Workers comp and general liability insurance near me—sounds boring, right? Wrong. These policies aren’t just dusty legal documents; they’re your business’s safety net. Think of them as your financial airbags, protecting you from the unexpected bumps and bruises of running a company. A slip, a trip, a lawsuit – these are all realities, and understanding these insurance types is crucial for peace of mind (and a healthy bank account).

This guide breaks down workers’ compensation and general liability insurance, explaining what they cover, how to find local providers, and how to navigate the sometimes-tricky world of claims and regulations. We’ll explore the differences, the costs, and how to make sure you’re properly protected. Because let’s be honest, nobody wants to face a financial meltdown because of an accident or a lawsuit.

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance is a crucial safety net for employees injured on the job. It provides a system for compensating workers for medical expenses and lost wages resulting from work-related injuries or illnesses, regardless of fault. This means that even if the employee contributed to the accident, they can still receive benefits. This system aims to protect both employees and employers by providing a predictable and structured approach to handling workplace injuries.

Workers’ compensation insurance covers a wide range of workplace injuries and illnesses. The specific coverage can vary by state, but generally, it includes medical expenses related to the injury or illness, lost wages due to time off work for treatment or recovery, and potentially permanent disability benefits if the injury results in long-term limitations.

Types of Workplace Injuries Covered

Workers’ compensation typically covers a broad spectrum of injuries and illnesses sustained at work. This includes acute injuries like sprains, strains, fractures, burns, and lacerations resulting from accidents. It also extends to illnesses directly caused by the work environment, such as repetitive stress injuries (like carpal tunnel syndrome), exposure to hazardous materials (leading to respiratory illnesses or cancers), and hearing loss from prolonged exposure to loud noises. Furthermore, some states also cover mental health conditions resulting from workplace stress or trauma.

Examples of Situations Requiring Workers’ Compensation Claims

Consider these scenarios where a workers’ compensation claim would be appropriate: a construction worker falling from a scaffold and breaking their leg; an office worker developing carpal tunnel syndrome from repetitive typing; a nurse contracting hepatitis from a needle stick injury; a factory worker suffering hearing loss from prolonged exposure to machinery noise; or a firefighter experiencing PTSD after responding to a traumatic event. These are just a few examples, and the specifics of each claim would depend on the details of the situation and the applicable state laws.

The Workers’ Compensation Claim Process

Filing a workers’ compensation claim generally involves several steps. First, the injured worker should immediately report the injury to their supervisor. Then, the employer will typically file a First Report of Injury (FROI) with their insurance carrier. The worker will then need to seek medical treatment from a doctor approved by the insurance company. The doctor will provide reports detailing the injury, treatment, and prognosis. The insurance company will review the claim and determine the benefits to which the worker is entitled. Disputes may arise, and in such cases, mediation or arbitration may be necessary to resolve the issue.

Workers’ Compensation Claim Process Flowchart

The following flowchart illustrates a simplified version of the claim process:

Injury Occurs → Report Injury to Supervisor → Employer Files FROI → Employee Seeks Medical Treatment → Doctor Provides Reports → Insurance Company Reviews Claim → Benefits Awarded (or Dispute Resolution)

Understanding General Liability Insurance

General liability insurance is your business’s safety net against financial ruin caused by accidents or injuries on your property or resulting from your business operations. It protects you from lawsuits and related expenses stemming from third-party claims of bodily injury or property damage. Think of it as a shield against unexpected costs that could otherwise cripple your company.

Purpose of General Liability Insurance

The primary purpose of general liability insurance is to protect your business from financial losses arising from third-party claims. This coverage helps pay for legal fees, settlements, and judgments if you’re sued for causing bodily injury or property damage. It provides peace of mind, allowing you to focus on running your business without the constant worry of unexpected liability costs. This is especially crucial for businesses that interact with the public, such as retail stores, restaurants, or service providers.

Types of Incidents Covered Under General Liability

General liability policies typically cover a wide range of incidents. These commonly include bodily injury to a third party (a customer slipping and falling in your store, for example), property damage to a third party (a delivery truck damaging a customer’s fence), and advertising injury (libel or slander in your marketing materials). Specific coverage details vary depending on the policy and its endorsements.

Examples of Situations Requiring General Liability Claims

Imagine a customer trips over a loose floorboard in your office and breaks their arm. That’s a bodily injury claim. Or, perhaps a contractor working on your building accidentally damages a neighbor’s car. That’s property damage. Another scenario: a disgruntled customer sues you for defamation after you post a negative review about their business online. This would be an advertising injury claim. These are just a few examples; many situations can necessitate a general liability claim.

Filing a General Liability Claim

The process of filing a general liability claim usually begins by reporting the incident to your insurance provider as soon as possible. You’ll need to provide detailed information about the event, including dates, times, witnesses, and any related documentation. The insurance company will then investigate the claim and determine coverage. This may involve interviewing witnesses, reviewing police reports, and assessing the extent of the damages. Throughout this process, it’s crucial to cooperate fully with your insurance company.

Comparison of Workers’ Compensation and General Liability Insurance

| Feature | Workers’ Compensation | General Liability |

|---|---|---|

| Coverage | Injuries to employees on the job | Injuries or damage caused to third parties |

| Insured Parties | Employees | Customers, clients, visitors, and the public |

| Claims Process | Usually straightforward, with established procedures | Can be more complex, depending on the circumstances |

| Liability | Strict liability (regardless of fault) | Based on negligence or fault |

Finding Local Insurance Providers

Securing the right Workers’ Compensation and General Liability insurance is crucial for any business. But with so many providers out there, navigating the process can feel overwhelming. This section helps you pinpoint local options and make informed decisions.

Finding the perfect insurance provider involves more than just comparing prices. You need to consider your specific needs, the provider’s reputation, and the type of service they offer. Let’s break down how to effectively navigate this process.

Resources for Locating Local Insurance Providers

Several avenues exist to discover local insurance providers. Online directories, such as those offered by insurance comparison websites, provide a comprehensive list of companies operating in your area. These websites often allow you to filter results based on specific needs, such as the type of insurance, coverage amounts, and even customer reviews. Referrals from trusted sources, such as other business owners, accountants, or financial advisors, can also be invaluable. Networking within your local business community can uncover hidden gems and reliable providers you might not find through online searches alone. Finally, checking with your state’s insurance department website can provide a list of licensed providers in your region.

Factors to Consider When Choosing an Insurance Provider

Selecting an insurance provider requires careful consideration of several key factors. Cost is a significant concern for most businesses, but it shouldn’t be the sole determining factor. Equally important is the breadth and depth of coverage offered. Does the policy adequately protect your business from potential liabilities? Reviewing the provider’s reputation, including their customer service ratings and claims-handling process, is vital. Look for consistent positive feedback from past clients and investigate any reported issues. Financial stability is also a key factor; you need a provider that can pay out claims when needed. Finally, consider the level of personalized service offered. Do they offer responsive customer support and proactive risk management advice?

Types of Insurance Providers: Independent Agents vs. Direct Writers

Two primary types of insurance providers exist: independent agents and direct writers. Independent agents represent multiple insurance companies, allowing them to shop around for the best policy to fit your needs. This offers broader choices and potentially more competitive pricing. Direct writers, on the other hand, only represent one insurance company. While this limits your options, it can sometimes offer a more streamlined process and potentially stronger relationships with a single insurer. The best choice depends on your individual preferences and priorities. For example, a business needing specialized coverage might benefit from an independent agent’s wider network, while a business prioritizing simplicity might prefer a direct writer.

Questions to Ask Potential Insurance Providers

Before committing to a provider, preparing a list of questions is crucial. These questions should address the specifics of their coverage, their claims process, and their overall service. For example, inquire about the specifics of their policy exclusions, their claims handling timeline, and the availability of 24/7 customer support. Understanding their financial strength rating and their experience handling claims similar to yours is also essential. Asking about potential discounts or additional services they offer can help you secure the best possible value. Finally, clarifying the process for renewing your policy and any associated fees is important for long-term planning.

Evaluating Insurance Quotes Effectively

Comparing insurance quotes requires more than simply looking at the bottom-line price. Carefully examine the coverage details of each quote. Don’t just focus on the premium; analyze the deductibles, limits of liability, and any exclusions. A lower premium with significantly less coverage might ultimately prove more expensive in the event of a claim. Consider the reputation and financial stability of the provider offering each quote. A lower price from an unstable company could be a false economy. Ensure that all quotes cover the same aspects of your business and operations. For instance, make sure the coverage for your equipment is sufficient and accurately reflects its value. Finally, look beyond the initial price and consider the potential long-term costs, including potential increases in premiums over time.

Policy Coverage and Exclusions

Source: travelers.com

Understanding the fine print of your workers’ compensation and general liability insurance policies is crucial. While these policies offer vital protection, they aren’t all-encompassing. Knowing what’s covered and, equally important, what’s excluded, can save you significant financial headaches down the line. This section dives into the common exclusions and limitations you should be aware of.

Common Exclusions in Workers’ Compensation and General Liability Policies

Workers’ compensation and general liability policies typically exclude coverage for certain events or circumstances. For instance, workers’ compensation policies often exclude injuries resulting from an employee’s intentional self-harm or intoxication. Similarly, general liability policies frequently exclude coverage for damage caused by intentional acts, contractual liability (unless specifically included), and damage to the insured’s own property. These exclusions are designed to prevent abuse and ensure the insurance remains financially sound. Understanding these limitations helps you manage risk proactively.

Examples of Uncovered Situations

Let’s look at some real-world scenarios illustrating situations not covered by these insurance types. Imagine an employee intentionally injuring themselves to claim workers’ compensation benefits; this would likely be excluded. Or consider a business owner who, in a fit of anger, damages a client’s property; general liability likely wouldn’t cover the resulting damages. Another example could be a company failing to secure a permit for construction work, leading to a third-party injury; this might not be covered unless specific endorsements were added to the policy. These situations highlight the importance of understanding policy limitations.

Policy Limits and Deductibles

Policy limits represent the maximum amount your insurance company will pay for covered losses. Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. Understanding these crucial elements is essential for budgeting and financial planning. For example, a general liability policy might have a $1 million limit, meaning the insurer will pay a maximum of $1 million for covered claims. If you have a $5,000 deductible, you’ll need to cover the first $5,000 of any claim before the insurance company starts paying. Knowing your limits and deductibles helps you manage potential financial exposure.

Appealing a Denied Claim

If your claim is denied, understanding the appeals process is vital. Most insurance policies Artikel a clear procedure for appealing denials. This typically involves submitting additional documentation, providing further evidence, or even engaging a lawyer specializing in insurance disputes. The appeals process often involves specific deadlines and requirements. Failing to follow these steps precisely could jeopardize your chances of a successful appeal. It’s crucial to meticulously document every step of the process.

Key Policy Terms and Definitions

Understanding key policy terms is paramount to avoiding misunderstandings and ensuring you’re adequately protected. Here’s a list of common terms and their meanings:

- Policy Period: The timeframe during which the insurance coverage is active.

- Named Insured: The individual or entity specifically named on the insurance policy as the insured party.

- Occurrence: An accident, event, or happening that leads to a claim.

- Claim: A formal request for payment under the insurance policy.

- Exclusions: Specific situations, events, or losses explicitly excluded from coverage.

- Coverage Limits: The maximum amount the insurance company will pay for a covered claim.

- Deductible: The amount the insured must pay out-of-pocket before insurance coverage begins.

- Premium: The amount paid to the insurance company for the insurance coverage.

Cost and Pricing Factors

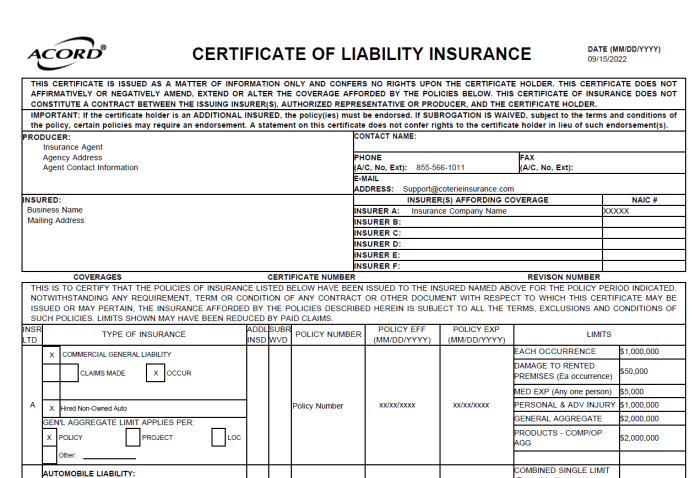

Source: coterieinsurance.com

Understanding the cost of workers’ compensation and general liability insurance is crucial for any business owner. Premiums aren’t arbitrary; they’re calculated based on a range of factors, and knowing these factors can help you make informed decisions and potentially save money. This section breaks down the key influences on your insurance costs and offers strategies for cost reduction.

Several interconnected elements determine the final price of your workers’ compensation and general liability insurance policies. These factors interact to create a unique premium for each business, highlighting the importance of careful consideration and proactive risk management.

Finding the right workers comp and general liability insurance near you is crucial for business protection. If you’re in the Grafton area, checking out the options available, like those offered by gaudette insurance grafton , is a smart first step. Securing comprehensive coverage for your workplace ensures peace of mind and protects your bottom line, so don’t delay in finding the best fit for your needs.

Industry Classification

Your industry plays a significant role in determining your insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of workplace accidents and injuries. Conversely, industries with lower inherent risk, like office administration, may enjoy lower premiums. Insurance companies use industry classification codes (like NAICS codes) to categorize businesses and assess their risk profiles. For example, a roofing company will pay significantly more for workers’ compensation than a software development firm because of the inherent dangers involved in roofing work.

Company Size and Employee Count

The size of your business and the number of employees you have directly impact your premiums. Larger companies with more employees generally pay higher premiums because of the increased exposure to potential claims. A larger workforce increases the statistical probability of accidents and subsequent claims, leading to a higher risk assessment for insurers. Conversely, smaller businesses with fewer employees often receive more favorable rates.

Claims History

Your company’s past claims history is a critical factor. A history of frequent or costly claims will significantly increase your premiums. Insurance companies view this as an indicator of higher risk and will adjust premiums accordingly to cover potential future payouts. Conversely, a clean claims history, demonstrating a commitment to safety and risk management, can lead to lower premiums and potentially even discounts. For example, a business with multiple lost-time injuries in the past year will likely see a substantial premium increase compared to a business with a spotless safety record.

Ways to Reduce Insurance Costs, Workers comp and general liability insurance near me

Several strategies can help businesses reduce their insurance costs. Implementing robust safety programs, providing comprehensive employee training, and maintaining a safe work environment are key. Regular safety inspections, detailed documentation of safety procedures, and investing in safety equipment can all contribute to a lower risk profile, leading to reduced premiums. Furthermore, actively engaging in risk management strategies and working closely with your insurance provider to identify and mitigate potential hazards can significantly impact your costs.

Pricing Structures of Different Insurance Providers

Insurance providers use various pricing models, often involving a combination of factors discussed above. Some might emphasize claims history more heavily than others, while some may offer discounts for bundling workers’ compensation and general liability policies. It’s essential to compare quotes from multiple providers to find the best value. Shopping around and negotiating with insurers can yield significant savings. Each insurer uses a proprietary algorithm, so comparing apples to apples can be challenging. Focus on understanding the coverage and the specific factors influencing the quote rather than solely focusing on the price.

Hypothetical Cost Calculation for a Small Business

Let’s consider a hypothetical small bakery with five employees. Assuming a low-risk industry classification, a clean claims history, and standard coverage limits, their annual workers’ compensation premium might be around $2,000. Their general liability premium, considering the relatively low risk associated with a bakery, could be around $500 annually. However, if this bakery had a history of employee injuries, the workers’ compensation premium could easily double or even triple. Similarly, if the bakery were to experience a significant liability claim (e.g., a customer slipping and falling), their future general liability premiums would likely increase. This illustrates the importance of proactive risk management in controlling insurance costs. These figures are illustrative and will vary widely based on location, specific insurer, and numerous other factors.

Legal and Regulatory Compliance: Workers Comp And General Liability Insurance Near Me

Navigating the world of workers’ compensation and general liability insurance isn’t just about finding the right policy; it’s about understanding the legal landscape and ensuring your business remains compliant. Failure to do so can lead to significant financial penalties and even legal repercussions. This section clarifies the legal requirements, potential penalties, and steps to maintain compliance.

Understanding the legal requirements for workers’ compensation and general liability insurance is crucial for any business owner. These requirements vary depending on your state and the specifics of your business operations, but generally, they center around providing adequate coverage to protect your employees and the public from potential harm. The overarching goal is to mitigate risk and ensure responsible business practices.

Workers’ Compensation Insurance Requirements

Most states mandate workers’ compensation insurance for businesses employing a certain number of people. These laws are designed to protect employees injured on the job by providing medical care and wage replacement. Failure to carry the legally required coverage exposes businesses to significant fines and potential lawsuits from injured employees. For instance, in California, employers who fail to secure workers’ compensation insurance can face penalties ranging from substantial fines to criminal charges. The specific number of employees triggering the requirement and the details of the coverage vary by state. Businesses should consult their state’s Department of Insurance or equivalent agency for precise information.

General Liability Insurance Requirements

While not universally mandated like workers’ compensation, general liability insurance is often a crucial requirement for businesses, especially those engaging in client interaction or operating in a physical location. This type of insurance protects businesses from financial losses resulting from accidents, injuries, or property damage caused by their operations or employees. While not always legally required, the absence of general liability insurance can severely impact a business’s ability to secure contracts, obtain loans, or even operate in certain locations. Many commercial leases, for example, specifically require general liability insurance as a condition of tenancy.

Penalties for Non-Compliance

The penalties for failing to comply with workers’ compensation and general liability insurance requirements can be severe. These penalties often include substantial fines, back taxes, and even criminal charges in some cases. Furthermore, a lack of insurance can leave a business vulnerable to costly lawsuits and reputational damage. In cases of employee injury without workers’ compensation insurance, the employer could face significant financial liability for medical expenses, lost wages, and potential legal fees. For businesses without general liability insurance, a single incident could lead to bankruptcy.

Ensuring Compliance

Ensuring compliance involves proactive measures. This includes regularly reviewing state and federal regulations, maintaining accurate records of insurance policies, and obtaining professional advice when necessary. Regularly reviewing your policy to ensure it adequately covers your evolving business needs is essential. Consulting with an insurance professional can help you determine the appropriate coverage levels and identify potential gaps in your protection. Maintaining meticulous records of your insurance policies and related documentation is vital for demonstrating compliance during audits or investigations.

Resources for Legal and Regulatory Information

Finding reliable information is key. Here are some resources to help you navigate the legal landscape:

- Your State’s Department of Insurance: Each state has a department responsible for regulating insurance. Their websites usually provide comprehensive information on workers’ compensation and general liability requirements.

- The U.S. Department of Labor: The federal government also plays a role in workplace safety and insurance regulations. The Department of Labor’s website offers resources and information on relevant federal laws.

- Legal Professionals: Consulting with an attorney specializing in business law or insurance law can provide tailored advice and guidance on compliance.

- Insurance Brokers and Agents: Experienced insurance professionals can help you navigate the complexities of insurance regulations and find appropriate coverage.

Illustrative Scenarios

Understanding when you need workers’ compensation insurance, general liability insurance, or both, is crucial for protecting your business. These scenarios illustrate the differences and the importance of having adequate coverage.

Scenario Requiring Both Workers’ Compensation and General Liability Insurance

Imagine a bustling bakery. A delivery driver, while unloading a shipment of flour, slips on a spilled bag of sugar (a hazard not properly addressed by the bakery), injuring their back. This incident requires both types of insurance. The driver’s medical bills and lost wages fall under workers’ compensation, as the injury occurred during work. However, the customer who ordered the flour and sustained damage to their property due to the spilled sugar (perhaps ruining a nearby display) would be covered under the bakery’s general liability policy. The bakery is liable for the customer’s damages, even if the accident involved an employee.

Steps for Business Owners in a Dual-Insurance Scenario

Following an accident requiring both types of insurance, the bakery owner should immediately: 1) Ensure the injured employee receives prompt medical attention and report the incident to their workers’ compensation insurer. 2) Document the accident thoroughly, including witness statements, photos of the spill and the damaged property, and details of the employee’s injuries. 3) Notify their general liability insurer about the incident and provide all relevant documentation. 4) Cooperate fully with both insurance companies during their investigations. Failure to follow these steps can significantly complicate claims and potentially jeopardize coverage.

Scenario Requiring Only One Type of Insurance

Consider a freelance graphic designer working from home. They trip and fall while getting a coffee, injuring their wrist. This is a personal injury and would not be covered by workers’ compensation. However, if they damage a client’s expensive computer during a remote consultation, their general liability insurance (if they have it) would cover the repair or replacement costs. Their personal health insurance would cover their medical expenses.

Steps for Business Owners in a Single-Insurance Scenario

For the graphic designer, the steps would be different. If the injury is personal, they would deal with it through their personal health insurance. If the client’s computer was damaged, they would notify their general liability insurer immediately, providing documentation of the damage and the context of the incident. Failure to notify the insurer promptly could jeopardize their claim.

Consequences of Inadequate Insurance Coverage

Inadequate insurance coverage can lead to devastating financial consequences for business owners. In the bakery scenario, if the bakery lacked workers’ compensation insurance, they could face significant fines and legal action from the injured employee. Without general liability insurance, they would be solely responsible for paying for the customer’s property damage, potentially leading to bankruptcy. For the graphic designer, a lack of general liability insurance would mean personally paying for a potentially costly computer repair or replacement, a significant financial burden for a freelancer.

Workplace Accident Requiring Both Insurance Types: A Detailed Illustration

Imagine a construction site. A construction worker, while operating a jackhammer, loses control due to a malfunctioning tool (a safety oversight by the construction company). The jackhammer slips, causing the worker to fall and break their leg. Simultaneously, falling debris damages a nearby parked car belonging to a visitor to the site. This accident necessitates both workers’ compensation and general liability insurance. The worker’s medical expenses, lost wages, and rehabilitation costs are covered under workers’ compensation. The damage to the visitor’s car, a direct result of the company’s negligence (malfunctioning equipment), is covered under the company’s general liability insurance. The detailed investigation would involve documenting the malfunctioning tool, witness testimonies, medical reports of the worker’s injuries, and an appraisal of the car damage. The consequences of insufficient insurance would involve significant legal battles and financial liabilities for the construction company.

Ultimate Conclusion

Source: bizinsure.com

Navigating the world of workers’ compensation and general liability insurance can feel like wading through a swamp of jargon, but it doesn’t have to be. By understanding the basics, comparing providers, and asking the right questions, you can secure the right coverage for your business. Remember, proactive insurance planning isn’t just about protecting your bottom line; it’s about safeguarding your future. So, ditch the insurance anxiety and get covered!