately driving customer retention and positive word-of-mouth referrals. This section Artikels best practices for ensuring a positive customer experience related to personal invitation numbers.

Effective communication and readily available support channels are crucial for a positive customer experience. Proactive communication about the PIN’s purpose and usage, combined with easily accessible support resources, minimizes confusion and frustration. Addressing potential issues swiftly and efficiently shows customers that their concerns are valued.

Email Communication Regarding Personal Invitation Numbers

A well-crafted email is essential for informing new customers about their personal invitation number (PIN). This email should be clear, concise, and easily understandable. It should explain the PIN’s purpose, how to use it, and what to do if it’s lost or compromised.

Here’s a sample email template:

Subject: Welcome to Trustage Auto Insurance! Your Personal Invitation Number

Dear [Customer Name],

Welcome to the Trustage Auto Insurance family! We’re thrilled to have you as a customer.

This email contains your personal invitation number (PIN): [PIN]. This number is unique to you and is required for accessing certain account features and offers. Please keep this number safe and secure. Do not share it with anyone.

You can use your PIN to:

- Access your online account.

- Manage your policy details.

- Take advantage of exclusive offers.

If you have any questions or require assistance, please don’t hesitate to contact us at [phone number] or reply to this email.

Sincerely,

The Trustage Auto Insurance Team

Frequently Asked Questions (FAQs) About Personal Invitation Numbers

Addressing common customer queries proactively helps streamline support and improve customer satisfaction. Providing clear and concise answers in a readily accessible format is key.

Here’s a list of frequently asked questions about personal invitation numbers:

- What is a personal invitation number (PIN)? Your PIN is a unique number assigned to you, providing secure access to your Trustage Auto Insurance account and exclusive offers.

- Where can I find my PIN? Your PIN is provided in your welcome email and can be accessed through your online account.

- What should I do if I forget my PIN? You can reset your PIN by following the instructions on our website or by contacting our customer support team.

- What if my PIN is compromised? Immediately contact our customer support team to report the issue and have your PIN reset. We will take steps to secure your account.

- Is my PIN the same as my policy number? No, your PIN is different from your policy number. Your policy number identifies your insurance policy, while your PIN provides secure access to your account.

- Why do I need a PIN? Your PIN adds an extra layer of security to your account, protecting your personal information and ensuring only you can access it.

Resolving Issues Related to Lost or Compromised Personal Invitation Numbers

A clear and efficient process for handling lost or compromised PINs is vital for maintaining customer trust and security. This process should be easily accessible and clearly communicated to customers.

If a customer reports a lost or compromised PIN, Trustage Auto Insurance will follow these steps:

- Verify the customer’s identity through security questions or other methods.

- Reset the customer’s PIN and send the new PIN via a secure method (e.g., a secure email or SMS message).

- Advise the customer to update their password and security questions for added protection.

- Document the incident for security and auditing purposes.

Legal and Regulatory Compliance: Trustage Auto Insurance Personal Invitation Number

Navigating the legal landscape surrounding personal invitation numbers in the insurance industry requires a keen understanding of data privacy regulations and security best practices. Failure to comply can lead to hefty fines, reputational damage, and loss of customer trust. Trustage Auto Insurance must proactively address these concerns to ensure long-term success and maintain ethical operations.

The use of personal invitation numbers, while potentially beneficial for marketing and customer acquisition, introduces several legal and regulatory risks. These risks stem primarily from the collection, storage, and use of personally identifiable information (PII), which is subject to various state and federal laws. Mismanagement of this data can lead to significant legal repercussions.

Data Privacy Regulations and Compliance

Trustage Auto Insurance must adhere to a comprehensive framework to ensure compliance with relevant data privacy regulations. This includes, but is not limited to, the California Consumer Privacy Act (CCPA), the California Privacy Rights Act (CPRA), and other state-specific laws, as well as the federal Health Insurance Portability and Accountability Act (HIPAA) if applicable to any health-related information collected. The company needs to implement robust data governance policies, including data minimization, purpose limitation, and data security measures. This involves clearly defining the purpose for collecting personal invitation numbers, obtaining explicit consent from individuals, and limiting the data’s retention period. Regular audits and internal compliance training are also crucial for maintaining ongoing adherence. Furthermore, Trustage must establish a clear process for handling data breach incidents, including prompt notification to affected individuals and regulatory authorities.

State-Specific Data Privacy Laws

Data privacy laws vary significantly across different states. For instance, California’s CCPA and CPRA grant consumers extensive rights regarding their personal data, including the right to access, correct, delete, and opt-out of the sale of their information. Other states, such as Virginia, Colorado, and Utah, have also enacted comprehensive privacy laws with similar provisions. Trustage Auto Insurance must conduct a thorough analysis of the specific regulations in each state where it operates and tailor its data handling practices accordingly. This might involve creating different data processing procedures for different states or employing a nationwide standard that exceeds the minimum requirements of all relevant state laws. Failure to comply with state-specific regulations can result in significant penalties and legal challenges.

Data Security Best Practices

Protecting personal invitation numbers requires a multi-layered approach to data security. This includes implementing robust technical safeguards such as encryption, access controls, and intrusion detection systems. Regular security assessments and penetration testing are necessary to identify and address vulnerabilities. Trustage should also establish strict employee access controls and implement comprehensive training programs to educate employees about data security best practices. The company must also develop a comprehensive incident response plan to effectively manage and mitigate the impact of any data breaches. This plan should include procedures for identifying, containing, and remediating security incidents, as well as communicating with affected individuals and regulatory authorities. Regular backups and disaster recovery planning are also essential to ensure business continuity in the event of a data loss or system failure.

Illustrative Scenarios

Let’s explore some real-world examples showcasing both the smooth sailing and potential bumps in the road when using a Trustage Auto Insurance personal invitation number. These scenarios highlight the importance of clear communication and robust systems to ensure a positive customer experience.

Successful Use of a Personal Invitation Number

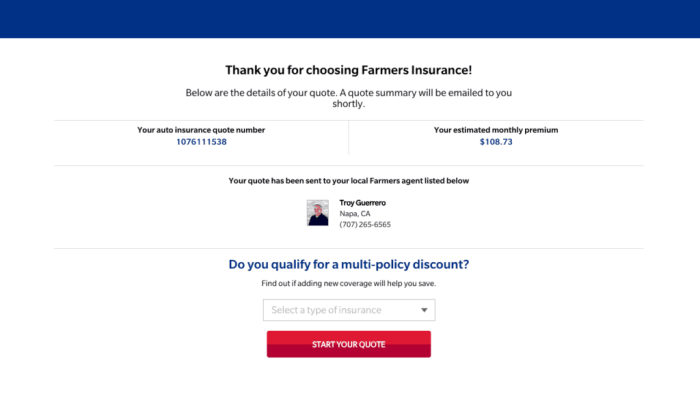

Successful Quote Acquisition

Imagine Sarah, a friend of an existing Trustage customer, receives a personalized email containing a unique invitation number. Intrigued by the potential savings, she clicks the link, which takes her to a dedicated landing page on the Trustage website. The page clearly prompts her to enter her invitation number. After entering the number and providing some basic vehicle and driver information, Sarah receives an instant, personalized auto insurance quote that reflects the discount offered through the referral program. The entire process is seamless and takes less than five minutes. She’s impressed by the simplicity and transparency and proceeds to purchase the policy.

Problem Encountered with a Personal Invitation Number

Invalid or Expired Invitation Number, Trustage auto insurance personal invitation number

Now consider John, who receives an invitation number from his neighbor. However, when he tries to use the number, he receives an error message stating that the number is invalid. This could be due to several reasons: the number might have been entered incorrectly, it might have expired, or it might have already been used. John contacts Trustage customer support, where a friendly agent quickly verifies the issue. It turns out the number had expired. The agent apologizes for the inconvenience and explains the program’s terms, offering John an alternative discount code for new customers. John is satisfied with the resolution and proceeds to get a quote using the new code.

Visual Representation of Customer Journey

Customer Journey Map

The customer journey begins with a referral email containing the personal invitation number. This email is visually appealing, with clear instructions on how to use the number. The email directs the customer to a dedicated landing page on the Trustage website, designed with a clean and intuitive interface. The page prominently features a field for entering the invitation number, along with clear instructions and helpful visuals. Upon successful entry, the customer is guided through a streamlined process of providing necessary information. The system dynamically updates the quote as the customer fills out the form, providing real-time feedback. Once the customer completes the form, they receive an instant quote, highlighting the savings associated with the invitation number. If the customer chooses to proceed, they’re seamlessly guided through the policy purchase process. The final step includes a confirmation email summarizing the policy details and next steps. The entire process is designed to be simple, transparent, and user-friendly. Each stage is clearly defined, with minimal friction points, resulting in a positive customer experience.

Detection and Addressing of Fraudulent Use

Fraud Detection and Response

Trustage employs several mechanisms to detect fraudulent use of personal invitation numbers. This includes monitoring for unusual patterns in number usage, such as a single number being used for multiple policy applications from different IP addresses or locations. The system also flags instances where a large number of quotes are generated using a single invitation number within a short period. Suspicious activity triggers an alert within the Trustage system, prompting a manual review by the fraud prevention team. If fraud is confirmed, the fraudulent accounts are immediately suspended, and the appropriate authorities are notified. The legitimate referrer’s account is also reviewed to ensure there is no complicity. Trustage regularly updates its fraud detection systems to adapt to evolving tactics and maintain the integrity of its referral program.

End of Discussion

Source: wua.cx

So, there you have it – the lowdown on your Trustage Auto Insurance Personal Invitation Number. From understanding its purpose and security implications to maximizing its potential through smart marketing strategies, we’ve covered the essential aspects. Remember, this number is your key to unlocking potentially significant savings and a smoother insurance journey. Use it wisely, protect it fiercely, and enjoy the ride!